Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

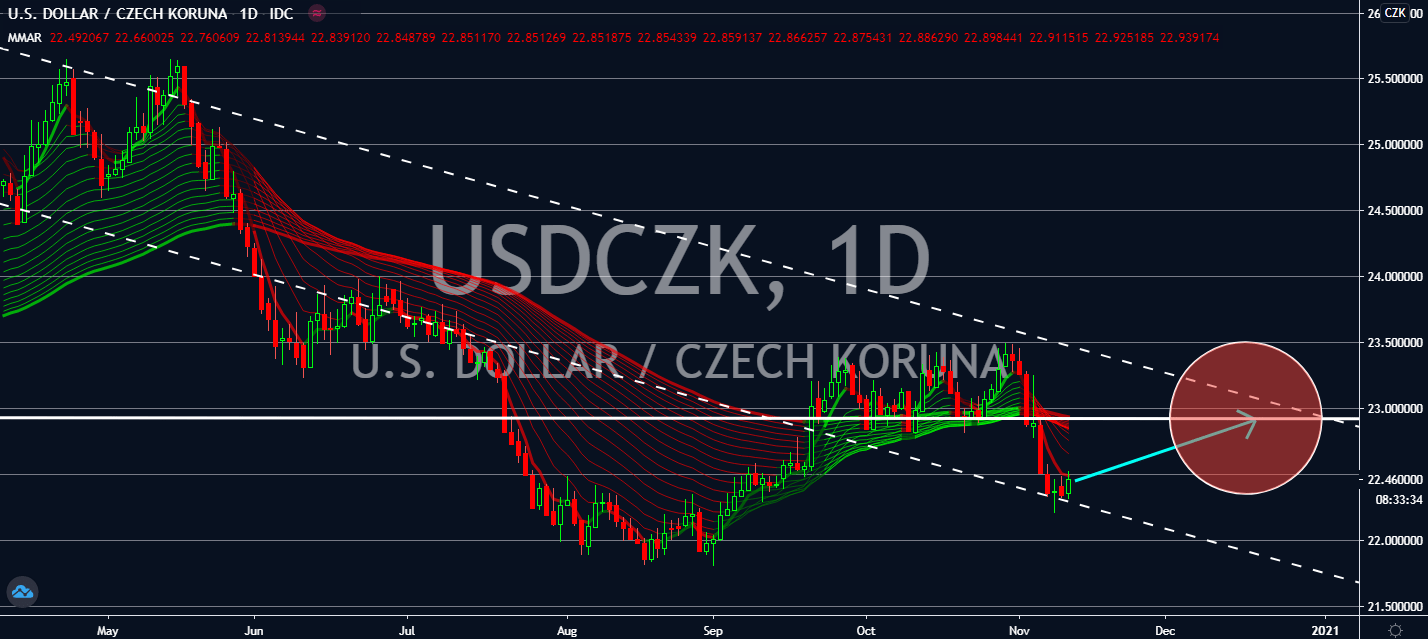

USDCHF

It looks like the US dollar will suffer greatly before it’s able to recover from its safe haven counterparts within the year. Optimism about the coronavirus vaccine¸ which is expected to be distributed by millions by the end of 2020, will only take effect by next year as the United States continues its struggle against the economic effects of the coronavirus. The dollar recovery is projected to halt over shuffling concerns of another stimulus package in the country, which is more likely to be another 2 trillion US dollars in support for state and local governments facing steep layoffs across the nation. Although the Federal Reserve is in talks for what could be a smaller package thanks to newly discovered vaccines, economists claim that the central bank should still go through with new stimulus before the country could face another presidential term in January. After all, the US still has more than 10 million coronavirus cases to catch up on.

