Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

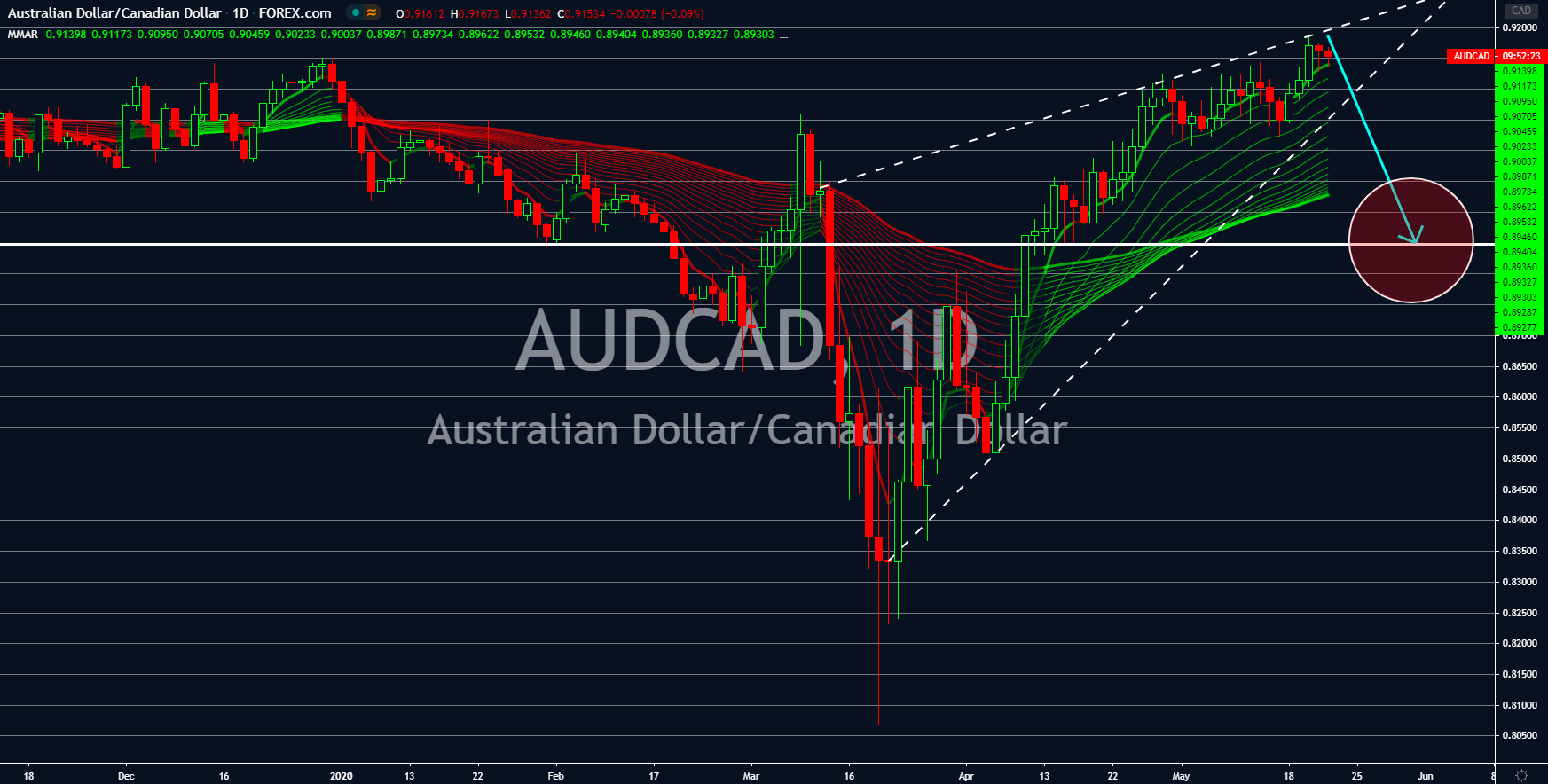

AUDCAD

The Australian dollar is under fire following the revised outlook from the Fitch Ratings. The credit rating agency is now anticipating a negative growth for the Australian economy. The change in the tone of Fitch Ratings was due to the insufficiency of the fiscal stimulus introduced by the government. The Morrison administration offered to subsidize 6 million of its citizens over the next six (6) months to prevent its unemployment rate from skyrocketing. However, the country was not able to include the economic impact of the global lockdown on its decision. The slowdown in major economies could directly impact the Australian economy, especially that it considers China and the United States as its largest trading partners. Another country that’s struggling from the impact of COVID-19 is Canada. However, its 150 basis points cut on its interest rate in March is expected to fend off the coronavirus impact on its economy.

