Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

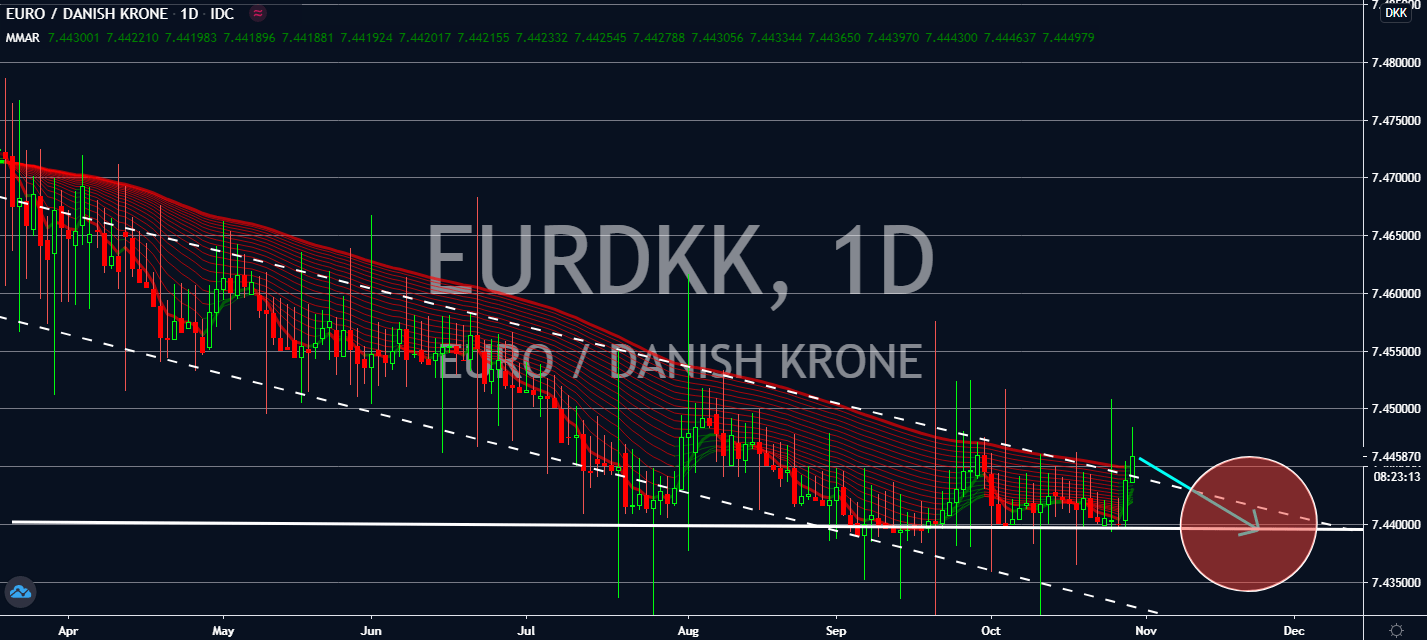

EURDKK

Denmark’s currency is projected to benefit from geopolitical relations with its trading peers. Turkey and Denmark are planning to increase their bilateral trade from around 2 billion US dollars to 5 billion US dollars on a yearly basis, according to the Turkish trade minister. The NATO allies are projected to collaborate on several fields, such as defense, renewable energy, medicine, chemical, and automotive industries on both economies. Meanwhile, the European Central Bank is expected to meet later today to discuss its plans to combat the recent Covid-19 resurgence in some of its biggest economies. The meeting will most likely influence the pair’s track. Although Germany had seen its unemployment rate plummet to -35 thousand, markets worry that this wouldn’t be enough to buoy the euro due to the need for stimulus packages by the end of the year, pushing its currency down until it reaches an agreement with the United Kingdom.

