Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

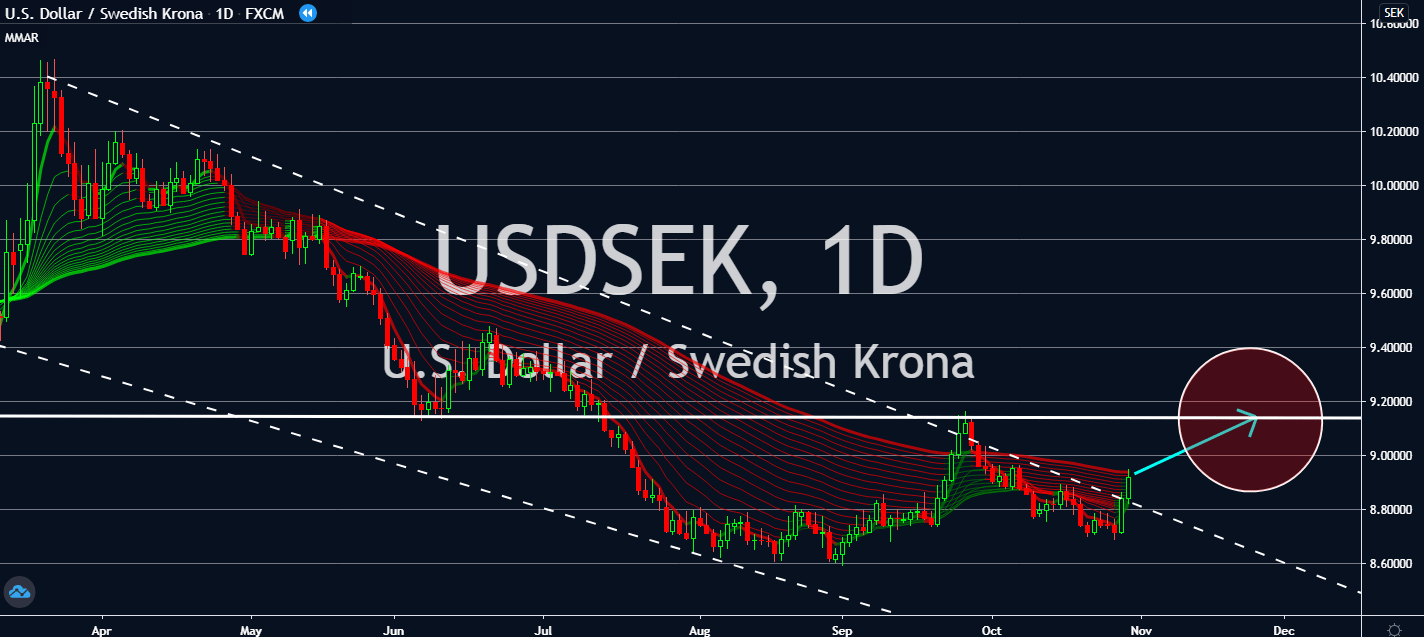

USDSEK

Sweden is about to experience a trade-off to its refusal to initiate a national lockdown for its economy. Economists claim that the Swedish economy has relied too heavily on its Public Health Agency, which had underestimated the risk of asymptomatic contagion, which was the primary reason why there wasn’t a lockdown in the first place. Three new regions in Sweden have also been forced to roll out sharper coronavirus measures after the government saw 2,820 new coronavirus cases earlier this week. This was the highest number of daily cases since the pandemic began. What makes matters worse: the record was at its third peak in three days. The increase in new coronavirus cases has been gaining momentum in recent weeks, which is expected to continue even faster throughout the rest of the year. Authorities are projected to urge Sweden to limit physical contact, which could hinder its progress from earlier months.

