Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

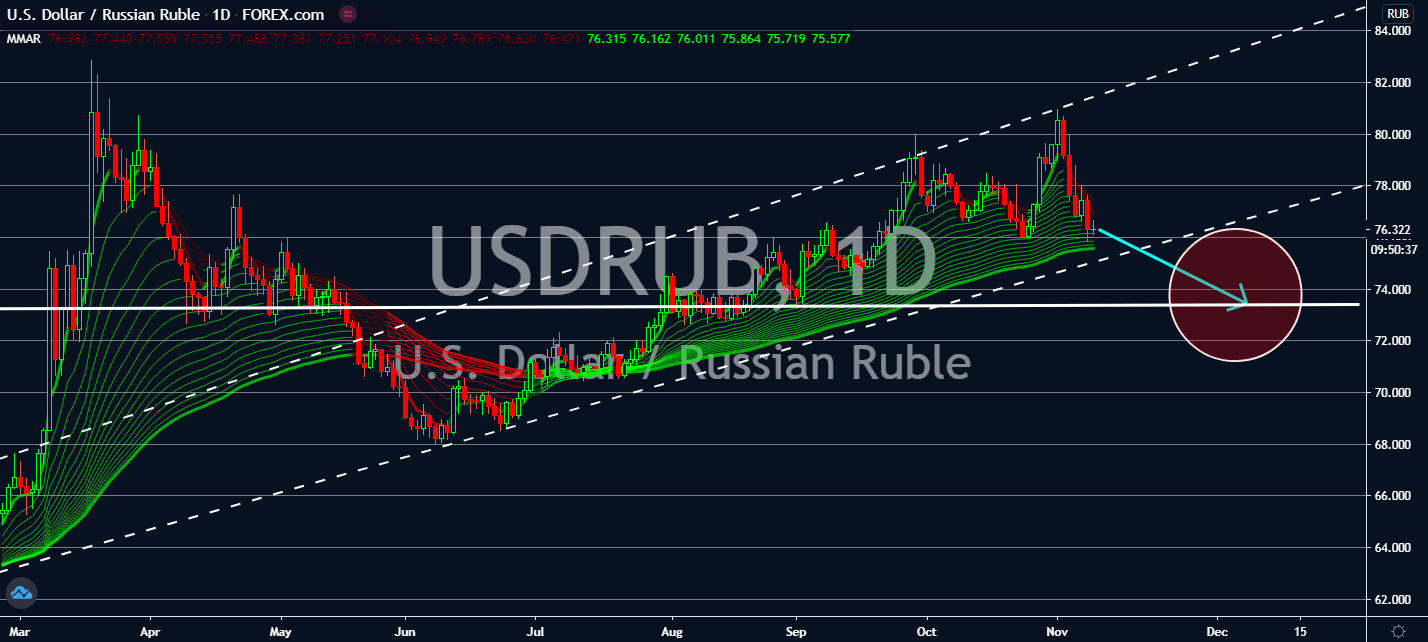

USDILS

After having crossed the 270 electoral college votes over the weekend, Joe Biden’s victory in the presidential elections is projected to help lift risk-oriented currencies in the near-term. Investors and economists alike will be looking forward to a boost in international trade relations alongside good news from a possibly successful coronavirus vaccine to be distributed by the end of the year. Although the US dollar is expected to remain relatively quiet today, markets are worried that Congress may need to pass on another round of coronavirus stimulus before Biden officially steps into the White House in January with an even steeper aid toward its economy that continues to suffer from its health crisis. Asia-Pacific shares will also boost thanks to the new vaccine announcement from Pfizer and BioNtech, which claimed that their candidates are about 90 percent effective in preventing the coronavirus among those without evidence of prior infection.

