Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

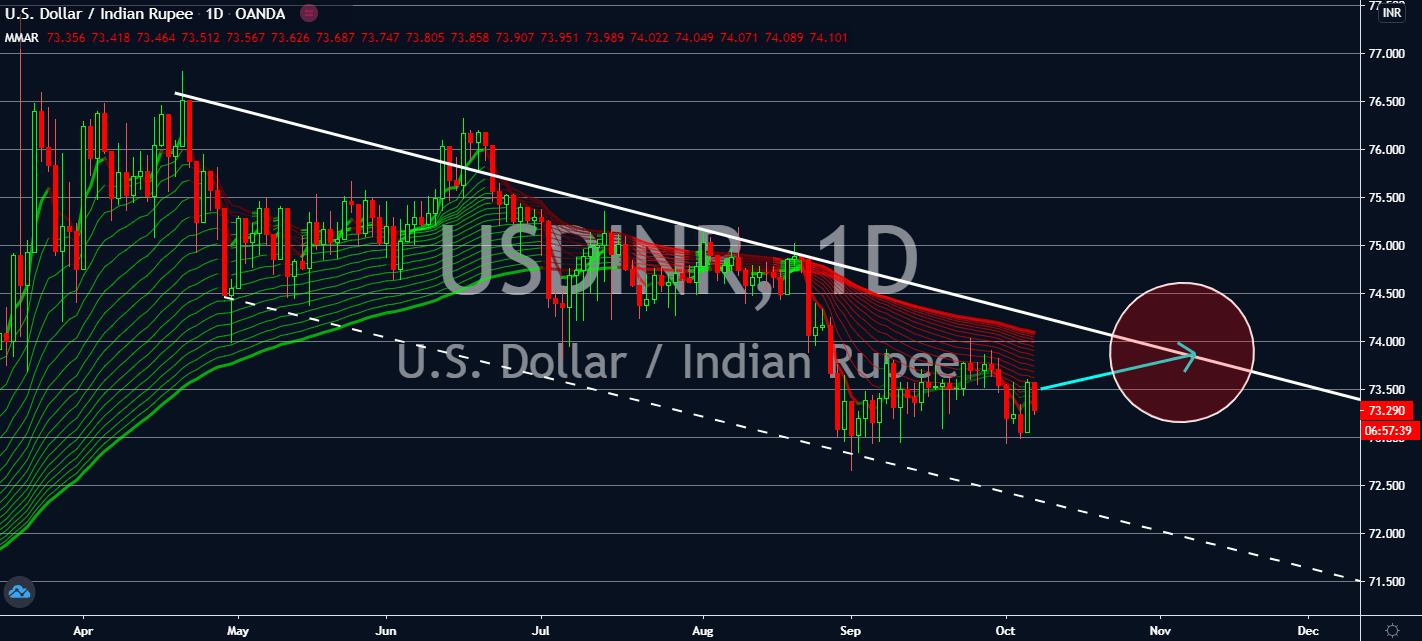

USDINR

It’s a relatively quiet day for economic indicators in the United States, but it looks like risk aversion will prevail. The Indian rupee has been going through a miraculous months-long rally largely because of several factors: rare account surplus, stock inflows, and asset sales have all helped the rupee despite having 6.7 million coronavirus infections in the country and a worse economy than most of its peers, but it looks like its advantage wouldn’t last any longer. Investors will have to keep a close eye on FOMC minutes today. The Federal Reserve is determined to keep its interest rates low until 2023, but the market is bracing for outlooks on how the US economy should improve within that time frame. The results of this meeting will be the catalyst of dollar strength near-term, but will more likely strengthen over weakening safe alternative such as gold and silver. If Wall Street moves higher, the greenback is projected to fall.