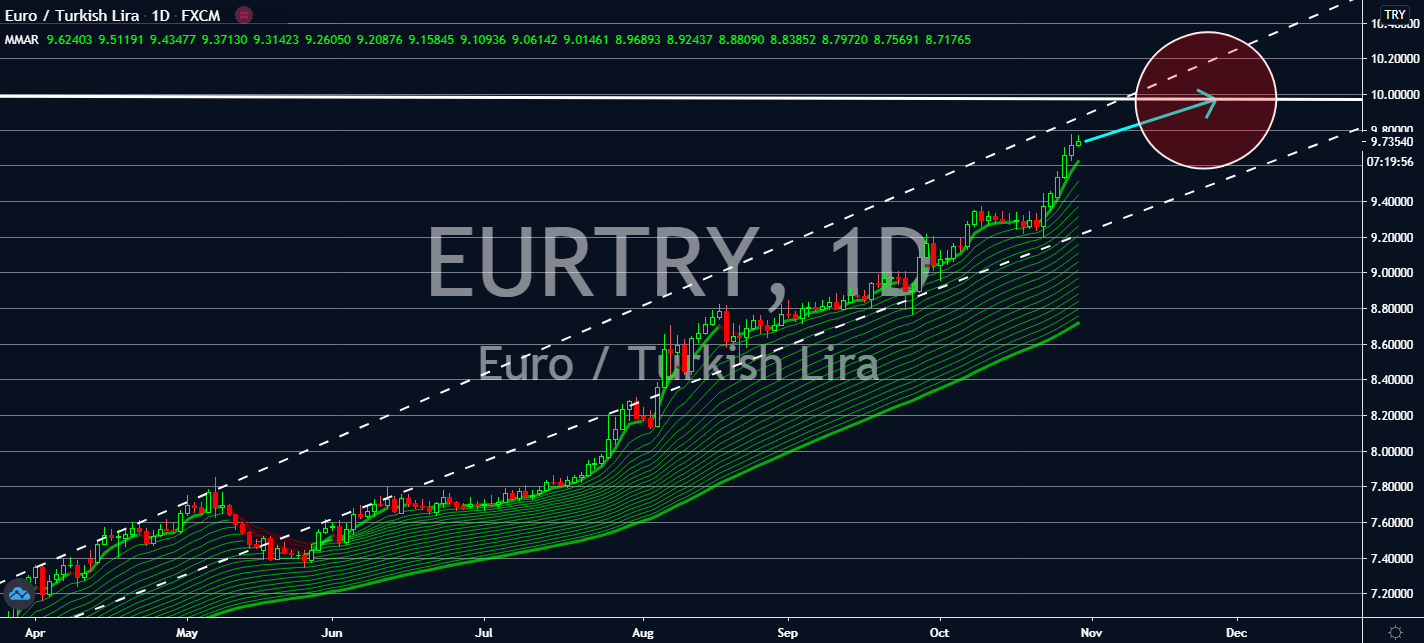

EURTRY

Turkey’s central bank held back on increasing its interest rate last Thursday. This will keep the lira low against its safer counterpart even after state-run leaders sold more than 1 billion US dollars to support the currency for the past week. The Turkish economy is likely to suffer from the anticipated surge in inflation seen at the end of the year, which the central bank had expected to jump from 8.9% to 12.1%. Because of this, the lira will remain undervalued despite the interference thanks to safer counterparts like the euro in the near-term. Meanwhile, the European Central Bank is projected to discuss further stimulus packages for participating economies in the eurozone later. The results would likely be influenced by Germany’s unemployment change, announced earlier today, which came in at -35 thousand. Relative optimism will benefit the euro, considering that the market previously anticipated a decrease to -5 thousand, at best.

