Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

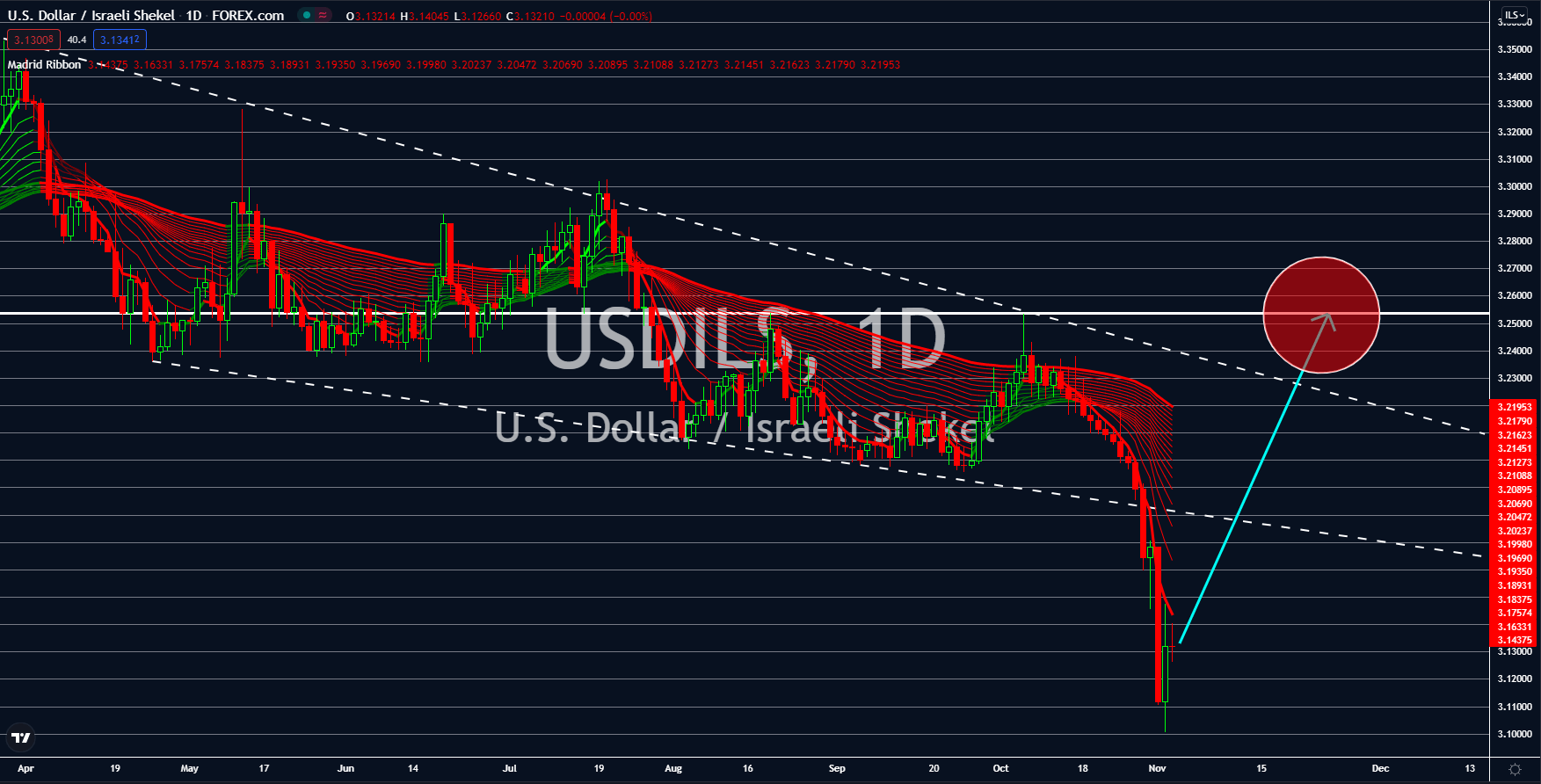

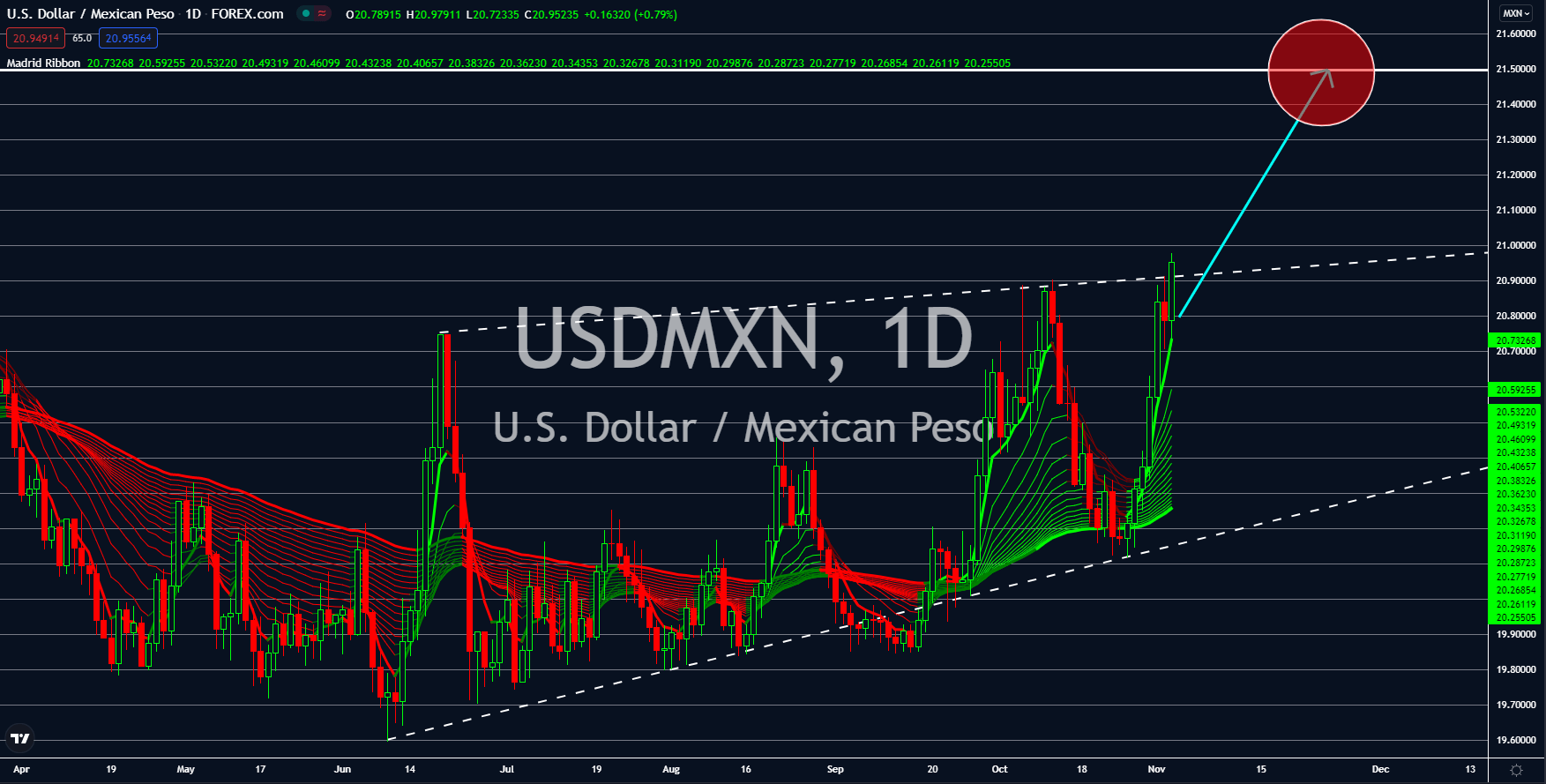

USDMXN

During its latest release in November 01, Mexico’s Manufacturing Purchasing Managers’ Index hikes conservatively. The important economic gauge rebounds to 49.30 points from September’s 48.60 points. On the other hand, the actual result remains under the 50-point threshold which will return it back to the expansion territory. Looking at the upside, such a settlement is already one of the highest hits this year, after August’s 49.60-point update. For the record, the Mexican economy narrowed by 0.2% during the July to September period. This is the first dent recorded so far since the start of its economic rebound. It also dismayed analysts’ expectations which gave a 0.1% hike consensus. Nevertheless, the Mexican government is positive that its economy will recover by a robust 6.3% in fiscal 2021 and another 4.1% pace in the year after. Investors have yet to confirm the bullish projection on the central bank’s next interest rate decision scheduled on November 11.

