Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

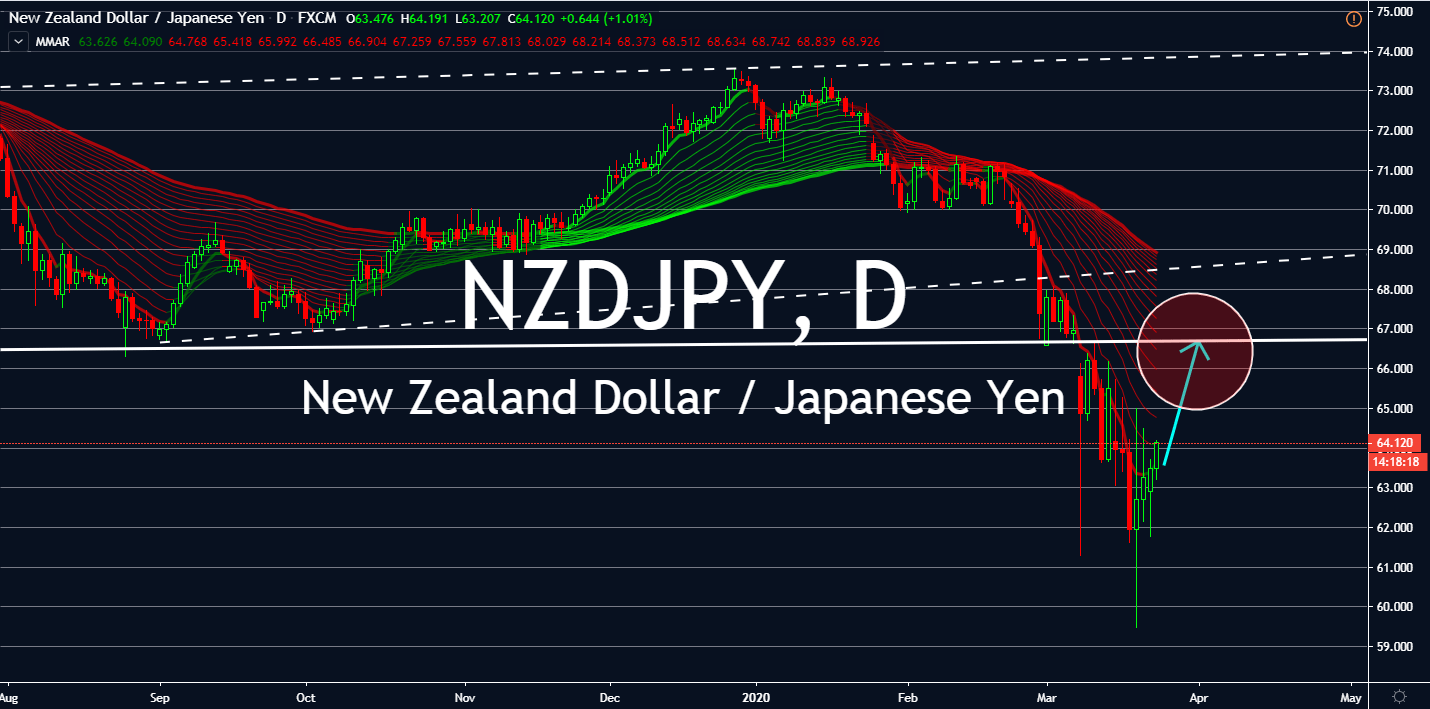

EURPLN

The Polish zloty has been the weakest in eleven years. Not only did its central bank lower its interest rates by 50 basis points down to 1.00% last week, the country also now has the green light to buy treasury bonds worth up to 10 billion zloty. The decision is part of a quantitative easing after the central bank saw increasing demand for local cash. Ideally, the QE would open doors to a large anti-crisis fiscal policy package that could slow the risk of the T-bonds market similar to Poland’s experience in 2008. While the Euro is still suffering across markets for failing to implement coordinated policies in the bloc, Poland’s movements against the coronavirus will determine the pair’s movement instead. That said, the Polish health system is suffering critical shortages in supplies necessary to test and cure symptoms, and investors are questioning every movement from the Polish government due to its proximity to the presidential election in May.

