Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

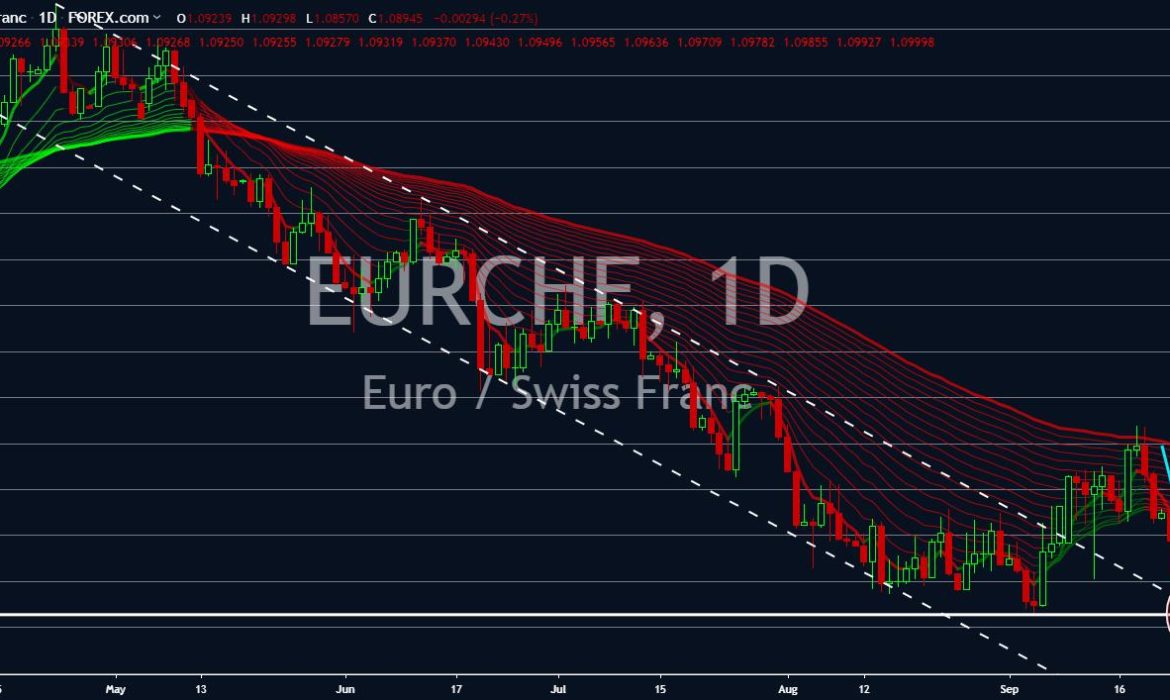

EURCHF

The Single Currency will continue to experience weakness amid a more assertive Swiss government. The European Union and Switzerland were still at odds on a framework deal, which will incorporate the existing bilateral trade agreements between the two (2) economies. The EU argued that the Swiss government will face pressure from the bloc after it signed a post-Brexit trade agreement with the United Kingdom while ignoring the framework deal with the bloc. The framework deal is the result of fear among the EU leaders that the UK might access the bloc’s Single Market through the bilateral trade agreement between the EU and the EFTA (European Free Trade Agreement). Despite pressure from the largest trading bloc in the world, Switzerland is not worried that the tension will affect its economy. Switzerland has a diversified trading deals with other nations including China.

