Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

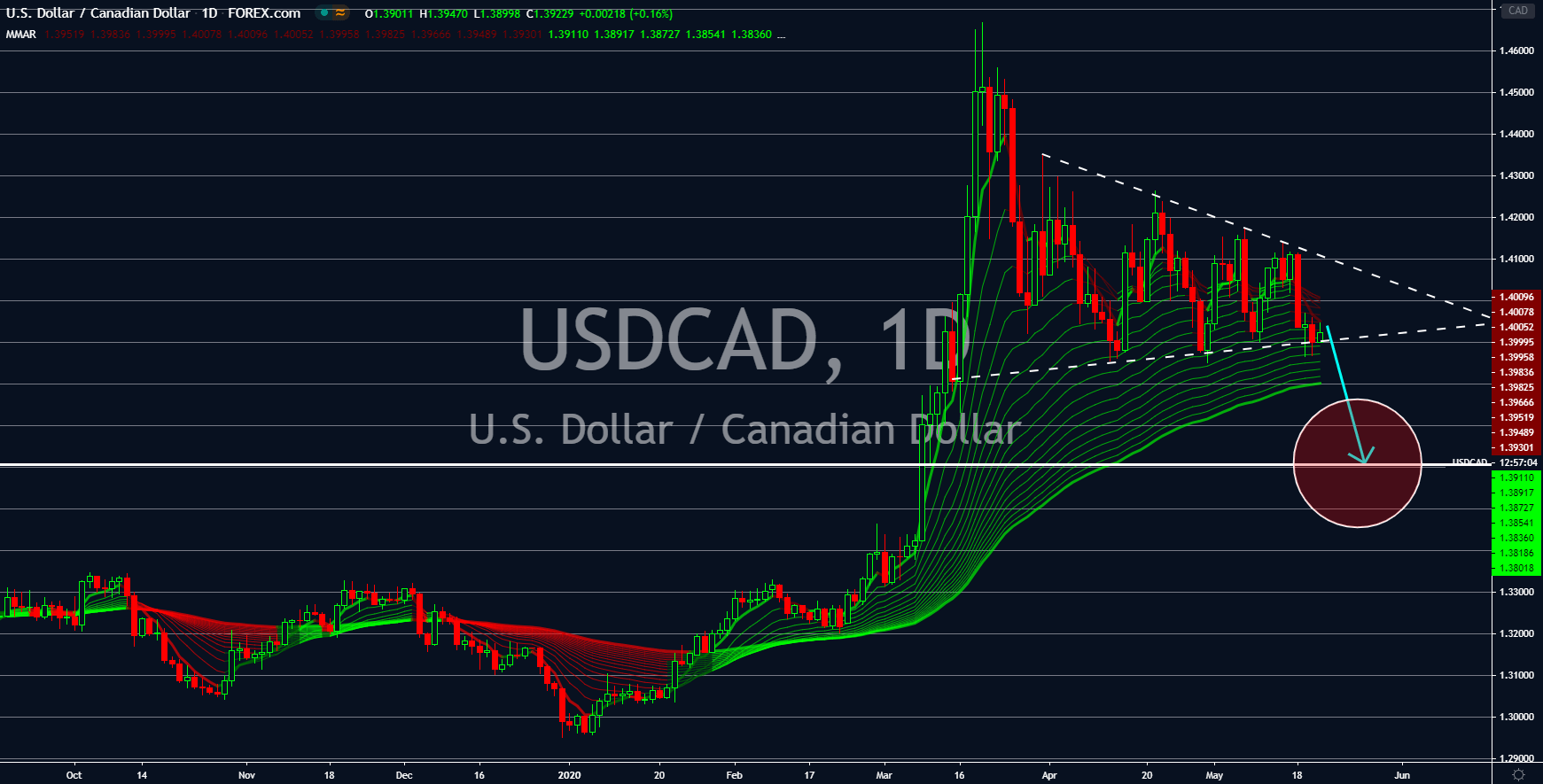

USDCAD

The US dollar would see some weakness in the coming sessions amid the expected recovery in Canada’s ADP non-farm payrolls report. For April, Ottawa’s record for the report plunged by 177.3K. The result highlights the economic effect of the coronavirus pandemic in the country. However, as some Canadian provinces began easing their lockdown since the first week of May, analysts are now expecting a positive figure for the report of April. Meanwhile, the US is also set to publish a key report on employment. Washington expected the initial jobless claims report to drop to 2,891K. Currently, the unemployment rate in the US was at 14.7% of the country’s workforce. If the report turns out negative in the US jobless claims report, this will be catastrophic for the US economy. As the US continues to rely on the dollar to keep its economy afloat, additional stimulus in the US could further weaken the value of the US dollar.

