Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

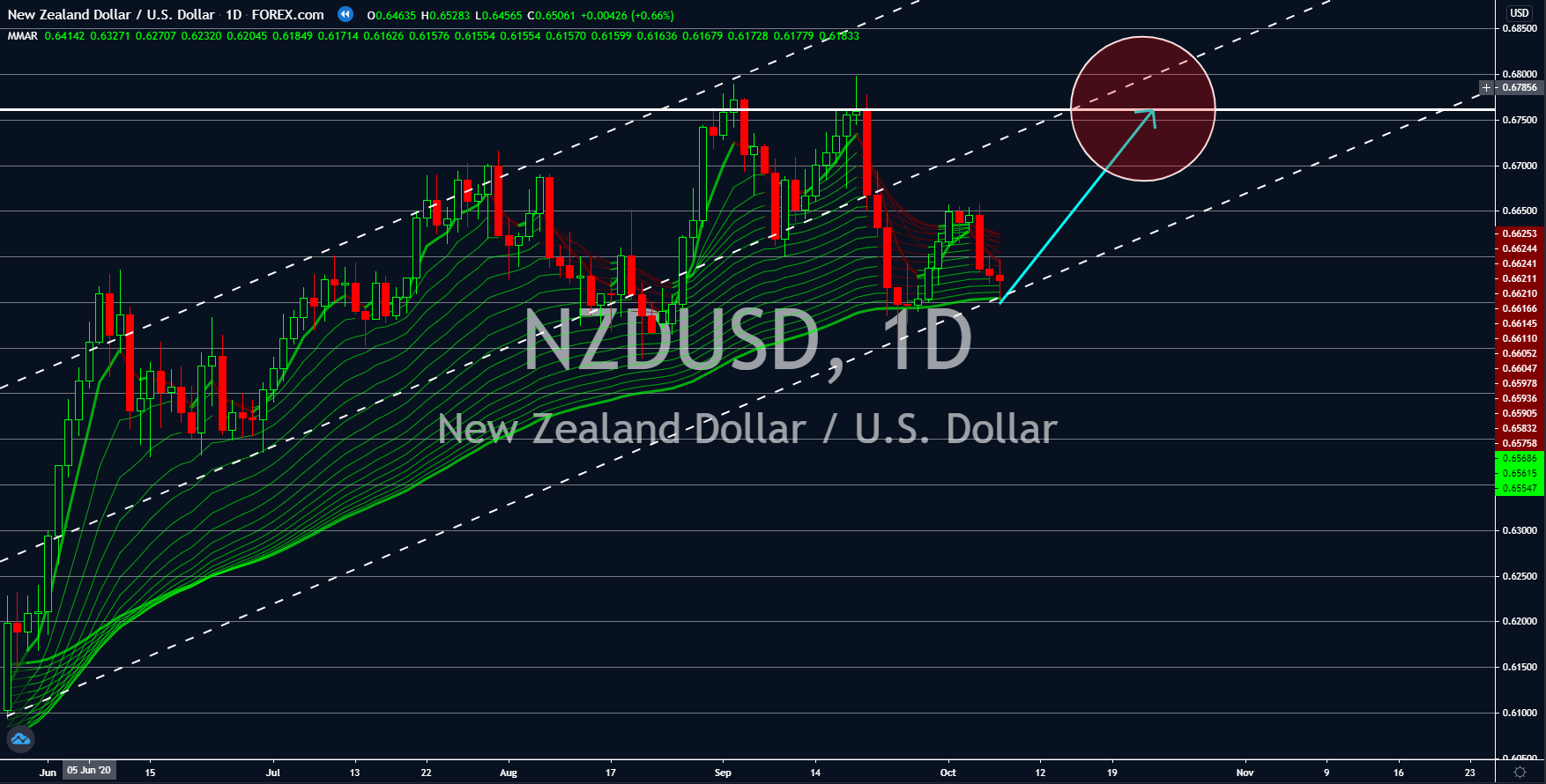

NZDUSD

The US initial jobless claims report confirms the worries of analysts and investors of a stagnant labor market. For the reported week, claimants of unemployment benefits added 840K individuals. This was slightly lower than the reported 149K in the previous week. Also, the report has been consistent in publishing 850K average claimants for the past 2 months. Another worry by investors was more people will file for unemployment benefits in the coming weeks. The US government and the congress failed to make compromise with the proposed $2.2 trillion stimulus package. For several months, the US economy has relied mostly on the stimulus created by the government and by the Fed. On the other hand, New Zealand focuses on creating jobs rather than finding money to support the local economy. With both presidential candidates Jacinda Ardern and Judith Collins.

