Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

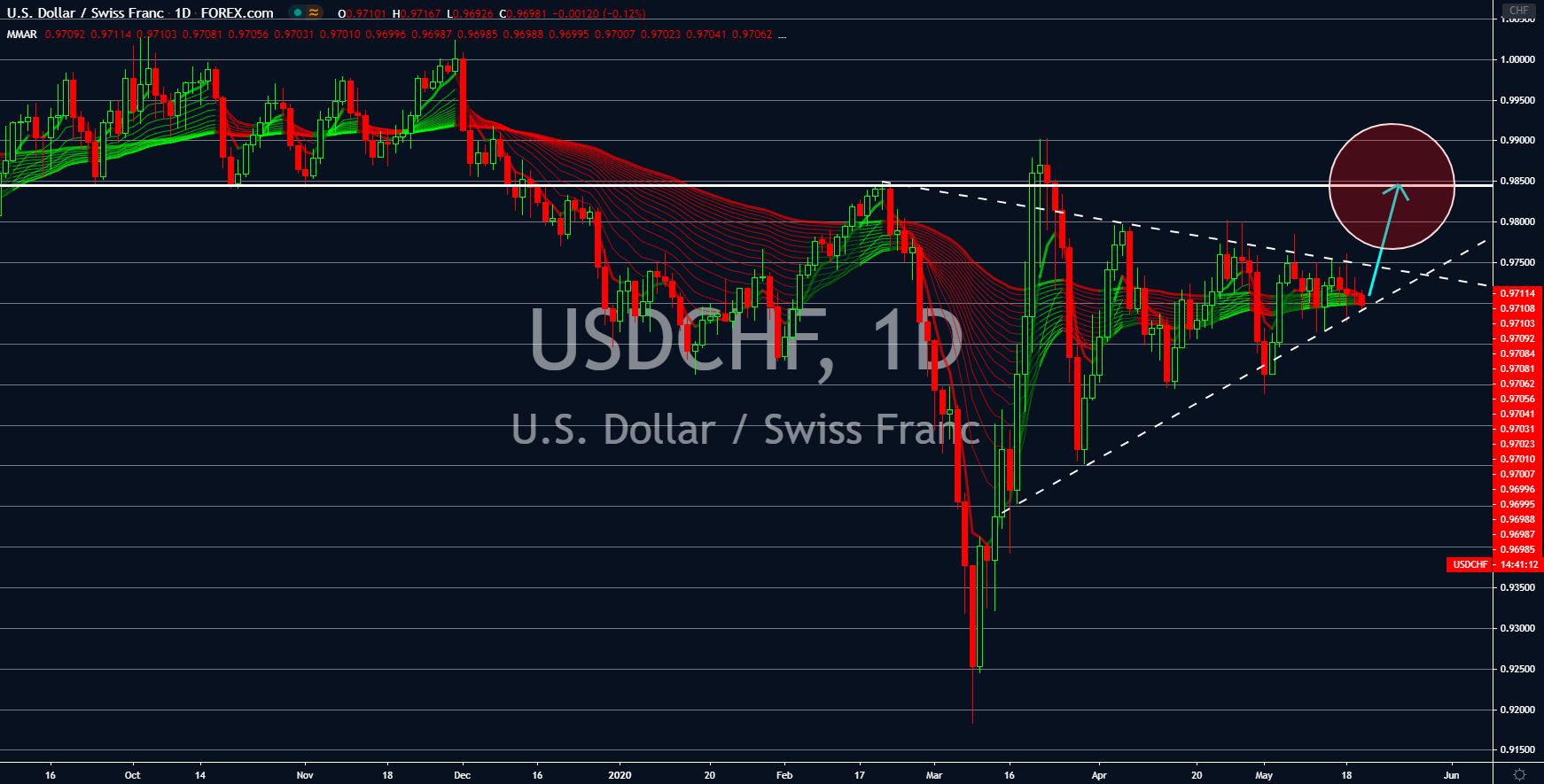

USDCHF

The safe-haven appeal of the Swiss franc is fading along with the economy of Switzerland. The Swiss economy would face the biggest slump since 1975 with the projected 6.7% contraction for the first quarter of 2020. Other European economies already plunged following their disappointing results. Germany’s GDP growth went down by -2.2% while France contracted by -5.8%. The disappointing outlook on the Swiss economy was largely attributed to its safe-haven status. The country is among the only three (3) economies in the world with a negative interest rate. This means that the banks are paying businesses to take loans. However, as Switzerland faces the coronavirus pandemic, the country was left with little to no room for economic stimulus. Meanwhile, the US interest rate is still in the positive territory. Its government and central bank also expressed their willingness to save the American economy no matter what it takes.

