Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

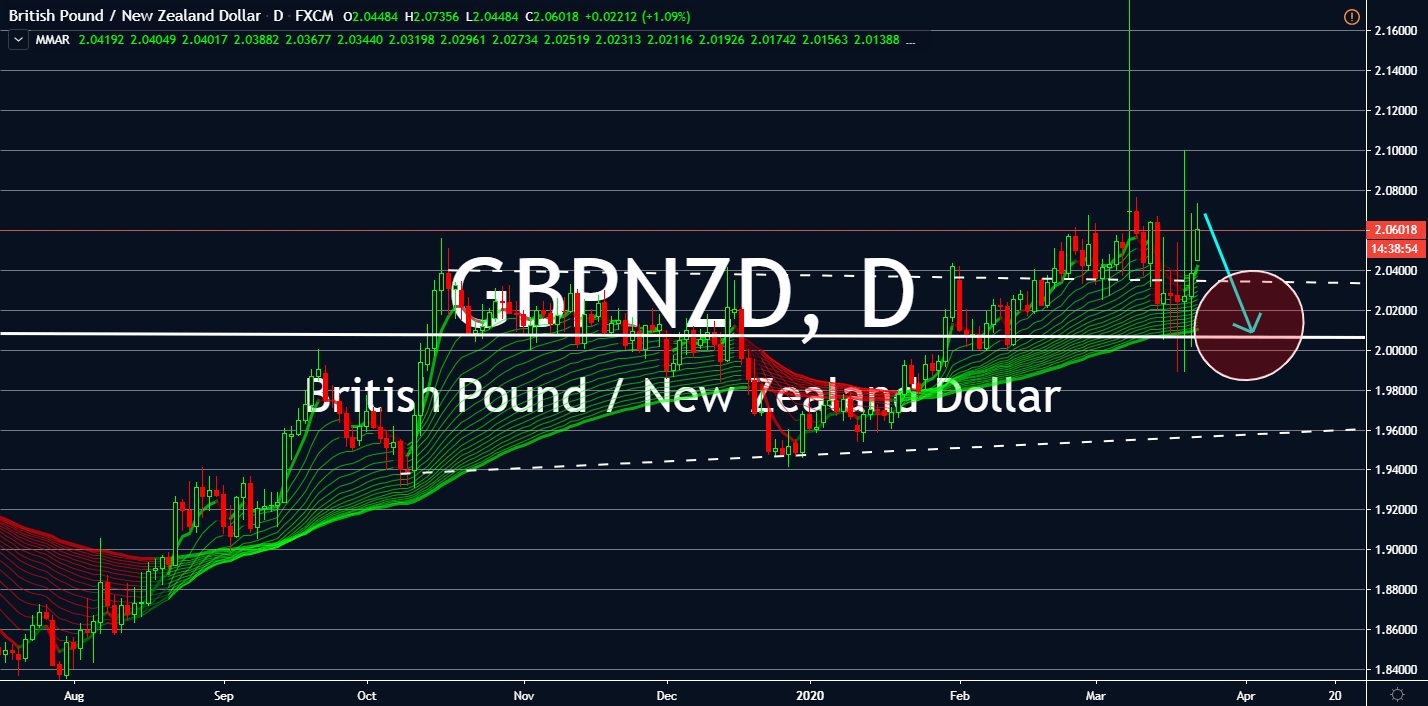

USDBRL

The Brazilian real began to drop across several markets in August 2019 when the country saw investor boycott with increasing deforestation rates in the Amazon forest. Since the USDBRL broke out of its sideways market some time in February, the greenback saw much more gains than losses. Now that the largest state in Brazil had closed down due to surging cases of the coronavirus, BRL is expected to weaken further. Brazil also saw less gains and more losses after the Central Bank of Brazil loosened its interest rate by 25 basis points into 3.75% last week. The US Dollar is also expected to rise against a basket of most currencies as the pandemic drives global demand for cash. Investors are selling riskier assets to buy dollars in a phase where major players are competing for the largest currency’s safety. Markets are now waiting for more results from New York and Washington’s plea to increase disaster deceleration in the country.