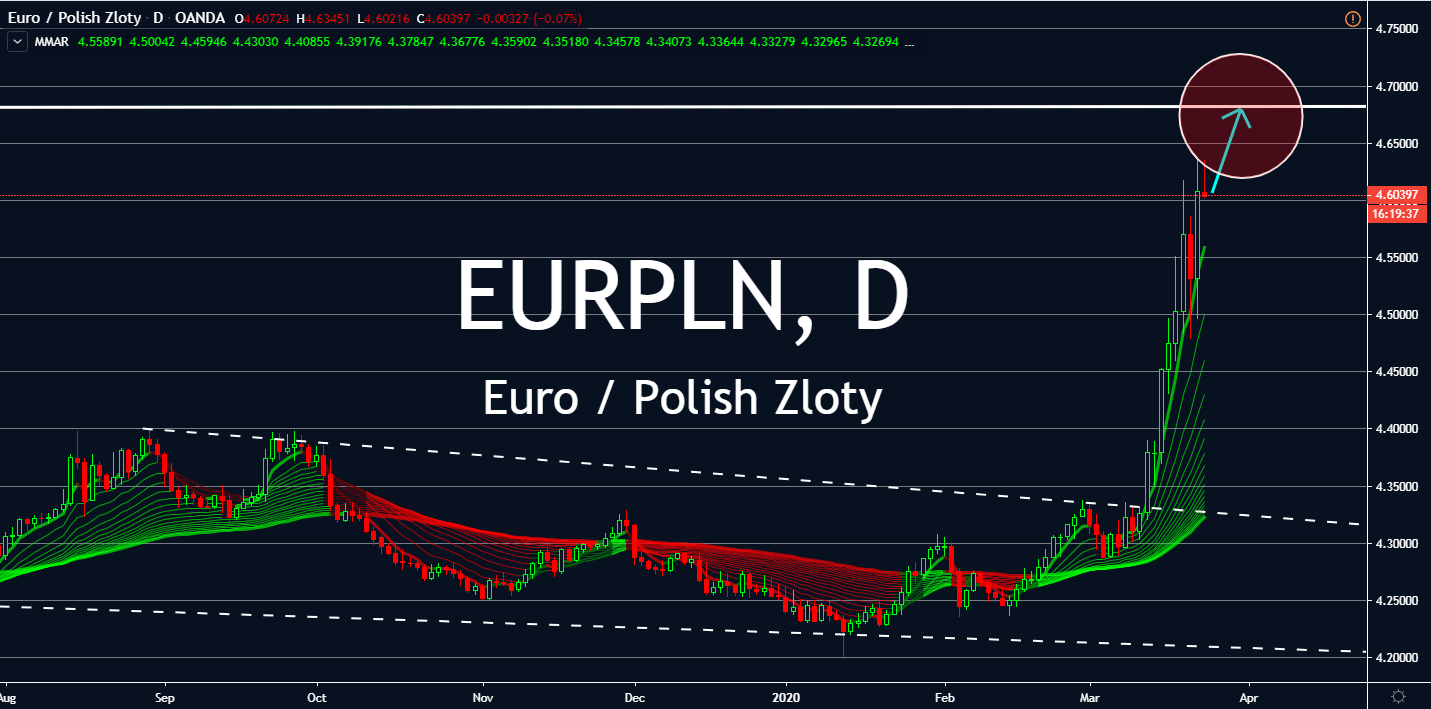

EURTRY

The Euro is still seeing high volatility in the market as the world engages in the European Commission’s movements against a heightened possibility of a split up in the eurozone. Germany, in particular, signed on a €156 billion supplementary rescue package to save businesses and employment in the bloc only yesterday. In the short term, its higher-than-expected manufacturing PMI is expected to drive the Euro higher than most markets. In the long term, however, the pair will go back into its previous resistance. Turkey just began its mass respirator production to help boost progress against the coronavirus, in addition to appointing 32,000 new healthcare personnel to help treat local victims. This will help investors root for the Turkish lira as it uses medicines supplied by China with continuing solidarity between Turkey’s health sector and its citizens with rapid mass testing as recommended by the World Health Organization.