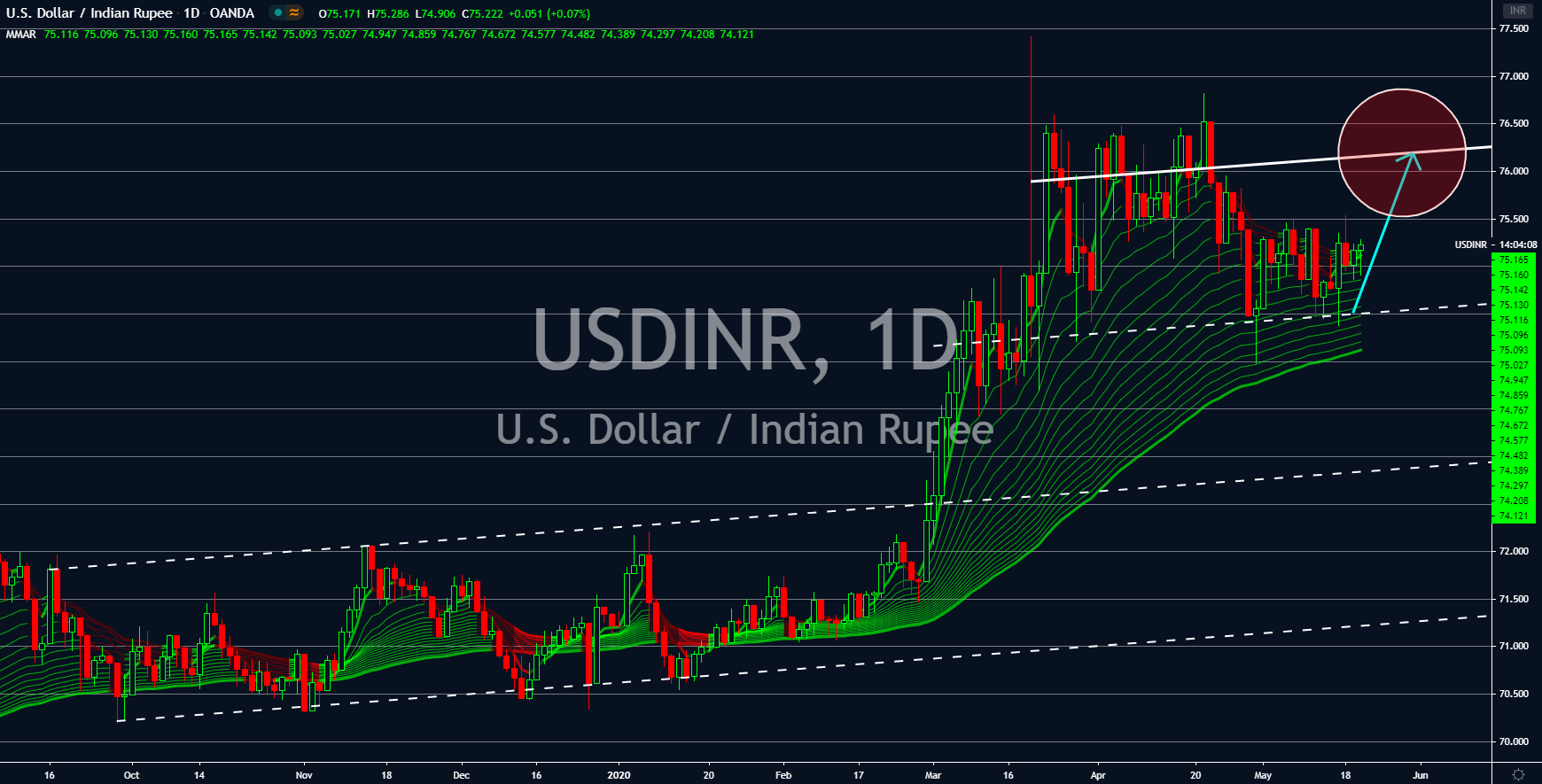

USDINR

As one of the fastest growing economies in the world, India is expected to take a big hit from the slowdown in global economic activity. Goldman Sachs gave a dire warning on India’s economic outlook. The investment management firm said it is looking for a 45% decline in India’s growth for Q2 2020. The country hasn’t published its first quarter results, but analysts are already anticipating a negative growth for the said quarter. For February, the country’s unemployment rate was at 7.8%. However, as most economies began to lockdown in March, analysts are expecting a worse result for March. Some experts believe that the effect of total lockdown in India will result in a 25% unemployment rate for April and May. The Indian government only introduced stimulus for businesses affected. On the other hand, the US is countering the rise of its unemployment rate by distributing $2,000 cash aid for people affected by the coronavirus pandemic.