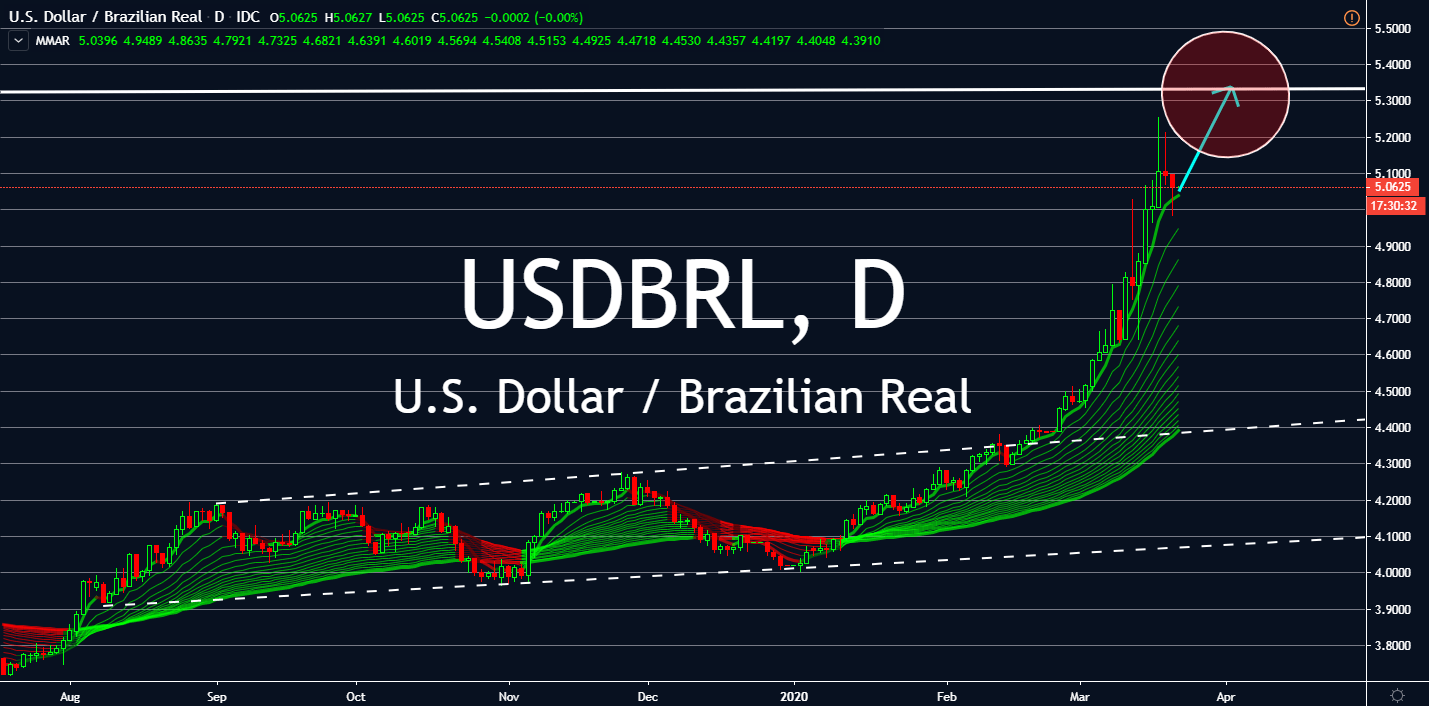

EURBRL

The Euro is seeing weakening figures across the market as investors worry of about the bloc’s potentially upcoming but familiar recession with the looming threat of a split in the region. The European Central Bank refused to alter fiscal policy to help its economy, which led to long red candles against many currencies. The currency also suffered losses when it provided a disappointing policy to replace it. Fortunately for the Euro, the ECB then launched a €750 billion Pandemic Emergency Purchase Program last week – it will purchase public and private sector securities until the end of 2020. Reports called this move a “bazooka” after the previous failed attempts to ease its investors. Because of this, the EURBRL pair is expected to experience high volatility this week. Investors are looking back and forth between the two after Brazil locked down its biggest state, Sao Paulo, to counter increasing cases of the coronavirus in the area.

