Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

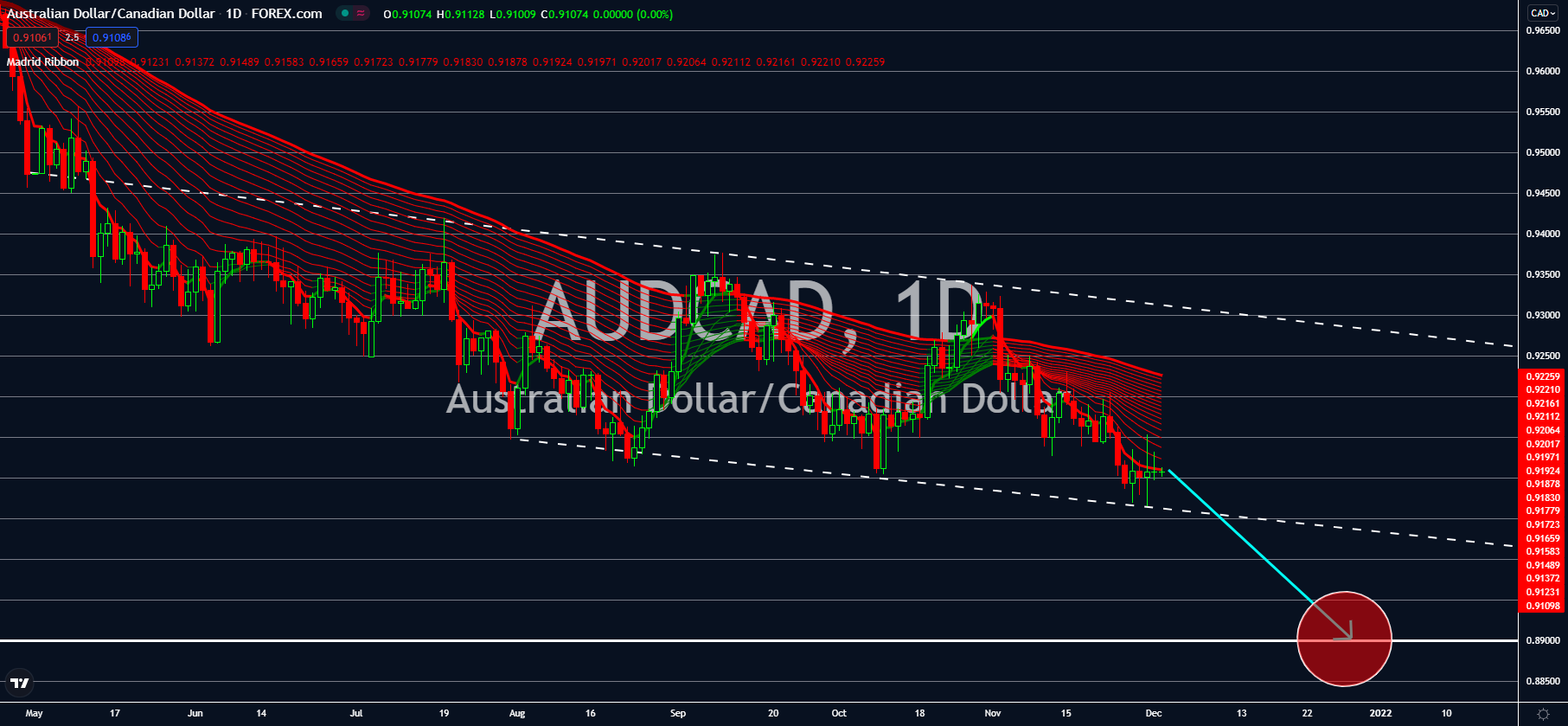

NZDUSD

New Zealand will not take a step against Omicron and will go ahead with the easing of its travel restrictions this week. Although economists ascertain that the new variant will certainly take a toll on its recovery. Experts predict that the NZ economy would experience a slow recovery from the covid until 2022. On the other hand, good performance among the country’s main income makers is expected to provide support. In the end of September, exports and imports have reached an all-time high which signifies a revitalizing consumer demand. Export prices during the third quarter are expected to increase 1.4% anew. The data will extend the previous three months’ 8.3% update. Moreover, import prices are forecasted to hit a solid 3.0% jump from 4.8% recorded prior. On the downside, exports volume is expected to rest at the negative territory at -4.0%. This is as the global supply chain disruption continues to weigh on business operations, also made worse by inflation.