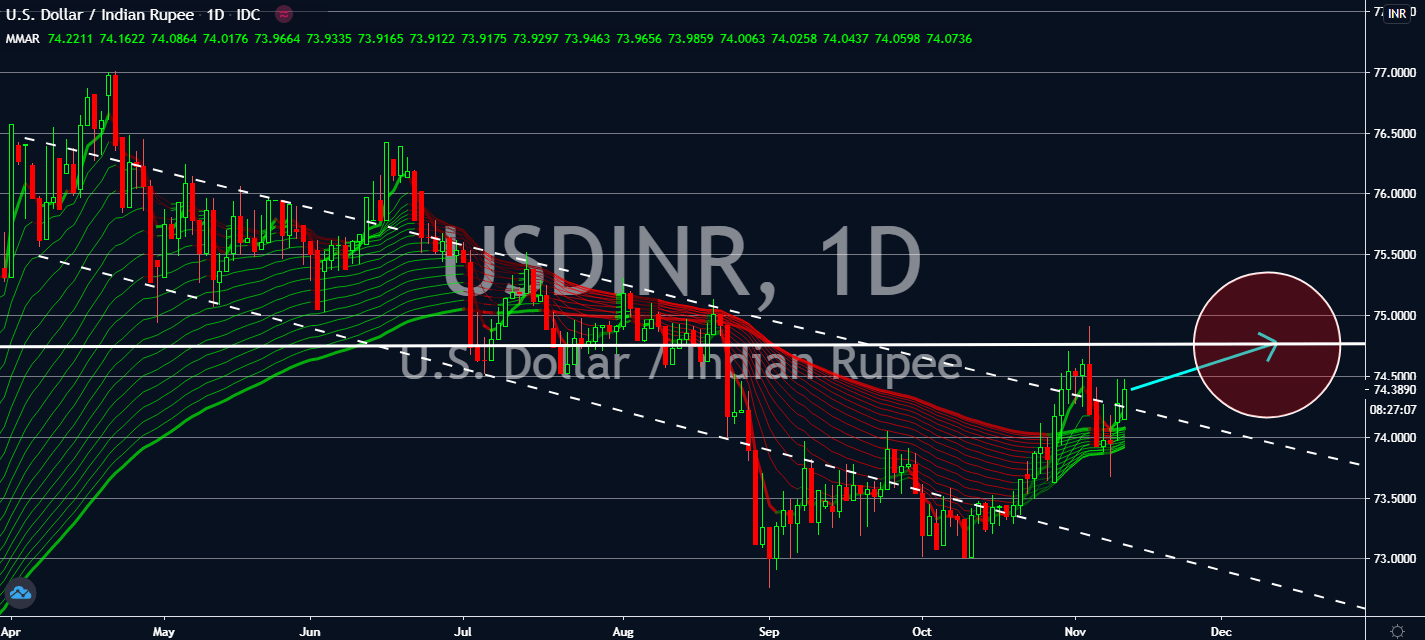

USDINR

Government officials in India confirmed on Wednesday that they are planning to announce another round of fresh stimulus amounting to 20 billion US dollars within the week in order to help pull its economy out of its coronavirus contraction. The announcement followed an earlier claim to allow production-linked incentives of about 27 billion US dollars over the next five years within 10 sectors. The economy is projected to follow up on its failed stimulus implemented back in May. With a near 24 percent contraction in the April to June quarter, the Indian economy is expected to witness an overall loss of 10 percent in gross domestic product over the fiscal year ending March of next year. Investors should keep an eye on the slowly descending coronavirus cases in the country, which had fallen below 500,000 for the first time in over three months. If the Federal Reserve also reports a specific fiscal package within the year, the bears could pounce.

