Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

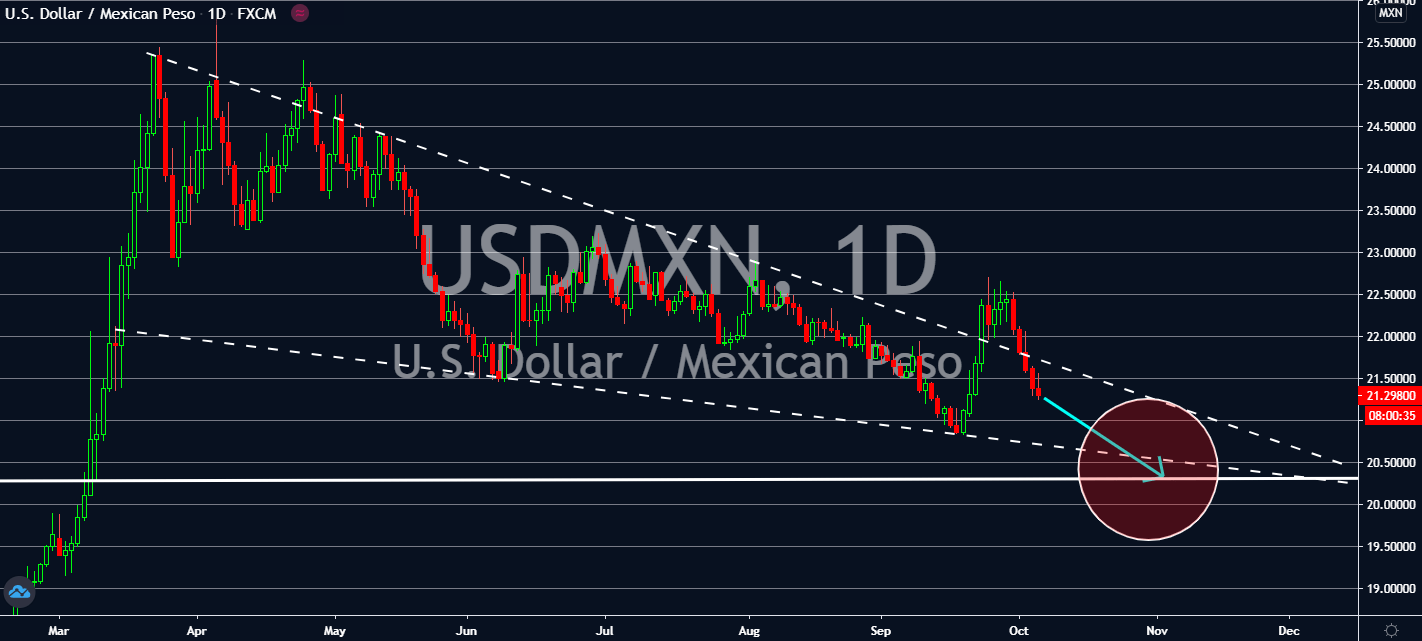

USDMXN

Dollar weakness is projected to strengthen the Mexican peso against the greenback soon as the Mexican government looks to create an ideal environment for economic growth. President Andres Manuel Lopez Obrador will continue this strength despite being exposed to volatility that would lead up to the US presidential elections on November 3. Its strong relationship with the dollar is expected to help its currency up as the market waits for employment figures to be announced later today. It looks like recent export and import figures are projected to muffle its increase, because the former figure had seen an uptick from 168.10 billion to 171.90 billion near-term. The latter, on the other hand, inched up from 231.70 billion to 239.00 billion. US trade balance fell deeper than the steep fall it already expected at -67.10 billion, lower in comparison to both market consensus of -66.10 billion and the previous record of -64.40 billion.