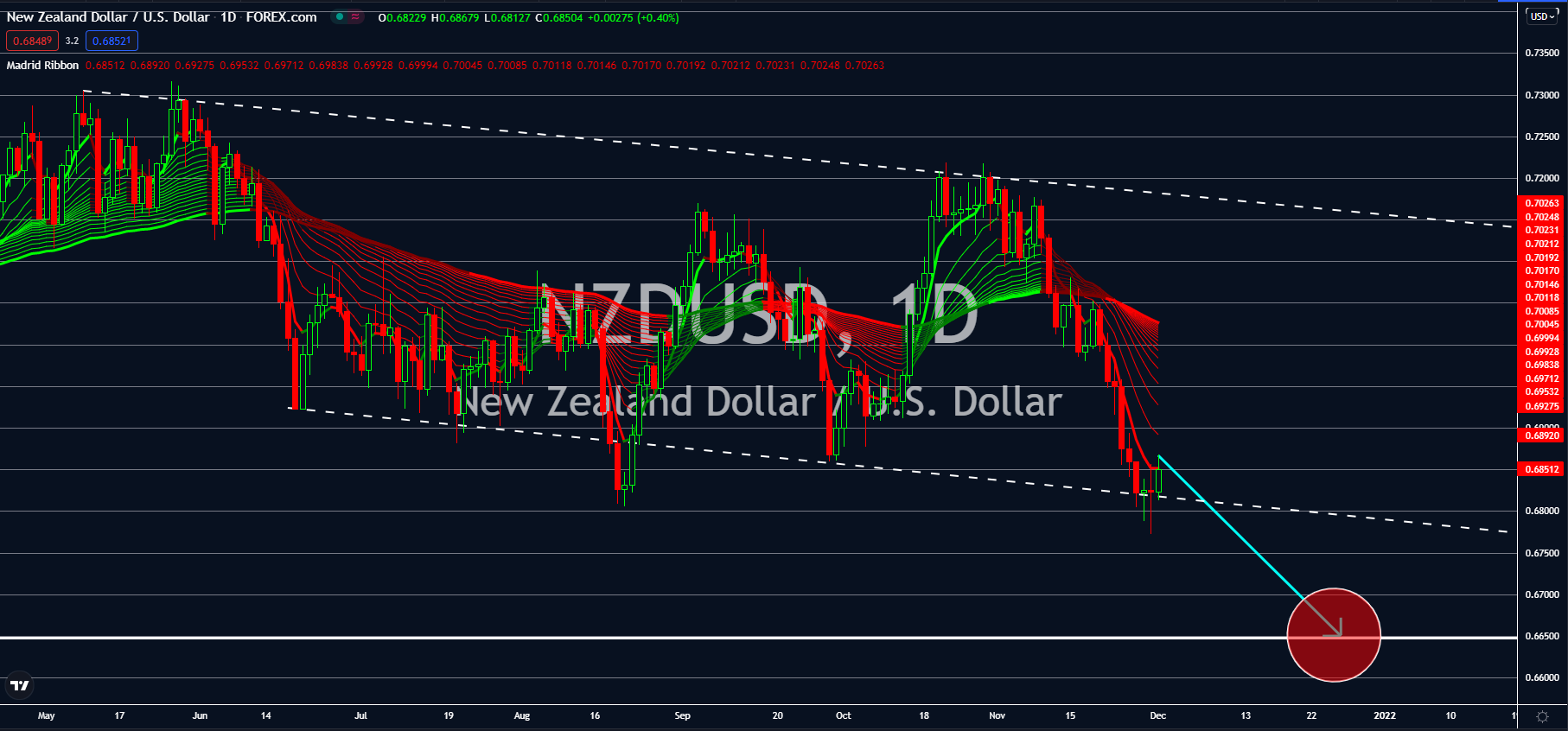

AUDJPY

Japan’s Manufacturing Purchasing Managers’ Index improved slightly in November after coming at 54.5 points. The recent update is higher than the 54.2 points recorded in October, managing to stage an advance in the middle of economic challenges. The Japanese manufacturers are benefiting from the global reopening of trade and the stimulated demand for Japan’s manufactured goods in the international market. This helped the measure to sit steadily above the 50-point expansion turf for the month. Earlier in the week, the country updated its Unemployment Rate which fell to 2.7%, beating analysts’ 2.8% expectations. However, economists warned of the tough times ahead given that the new strain is starting to take hold among its main trading partners in the European region. With the growing risk, Japan has barred entrance of foreign nationals to its borders for either tourists or business purposes. This is expected to bring negative momentum to the economy this December.

