Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

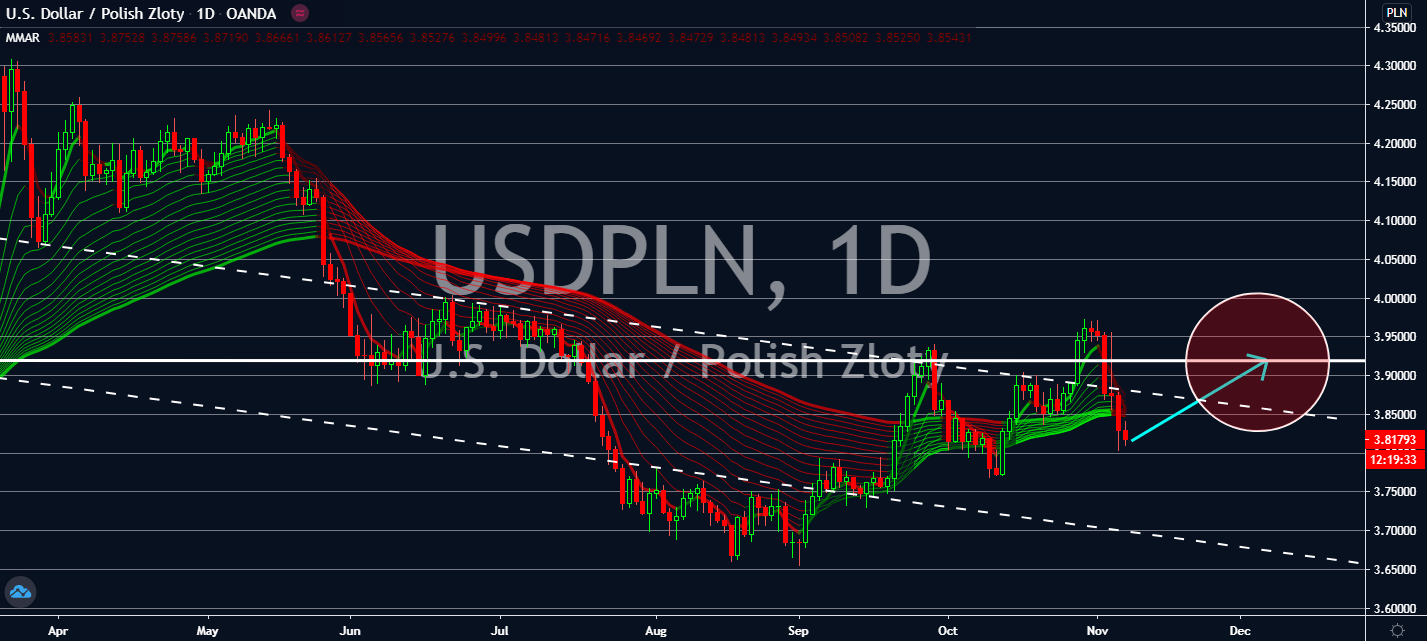

USDHUF

The intensifying spread of coronavirus cases in the US, as well as the lack of additional support measures, will likely be the main drivers of the pair’s near-term sessions as its economy struggles to come up with additional support measures. The United States recorded more than 100,000 daily new coronavirus cases for the first time on Wednesday, agitating the market from investing in the greenback. Data compiled has recorded a total of 9.6 million cases of Covid-19 so far, which keeps its place as the highest number in the world. Nonfarm Payrolls are also due for reporting today, which are projected to have fallen in the month of October from 661 thousand to 600 thousand. Private Nonfarm Payrolls are also expected to decline from 877 thousand to 690 thousand. Although the Federal Reserve recently promised to do whatever it takes to help its economy, the outcome of the US elections will also likely influence the pair more near-term.