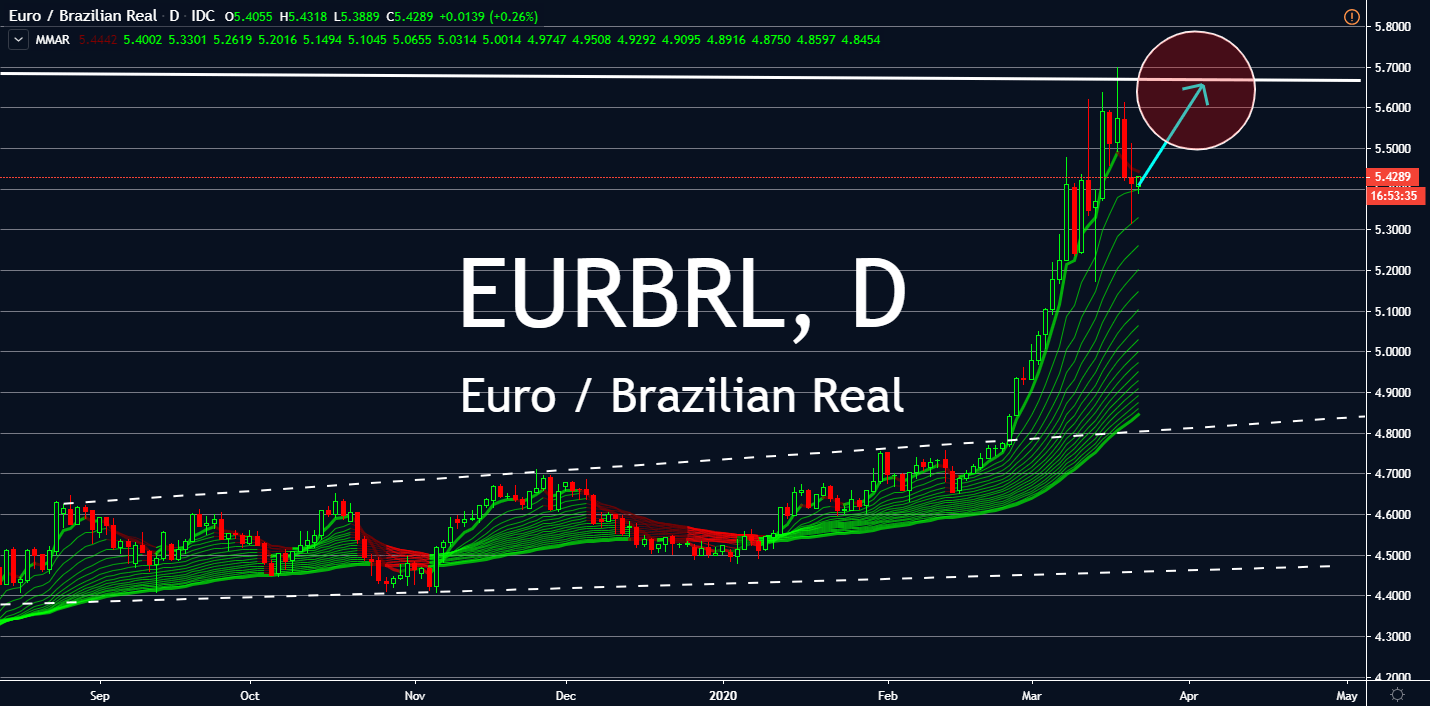

GBPBRL

Sterling is expected to see an ongoing bull market against the Brazilian real this week after the Bank of England delivered another emergency rate cut to an all-time low of 0.1% in attempt to prevent hundreds of thousands of layoffs in the country. Moreover, the Treasury announced a £200 billion money creation scheme, designed to lower the costs of borrowing and pumping cash into its economy. The decision followed only a week after the BoE cut its rates down to 0.25% to pressure the Treasury to make movements against economic damage caused by the pandemic. The compensation scheme will be the main driver of the GBP pair unless the Brazilian government makes a decision on how to help lessen COVID-19 cases in the country. Fortunately for the real, both federal tax revenue and CAGED net payroll jobs were higher than expected this month – this could be another driver of investors’ engagement in the currency across its other pairs.

