Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

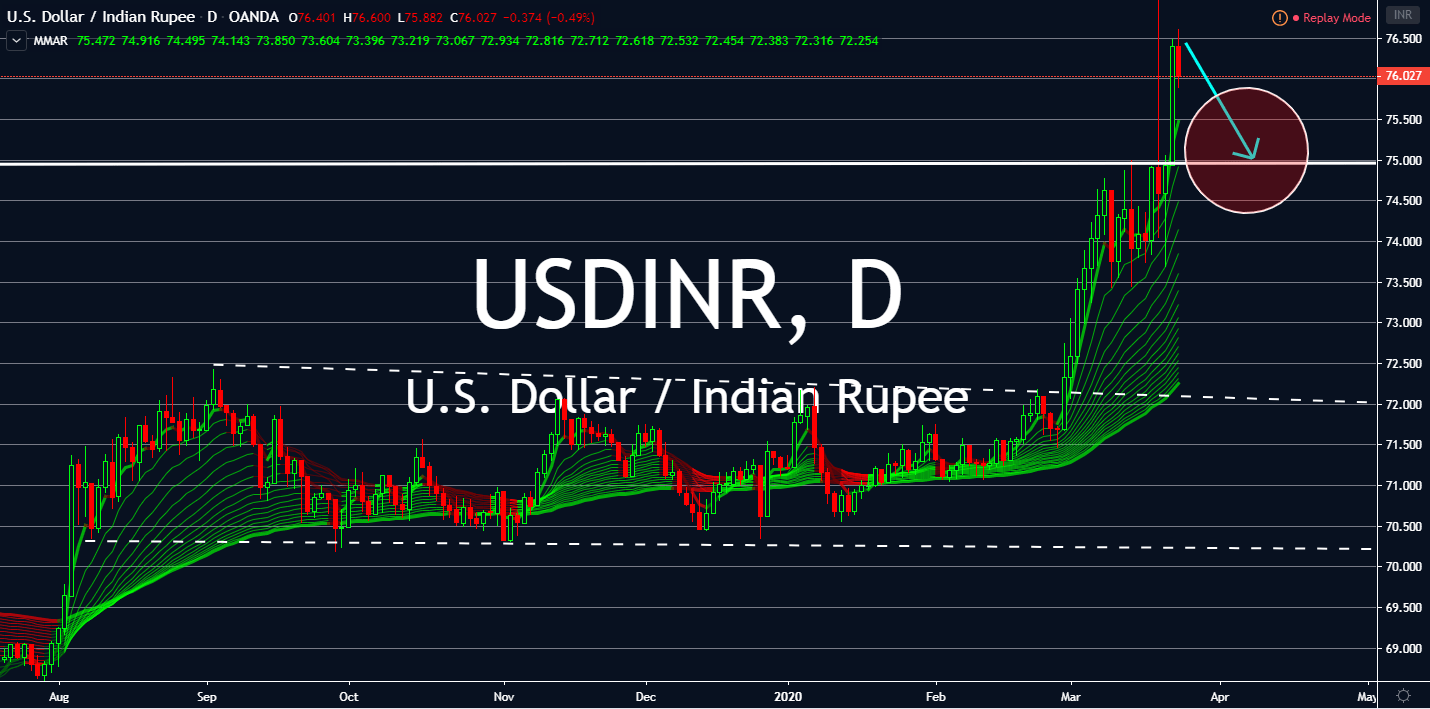

USDINR

Obviously, the US Dollar is the main driver for people going long. After the Federal Reserve’s historical unlimited quantitative easing decision rattled the market, the greenback is gearing up for a skyrocket. The US government is also planning to launch a $2 trillion stimulus package for the business sector as part of President Donald Trump’s ploy of getting elected for another term. Therefore, the US dollar will see itself inching down slightly in today’s session. About one billion Indians joined in the worldwide quarantine today under a 21-day lockdown, prompting the Indian government to begin talks of a 1.5 trillion rupees ($20 billion) stimulus package to tackle the crisis. Prime Minister Narendra Modi, the finance ministry, and Reserve Bank of India haven’t finalized the package yet, although some sources claim it could be as large as 2.3 trillion rupees. India also plans to increase its borrowing plan for the fiscal year 2020-2021 starting April 1.