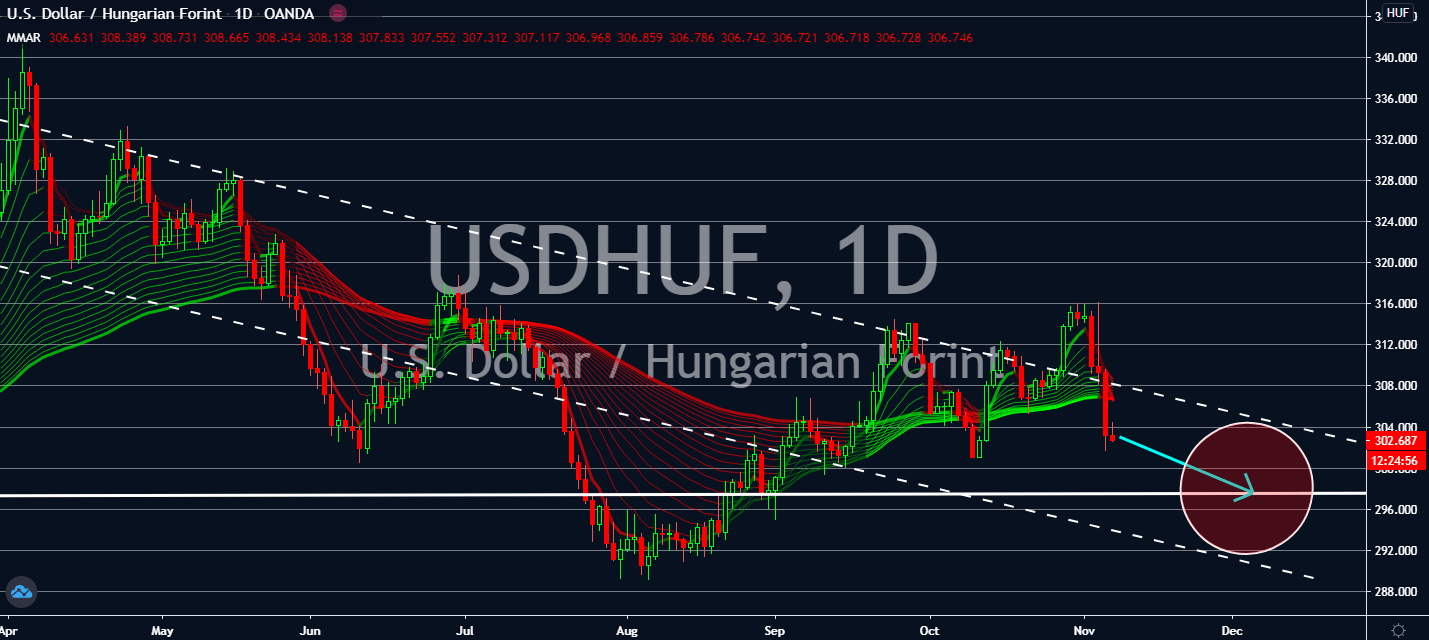

USDMXN

A Biden victory will be seen as positive for the Mexican peso, even after having touched its highest level in nearly eight months to multi-year highs. Emerging markets such as Mexico will lift from a fading dollar in the near term. The seasonally adjusted increase in gross domestic product turned out to be better than economists’ expectations at 12 percent during the third quarter, better than the 11.9 percent expected, after having contracted over the previous three months at the peak of the coronavirus lockdown. The increase turned out to be its biggest in history. Mexico managed to earn large trade surpluses throughout the past four months, particularly in its automotive industry, managing to offset lagging domestic demand. As Joe Biden’s win becomes increasingly possible, Mexico’s peso is projected to continue to benefit from better trade relationships with its neighbours, which also includes the largest economy in the world.