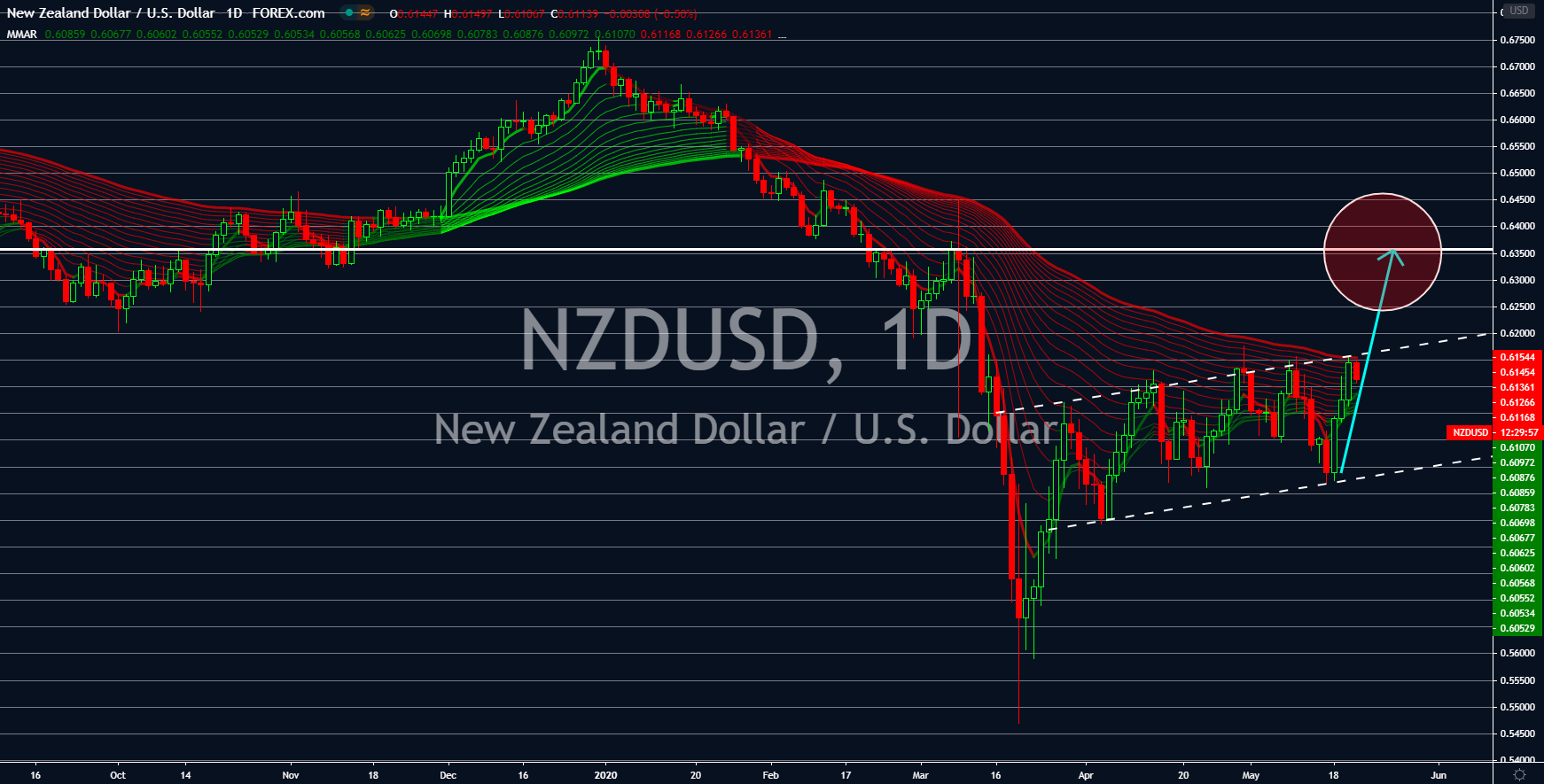

NZDUSD

The NZD will see some recovery on its value in the coming days following the easing of restrictions in New Zealand. Prime Minister Jacinda Ardern was recognized on the world stage once again following her successful campaign against the coronavirus. Confirmed cases in the country were only 1,153 with deaths at 21. With low figures of COVID-19 cases, PM Ardern announced the lifting of lockdown in the country starting on Monday, May 18. Meanwhile, the US is still leading in the world with the highest number of coronavirus cases and deaths. Some states in America were still in a lockdown, which results in higher unemployment in the country. In relation to this, the US government is expecting a lower figure for its initial jobless claim report today, May 21. However, analysts warned that despite the lower figure expectations for jobless claims, the damage has already been done in the US economy.