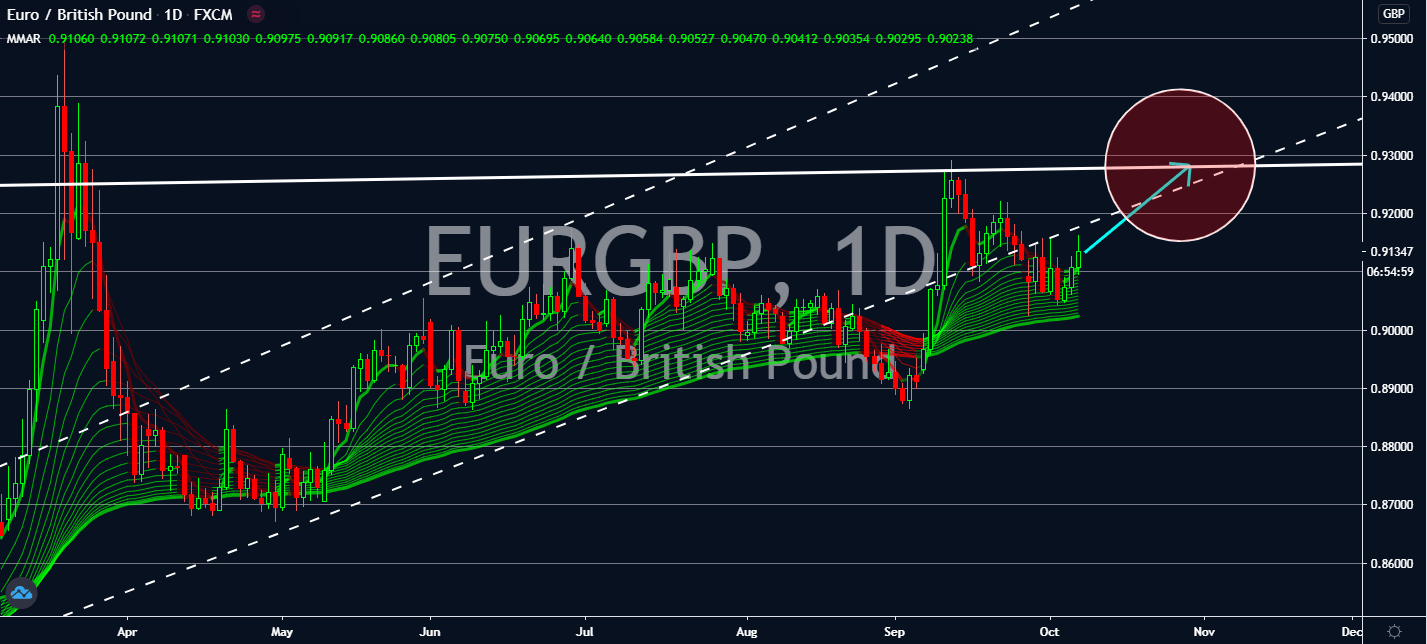

EURGBP

After US President Donald Trump tweeted that he barred attempts to create new stimulus for its economy, markets turned to Brexit for risk sentiment. The euro is projected to become a safe haven alternative following the European Central Bank’s announcement that it seeks to maintain its monetary policy easing program to reach its inflation goals by the end of the year. Although the conclusion received mixed reaction in the market, the euro is more likely to benefit over a relatively better economy. Between the two economies, it looks like the euro is at an advantage over the UK since the former had launched legal action on the latter over breaching Northern Island legislations. The pound will then be under pressure to improve its case to restrict trades and travel to and from the only boundary between the territories. From here on out, a possible no-deal Brexit is projected to benefit the eurozone over the pound, which would be the case today.