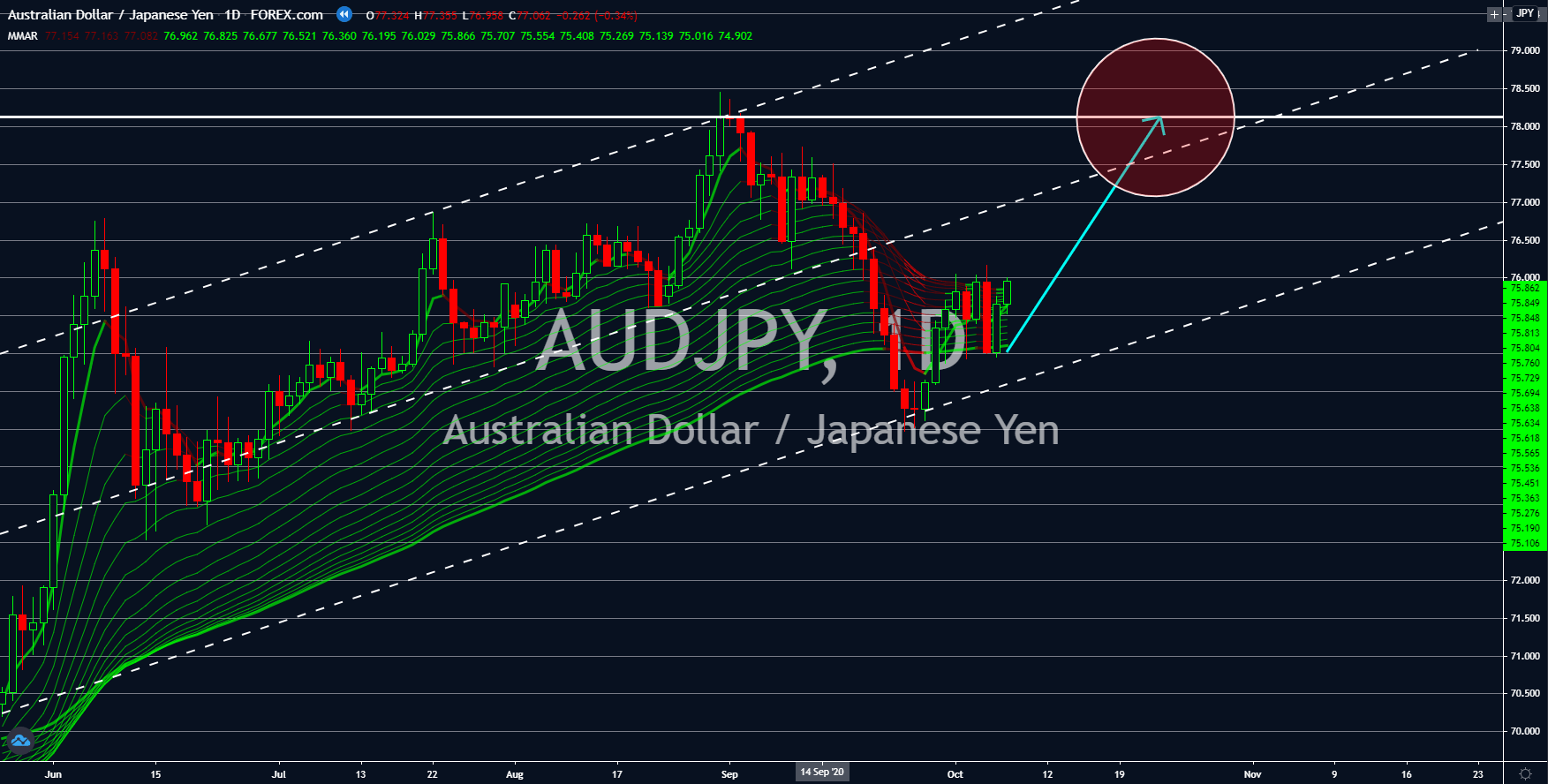

AUDJPY

Australia’s housing loan will drive the AUDJPY pair in coming sessions. The Home Loan MoM report increased by 13.6% today, October 08. This figure was the second-highest recorded growth for the report since it began in December 1975. The high consumer spending on housing reflects their confidence on the overall economic health of the Australian economy. On the other hand, Japanese data were mixed. Household spending in the country rose only by 1.7% for the month of August. Meanwhile, the Coincidence Indicator suggests the end of Japan’s economic contraction. A preliminary report shows a 1.1 point improvement for the report. This, in turn, prompted the government officials to upgrade their outlook in the Japanese economy. However, some analysts are still skeptical since this improvement in the coincidence indicator was not sufficient to cover the losses that the country incurred during the lockdown.