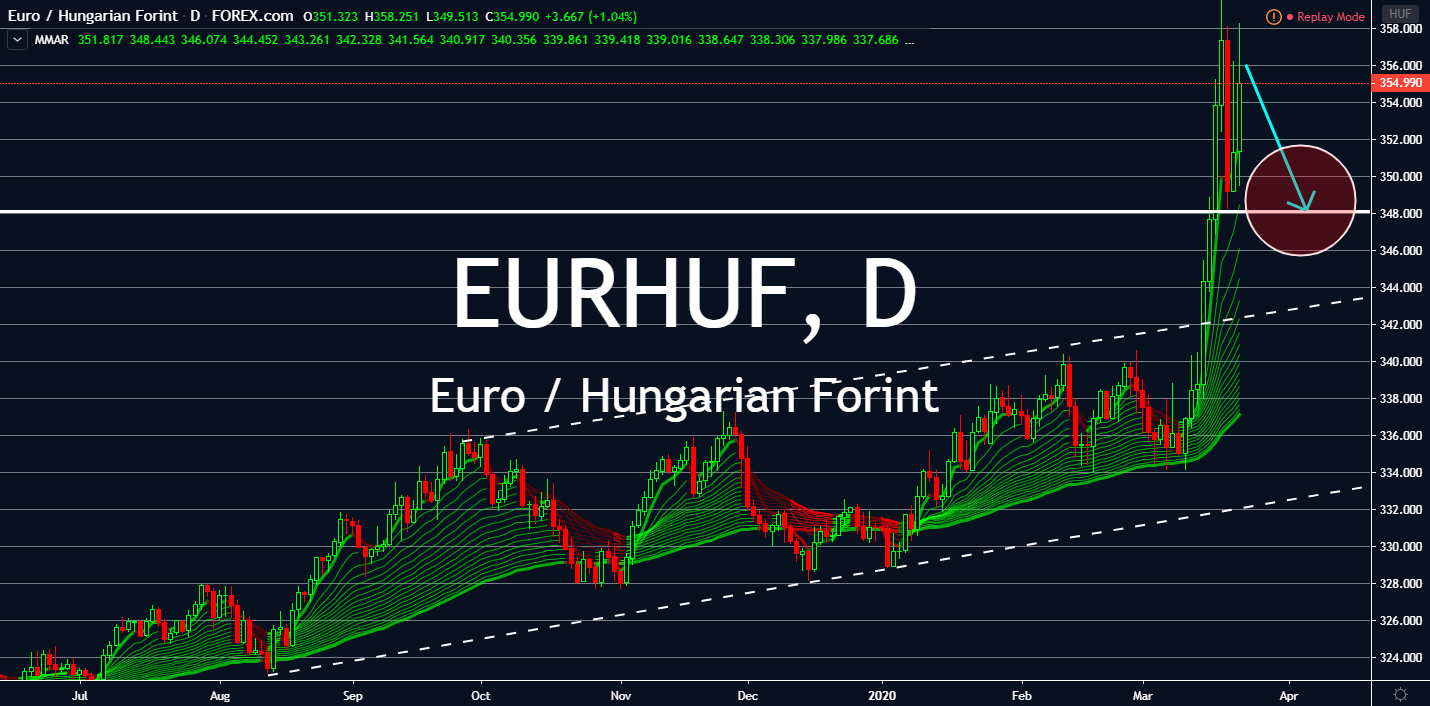

EURHUF

The EURHUF pair began to see rapid, consecutive gains since March 16th when Prime Ministers in the eurozone began discussing possible united fiscal stimulus to help combat the rapidly increasing cases of the novel coronavirus in the bloc. Since then, the pair saw high volatility well above its previous resistance. Now that the European Central Bank is doing whatever it can to help keep its bloc intact, the Hungarian forint is left to fend for itself. As the coronavirus proceeds to drive investor sentiment, the EURHUF will see itself leaping back into its previous resistance level long-term – Hungary just banned the commercial export of a critical ingredient used in drugs for coronavirus treatment in several countries. Hungary is one of the world’s largest exporters of hydroxychloroquine sulfate and the drug associated with it. Meanwhile, the European Central Bank’s €1 trillion bazooka is still in the oven, and the market is waiting for it to show results.

