Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

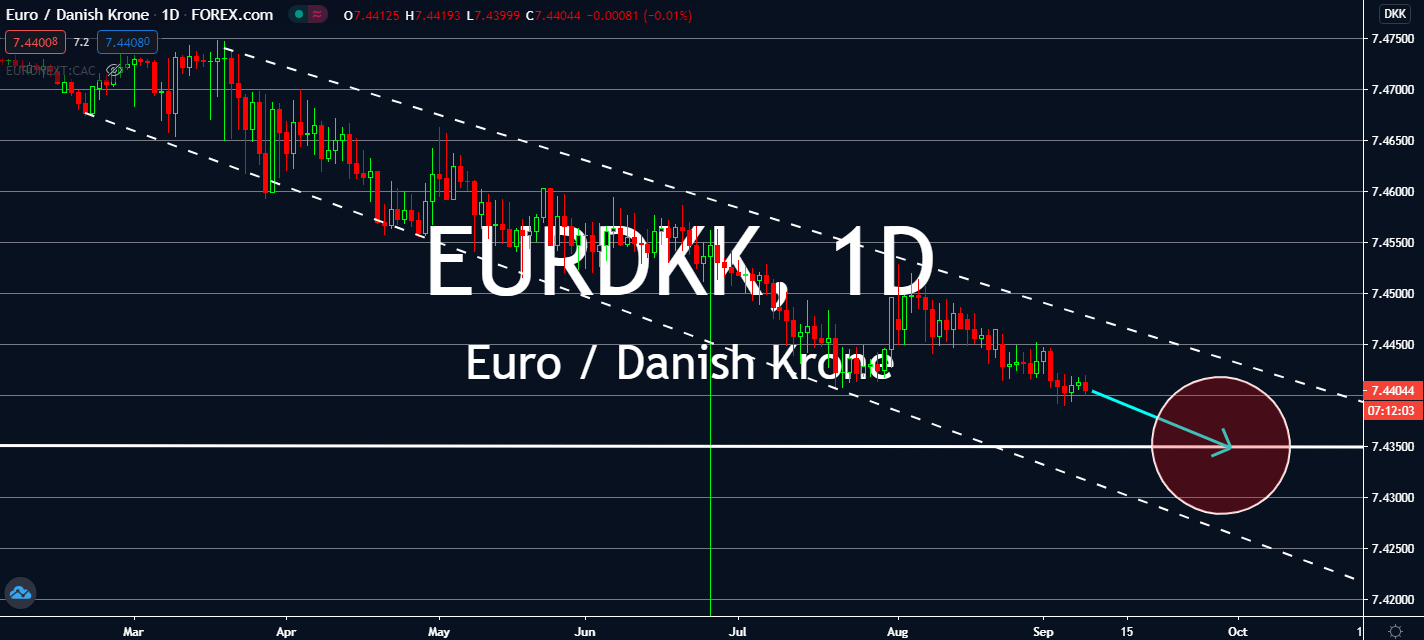

EURDKK

Earlier this week, the euro saw immense support from the forex market. This was brought by the announcement that instead of retaining its gross domestic product from last year’s second quarter, it had surprised markets to an even higher record for this year. In fact, it had seen an annualized -14.7% GDP for Q2 2020, up against last year’s -15.0%. This was also miraculously above figures seen in the first quarter from -12.1% to 11.8% after the market had expected the figure to retain the previous levels instead. But investors should remember that inflation for its GDP in the middle of a global economic recession isn’t good for its currency at all – in fact, after the single currency had met unforeseen appreciation for the past few months, the European Central Bank is anticipating an irreversible crash for the currency long-term. Denmark isn’t set to report any economic data today, but the ECB’s warning should deplete its counterpart in the coming sessions.