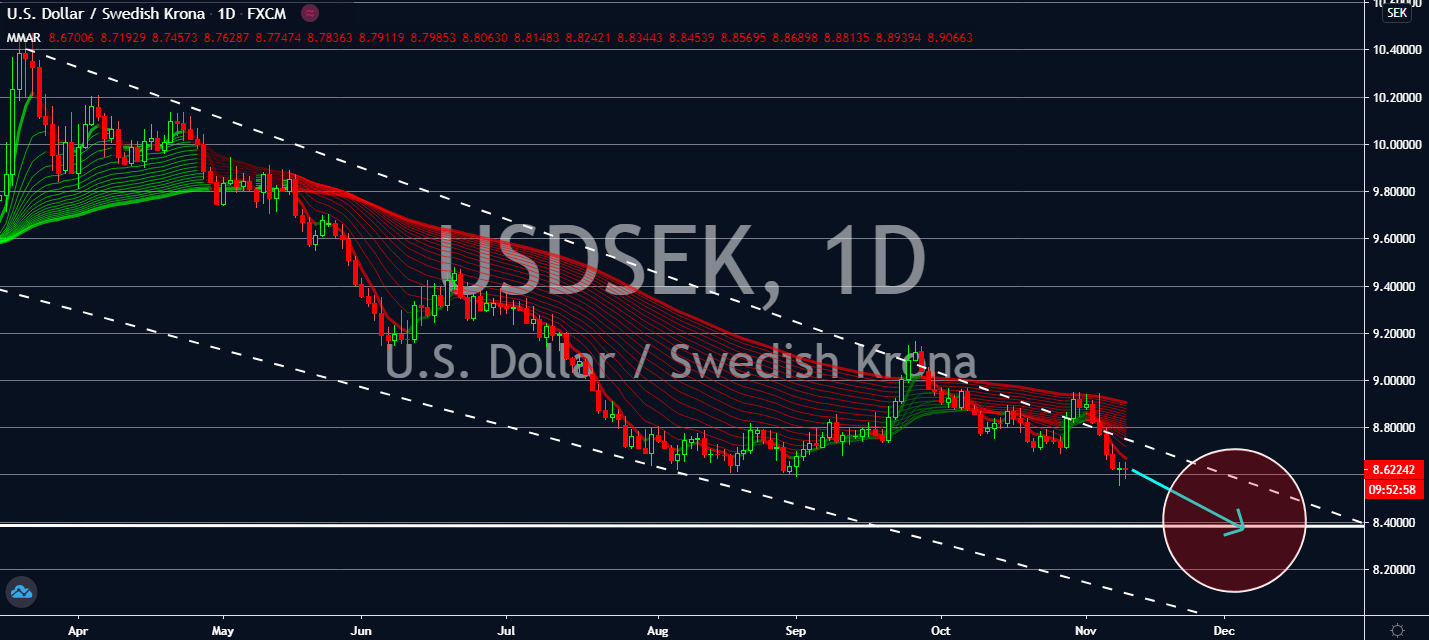

USDSEK

A widely available vaccine in the coming months will help boost global growth in financial markets, such as those with crown currencies. Optimism surrounding Pfizer and BioNtech’s vaccine candidates will help boost optimism, or as the companies claim, which is projected to continue the greenback’s 10-week low in near-term trading. Now that the Democratic president has guaranteed his seat in the White House, an expected improvement in global trade relationships will also likely drive the Swedish currency higher with it. Scandinavian currencies will experience the biggest boosts, so investors should keep an eye on data seen in Sweden, in particular. As the country continues its loose lockdown strategy with no signs of ending anytime soon, hopes of global distribution of the most effective vaccines by the end of the year could keep the Swedish economy going and even surpass the pandemic without a total lockdown.