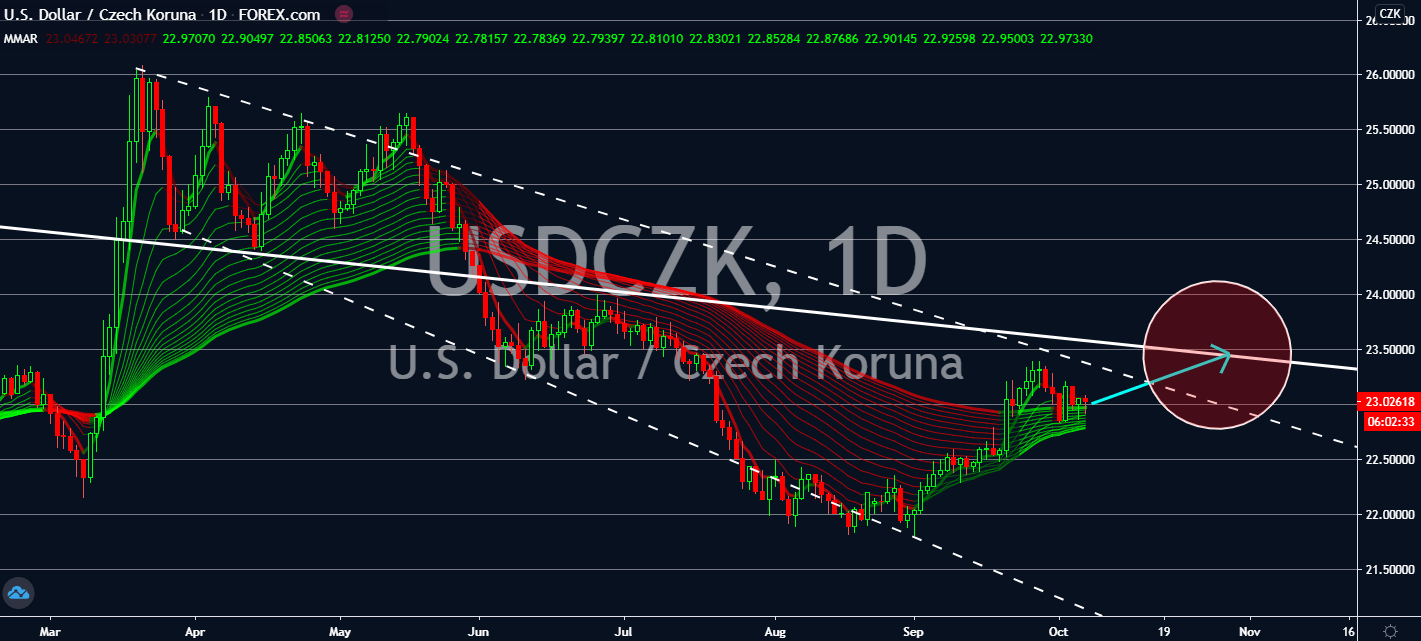

USDCZK

The second wave of coronavirus infection forced the Czech Republic to implement another state of emergency in the country. The rate of the virus’ spread is, according to its new health minister Roman Prymula, among the worst in Europe with its new daily cases at its highest at more than 3,000 since the pandemic hit the first time earlier this year. The restriction would last 30 days, which is projected to bleed on its economy in the next quarter. In turn, the US dollar’s bullish traders will take advantage, thanks to the widening gap between the two presidential candidates in the United States less than a month before elections. Investors are also projected to tune into how the Federal Open Market Committee will report how the economy has been coping for the past month, as well as its outlook for the rest of the year. The US will likely have a sluggish but increasing improvement regarding its employment figures.

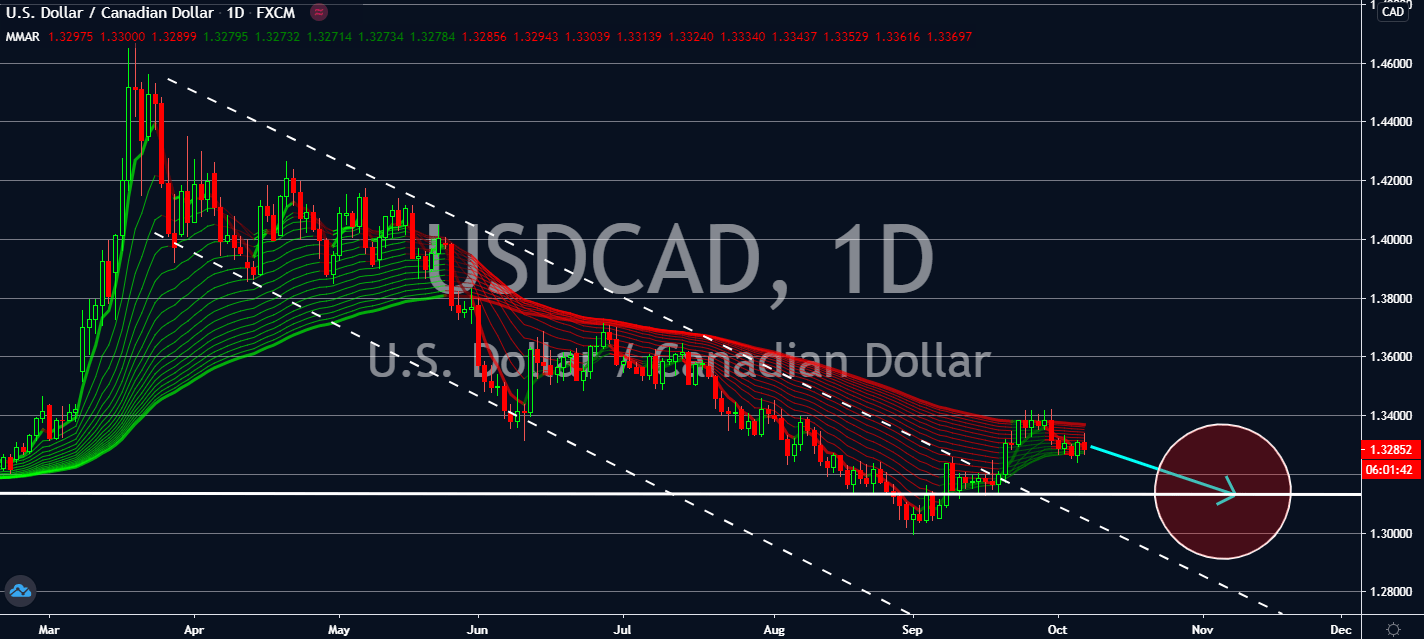

USDCAD

The dollar is projected to fall after US President Trump called to halt some stimulus measures that would help its economy buoy in the pandemic, a move to offset the widening gap between Democratic presidential candidate Joe Biden and his party by next month. Meanwhile, the Canadian dollar is projected to strengthen over calming stock market investors that lifted Wall Street in early trading. As US futures rise over the possibility of a wide win for the blues taking control of the US, risk sentiment is projected to lift the loonie. Moreover, the market is waiting for an announcement from Bank of Canada Governor Tiff Macklem on Thursday regarding how the pandemic will affect its economy by the end of the year. Notably, Canada’s record for new daily coronavirus cases might muffle the Canadian dollar’s near-term advantage, which reached more than 2,000 cases since its first surge earlier this year.