Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

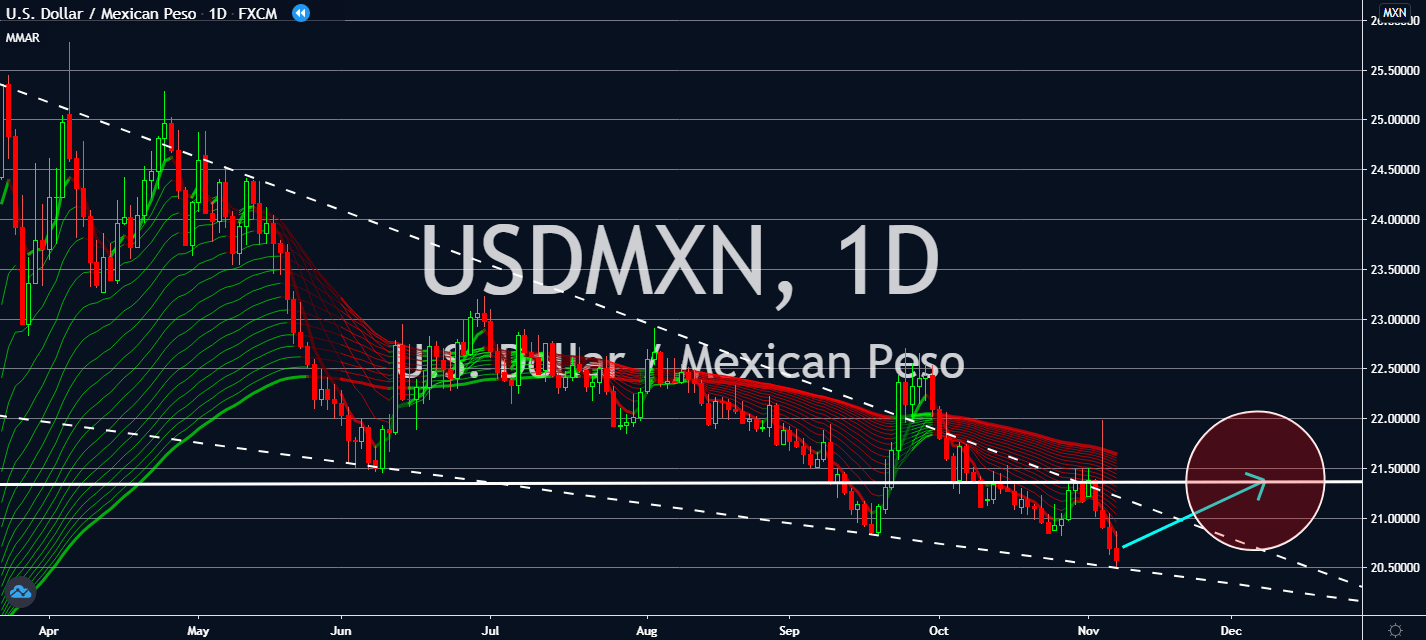

USDMXN

A former minister and retired army officer, Salvador Cienfuegos, is under investigation for drug charges that he denied in federal court last week. President Andres Manuel Lopez Obrador said that he will announce a review of cooperation agreements with the United States regarding the case. The tension between the two countries is increasing uncertainty towards the Mexican peso, considering that the second-largest economy in Latin America is facing a never-before-seen economic decline of 9 percent within the year because of the pandemic. Although central banks are unlikely to change their near-term monetary policies, only a vaccine deployment and a possible rapid increase in growth, inflation, and labor market could help Mexico witness consecutive gains against the largest economy in the world. Coronavirus uncertainties are still likely to loom over relatively uncertain economies including Mexico’s.