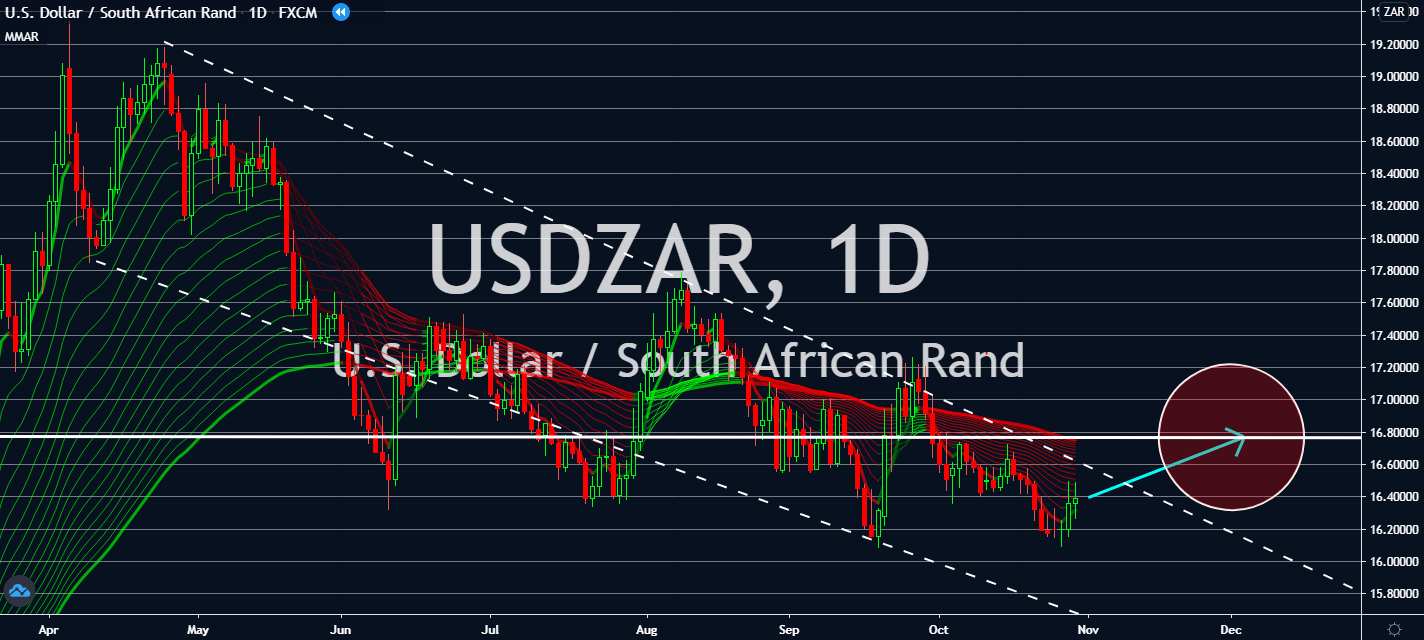

USDZAR

South Africa’s economic outlook is in danger. According to a tax team in the country, debt has come to unreasonable heights and is now expected to reach more than 80 percent by the end of this year. Tax managers believe that the country’s debt trap could result in an irrevocable economic decline, considering that its record was only 30 percent ten years ago. The South African rand is projected to lower the closer the United States presidential draws near. Moreover, the South African government is planning to freeze public sector wages for the next three years to make up for it. But forecasts insist that debt could peak at a higher level while they’re at it. Africa’s most industrialized economy will consequently suffer even more so before the coronavirus came around, and one of the world’s strict lockdowns will worsen its state. Economists now believe that the consolidated budget deficit will reach 15.7 percent of its GDP in its fiscal year ending March.