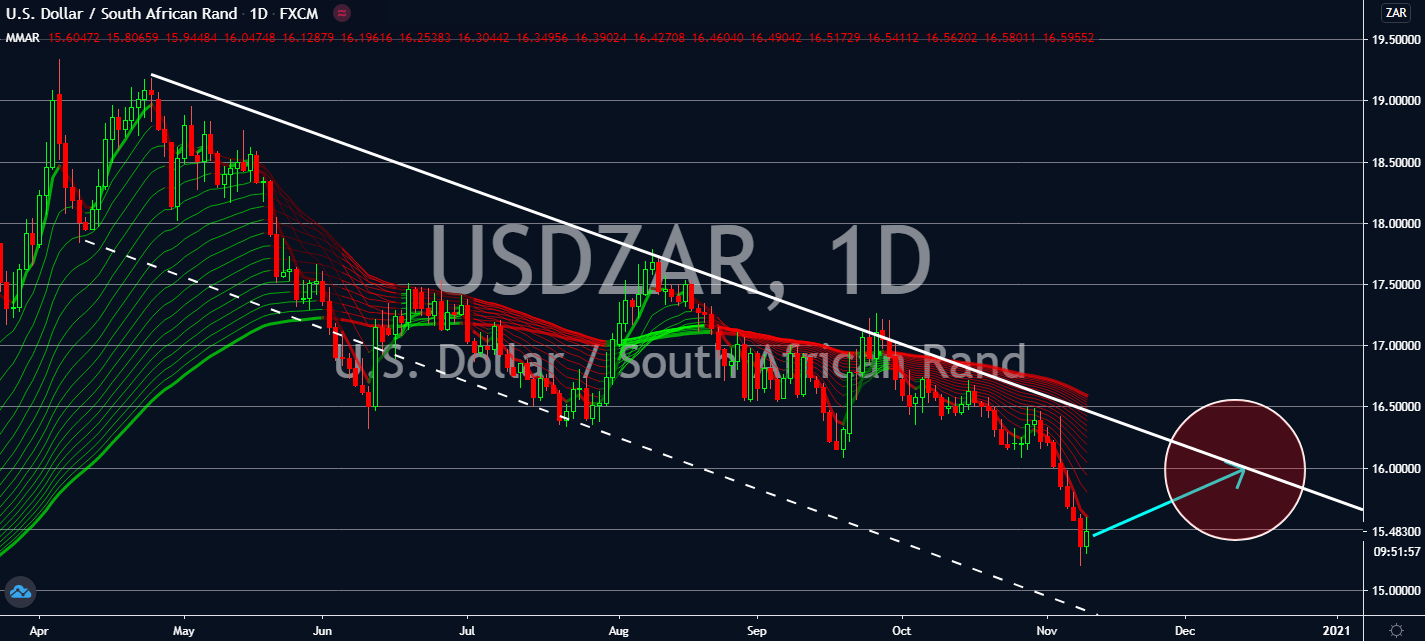

USDZAR

Economists believe that the South African lockdown will experience devastating fiscal and economic effects throughout the year. As part of one of the longest implemented lockdowns in the world, they found that the full economy will fall down by 10 percent below the baseline level by the end of 2020. Its hospitality and tourism industry is projected to suffer alongside transportation services, beverages, and overall tobacco exports around the world. Prohibitions in the earlier months in the manufacturing sector are projected to crawl through its recovery to 2027. The analysis is expected to pull the rand lower than its greenback opposite in the near-term despite risk sentiment in the market, now that its economy is still having a hard time financing its activity even after receiving a 4.3 billion US dollars in emergency funding from the International Monetary Fund so far this year. It now has less than a 33 percent chance of another bailout.

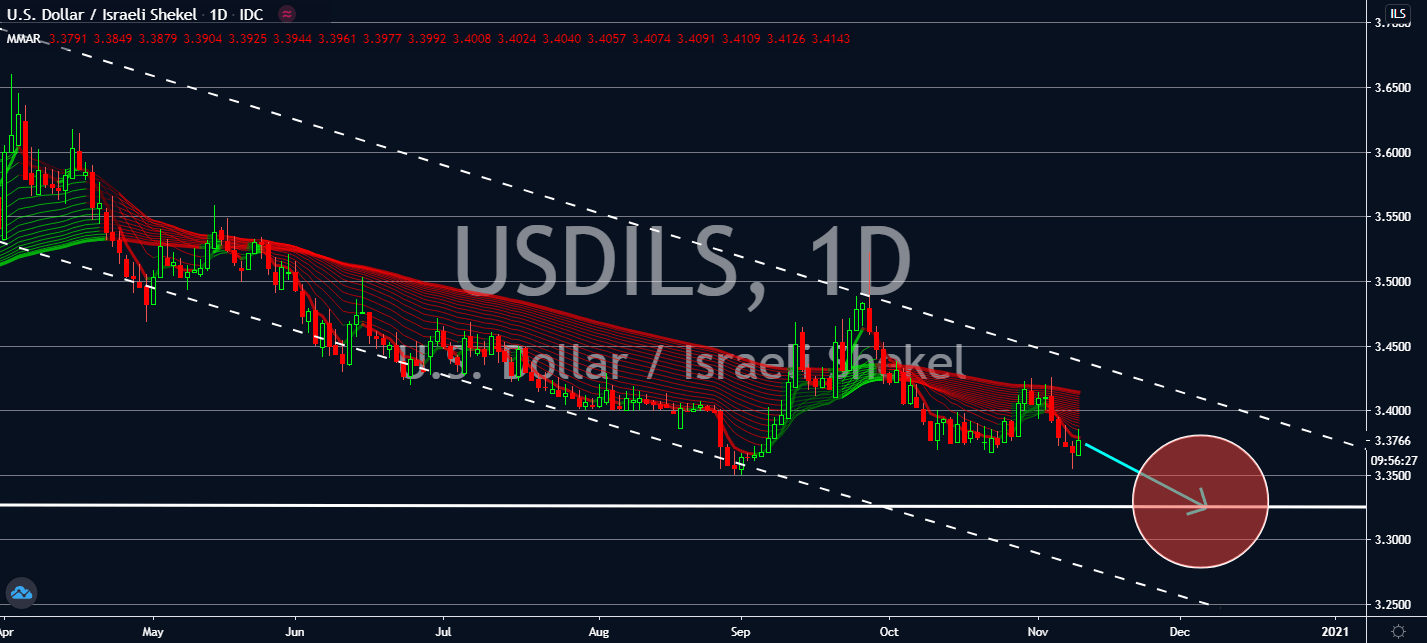

USDRUB

The United States is still expected to face another wave of debt defaults through the coronavirus pandemic and recession, according to the Federal Reserve. Many households will still continue their struggle as debt rise sharply through the year as business debt spiked to keep up with weak earnings throughout the previous quarter. The general decline in revenues will pull economic activity away weakening the ability of businesses to continue. As the US stock market surges thanks to a possible coronavirus vaccine within the year, the greenback is projected to pay the price with risk sentiment toward its currency counterparts, even the ruble. The central bank also warned Americans that its government’s failure to keep up with grant programs that let households and businesses keep paying bills will raise the risk of another economic crater despite the jump in gross domestic product announced a few weeks ago.