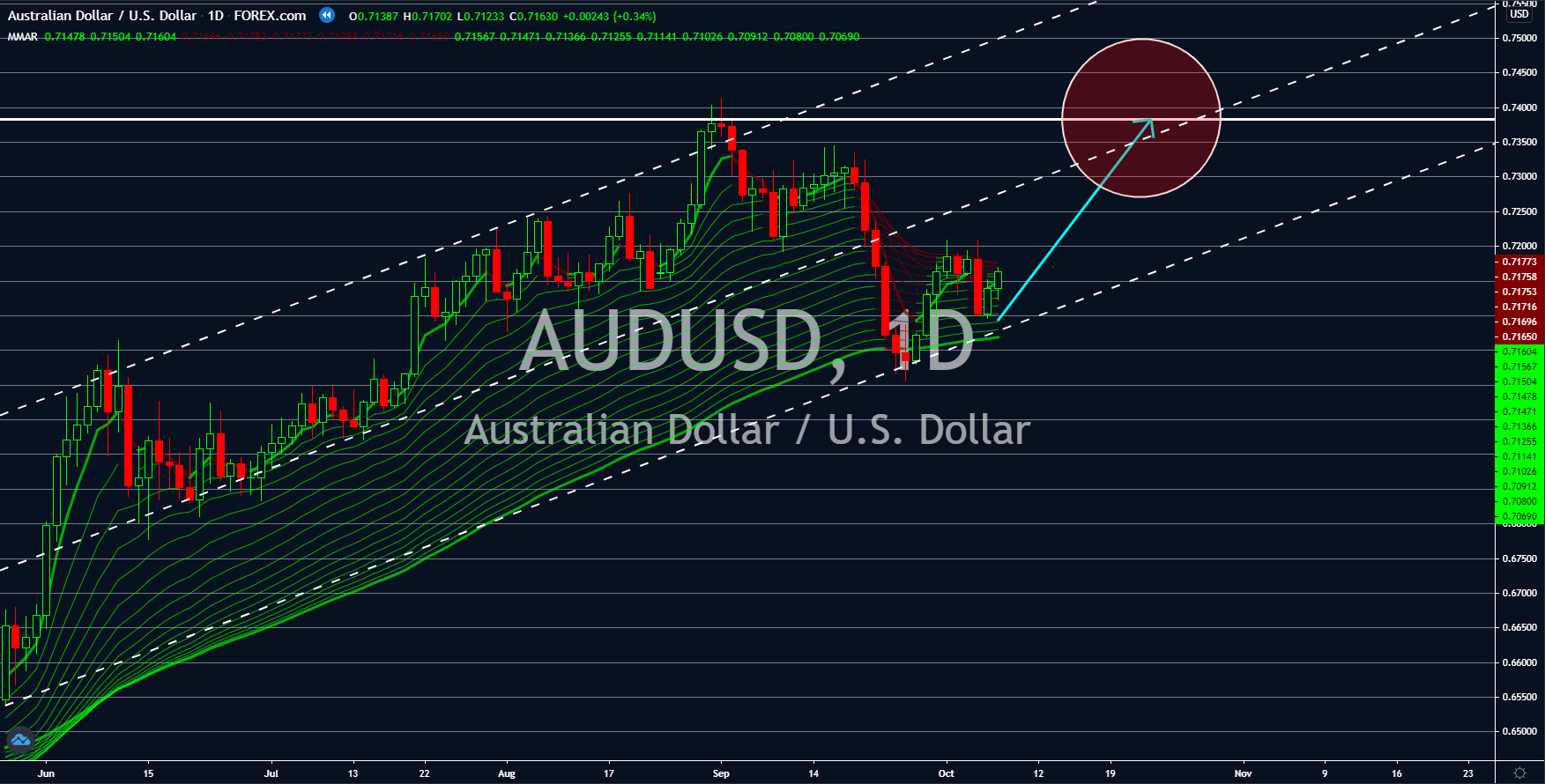

AUDUSD

The Australian dollar will continue its uptrend movement in the following days. The catalysts for the renewed strength in the currency pair was the strong consumer market and the new stimulus package. Consumers are in a buying frenzy of houses as the country moves toward recovery from the pandemic. In addition to this, the coalition government approved a federal budget of $98 billion to jumpstart the economic recovery. Part of the package was tax cuts for businesses affected by the pandemic, a 2 cash payment of $250.00 to pensioners, and a business credit to any company who will hire among the affected age group. The government is expecting a 3.75% economic contraction for the fiscal year before rebounding by 4.25% in 2021. Meanwhile, investors will need to wait for another month before the government can sign a new stimulus package. Due to uncertainty in elections, Trump postponed any negotiations for the proposed $2.2 trillion stimulus.

