Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

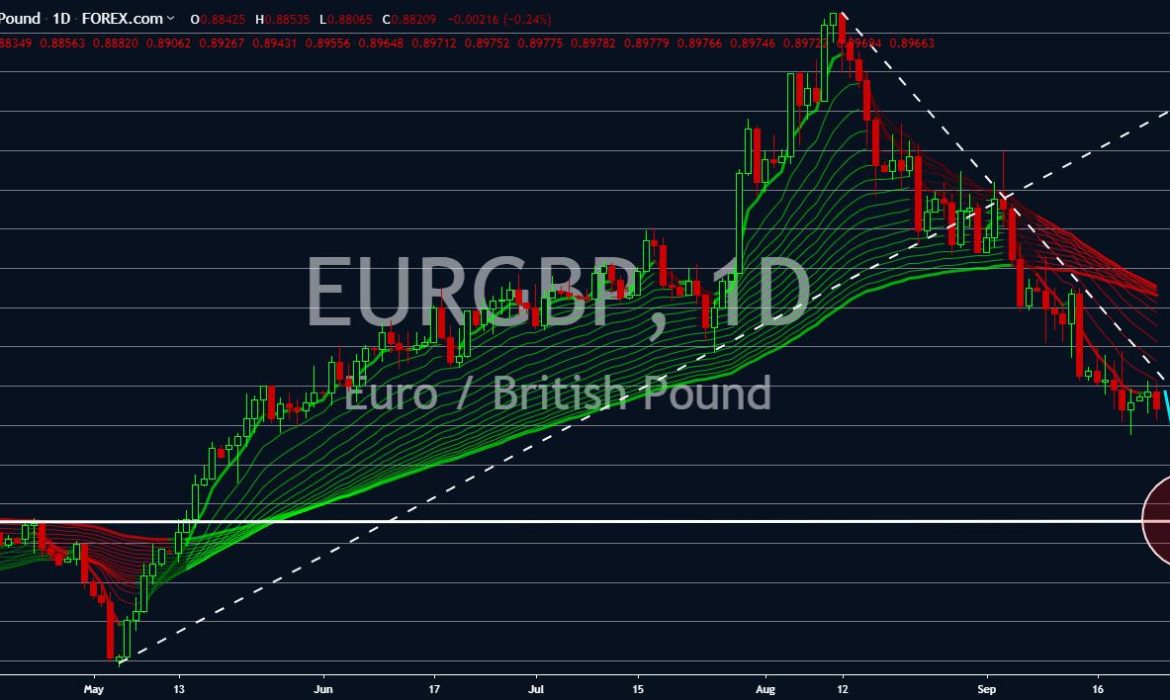

EURGBP

There is no turning back for the European Union and the United Kingdom. British PM Boris Johnson, who suffered when he lost his parliamentary majority and ability to govern through legislature, suspended the UK Parliament just weeks before the country is set to leave the EU. Despite the UK Supreme Court declaring the move as unlawful, government attorneys say that there will be no way to stop Johnson from achieving a no-deal Brexit. In line with this, the Labour Party, rival to the Conservative Party headed by Boris Johnson, rejected campaign to remain in the European Union. The unity of the British people is expected to boost the British Pound. The Single Currency on the other hand, is expected to suffer following the slowdown in the European region, particularly EU’s economic powerhouse, Germany. Germany saved EU-member states’ economies, but the problem rest on the question “who will save Germany?”

EURJPY

Japan holds the card in the economic and political tension between the European Union and the United Kingdom. Japan recently ratified the EU-Japan free trade deal, which became the largest trading zone in the world. But Japan wants more. Japanese government recently called for public support in bridging gap between the country and with the UK. Japan wants a post-Brexit trade agreement with the United Kingdom, threatening the country that it will become Europe’s sick man unless a free trade deal with the third largest economy in the world has been made. Further boosting the Japanese Yen was the hope that the country, together with the United States, will sign a bilateral trade agreement. Japan started the year with the ratification of the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). The European Union on the other hand, was still at odds with America.