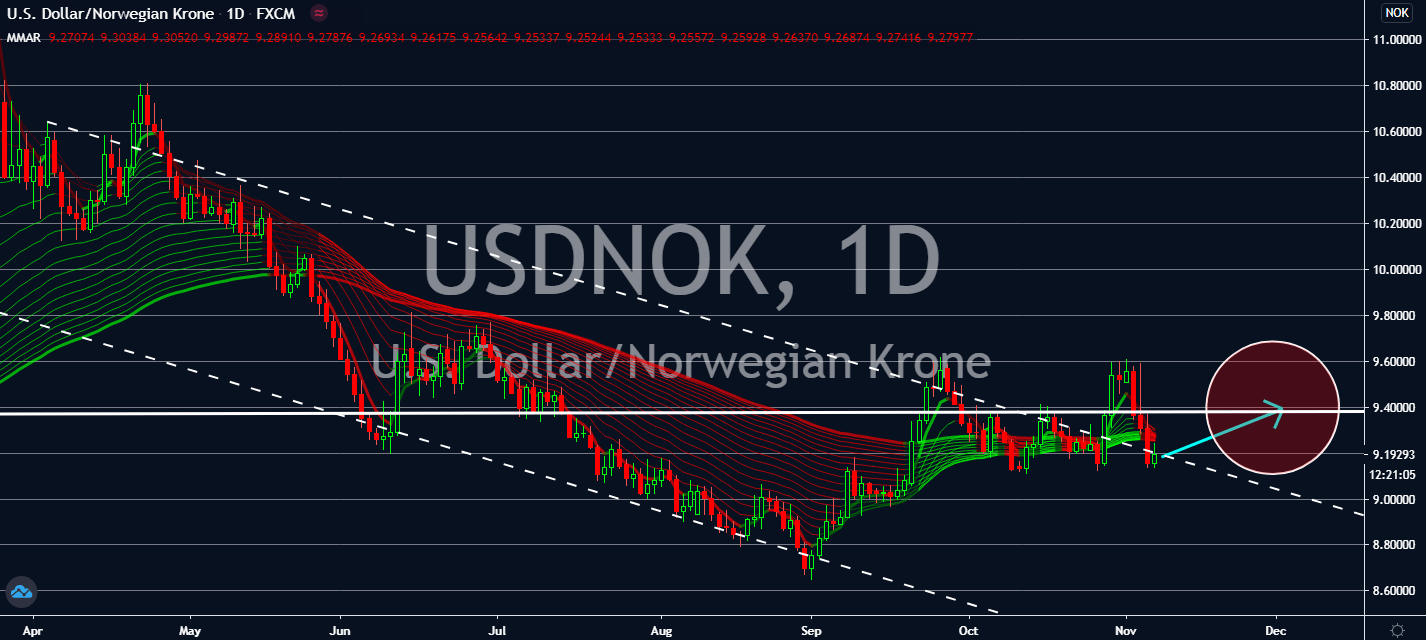

USDNOK

The Federal Reserve is projected to keep the market’s focus on the US economy’s employment figures, such as Nonfarm Payrolls and its Private equivalent. Chairman Jerome Powell noted that economic activity would continue to recover from its depression in the second quarter, despite the recent announcement that it had reached beyond 100,000 new daily coronavirus cases nationwide. Improvement is expected to keep at a moderate pace. Initial jobless claims had fallen to 751,000 by October 30, and continuing claims reached 7,825 million. Both figures were at their lowest since the beginning of the pandemic. If the unemployment rate falls steeper than 7.7 percent, down from 7.9 percent in September, the figure could pull the greenback up in the near term. Meanwhile, Norway’s central bank kept its interest rate at a low zero as expected. Uncertainty surrounding its economic outlook grew worries in the market, pulling the krone low.

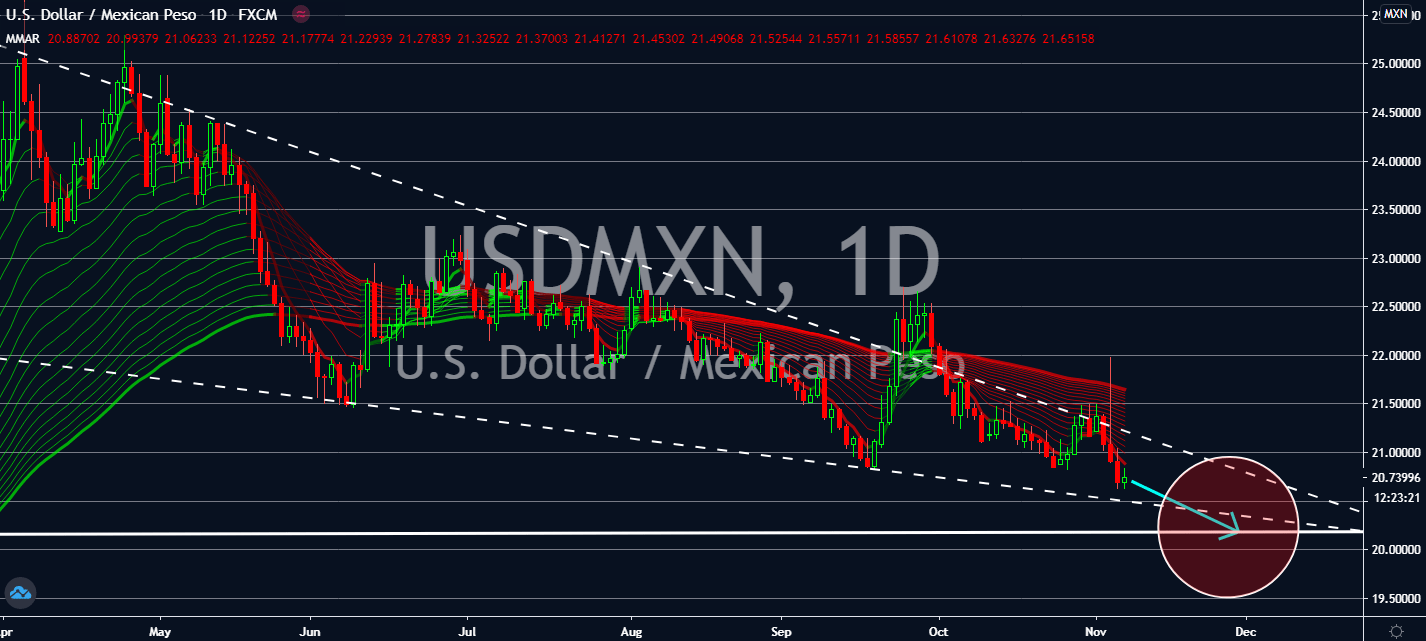

USDPLN

Poland’s central bank is delaying its policy meeting. Economists have speculated that the economy is seeking to update its economic projections for the year or an interest rate cut by about 10 basis points as well as a quantitative easing program that commits to purchase assets and private credit. It looks like economists are more worried that Poland will be in uncharted territory. Any changes in monetary policies will likely be detrimental towards the zloty, especially now that the European Parliament and the Council of the European Union are looking to penalize economies such as Poland for disrespecting rule of law, which includes democratic values, human rights, and the independence of the judiciary, as long as most of the member states approve. The EU will likely cut the agreed 1.8 trillion-euro budget and coronavirus recovery package over the Polish government’s threat to tighten its abortion laws, which were already the strictest across Europe.