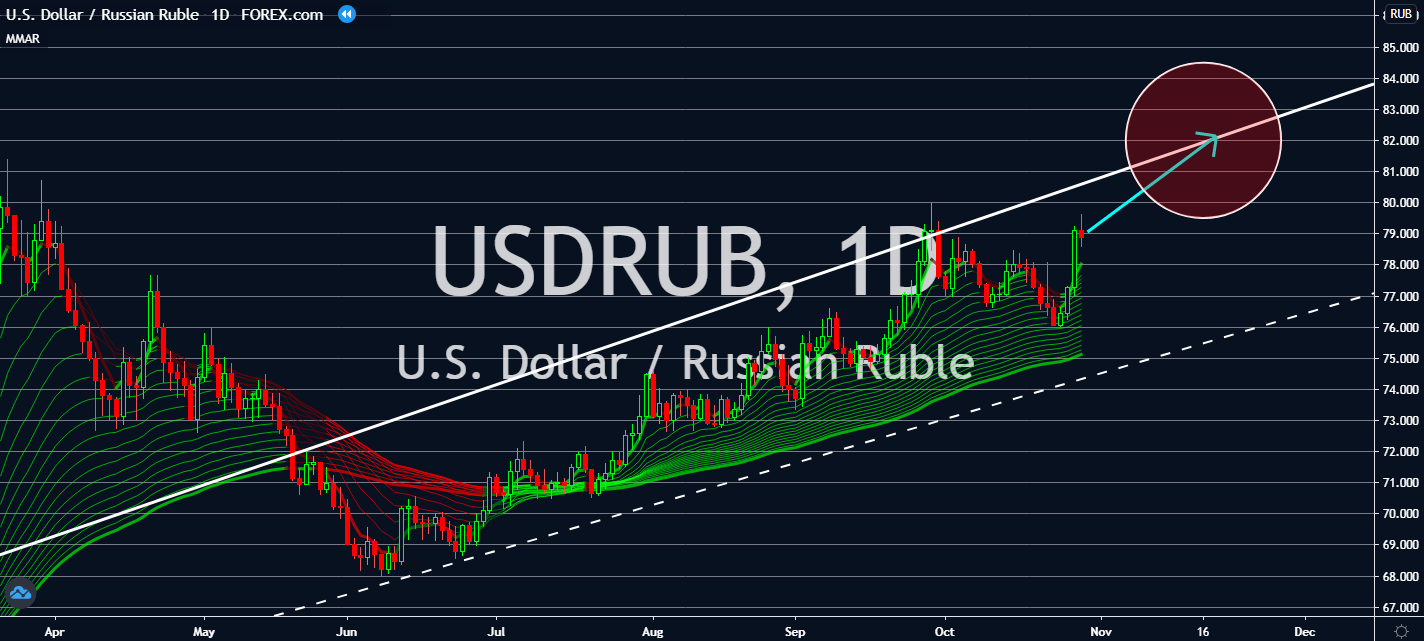

USDRUB

The US economy bounced sharply in the recent quarter, nearly erasing the record slump seen at the beginning of the coronavirus pandemic. Gross domestic product rose by 33 percent between July and September on a yearly basis, which is also up by 7.4 percent in the quarter prior. The biggest record beforehand was an increase of 3.9 in 1950. The country is also preparing for its national elections, which could change the course for international relations within the year. Either way, investors are projected to take advantage of the increase in the near-term or until the elections change the game for the currency in the longer-term. Meanwhile, the Russian ruble will only be suffering in the much longer term over worries that its economy has been losing steam even before the second wave of the coronavirus that took over the country. For now, remote working is projected to continue benefitting Russia’s economy.

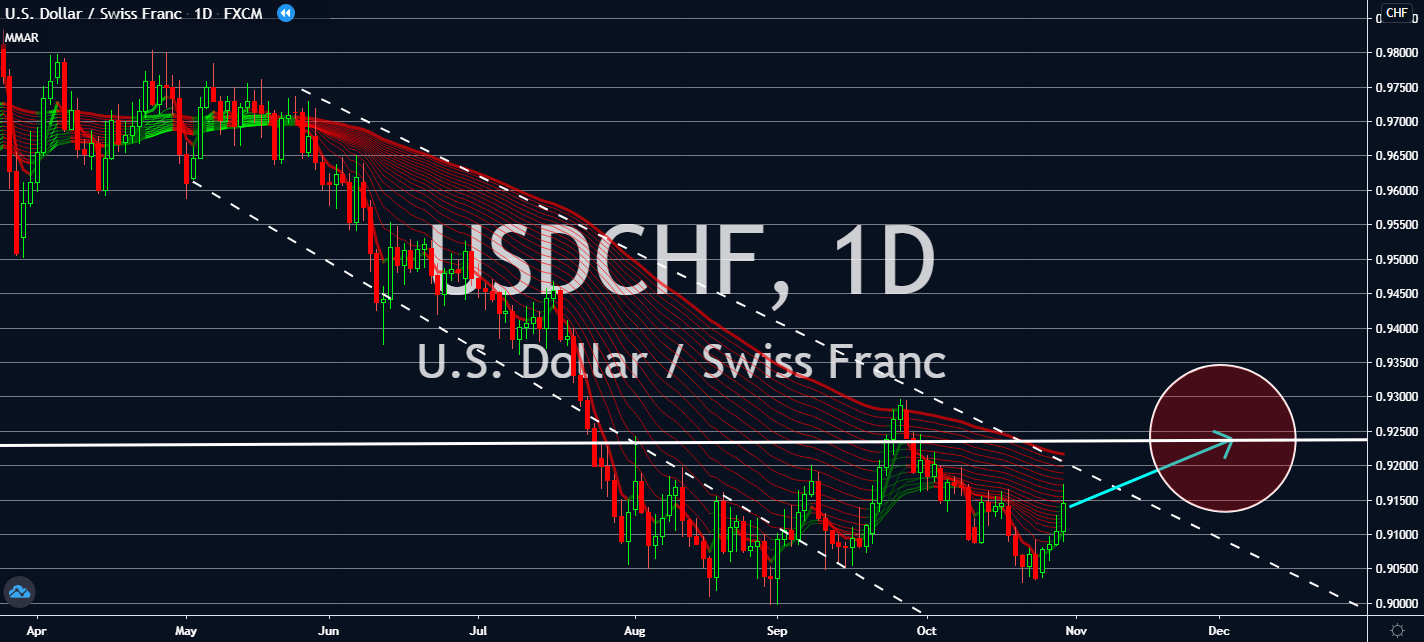

USDCHF

The Switzerland economy is at risk of another fall as the coronavirus continues to weigh on its output. A GDP index plunged by a shocking 24 points in October, pulling the level down to 2.3. The increase in coronavirus cases will continue to infect the franc, as well. The central bank also confirmed that it will retain its -0.75 percent interest rate. The rate is expected not to go lower, as well. Switzerland ordered dance clubs closed and added new mask requirements earlier this week as the country grapples against resorting to an economy-crippling national lockdown. In-person colleges halted earlier this week, while sporting and leisure activities were told to lessen. The country had once seen its daily coronavirus cases fall to less than 10 in June – it had just soared to 8.616 on Wednesday, alone. The government is projected to rely on retail businesses, restaurants, and other significant key segments that could help stop the economy from stooping too low.