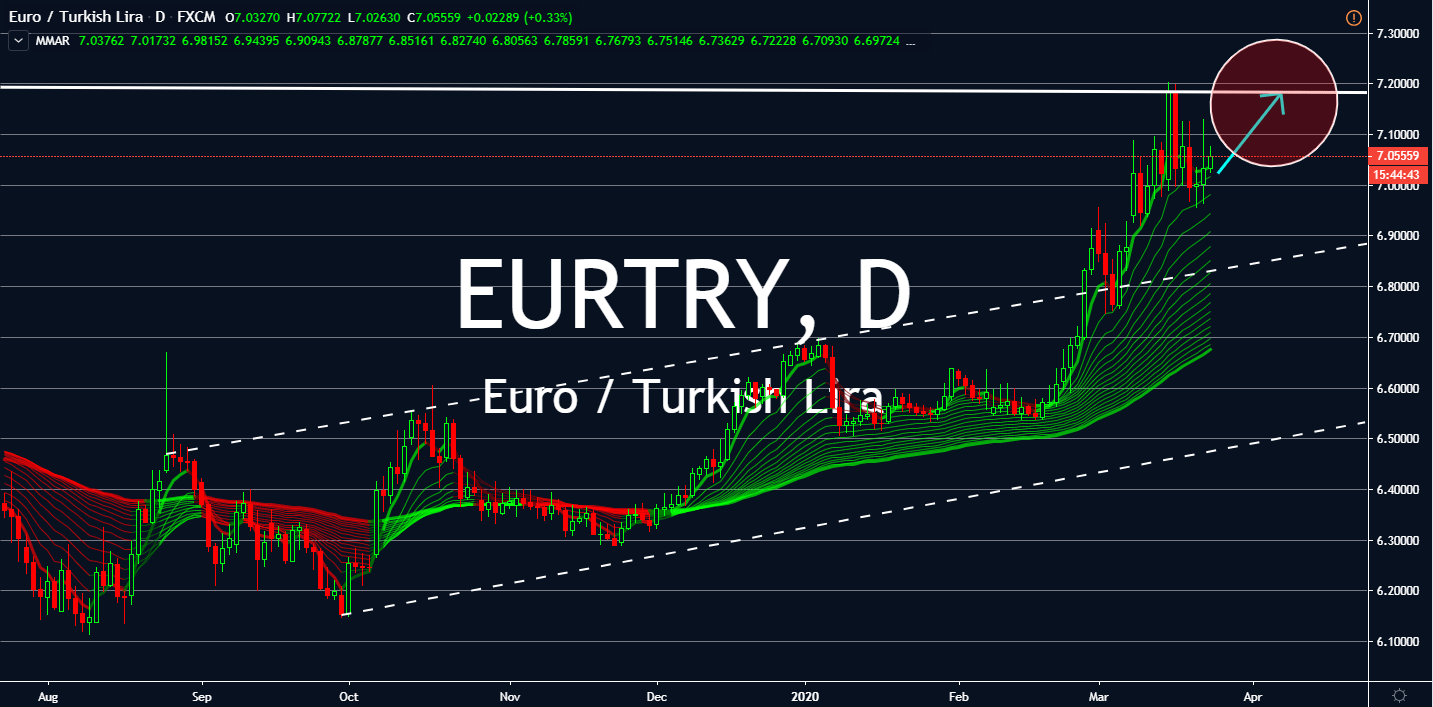

EURNZD

The euro kiwi pair broke out of its largely sideways pattern in early March after consecutive losses beginning in November, which ended in late December. Both saw high volatility in several markets after it broke out of its record, but the pair is now expected to go back into its old territory after it will go a little higher in short-term sessions. Germany achieved higher manufacturing PMI than expected for March, in addition to pursuing a €156 billion supplementary rescue package to save businesses and employees in the region. Manufacturing PMI in the eurozone overall was also higher than expected for the same month, which will help the euro across different exchanges. However, the euro’s current lack of unity amid its financial crisis led by the coronavirus might cause investors to lose faith in the currency, especially as its individual currencies are still having a hard time finding an effective solution to a simultaneous financial decline.