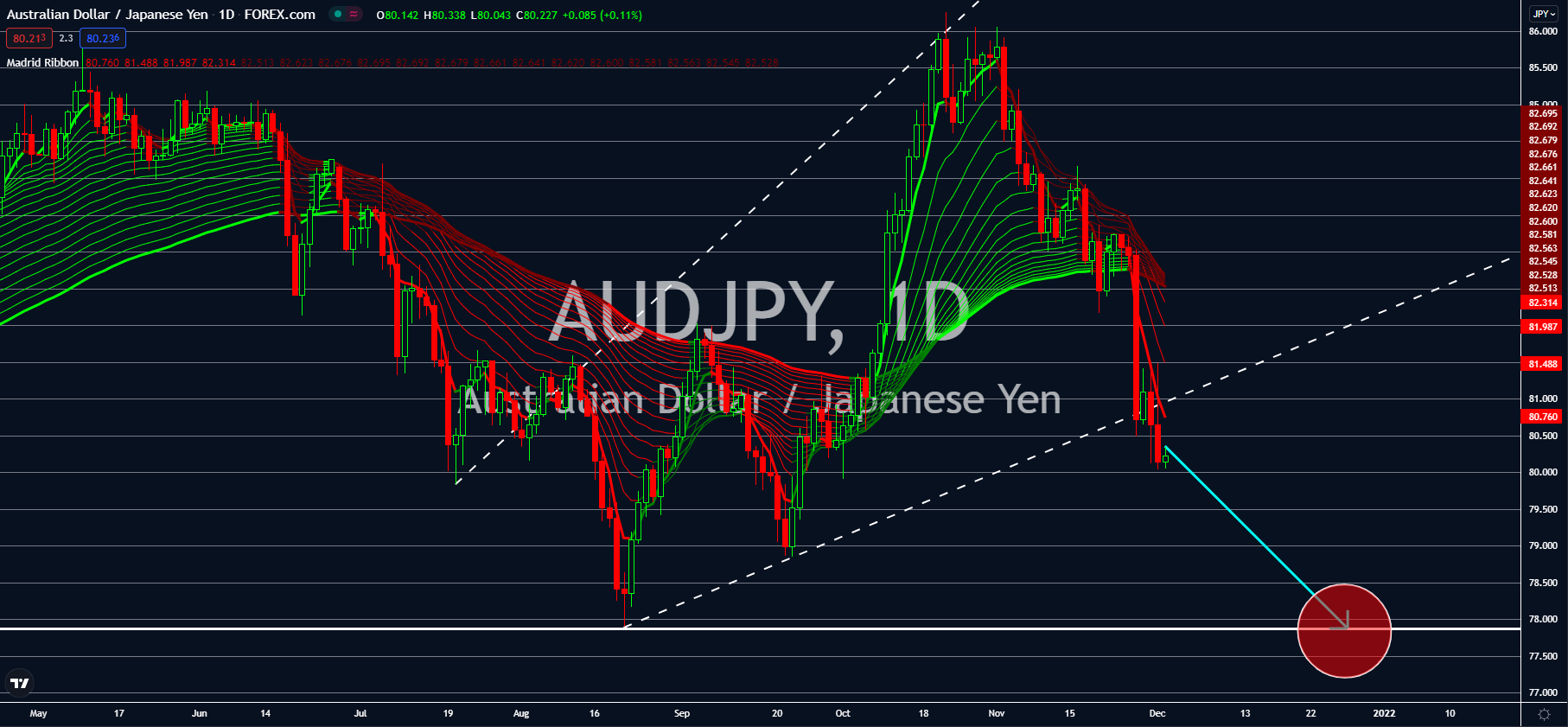

AUDUSD

The United States will update on some of its most important economic indicators on the first day of the new month. The US Manufacturing Purchasing Managers’ Index will be up for viewing on December 01. It is expected to continue its positive momentum through November after showing a solid 59.1-point growth in October. This comes with the expectation that the sector will cap gains from the global economic recovery which accelerated during the month. The ISM Manufacturing PMI will also be released on the same day and is looking to come at 61.0 points. This is a higher projection compared to its prior settlement of 60.8 points. Meanwhile, the US crude oil inventories are expected to decline by -1.23 million barrels for the week after showing an unexpected build up in the previous week. Analysts are convinced that crude demand continues to increase as Omicron remains a bleak case for now. Similarly, OPEC+ is still adamant to keep supply at current levels.