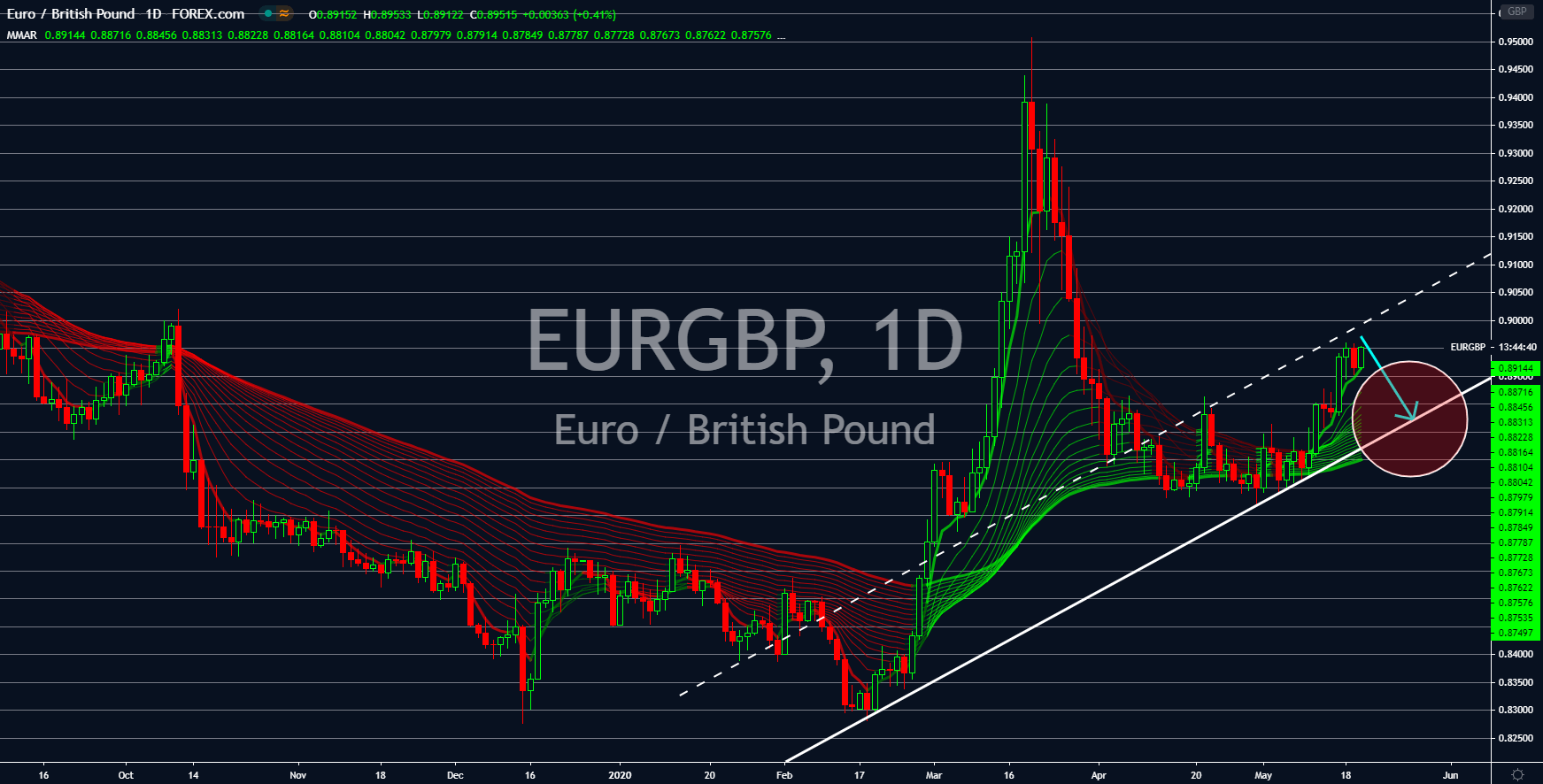

EURGBP

The single currency will underperform against the British pound in the coming days following the upbeat Q1 performance of the United Kingdom. The UK only recorded a decline of -0.2% in its GDP growth for the first quarter of 2020. Meanwhile, Germany and France posted figures of -2.2% and -5.8%, respectively, for their Q1 result. The resiliency of the UK economy is expected to reflect on the performance of the pound in the coming sessions. The burden to keep the integrity of the euro, and the European Union as a whole, lies on Germany and France. However, with both countries experiencing a recession, analysts are expecting the single currency to underperform against its peers. Despite the members of the eurozone easing their lockdown restrictions, analysts expected the group to have a slow recovery. Foreign investors are expected to prefer the American economy as its government and central bank introduces trillions of dollars of stimulus.