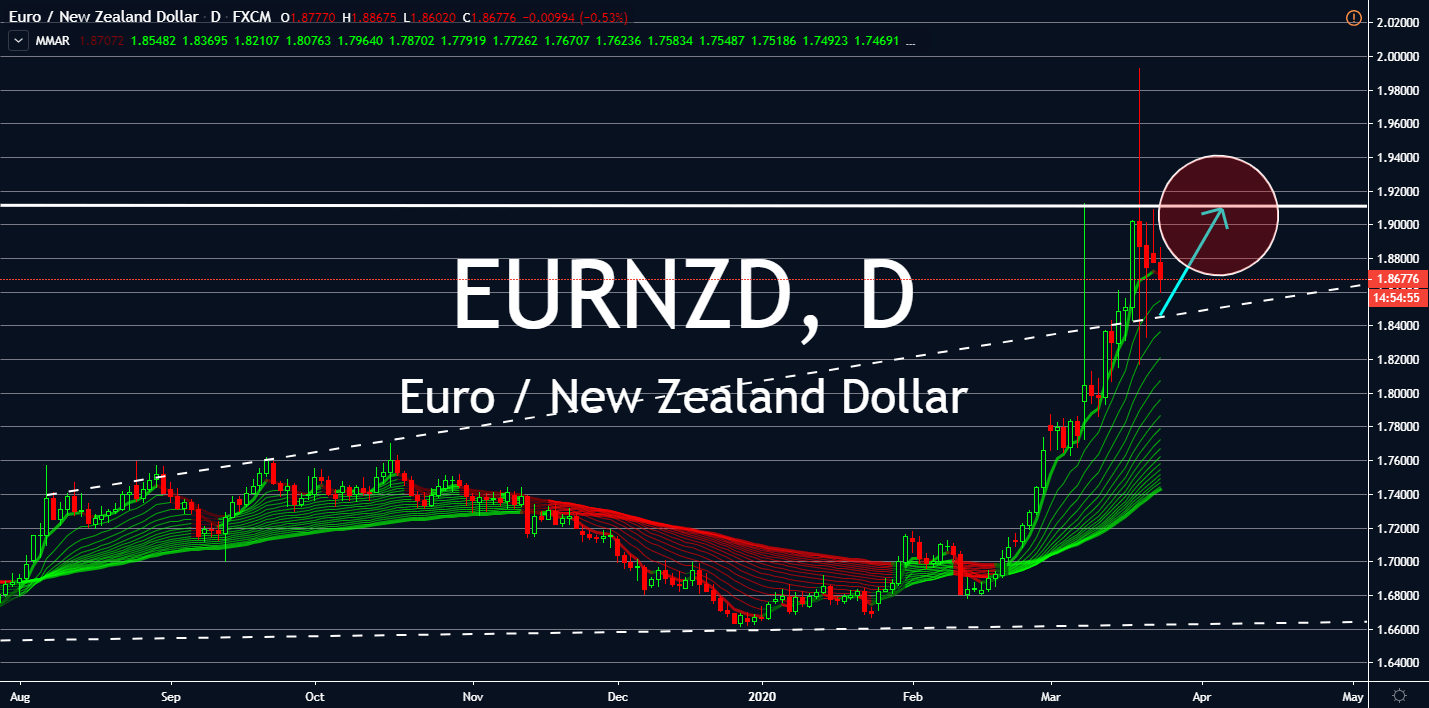

NZDJPY

Two safe haven currencies are going head to head amid the seemingly endless uncertain time. The Japanese yen and New Zealand dollar pair is experiencing high volatility, especially since after breaking down in early March. Now, it’s at lows last seen in 2012. The Bank of Japan maintained its current interest rates as per its announcement on March 16 with a follow up of positive reports on exports and imports year in a yearly comparison, industrial production and capacity utilization in a monthly comparison, and its trade balance in February. Meanwhile, the Reserve Bank of New Zealand lowered its interest rates down by 75 basis points on the same week, which led to a surge in engagement for the JPY for two consecutive sessions. Signs show that the pair is heading back up with overselling, although it still might see slight resistance in near-term sessions. As with most markets, the pair is on the passenger seat beside fiscal progress against the coronavirus.