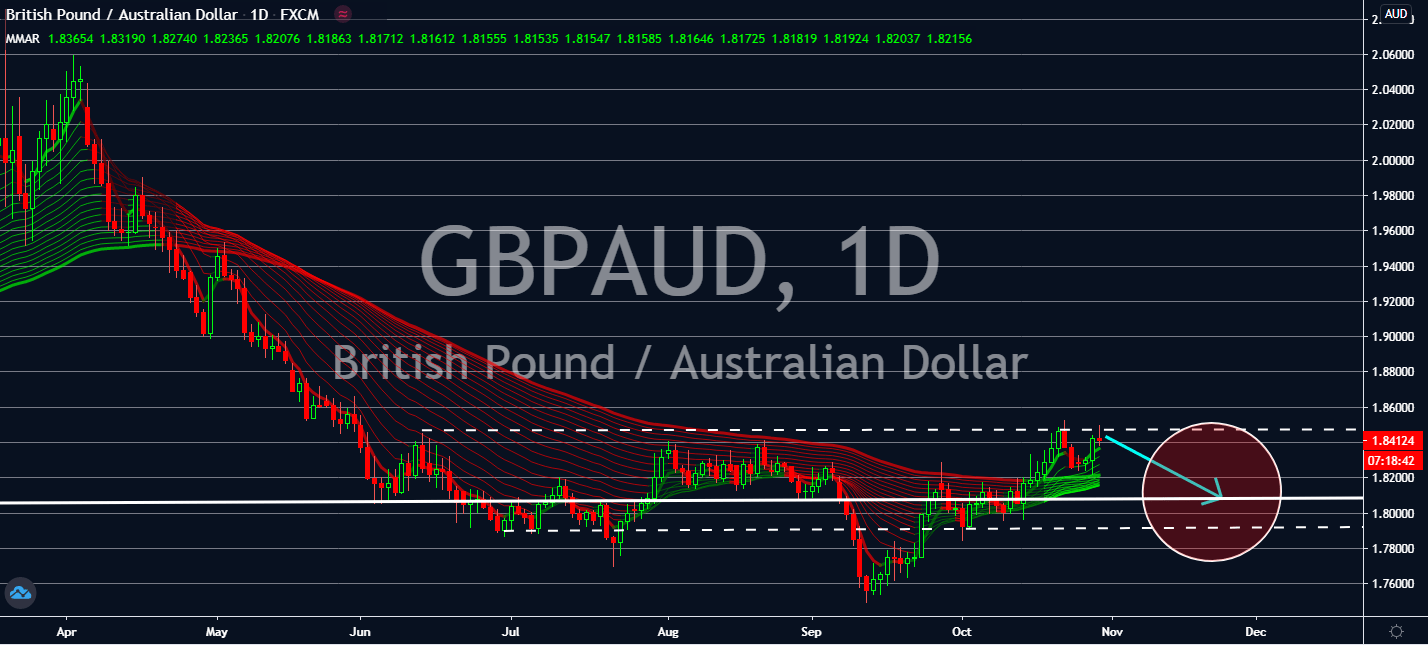

GBPAUD

Unemployment is expected to jump as Christmas approaches the United Kingdom. The number of redundancies in the City had grown to its fastest rate in history in the three months ending August, which increased by 114,000 to 227,000 as the coronavirus affected its businesses. This increased the UK’s unemployment rate to 4.5 percent, up from the 4.1 percent seen in July. About 1.5 million people were left out of work within the period, and experts claim this will continue through the rest of the year. Rishi Sunak is now under pressure to prolong the Treasury’s aid measures way longer than the levels announced last week, which both Capital Economics and Oxford Economics had claimed were “inadequate” to meet the demands of lockdowns used to counter the rising infection rate in the City. Although the Australian economy is bracing itself for another period of economic suffering after flattening its most recent wave, the Sterling is more likely to fall.

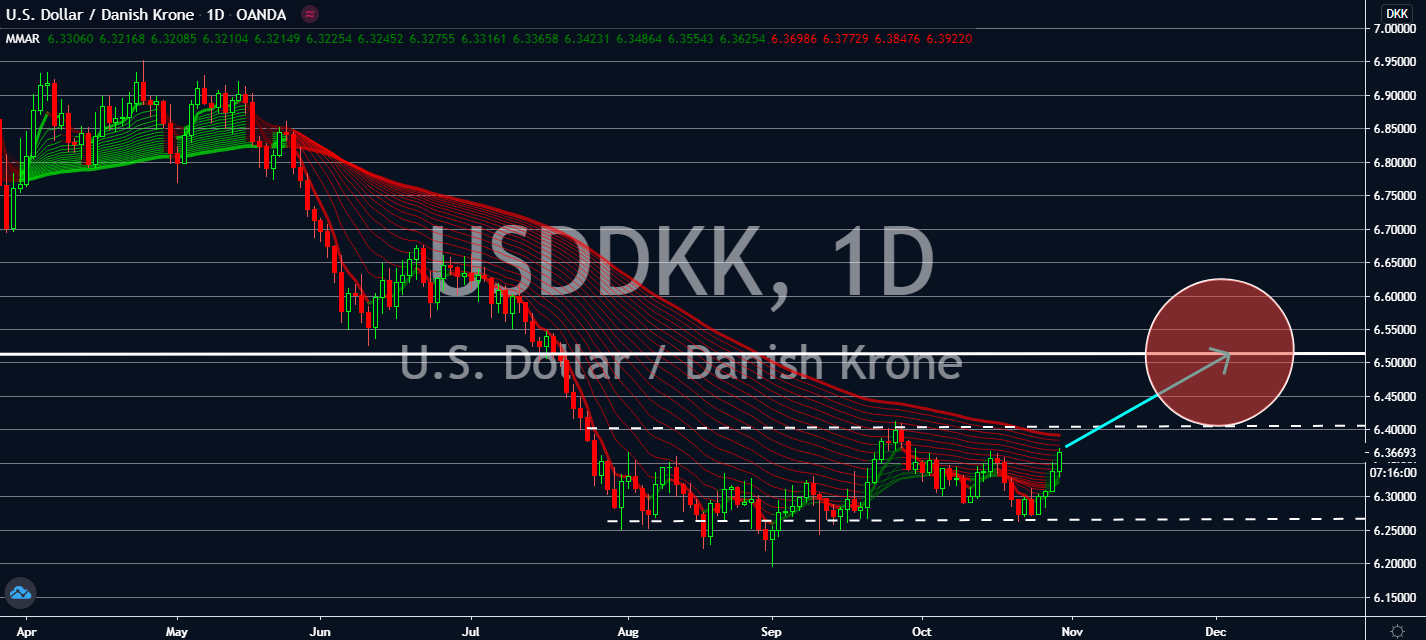

USDDKK

The US Commerce Department confirmed that its economy recovered much of the gross domestic product it had lost in the spring season. In fact, it had grown by 33.1 percent on both an annualized and seasonally adjusted rate in the quarter between July and September. Despite the worry led by the recent coronavirus surge in the country that led to its biggest daily coronavirus count, the greenback is likely to retain its status as the safest currency in the near-term. Investors are still waiting for the results for the presidential elections, after all. However, the market should keep a close eye on Denmark and Turkey’s geopolitical relationship in the long-term. Both countries are in discussion to expand their trade relationship over the next years to a total of 2 billion US dollars. Progress from these talks will likely help the crown’s bullish market in the longer term, but short-term markets will likely keep rooting for the greenback.