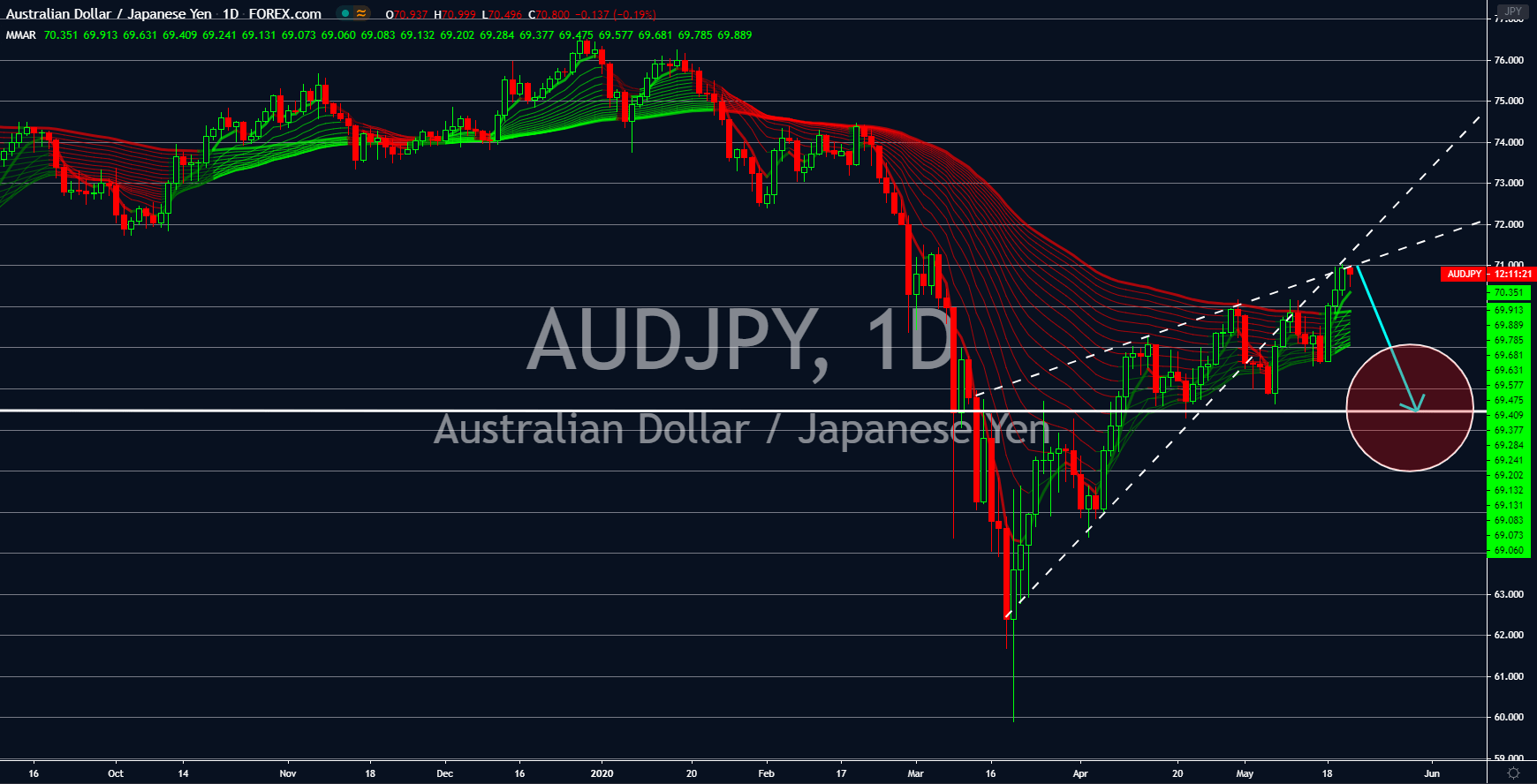

AUDJPY

Australia and Japan were taking the hits from the slowdown in the American and Chinese economy. The coronavirus outbreak in China that started in January forced some businesses in the country to temporarily suspend their operations. This resulted in a decrease in the economic activity of the Chinese economy. On the other hand, the US has now the largest cases of the coronavirus pandemic. The lockdown in the country ended up reversing the US’ GDP growth for the first quarter of 2020 by 4.8%. In addition to that, a new tension between Beijing and Washington is brewing, which could result in a renewed trade war. Aside from this, the pandemic has also been affecting Australia and Japan. The latter already injected several stimulus in the local economy to keep it from crashing. Meanwhile, stakeholders in Australia were not satisfied with the actions taken by the Morrison Administration to contain the virus.