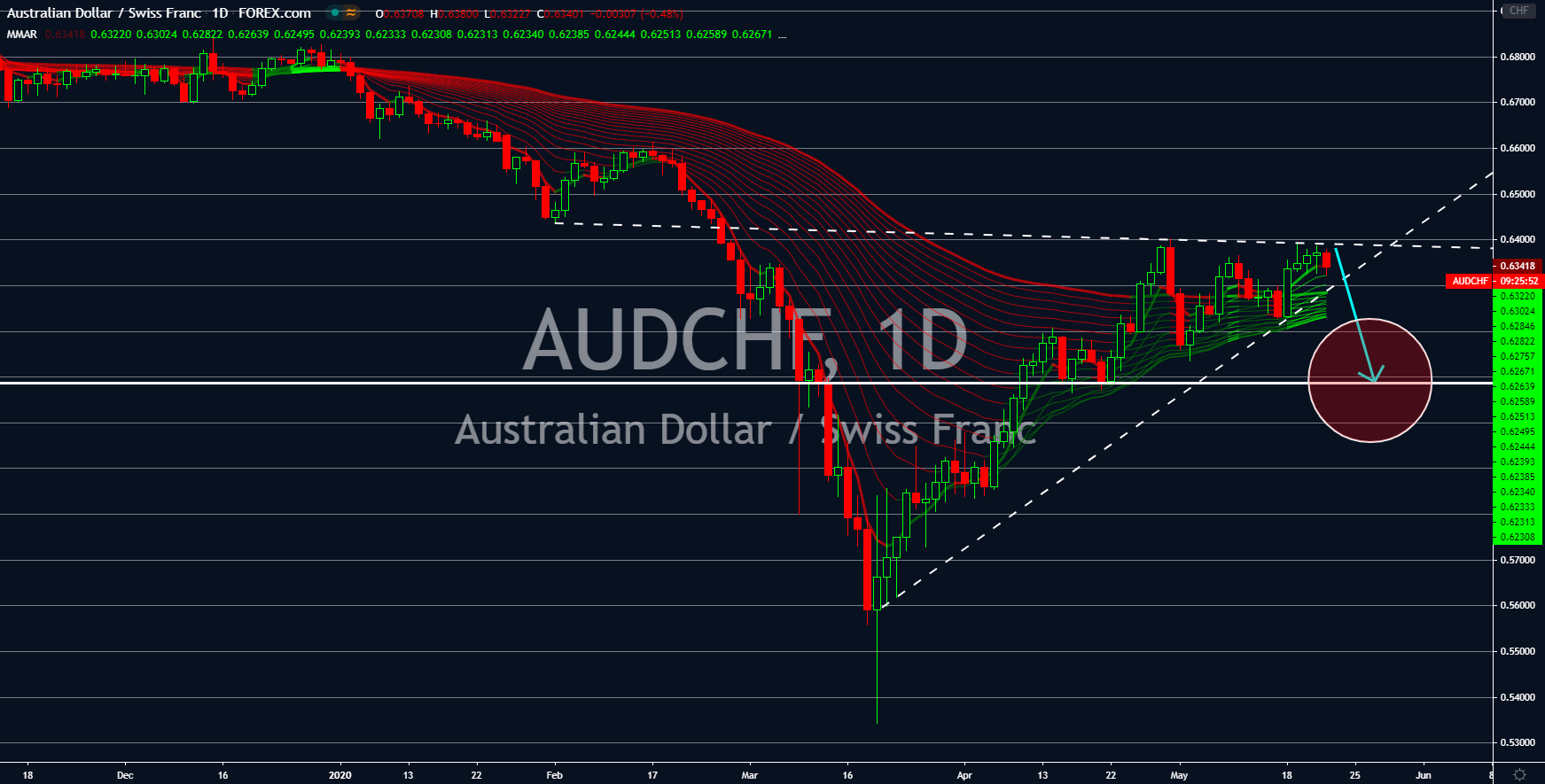

AUDCHF

The recovery of Europe from the coronavirus pandemic will bring back the attractiveness of the Swiss franc. Switzerland’s currency loses its appeal in the previous months after Europe became the epicenter of the pandemic. Italy, Germany, and France were among the most infected countries in Europe and the world and together they share borders with Switzerland. This had investors thinking whether Switzerland will be spared from the contagious disease. However, as Europe began easing their restrictions, investors are now turning to the Swiss franc. The United States has now the largest number of coronavirus cases and deaths, making the efficiency appeal of the US dollar in the international market to falter. Despite some economies beginning to ease restrictions, however, not all of them will see their economies go back to its normal level prior to the pandemic. Australia was given a negative outlook by the Fitch Ratings agency.