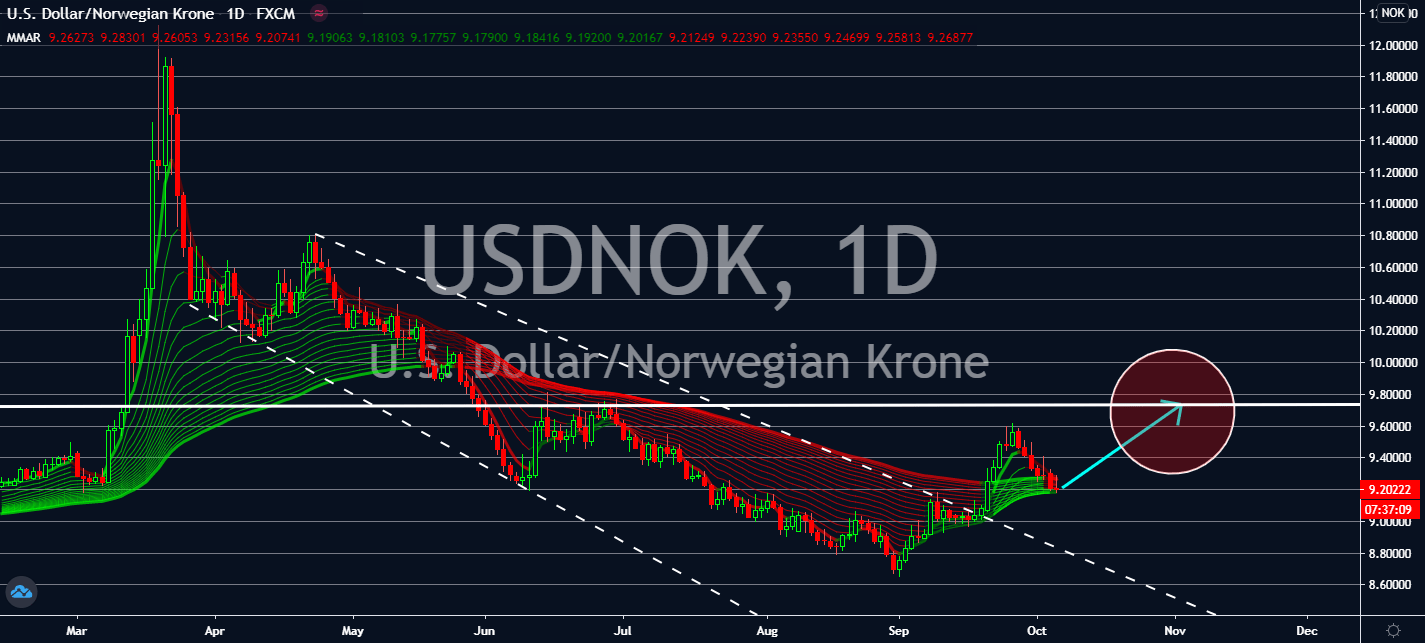

USDNOK

Risk aversion is in today’s agenda against the oil-dependent Norwegian krone as the market awaits JOLTs job openings in the US to be reported later today. Employment figures have been improving for the past few weeks, and it looks like there’s a high possibility today would meet the same standard. August is projected to add more than 65 million job openings from 6,618 million to 6.685 million. Exports and imports figures have also reported increases during today’s trading session. The US dollar is projected to continue its weakness near-term as the market gauges its reaction to US President Donald Trump’s return to the White House after having diagnosed with a coronavirus infection late last week. The forex pair is now projected to record high volatility starting with risk aversion, a reaction to his better health less than a month before the presidential elections. Investors should look out for several speeches from the Federal Reserve later today.