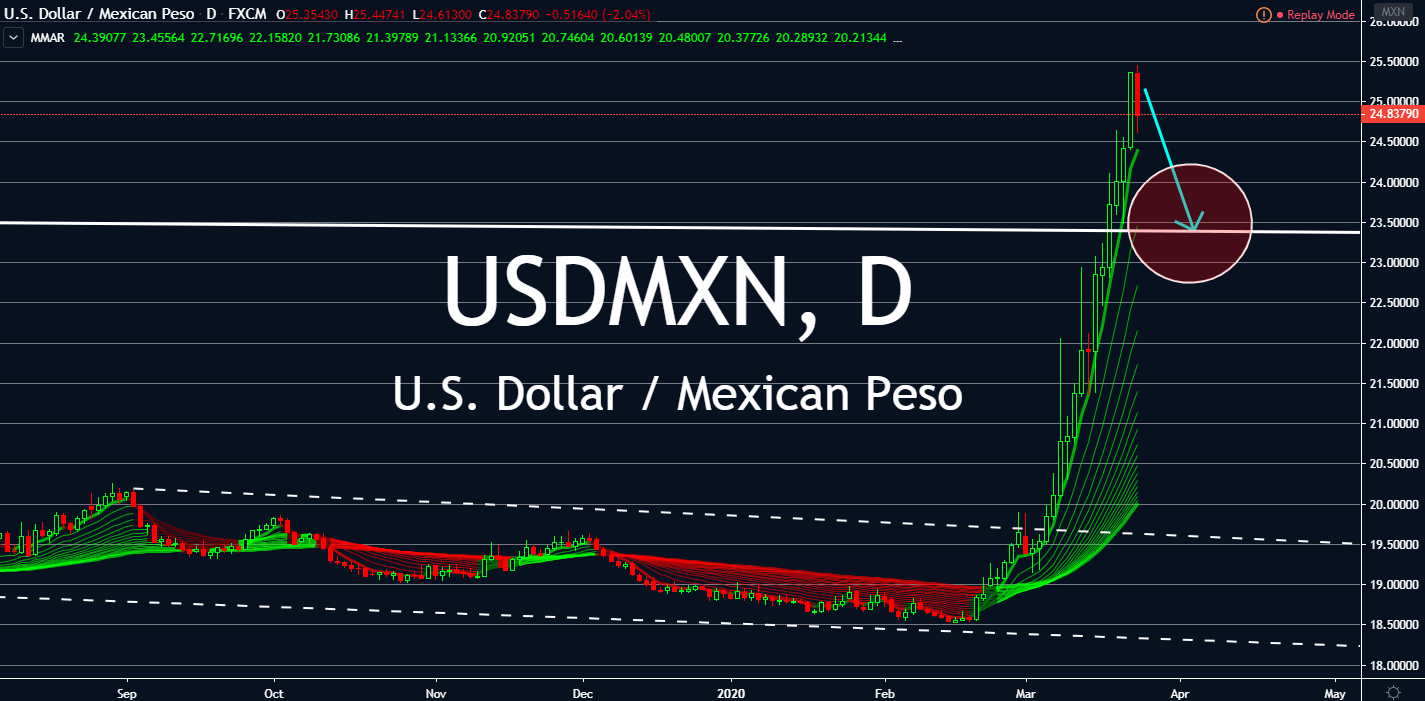

USDMXN

The US Dollar and the Mexican peso started seeing an almost unchanging sideways pattern since late July of 2019. The greenback first broke out of this early this month as the coronavirus transitioned from an epidemic into an alarming pandemic. The pair will see slight resistance in today’s session as investment sentiment drives the pair back to its previous resistance. However, the Mexican president Andrés Manuel López Obrador’s lack of urgency for the safety of his citizens might take a toll on the country against the US dollar. Obrador encouraged people to leave their houses and live their lives as usual, driving criticism toward his intentions regarding the pandemic. The Federal Reserve’s unlimited quantitative easing decision might drive high volatility between the two currencies as the aggressive movement takes effect in the world economy.