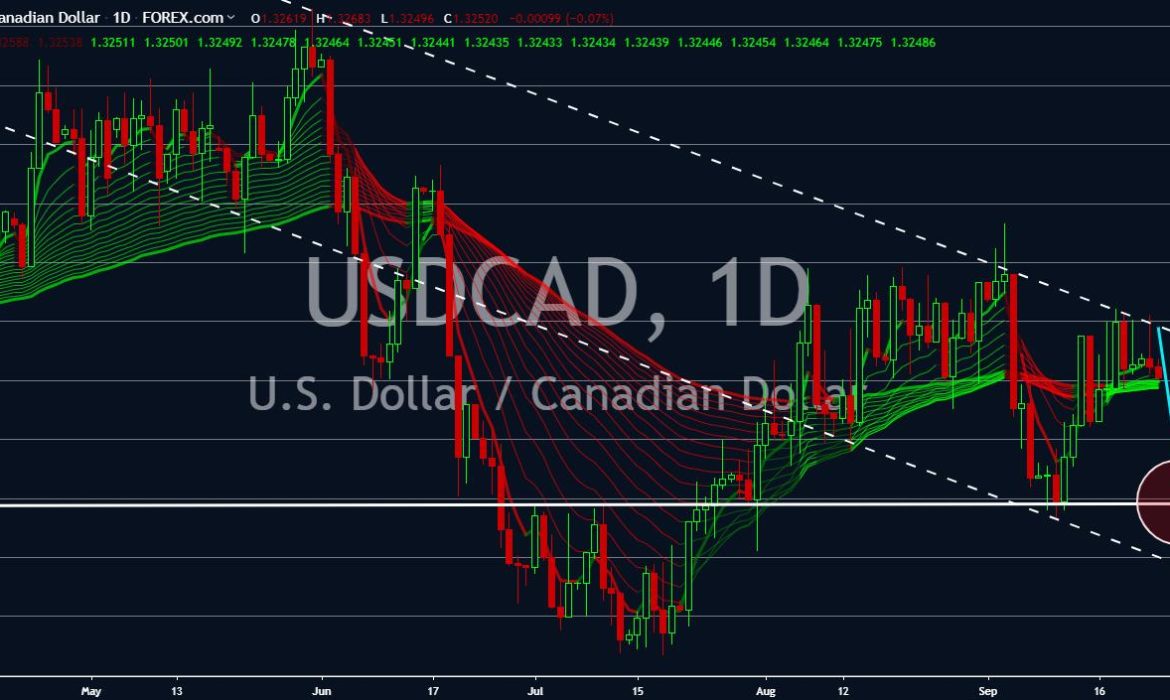

USDCAD

The United States is under pressure to pass key policies promised by President Trump during the 2016 Presidential Election. This was amid the looming 2020 U.S. Presidential Election wherein Trump was seeking for a reelection bid. The USMCA (United States-Mexico-Canada) is a draft deal that is seen to benefit U.S. agricultural sector. However, as Democrats took control over the House of Representative, Trump and his government might take some time to defy the Democrats. The trade war started by Trump had strengthened the U.S. Dollar against baskets of major currencies. However, this is also hurting the American economy. Therefore, passing the ratified NAFTA (North American Free Trade Agreement) might only do bad than good in the American economy. Aside from this, Canada had already lessened its exposure to the U.S. Dollar after shifting its focus to the pacific rim trade pact wherein the U.S. left back in 2017.

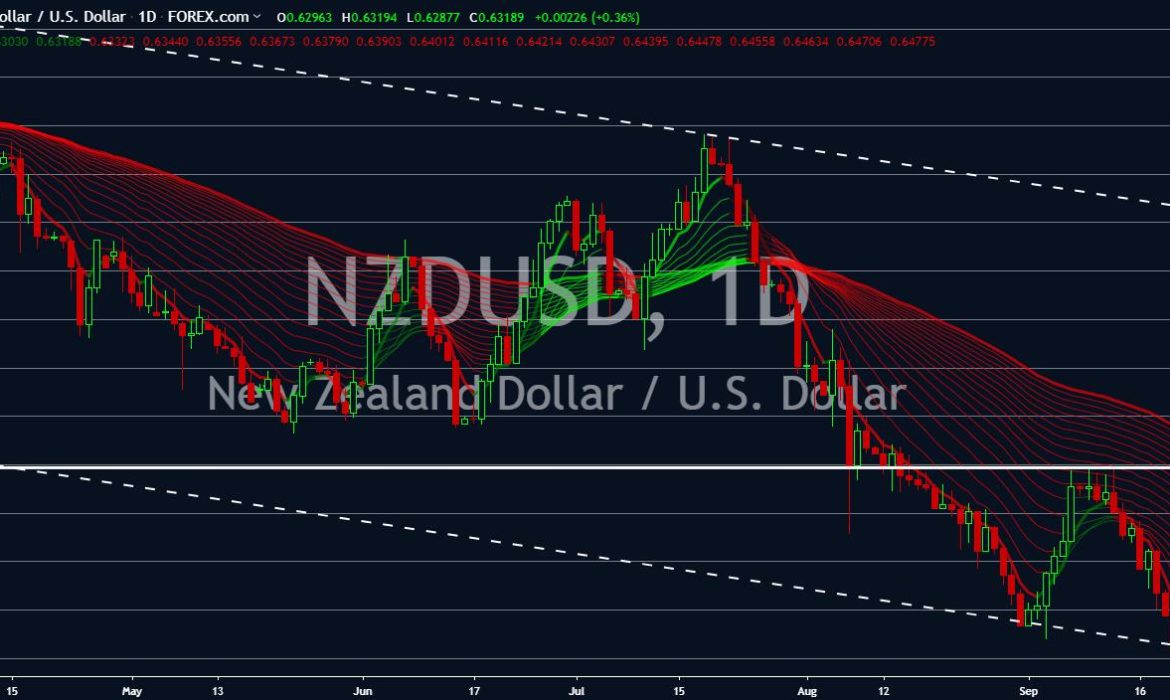

NZDUSD

In an unexpected move, U.S. President Donald Trump described that meeting that he had with New Zealand Prime Minister Jacinda Ardern a “wonderful meeting.” World leaders are currently attending the United Nations General Assembly in New York to discuss several issues. The controversial PM is one of the highlights in this year’s meeting. In the recent months, the world saw how the PM throw shade at Trump and its former colonial master, the United Kingdom. PM Jacinda said that the country’s decisions will neither be influenced by the United States nor the United Kingdom, referring to U.S. pressure to ban Chinese telecom giant Huawei. However, the tweet by Trump only boosts New Zealand Dollar as the country project itself as a neutral power against political and economic powerhouse. New Zealand’s closeness with China, the European Union, and the United Kingdom puts the United States on shame.