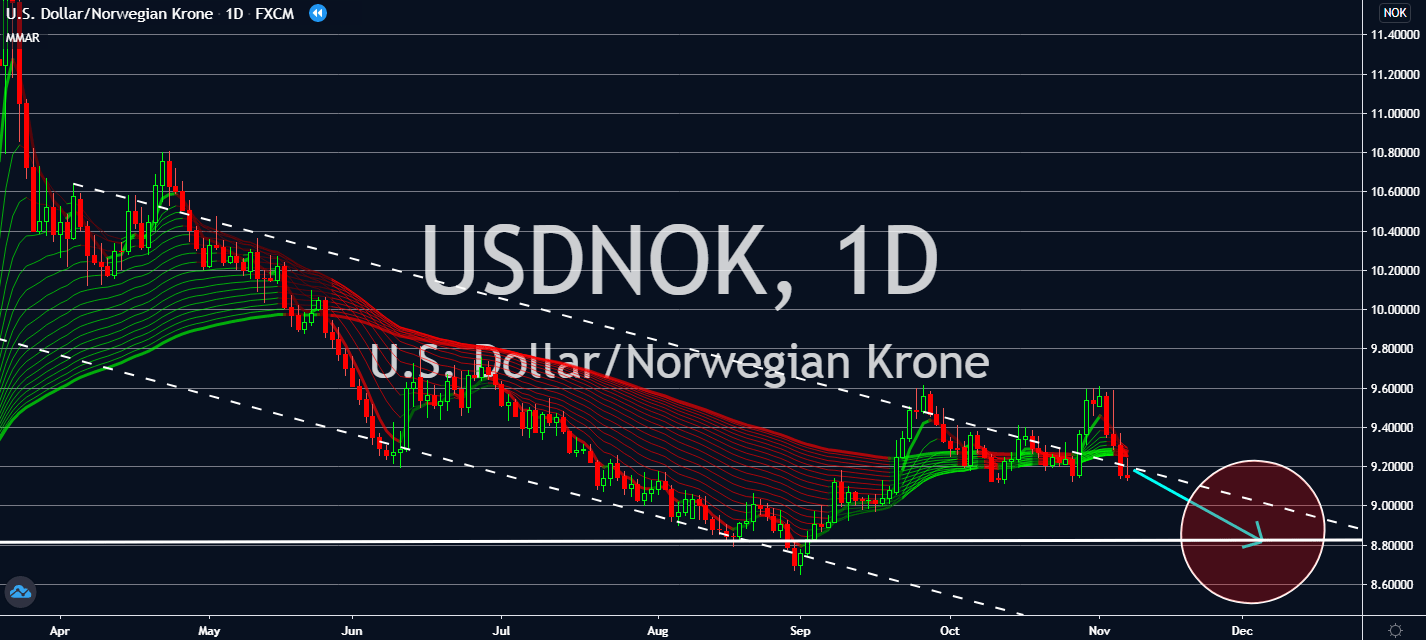

USDNOK

The Norwegian krone is projected to be one of the riskier currencies that could increase in place of the greenback near-term. Investors are counting on Biden’s presidency as an opportunity to improve the United States’ relationship with its peers, and the newly emerged successful coronavirus vaccines are projected to help risk appetite jump in the near-term. The fact that Pfizer’s candidate had greatly exceeded the consensus at a 90 percent effectivity rate has helped relieve the markets to lean towards the krone. The improving global growth expectations will offset most uncertainties in the near-term. Recovery is still slowing in Norway, with policymakers continuing support as it continues its recovery. Its central bank is considering increases for their key interest rates before the end of 2022, which could be a catalyst within the next weeks. For now, the krone should relish its increase against the greenback.