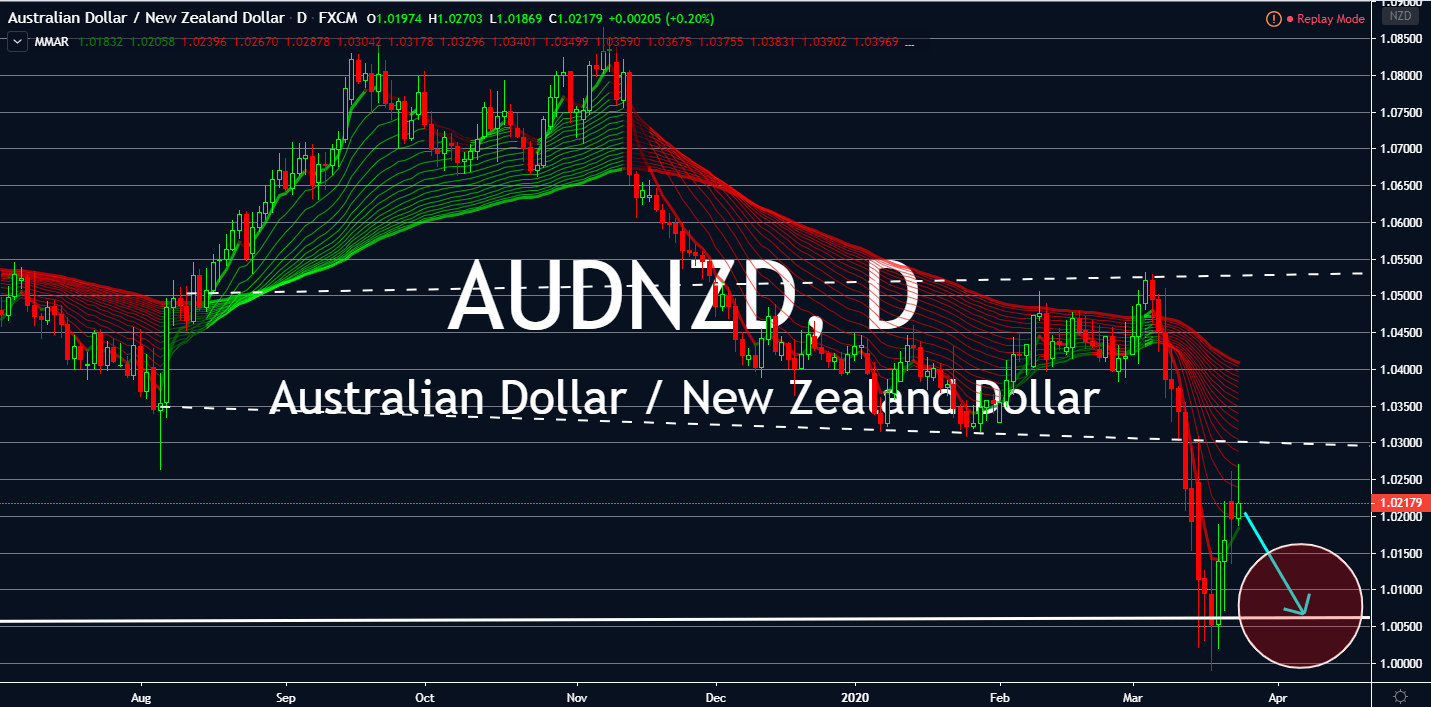

AUDNZD

Even as oil inventories begin to ease, the oil-dependent pair is showing signs of high volatility. The aussie saw a near two-week loss against the kiwi from March 6th to March 18 and quickly rose when the Reserve Bank of Australia eased its interest rates down by 25 basis points in attempt to save its slowing economy amid its local tragedies. Furthermore, Australia’s oil and gas sector can operate more sufficiently and help with the nation’s economic recovery after the Productivity Commission reported regulatory reforms that could provide highly skilled jobs, sustainable energy for sustainable homes and businesses, and export revenue. The economies are on their way to see highs and lows, more in favor of the AUD into previous support, in the long term after the US Congress turned to a massive stimulus package to alleviate the global economic impact of the novel coronavirus pandemic. That said, the pair is set to inch slowly in today’s session.