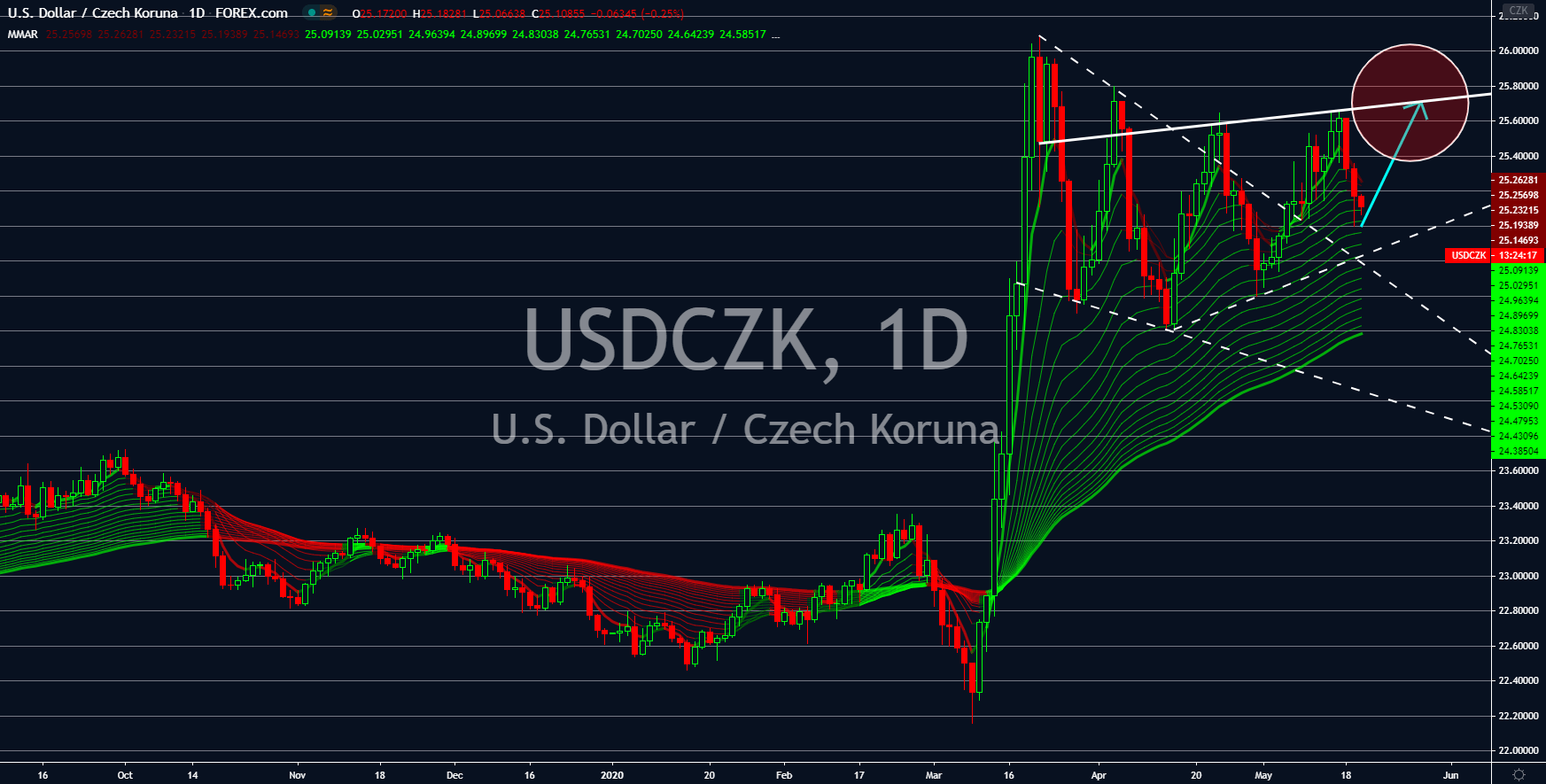

USDCZK

The fear of a second wave of coronavirus cases in the Czech Republic would hurt the performance of CZK in the coming days. Czechia is among the first European countries who reopened their economy in April as they successfully contain the virus. However, a recent report shows cases in Czech Republic reemerging once again. Monday’s additional cases for Czech Republic was at 111 while deaths were 3. Despite its win against the coronavirus, Czech Republic will still take a hit on its economy. The country is expected to decline by 6.2% this 2020, effectively erasing the improvement made for the past two (2) years. On the other hand, the largest economy in the world is also on a decline. The US Q1 2020 GDP growth grew by -4.8%, disappointing investors. However, the support given by its government and central bank keeps the US dollar and its economy afloat. Cumulatively, the US institutions have inserted $6 trillion into its economy.