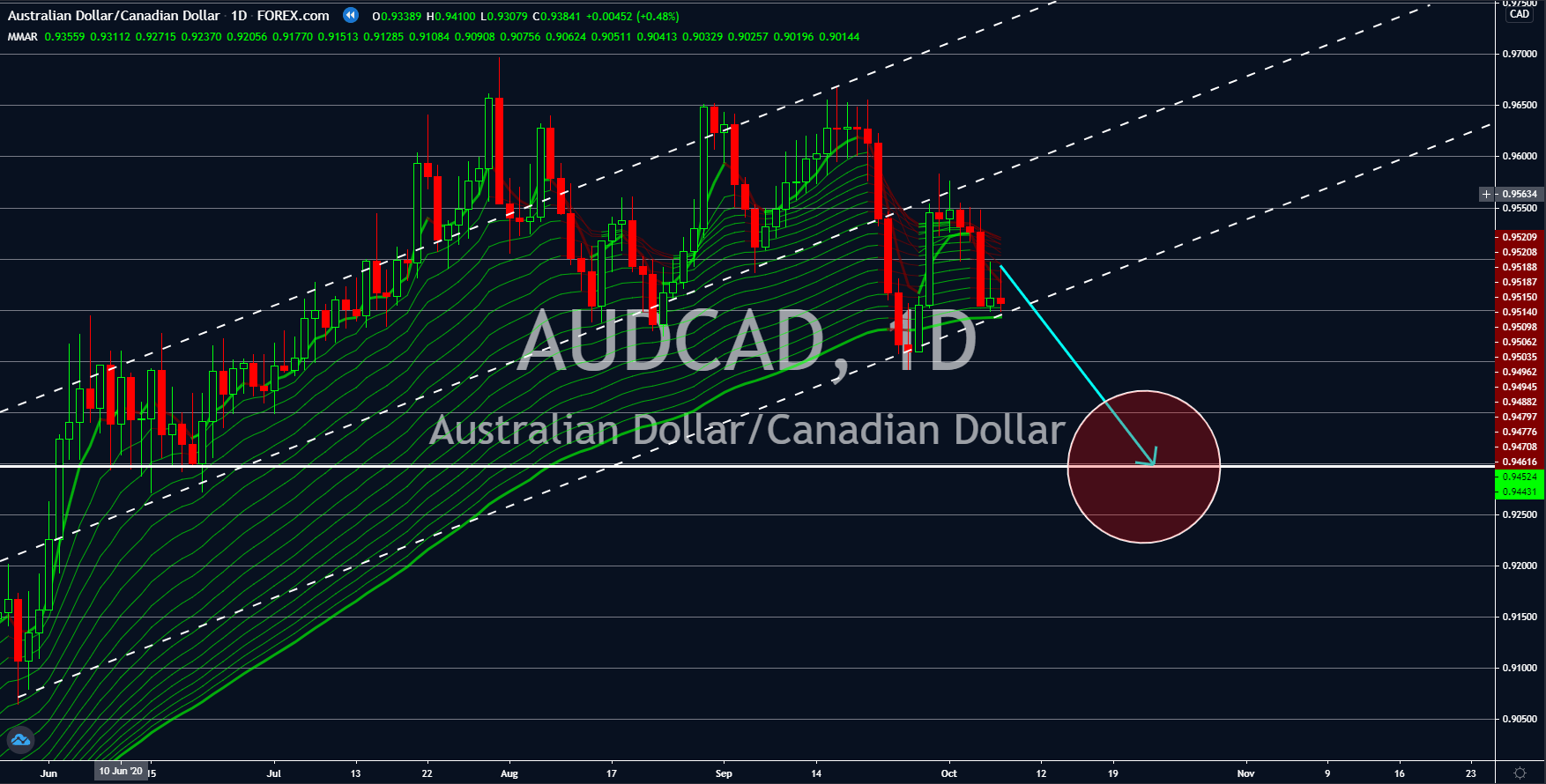

AUDCAD

Canada faces external challenges on its economy. Despite the Canadian economy recovering from the pandemic, the Bank of Canada Governor Tiff Macklem said the low interest rate of 0.25% by the central bank could create a bubble. This was particularly true for the housing market as refinancing mortgages became cheap. Aside from that, the uncertainty over the US election is stirring fears among local businesses. More than 75% of Canada’s businesses export to the United States. In August, Canada incurred a $2.4 billion in trade deficit following the $2.5% billion in July. Investors are now preparing for a possible disruption in trades as the export fell by 1.0% to $44.9 Canadian dollar 3 months prior to the 2020 US Election. On the other hand, investors welcomed the new federal budget for the fiscal year. Australia’s coalition government passed a new stimulus package of $98 billion, more than 7.0% of the country’s gross domestic product.