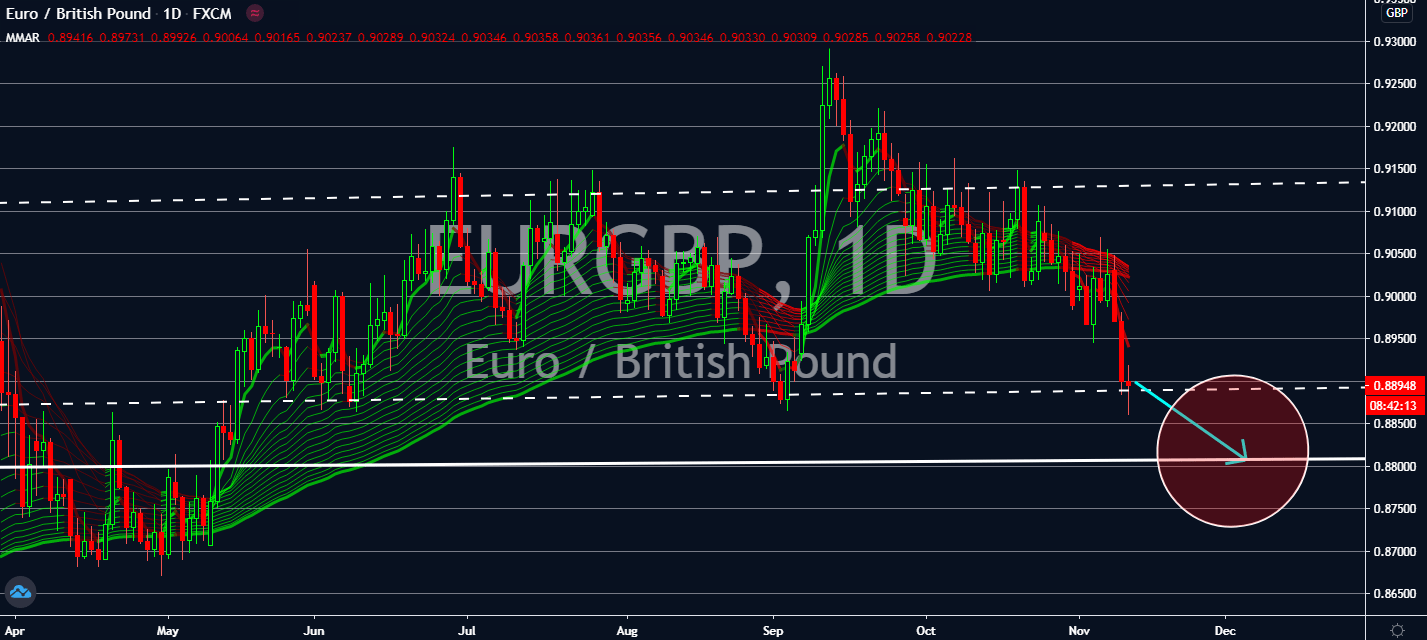

EURGBP

The European Central Bank is expected to talk later today. Investors are anticipating the eurozone may need to step up as the second wave of coronavirus keeps damaging its economy. According to Dutch central bank chief Klass Knot, the eurozone should continue to keep borrowing costs low to help buoy its economy instead of going back to pre-pandemic conditions. In fact, he claims that the banks should instead scale up its interest rates through the fourth quarter. The change in shift is projected to pull the single currency down when compared to its UK counterpart, now that economists have raised hopes that the United Kingdom could return to its pre-pandemic economy within six months if an effective vaccine was distributed within its borders. The City currently has 40 million doses on order of Pfizer’s candidate, which scientists and ministers claim were about 90 percent effective to prevent the disease during its third phase trials.

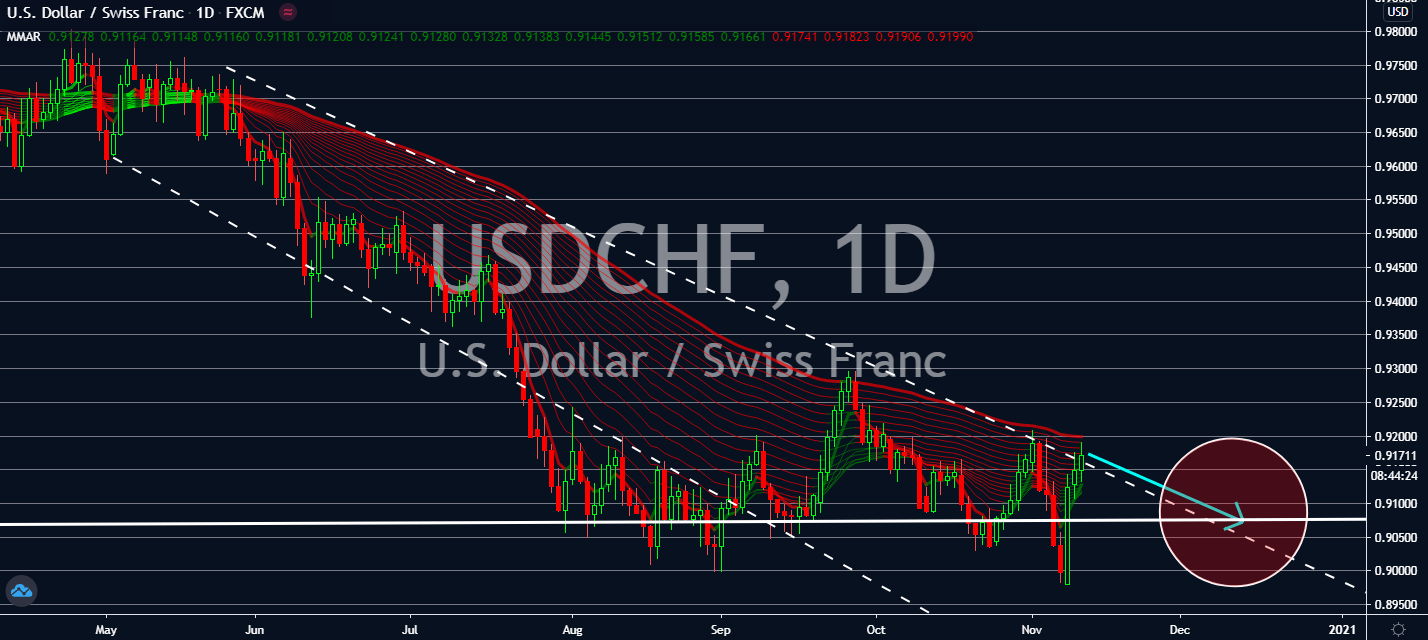

USDCZK

The Czech Republic now has one of the world’s largest fatality rates of the second wave of the coronavirus. The country is under fire for not closing down soon enough with 10,000 to 15,000 cases being confirmed by day while Covid-related deaths climb between 150 to 200 on the daily. Despite being a relatively low number, the record made the cases one of the world’s highest per-capita rate, while also effectively having one of the highest infection rates, as well. The Czech National bank also recently downgraded its forecast on economic growth this year, now fallen to a contraction of 8.2 percent by the end of it. Investors were also taken aback by Health minister Roman Prymula for violating his own restrictions last month, forcing the leader to resign. The worrying news will likely be the catalyst of the pair’s incline as the United States relishes in its recent success in seeking to approve a 90 percent effective coronavirus vaccine.