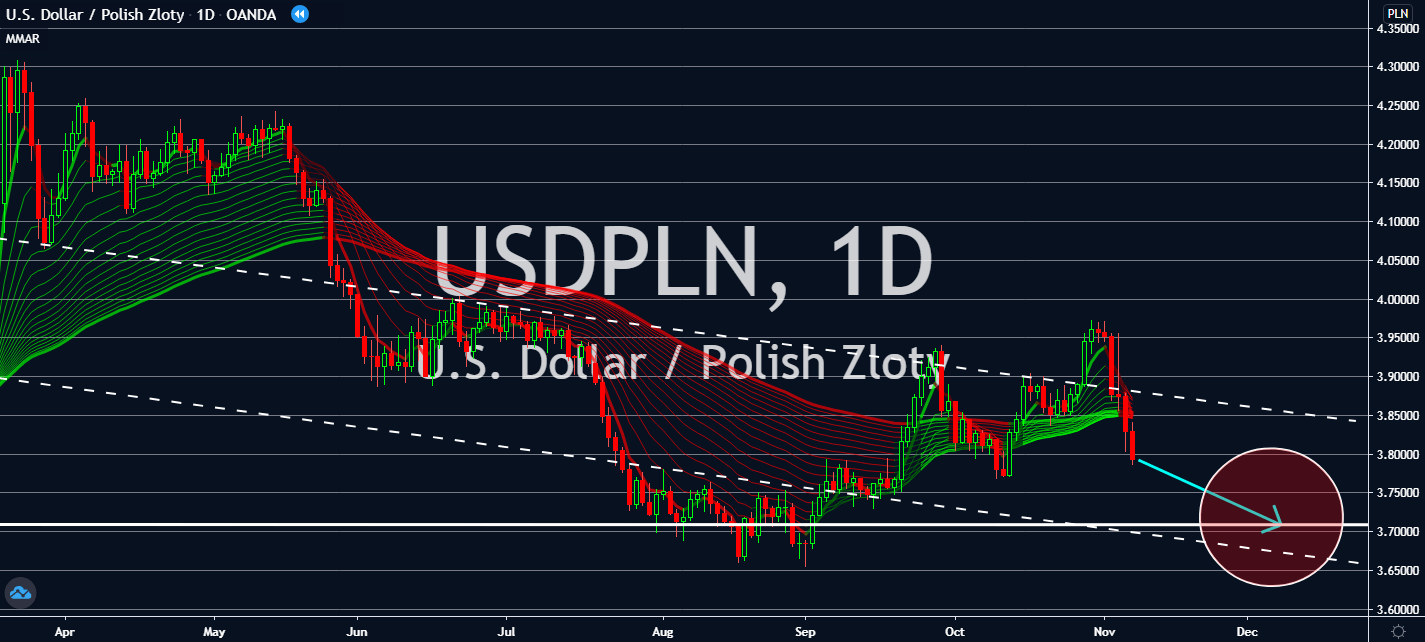

USDPLN

Greenback alternatives are projected to rise in today’s trading over promising news that Pfizer’s coronavirus vaccine candidate had been 90 percent effective in its third phase trials. Now that investors are anticipating a better economy in the future, the Polish zloty could be one investment projected to rise in the near-term. This is also considering that the United States’ economy is still going through a slow recovery. Forecasts claim that the Federal Reserve isn’t likely to recover 22 million jobs until 2024 with a looming possibility that its gross domestic product could fall back by 2.9 percent, with or without the prospect of a cure. Troubles about the storage capabilities could be another factor of the greenback’s fall. The Biden administration is now expected to push a continued fiscal stimulus package only by the first quarter of next year.

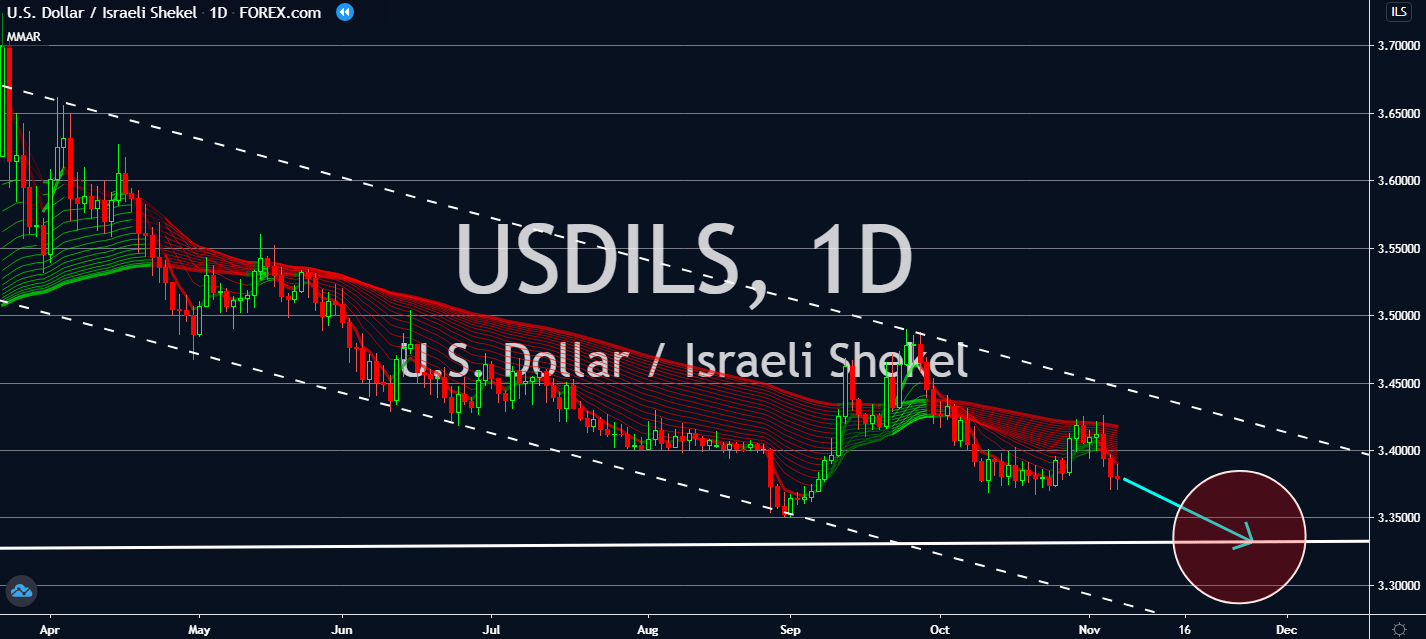

USDILS

The normalization agreement between Israel and the United Arab Emirates, which is also known as The Abraham Accords, is projected to uplift the participating economies’ geopolitical relationships and promote the imports and exports of their goods, services, and investments over their borders. The two nations are projected to participate in better oil deals as well as benefit from each other’s tourism industry with Emirati tourism packages encourage Israelis to take vacations in warmer climates. The improvement is projected to benefit Israel’s currency in the near-term as the US economy struggles to be assured of the recent development of Pfizer’s coronavirus vaccine, which claims to have 90 percent effectivity in its third phase trials. The largest economy in the world is still projected to suffer a contraction of gross domestic product by 2.9 percent by the end of 2020 with markets expecting an excruciating effort to recover 2 million lost jobs year-to-date.