Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

USDILS

The deep and expansive U.S.-Israel relationship might end following the defeat of Prime Minister Benjamin Netanyahu on the recent election. Netanyahu has been Israel’s longest serving Prime Minister in history and is credited to a much closer ties with America. His loss is also celebrated by big companies following the recent surge in the Tel Aviv Stock Exchange. This drastic change in the country’s politics is expected to open Israel more to foreign companies. This includes China who have invested in strategic Israel infrastructure, from shipping to electricity to public transportation, and bought millions of dollars stake in cutting-edge start-up technology. This is expected to hurt the U.S. Dollar and give strength to Israeli Shekel. Where Israel might see an opportunity to access the second largest economy in the world, the United States sees security threats posed by its economic and political rival.

USDCZK

Czech Prime Minister Andrej Babis said that it is crucial to approach climate change rationally. This was amid the rising green activism inside the European Union, particularly in the EU Parliament. This tone was timely as the country’s representative was elected as European Commission’s Vice President for Values and Transparency. Czech Koruna gained following the announcement made for the appointment of Věra Jourová. Aside from Czech Republic, other members of the informal group of the V4 were also appointed to key positions in the commission. This had strengthened Czech Republic’s position in the European Union amid months of conflict between the PM and EU leaders. Czech Republic said it recently approved a draft 2020 budget that promises significant spending increases. This is expected to increase the country’s leverage against the United States.

EURJPY

The Single Currency is falling amid the UK government’s appeal from businesses and members of the public to support a post-Brexit trade agreement in Japan. In February 2019, the ratified EU-Japan free trade agreement entered into force. This trade deal created the largest trading zone in the world. The move was also seen as an effort between the two (2) economies to support globalization to counter the rising trend of protectionist economy. During this time, the UK under Theresa May said the country will not negotiate any deal with Japan until it officially leaves the bloc. This turned upside down since the election of Boris Johnson. The United Kingdom said an accord with Japan will be the country’s priority for a post-Brexit Britain. The tug-of-war to get Japan in a trading deal with its European allies helped the Japanese Yen pegged against European currencies.

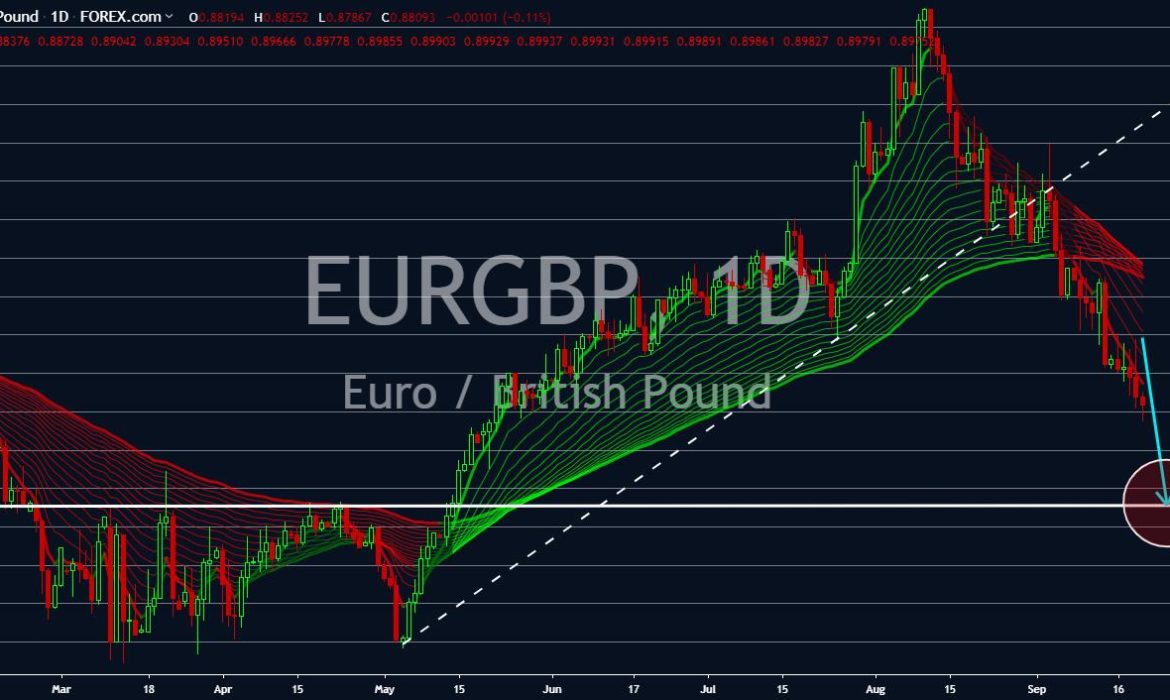

EURGBP

The Euro will continue to weaken amid threats by conservative MP Nigel Evans that a trade war between the United Kingdom and the European Union is likely. This was after British PM Boris Johnson suspended the parliament to pave way for a “no-deal” Brexit. He argued that this could taint outgoing European Commission President Jean-Claude Junker’s legacy unless the EU enclaves. Junker will leave the commission on November 01, a day before the UK is set to leave the bloc. The UK has also seen lobbying Japan to sign a post-Brexit trade agreement in its latest sign that the country is serious on leaving the bloc despite having no deal at hindsight. Earlier, the British Pound shot up to a 2-month high following the statement by Junker that a deal was possible. In line with this, Johnson is looking to strike an amended deal at an EU Summit on October 17 and 18.