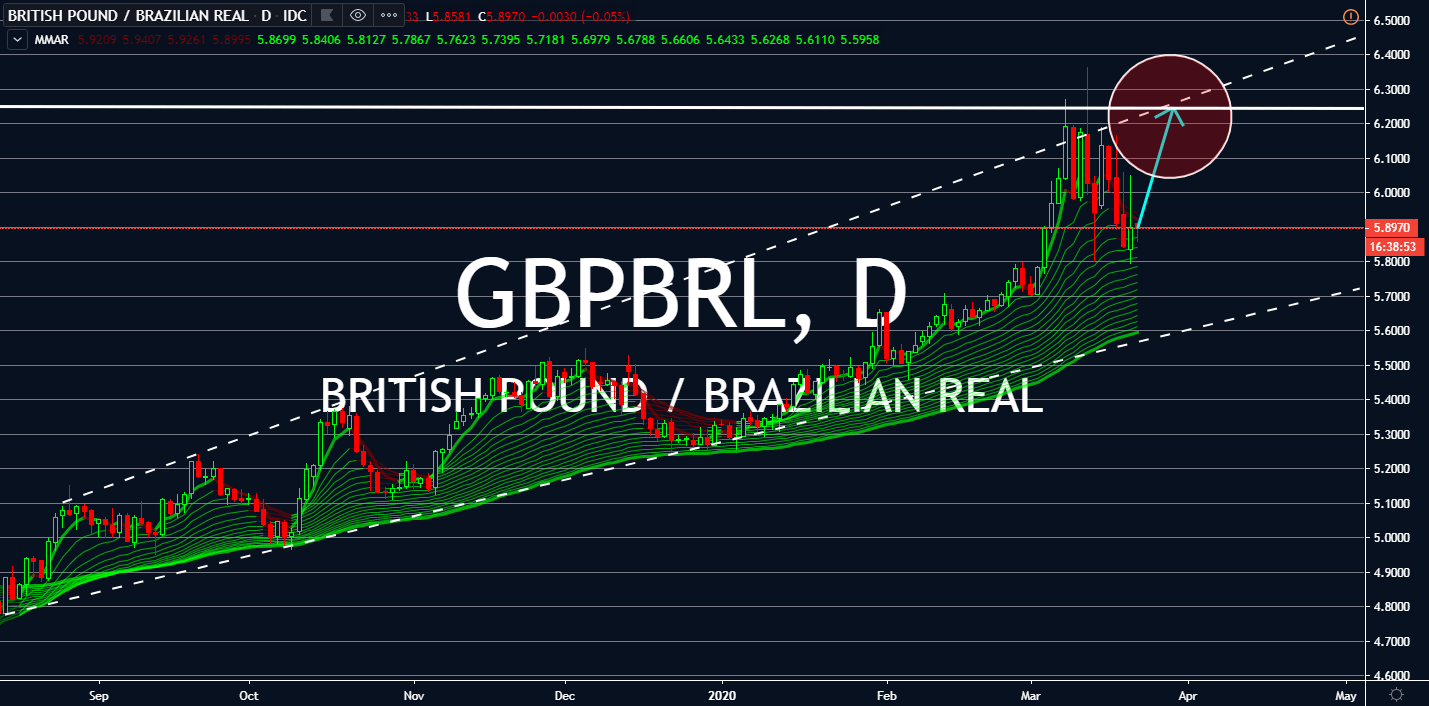

GBPNZD

The safe haven New Zealand dollar is catching up on its major currency counterparts following consecutively positive reports in its economy for the past month. The sterling/dollar kiwi pair went back to its sideways pattern two weeks ago when the UK saw a daily 35% increase in coronavirus cases in the country. Investors began to pressure the Bank of England to enact more stringent measures against the crisis, especially after cancelling large gatherings. Now, the pair is expected to see high volatility throughout the week. Investors are expected to flock over safer currencies like the New Zealand dollar against several of its opposites, but will also rely on the British pound after the BoE held another emergency rate cut last week. The Treasury also announced quantitative easing by £200 billion to lower the costs of borrowing and pumping cash into its economy. For now, NZD is expected to see more support to enter back into the pair’s previous pattern.