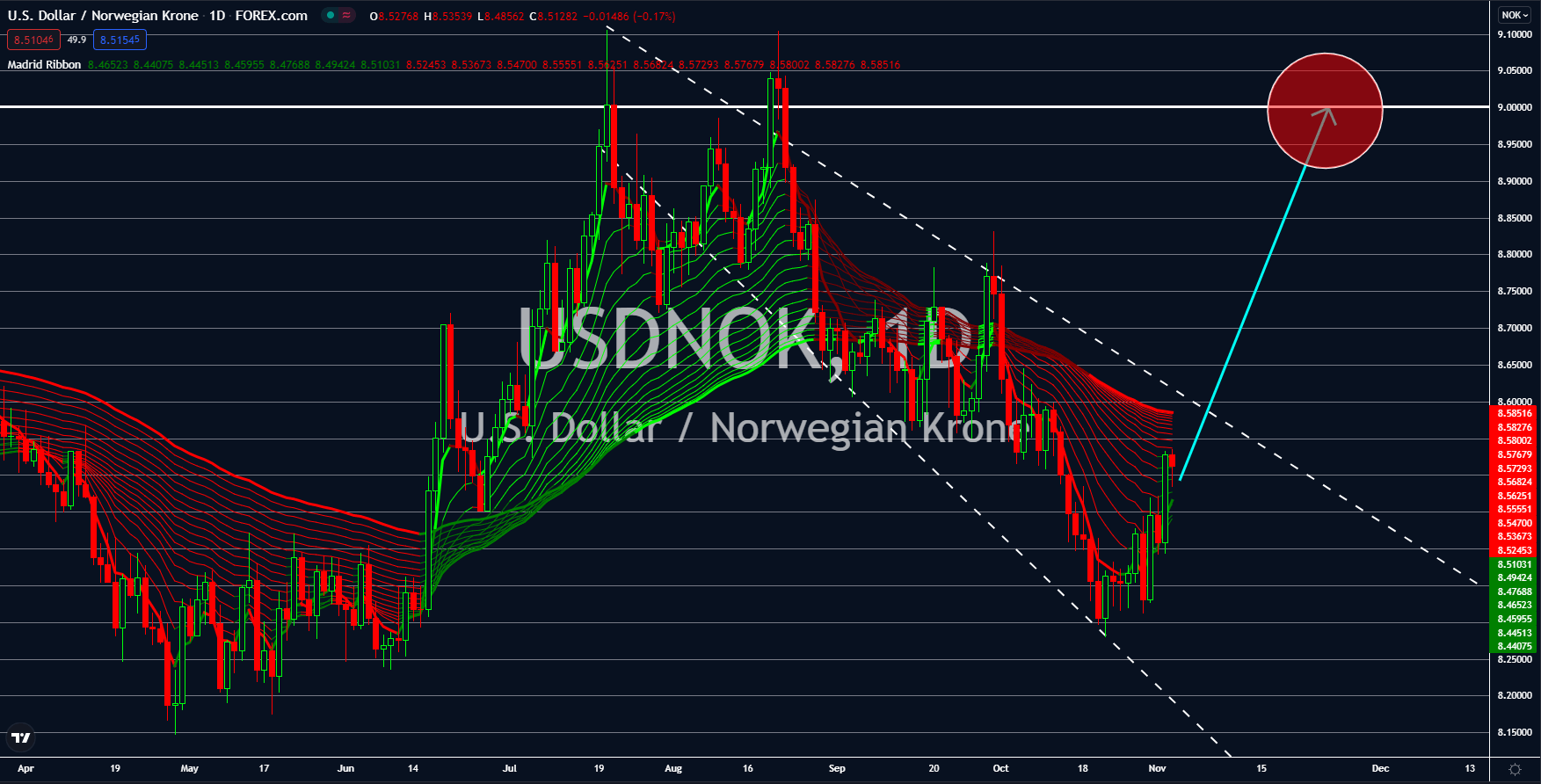

USDNOK

Norway’s manufacturing sector continues the positive data after its Purchasing Managers’ Index in October came at 58.5 points. This extends the previous month’s 59.0-point report. The economy is restarting to gain some leverage, with much of the thrust coming from travel and tourism. Last month, its main air carrier reported a load factor of 80.0% which is up from the previous period’s 73.0%. Analysts noted that the recent improvement signifies a steady recovery moving forward. Meanwhile, experts noted that the Norges Bank might go ahead with its interest rate hike plans in December. This is amid the surging oil and food prices seen since October. For the record, its G10 currency counterparts have already gone hawkish. Many of the member states’ central banks have become more assertive with their benchmark decisions. Experts are looking at another 25 basis-point hike by the end of FY 2021 as steady economic recovery plays for most EU member states.

