Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

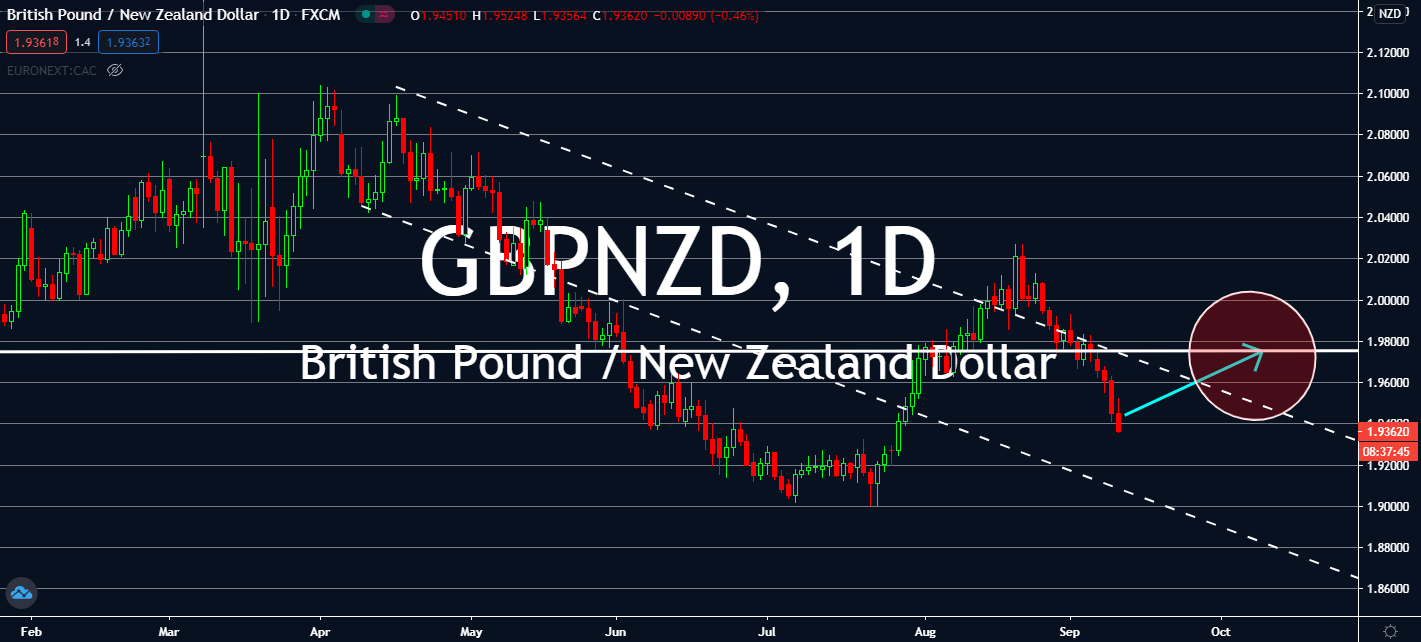

GBPNZD

New Zealand was doing well in earlier months, but it might not be the case for upcoming ones. Within the week, it announced a series of pessimistic news across key determiners of its economic track, such as its electronic card retail sales and manufacturing sales volume. Notably, its ANZ Business Confidence had seen a surge for the next few months, but it might not even do well for the kiwi dollar near-term. Australia and New Zealand Banking Group Limited agency found that business conditions had risen from -41.8 to -26.0 – which is typically a good thing until one remembers that actual optimism is above 50%. The Reserve Bank of New Zealand also kept its benchmark interest rates down at 0.25%, but it also admitted that it was open to lowering it in the next few months, which would be on top of its bond purchase increase from NZ$60 billion to NZ$100 billion. These updates are projected to help the sterling lift against it.