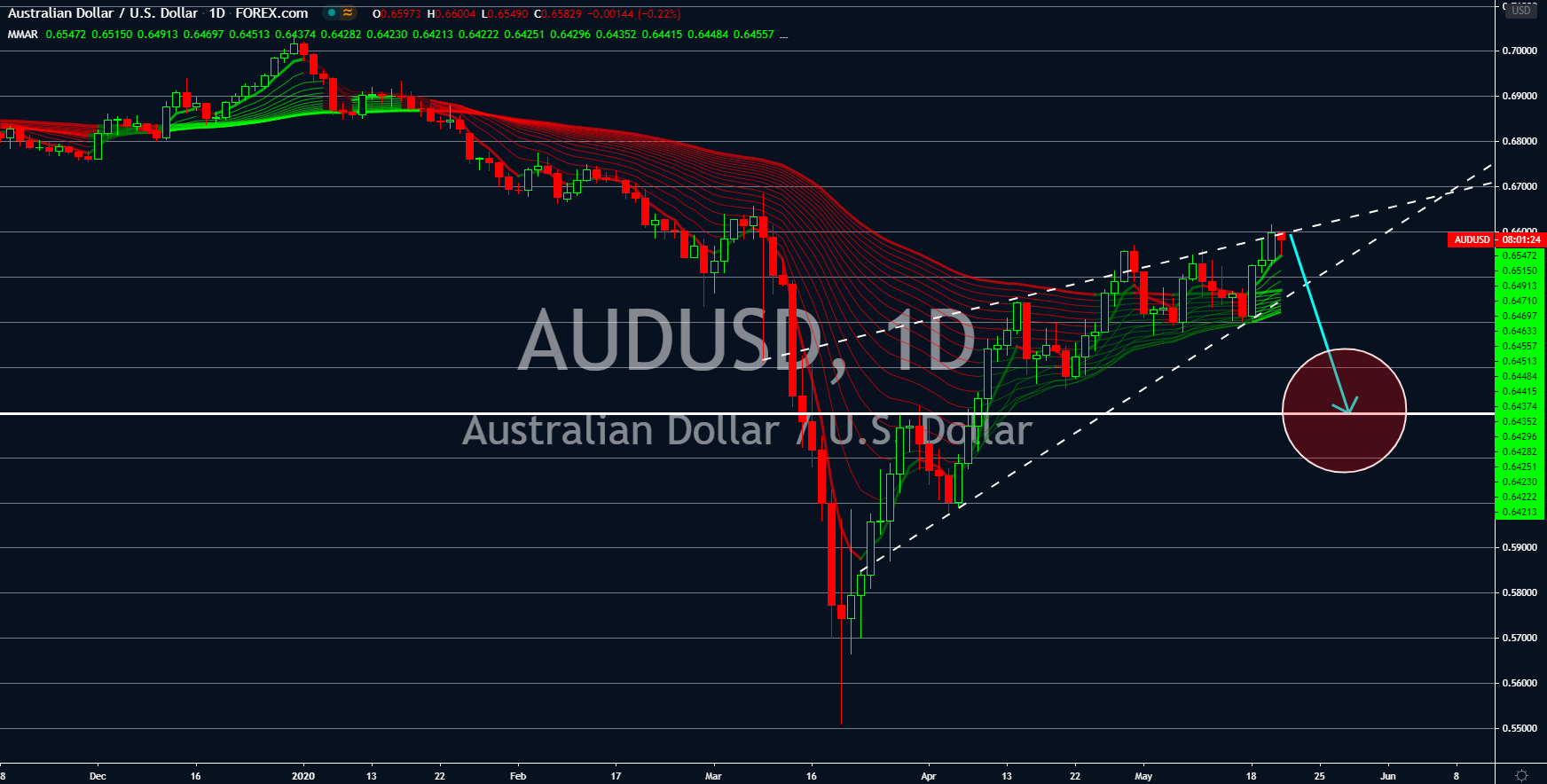

AUDUSD

The backing of the US government and the Federal Reserves on the greenback will reflect on the USD in coming sessions. As coronavirus cripples through the global economy, countries are unveiling their own version of fiscal stimulus to help their economies to stay afloat. The Australian government introduces a $320 billion fiscal stimulus, which represents 16.4% of the country’s annual GDP. However, investors of the Australian dollar are worried that the rising unemployment in the country could offset the benefit given by the stimulus. On the other hand, the US government and the US central bank unveiled a record of $6 trillion cumulatively to counter the economic effects of the coronavirus. This was supposed to hit the value of the US dollar. However, the usefulness of the greenback in the global market makes it a safe-haven currency in times of crisis like the coronavirus pandemic.