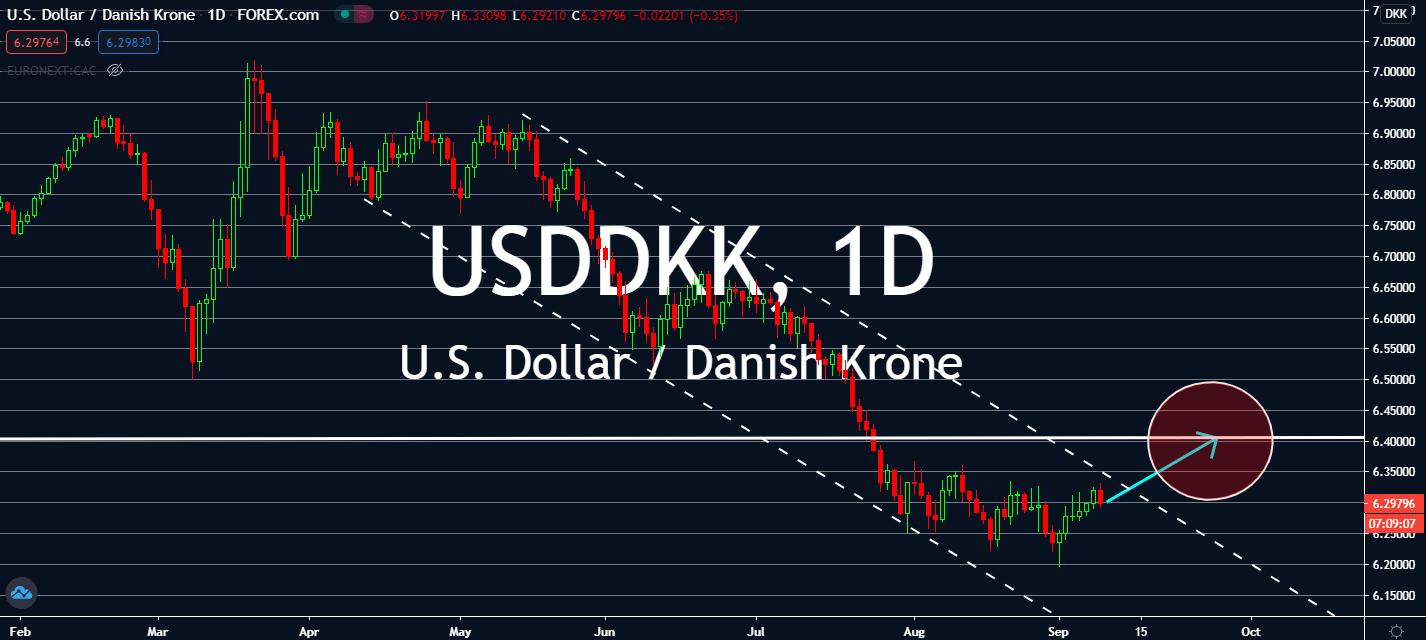

USDDKK

The United States’ unemployment may have spiked nearly 15% in April, but it looks like the figure is about to change. The Federal Reserve recently announced that it would shift its focus on the rate throughout the rest of 2020, and the central bank is already on its way to fulfill its promise. Economic analysts believe that the US economy might be on its way to recovering in 2021, similar to how it has grown after the second world war. The unemployment figure went back to 8.4% in August, and they believe that it’s only a matter of time until people will become eager to go back outside and skyrocket spending with the help of the continuing government stimulus from both the Federal Reserve and the US congress. The US stock market is also witnessing familiar sell offs from an earlier surge over worries of the global economic recession, but now that risk aversion is on the rise once again, the greenback is projected to rise near-term.