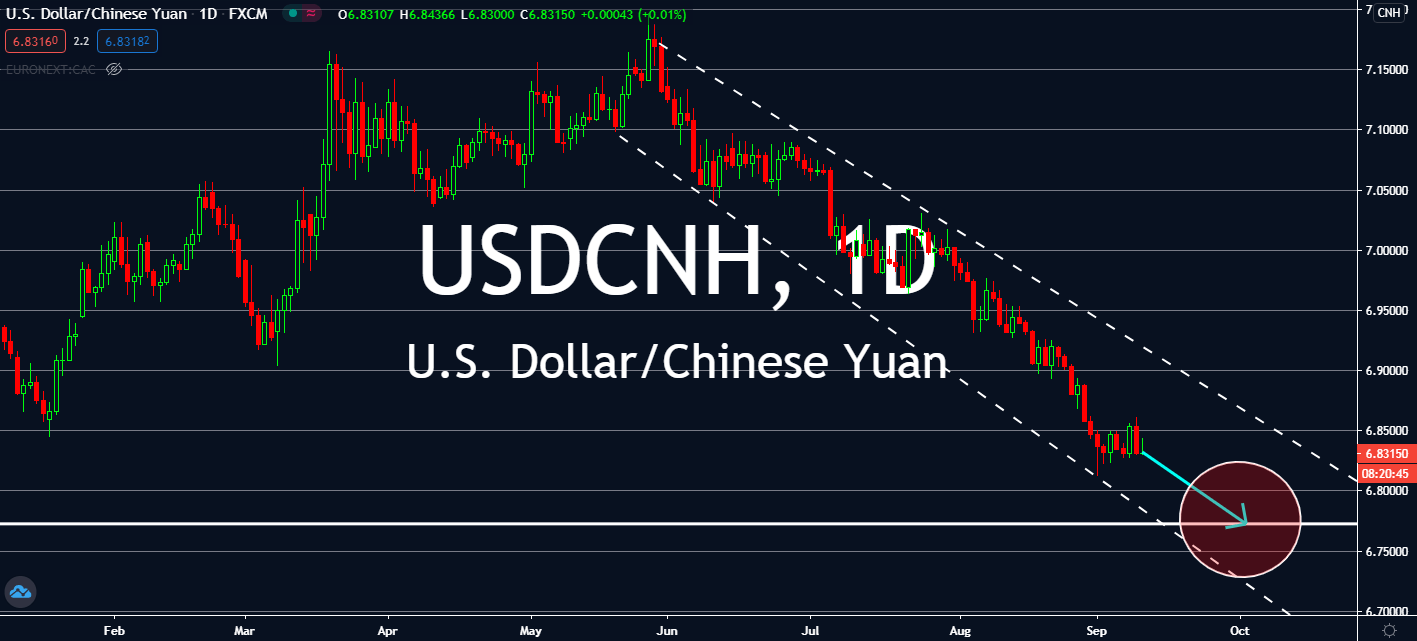

USDCNH

The Federal Reserve did promise that it plans to focus on its inflation rate, but it doesn’t mean that its effect would immediately come to fruition. Initial US jobless claims reached 884,000 once again on the week ending Sunday. Not only was this at least 38 thousand more than expected, but it also means that its effort might have been a little too late. Although its economy has been gradually reopening since June, the amount of recovering businesses hasn’t managed to overcome the number of laid-off workers to retaliate. The administration also said that 13.4 million people are still continuing to receive traditional jobless benefits, which was 100 thousand more than last week’s numbers. Hiring will remain at low levels in the United States as China continues its reopening. In fact, exports for August were even higher than what was recorded last year. The figure recorded an annualized 9.5%, greater than 7.2% in 2019 and a market consensus of 7.1%.