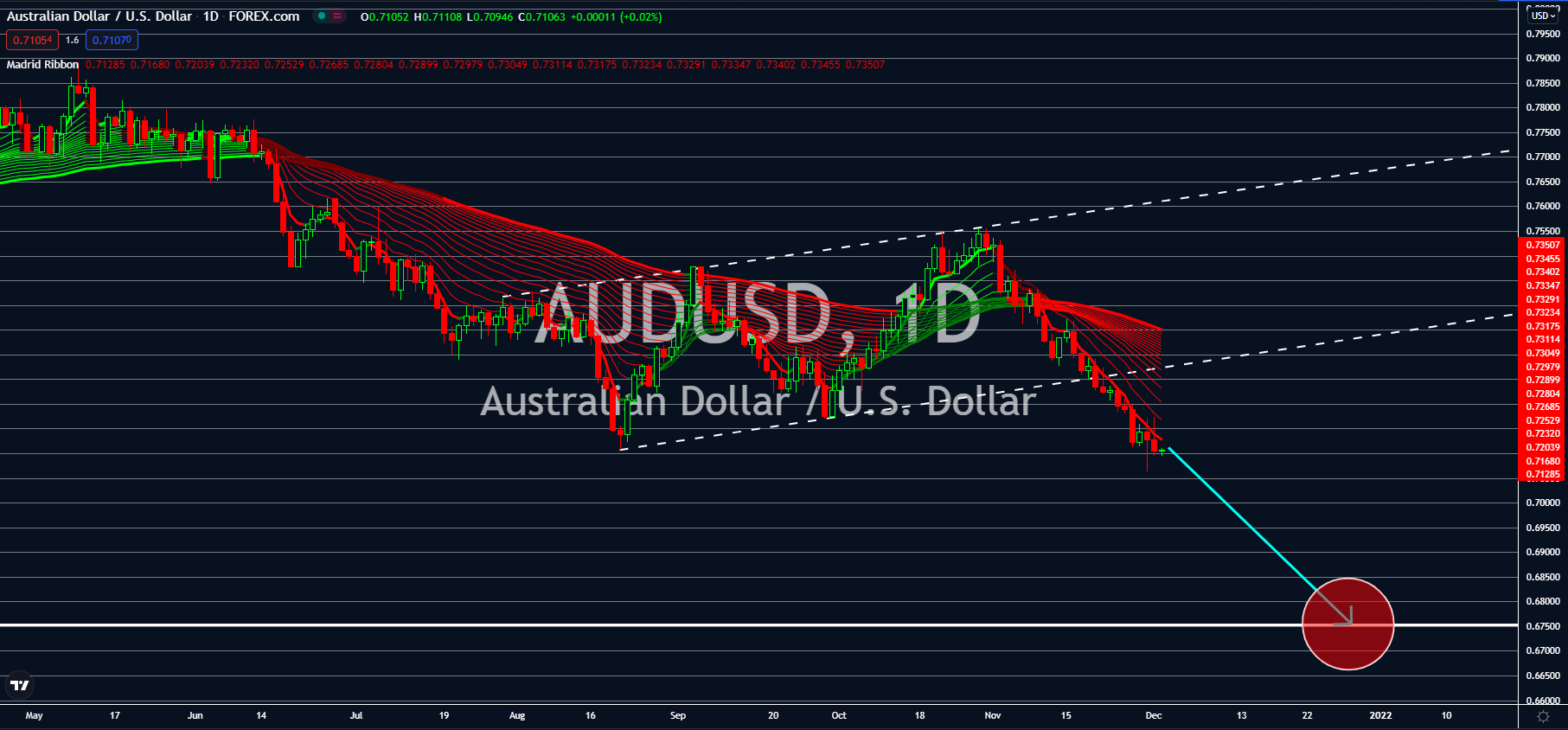

AUDCAD

Australia’s economy showed signs of recovery in the last three months to September. During the third quarter, the country’s gross domestic product advanced by 3.9% year-over-year. This notch is significantly higher than the average consensus for the quarter which was given at only 3.0%. On the other hand, it is lower than Q2’s revised 9.5% improvement. On a monthly basis, the country’s quarterly GDP plunged to a negative growth territory after recording -1.9% results. However, such a pace is already significantly better than analysts’ forecasted -2.7% decline. On the downside, it reversed the second quarter’s 0.7% update as global supply chain woes along with the problem in benchmark inflation took hold. In an update on Australia’s Manufacturing Purchasing Managers’ Index for October, the indicator came at 59.2 points, still well situated above the expansion side. It is also higher than the previous month’s 58.2 points, showing that the sector’s growth is steady.