Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

EURSEK

The Eurozone seems to be unbothered this month by the simultaneous challenges to its economic recovery. In November, the Flash Composite Purchasing Managers’ Index climbed to 55.8 points. The recent result surpassed October’s data which settled at 54.2 points. In a brief context, any area above 50.0 points indicates expansion and anything below suggests otherwise. The critical gauge dictates the overall health of the currency bloc’s economy. Experts are impressed about the latest update given that it exceeded their expectation of only 53.2 points. With this, analysts implied that the ballooning consumer prices still have not taken a heavy toll on recovery, at least for the month. On the other hand, economists are certain that the overall fourth quarter economic growth will be greatly compromised by inflation issues. Adding to the lukewarm mood, the region as an export-oriented economy will take a whammy on a resurging covid pandemic and supply chain problem.

EURCZK

Czech Republic imposes a new round of Covid-19 restrictions after infections in the country and in the entire region continue to mount. The administration adopted the “Bavarian Model,” which prohibits the unvaccinated population from entering service-oriented locations. Service providers are mandated to require the presentation of vaccination cards from the customers to transact. Many citizens protested on the recent move as this is said to undermine the individuals’ right in choosing to get vaccinated or not. Currently, Czechia battles both the returning pandemic and rising inflation rates. Earlier this month, the central bank made a surprise hawkish move to place a stopper on the overheating consumer prices. The monetary regulator raised interest rates by 125 basis points to 2.75% which is the boldest move seen by the market in many years. Due to the recent dilemma on its benchmark inflation, the central bank signaled a possibility of more rate hikes in fiscal 2022.

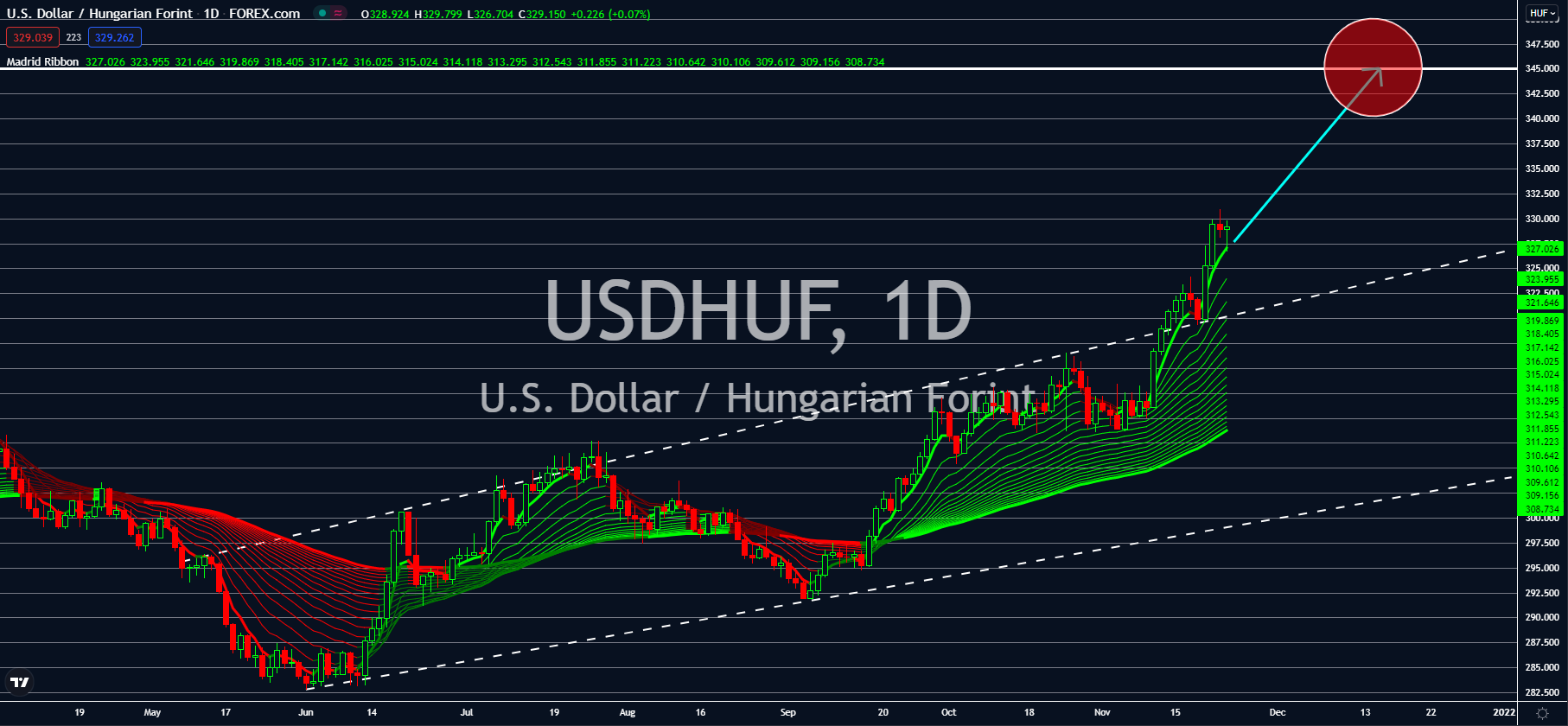

USDHUF

The United States will update on its most important gauge of economic health on November 24. The country’s third-quarter Gross Domestic Product is expected to grow 2.2% quarter-on-quarter. This pace is higher than the previous three months’ 2.0% result. Meanwhile, the US initial jobless claims for the prior week are expected to fall again to 260,000. This is after the new unemployment benefits claimants came at 267,000 in the week-ago period. Consequently, the continuing jobless claims might follow the downtrend and fall to 2.03 million. This compares to the previous record of 2.08 million. In his latest economic speech for the holidays, President Joe Biden acknowledged the United States’ strong economic performance. However, the leader also addressed the real score on benchmark inflation after long. Biden said that the government is currently deriving measures to drive gasoline and food prices down. Such will be critical for the standing of his approval rating.

USDMXN

Mexico’s economic growth remains at its weakest pace as macroeconomic factors pull it down. The country’s Retail Sales in September recorded a 5.9% advancement, disappointing the market’s average consensus. Analysts have expected a 6.1% yearly improvement for the month, given that Covid cases slightly plateaued during the period. Similarly, the latest number is significantly lower than August’s solid 7.2% hike. On a month on month basis, analysts expected a 0.8% result, only to be dismayed by the actual figures anew. September’s monthly growth came at 0.2% which is nevertheless higher than August’s no-improvement result. In a brief context, the Mexican economy is finding it hard to find a sure footing on recovery. It contracted by 8.3% in fiscal 2020 due to the pandemic. Meanwhile, in an update on its November 1st Half-Month CPI and Core CPI, the country is forecasted to report a 0.50% and 0.07% advance which are both lower than October’s update.