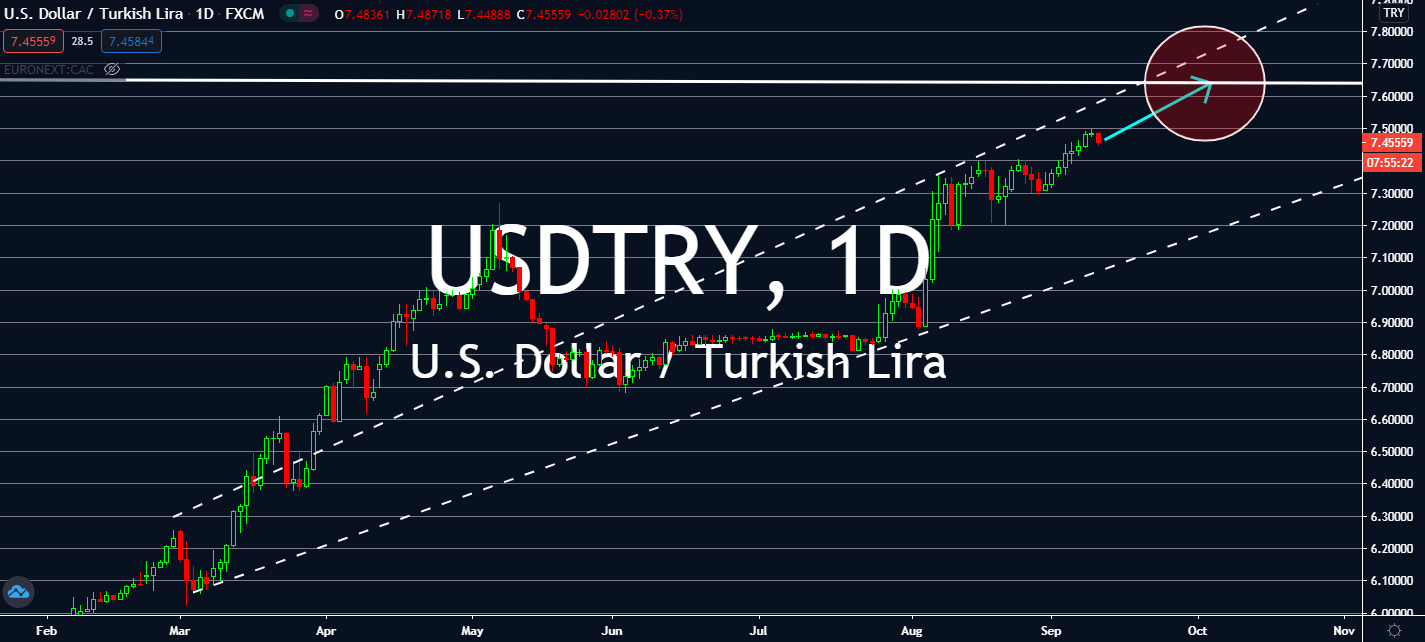

USDTRY

Turkey just saw an unemployment jump to 13.4% during the May to July period, even when the coronavirus lockdown was lifted and the ban on layoffs remained in place. The number of workers who claimed they were discouraged from looking for work raised to 1.38 million. This was three times as much as last year. The workers left were benefitting from its government’s 100 billion lire or $13 billion aid program, which partially paid for wages for 2 million people. Investors are worried about the emerging market, while some reports emerge that some Turkish adults are even working without wages. In the US, the change in the price of goods in the manufacturing sector increased. The figure is expected to pump into its economy as the Federal Reserve works to lift is the jobless rate in the country. Although, Fed Chair Jerome Powell admitted that its recovery is going to take a long time to bring itself back into pre-coronavirus levels.

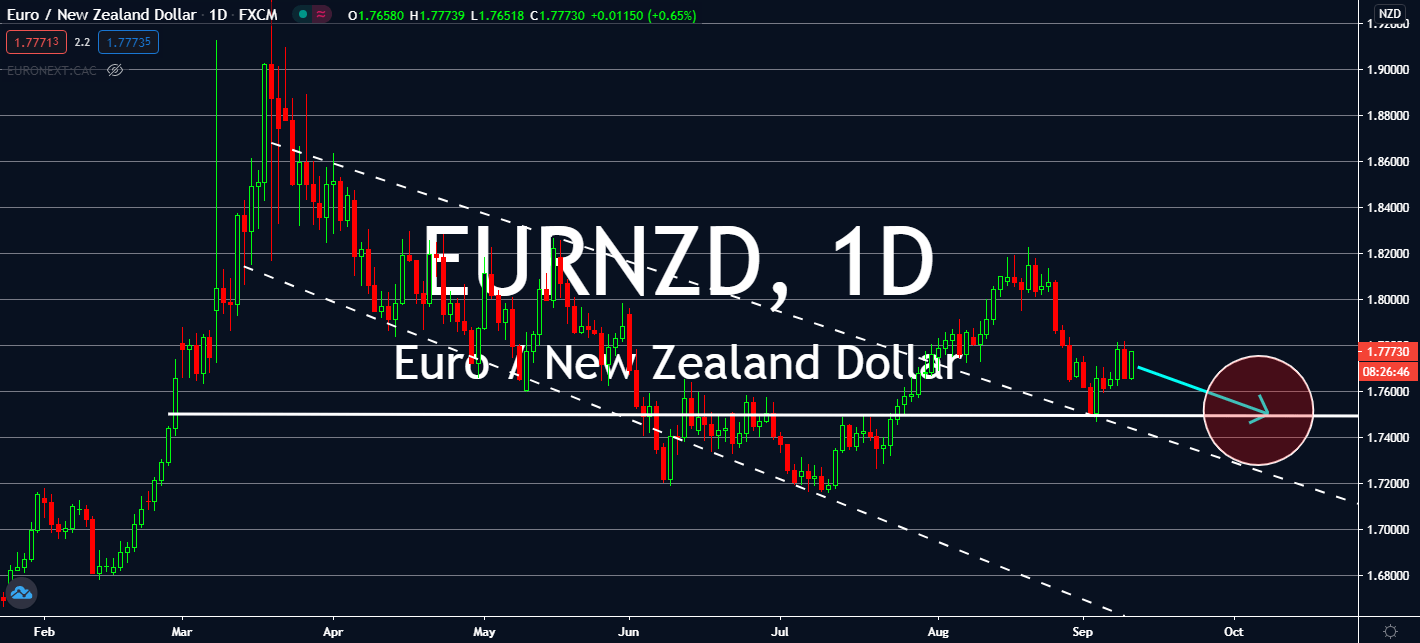

EURNZD

Euro investors were previously worried that the eurozone might implement another benchmark interest rate decrease today. This was because the euro currency had been inflating over the past few months across the board that it left the European Central Bank concerned about when its increase might end. Fortunately, it brought up a series of announcements that would help buoy its economy throughout the Covid-19 crisis: its €1.35 trillion programs are set to continue until the outbreak subsides, and its interest rate is still at a record low of 0.0%. The ECB doesn’t plan to change this anytime soon as long as it keeps up to its 2% inflation target for 2020. Meanwhile, New Zealand is struggling to keep up with the economic slump brought by nationwide lockdowns crippling its economy. Not only did it say that it might witness another interest rate change this year, but it also increased its bond purchase with high uncertainty.