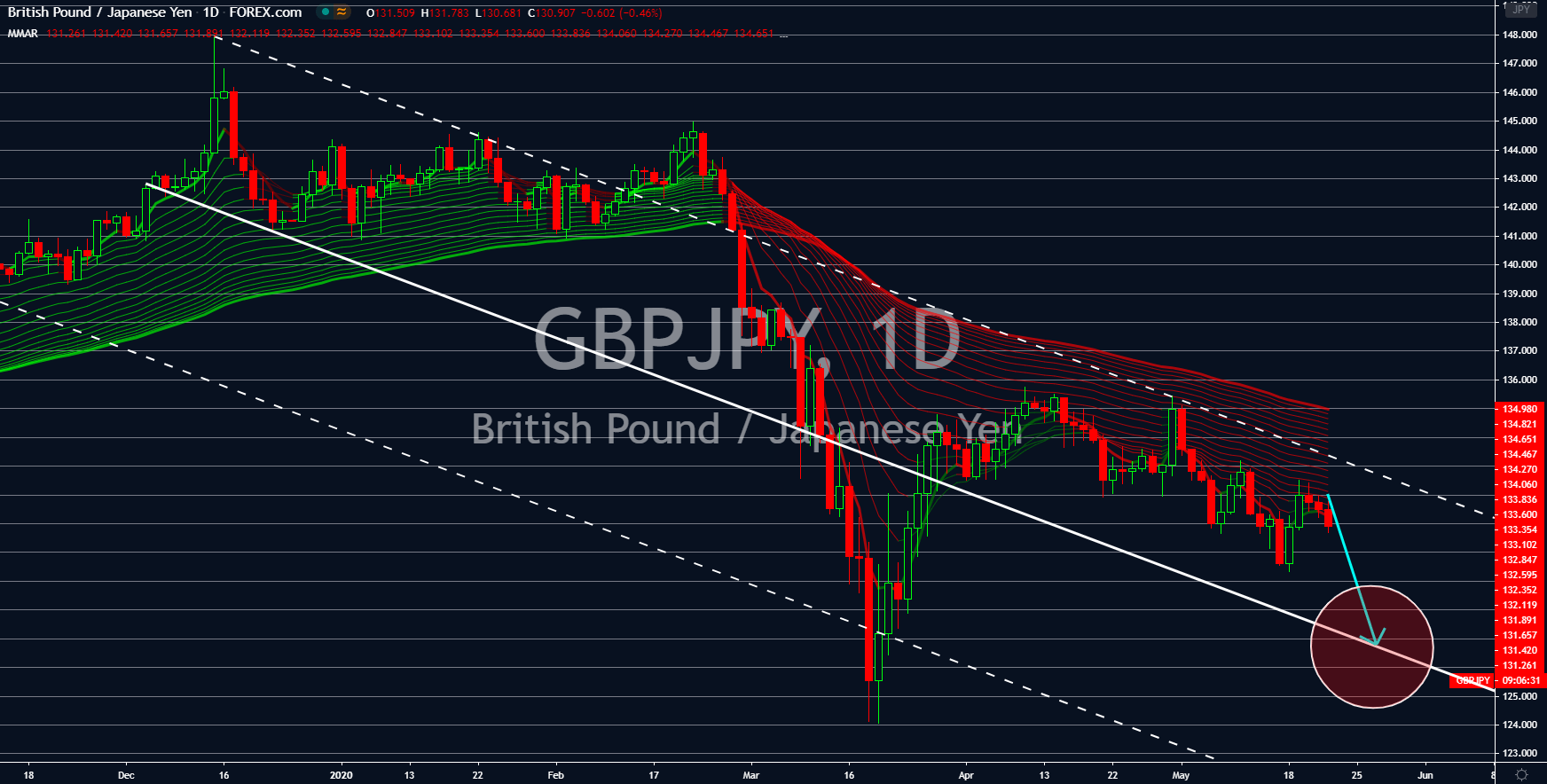

GBPJPY

The United Kingdom is losing on all fronts. The UK turns out to be the loser from its withdrawal from the European Union. Reports showed Britain’s economy slowing down following its divorce from the largest trading bloc on January 31. A double whammy of events further dragged the UK economy. In March, Europe became the epicenter of the coronavirus pandemic, forcing most economies in the region to close their borders and businesses. And now, data shows Britain having the most cases of coronavirus in Europe despite most of the economies in the region beginning to lift restrictions. Reports of the UK’s retail sales today also published disappointing figures, showing its biggest slump in history. Japan is facing the same fate. After shrinking 3.4% in Q2, the country recorded a deflation for its core consumer prices. However, recent actions by the Japanese government suggests that it is ready to protect its economy from the downfall.