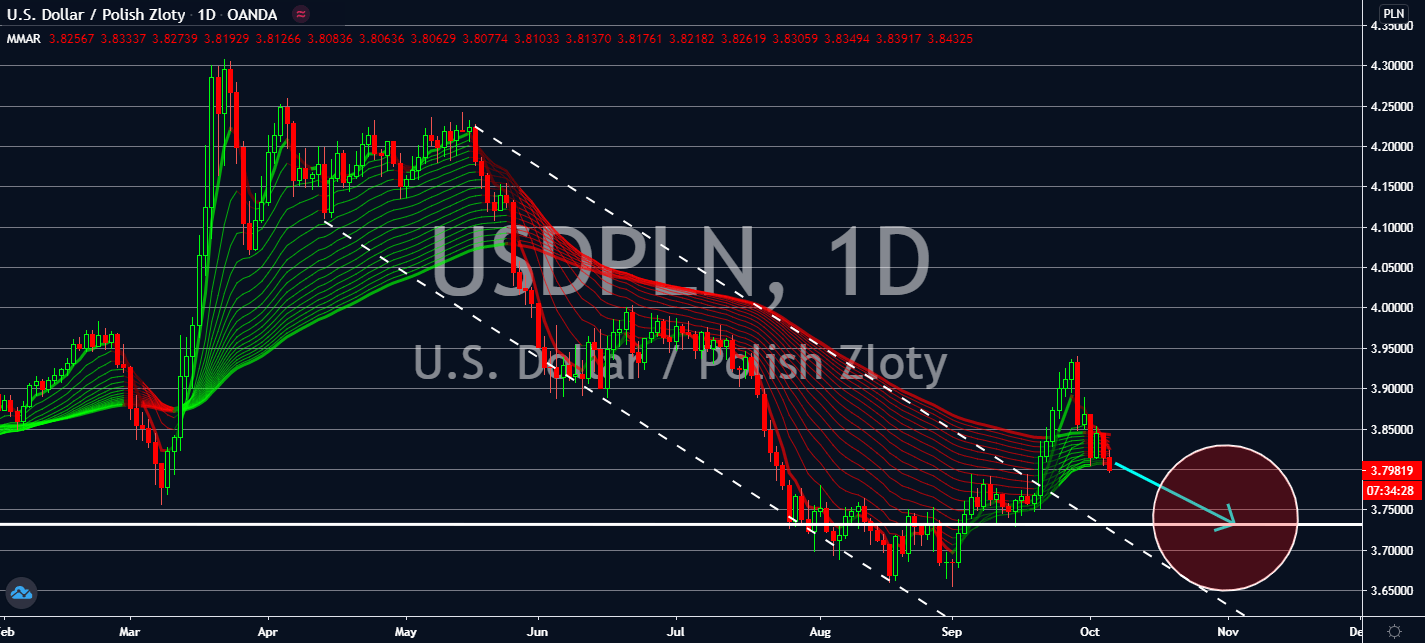

USDPLN

Poland is still processing optimism from last week’s news that its economy could fall less than 3.5% by the end of the year, including losses seen by the coronavirus pandemic. Prime Minister Mateusz Morawieki said he could allow this year to have witnessed a 4.6% contraction in GDP by maximum. The announcement came days before its central bank is projected to come up with monetary policies from October onwards, and is projected to retain its interest rate at 0.10%, as well. Uncertainty revolving around employment figures is projected to report improvements for August, which could report only a small improvement from 6.618 million in July to 6.68 million. The longer-term move would have to depend on how the market will react to several announcements from executives in the Federal Reserve later today. It’s worth noting that last week’s 661,000 figure in nonfarm payrolls last week was worse than expected.

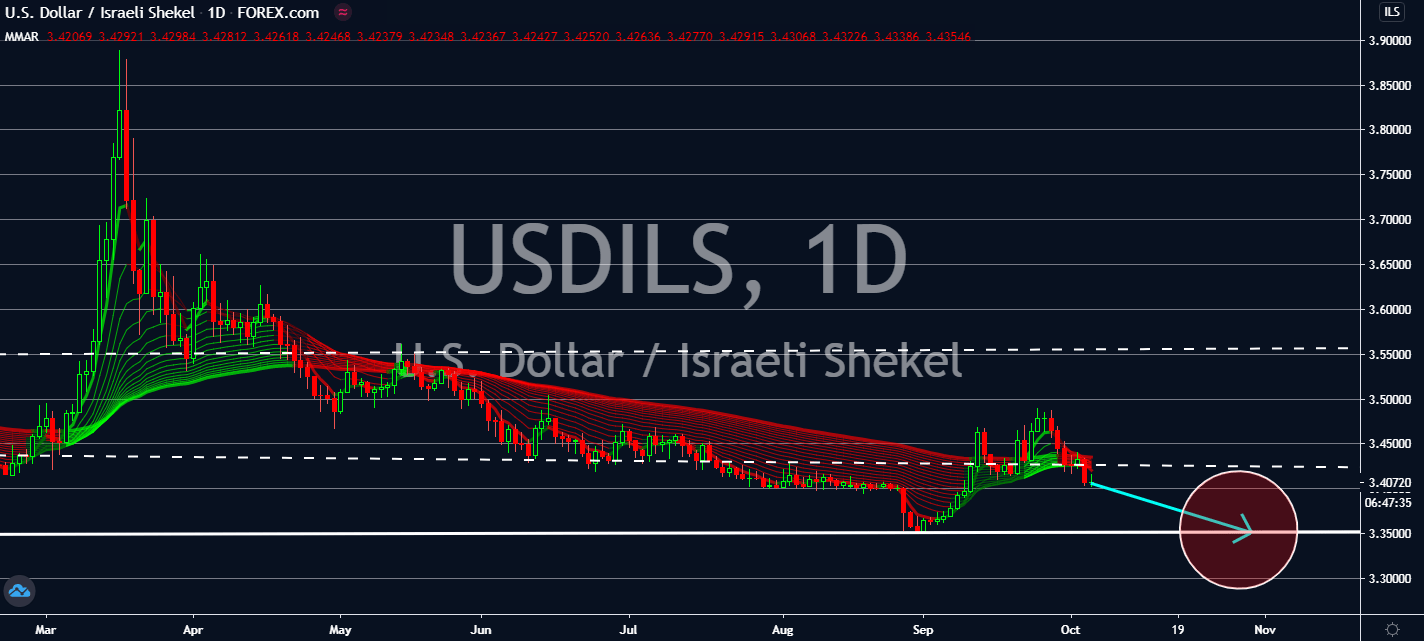

USDILS

The US dollar is projected to report sluggish employment figures today such as the JOLTs Job Openings, which could report none but a small improvement in August in comparison to July. In fact, the figure might only increase from 6.618 million to 6.68 million openings. Investors are also keeping a close eye on coronavirus cases in the US as well as the upcoming meeting minutes for several speeches from the Federal Reserve later today. That said, the Israeli economy isn’t doing any better: economists claim that the ongoing coronavirus crisis is negatively impacting Israeli’s housing market to its lowest for decades with a 27 percent drop on a yearly basis. More than 200,000 people have also been added to the unemployment records since its nationwide lockdown last month. It looks like the series of negative news from the Israeli economy wouldn’t be able to offset losses in the United States as markets hesitate to trade for the dollar.