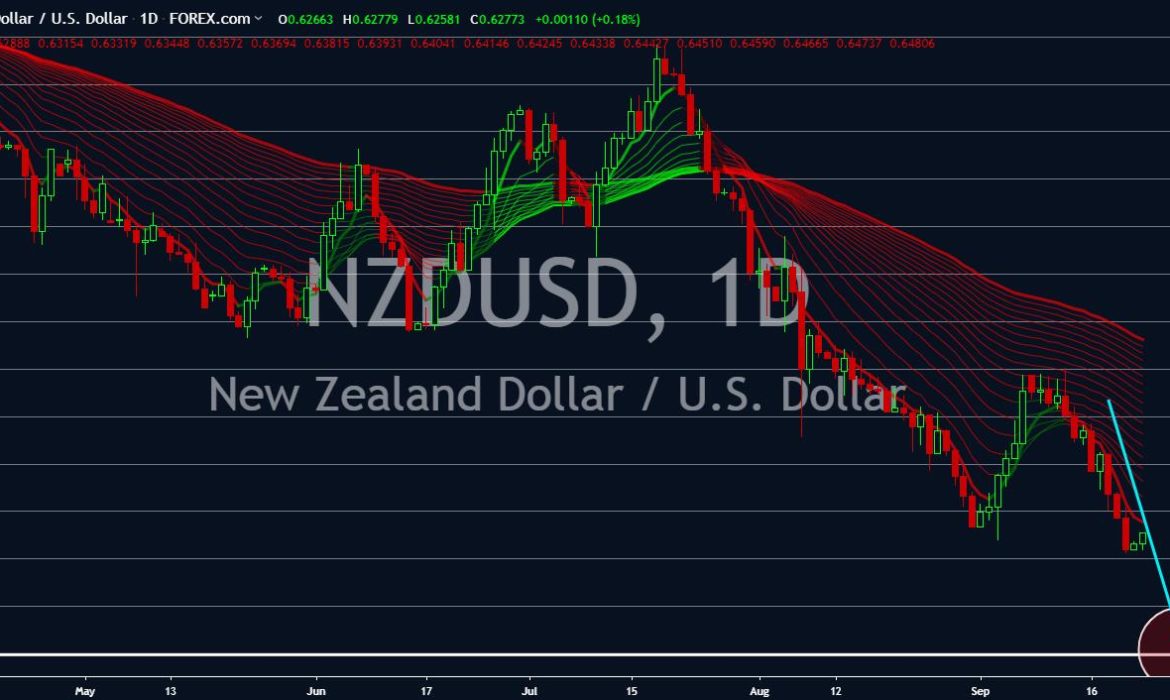

NZDUSD

New Zealand Dollar is being dragged to its 10-year low following a bitter relationship with the United States. President Trump condemned the statement by New Zealand Prime Minister Jacinda Ardern saying the country’s decision will not be affected by the United States. This was after Trump pressured the members of the intelligence sharing agreement of the Five Eyes to ban Chinese telecom giant Huawei. This is reflecting with Trump’s gesture during the United States General Assembly in New York wherein he only gave the prime minister 20 minutes to discuss a potential trading deal between the two (2) countries. New Zealand’s economy continued to slow, hitting a five-year low, despite exceeding expectations. The trade tension between the United States and China has been affecting the country’s economy, which had recently resulted from the RBNZ’s (Royal Bank of New Zealand) decision to cut its benchmark interest rate.

USDCAD

Economic and political uncertainty is weighing down on the Canadian Dollar. Canadian Prime Minister Justin Trudeau was caught in an issue which might affect his reelection bid on October. The PM was accused of influencing the decision on the SNC-Lavalin case, which was deemed illegal under the Canadian constitution. In another news, lawyers of Wang Meng Zhou, Chief Finance Officer and Heiress to the telecom giant Huawei, will be in Canadian courtroom today, September 23, to press details surrounding her arrest at Vancouver’s airport nearly 10 months ago. The arrest was done as part of Canada’s extradition treaty with the United States. In line with the arrest, China blocked Canadian exports on canola, soybeans, and pork. Trudeau’s main challenger, Conservative Leader Andrew Scheer, accused the prime minister of standing idly while China is performing an economic revenge.

USDCHF

The economic slowdown in Europe is expected to weigh down on Switzerland economy, particularly to the Swiss Franc. Germany, the largest economy in Europe who fuel the region’s growth, is facing recession. Aside from this, only a month remains before the United Kingdom is set to withdraw from the European Union. Despite being a non-EU country, Switzerland might face scrutiny from EU leaders following the possibility of the UK joining the EFTA (European Free Trade Agreement). EFTA composed of non-EU countries, which includes Switzerland. The United States on the other hand, is expected to put pressure on Switzerland once the draft deal between Switzerland and China take effect. Switzerland is the first country to sign an agreement with China’s Belt and Road Initiative. The ongoing trade war between the United States and China is expected to offset the interest rate cut by the Federal Reserve.