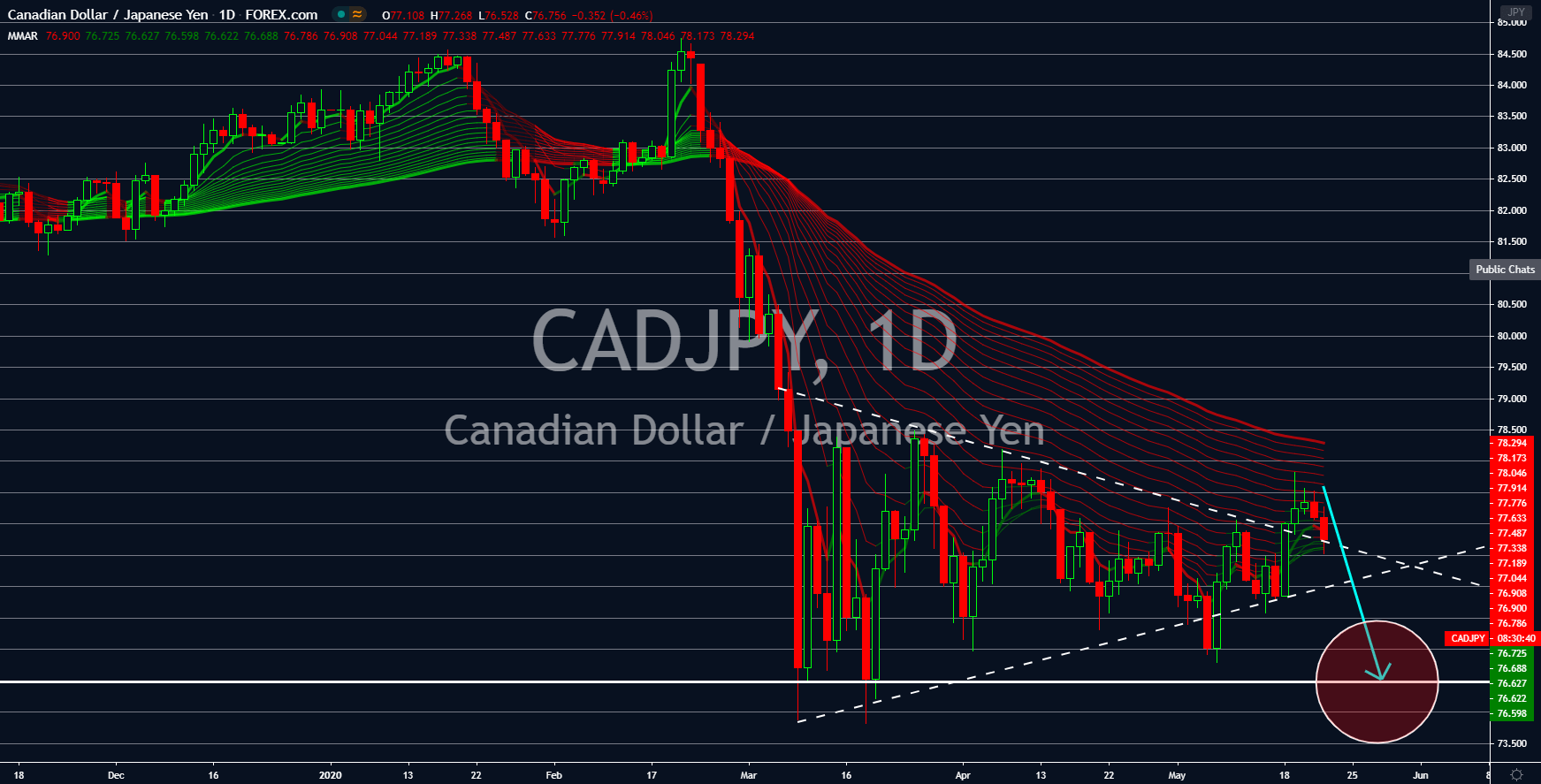

CADJPY

Both Canada and Japan unveiled drastic measures to help their economies to stay afloat. The Bank of Canada (BOC) slashed 150 basis points on its interest rate in the month of March alone. The country was able to dodge the economic impact of the US-China trade war but not the global pandemic. On the other hand, the Japanese government introduces its largest stimulus package ever. Cumulatively, the stimulus was $1 trillion dollars and key figures in Japan calls for further monetary measures to save the third-largest economy in the world. The economic aid in Japan was aimed at helping businesses and individuals to cope up from the global pandemic. Meanwhile, Canada’s response to the pandemic was more on businesses. This, in turn, might affect the country’s economic activity. Higher unemployment and lower income will contribute to a total disaster in Canada’s economy in the coming months.