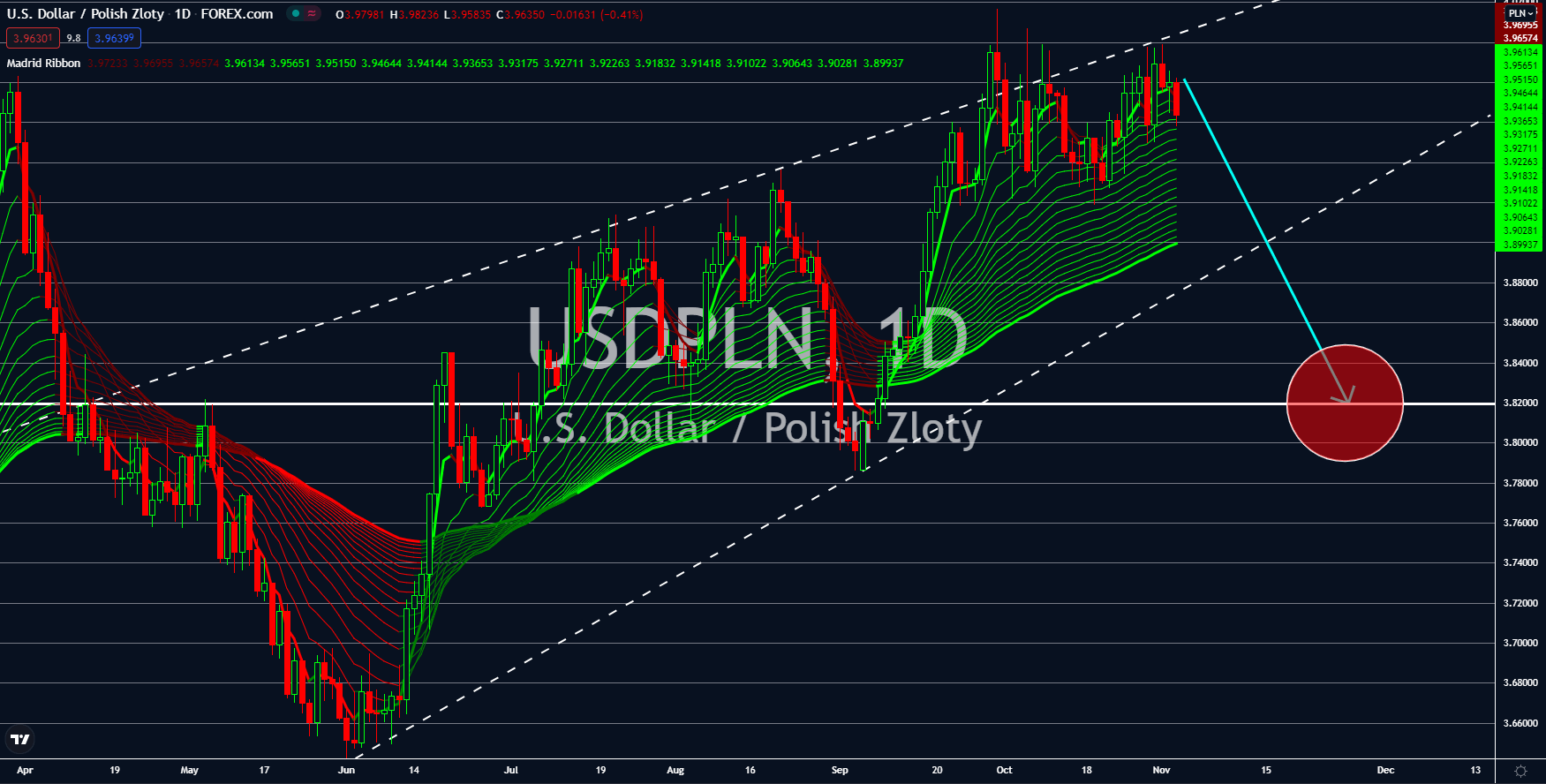

USDPLN

IHS Markit’s Purchasing Managers’ Index steps above market expectations in Poland. In October, the country’s prime economic indicator notched 53.80 points which is higher than the 53.00-point result forecasted by experts. Analysts are impressed about the recent growth, highlighting that the manufacturing sector remains robust despite the ongoing challenges in the global supply chain. On the other hand, price pressure presents itself on the downside, staging an inflation fear. Similarly, the period experienced a weaker demand in export compared to the previous months. Despite this, the Polish economy is expected to advance at an average pace of 4.5% to 4.7% in the coming two years. Economists noted that the country’s economic improvement has now reached back to before pandemic levels, underpinning a stronger monetary capacity. In its November 03 deliberation, the central bank is looking to hike interest rates by 50 basis points to 1.00% from October’s 0.50%.

USDILS

Investors’ eyes are all on the Federal Reserve’s latest policy interest decision scheduled for update this Wednesday, November 03. This will happen after the conclusion of its two-day meeting with key policymakers. Analysts expect that the US monetary regulator is now ready to taper down its $120.00 billion worth of monthly bond-buying budget. The tightening of bond purchases has been in discussion since October, when the United States reported a steady growth all across its primary economic indicators. Traders expect rate hikes to come soon after such a decision comes into force. For the record, the Fed kept its benchmark rate at 0.25% since the start of lockdowns to keep the economy supported from shocks. However, inflationary pressures have been lingering for longer than expected, with inflation rate skyrocketing at record-highs. Recently, US Treasury Department Secretary Janet Yellen said that the US economy is not overheating despite the ballooning CPI.