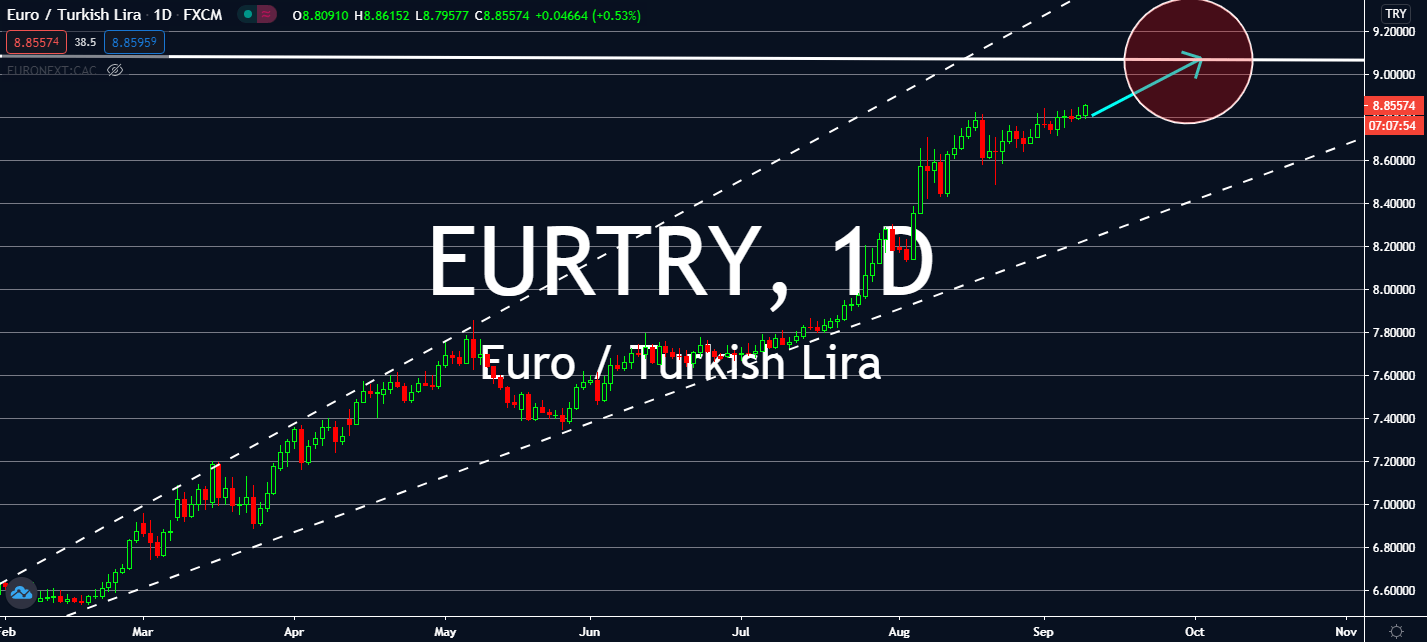

EURTRY

Industrial output in Turkey reached an annual decline of 8.1 percent in July, which had shoved the lira down against the euro currency last week. Its underperformance is projected to continue. Commerzbank analyst Tatha Ghose confirmed the possible fall with a hint that risk aversion is coming into fruition once again, making the lira’s emerging market at risk of a sell-off. Minister of Treasury and Finance of Turkey Berat Albayrak decreased Turkey’s economic growth figure compared to its pre-coronavirus levels from a target 5% increase for 2022 to a 2% contraction up to a 1% gain. The Turkish central bank avoided raising its benchmark interest rate of 8.25 percent, but investors believe that this could change soon, which could lead to even more sell-offs in the near-term. Turkey is also expected to initiate another fiscal stimulus.

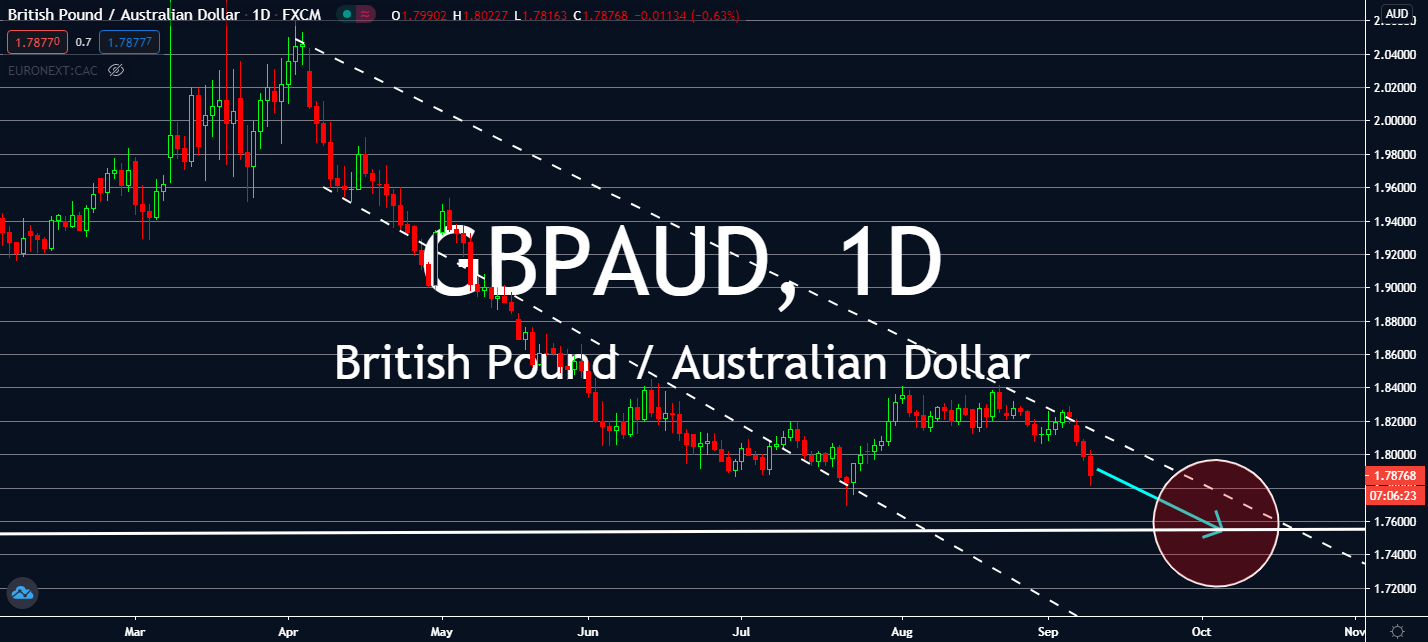

GBPAUD

The United Kingdom’s economic data will be quiet in today’s trading, but markets are closely waiting for its monthly gross domestic product announcement later this week. Last seen at 8.7% in July, markets remain unsure of how the City has fared throughout August largely due to the unprecedented nationwide lockdown from last week. However, markets had locked in on its yearly estimates: from -1.7% seen last year, the Office for National Statistics might report a -21.7% decline for September by Thursday. Meanwhile, Aussie investors are getting increasingly optimistic about the business sentiment in the region. Of course, households and businesses will remain cautious of the virus, but its Reserve Bank’s confidence in retaining its interest rates at 0.25% projects further confidence that the figure might grow from the -8% seen in August, which was already an increase from the -14 percent figure seen in July.