Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

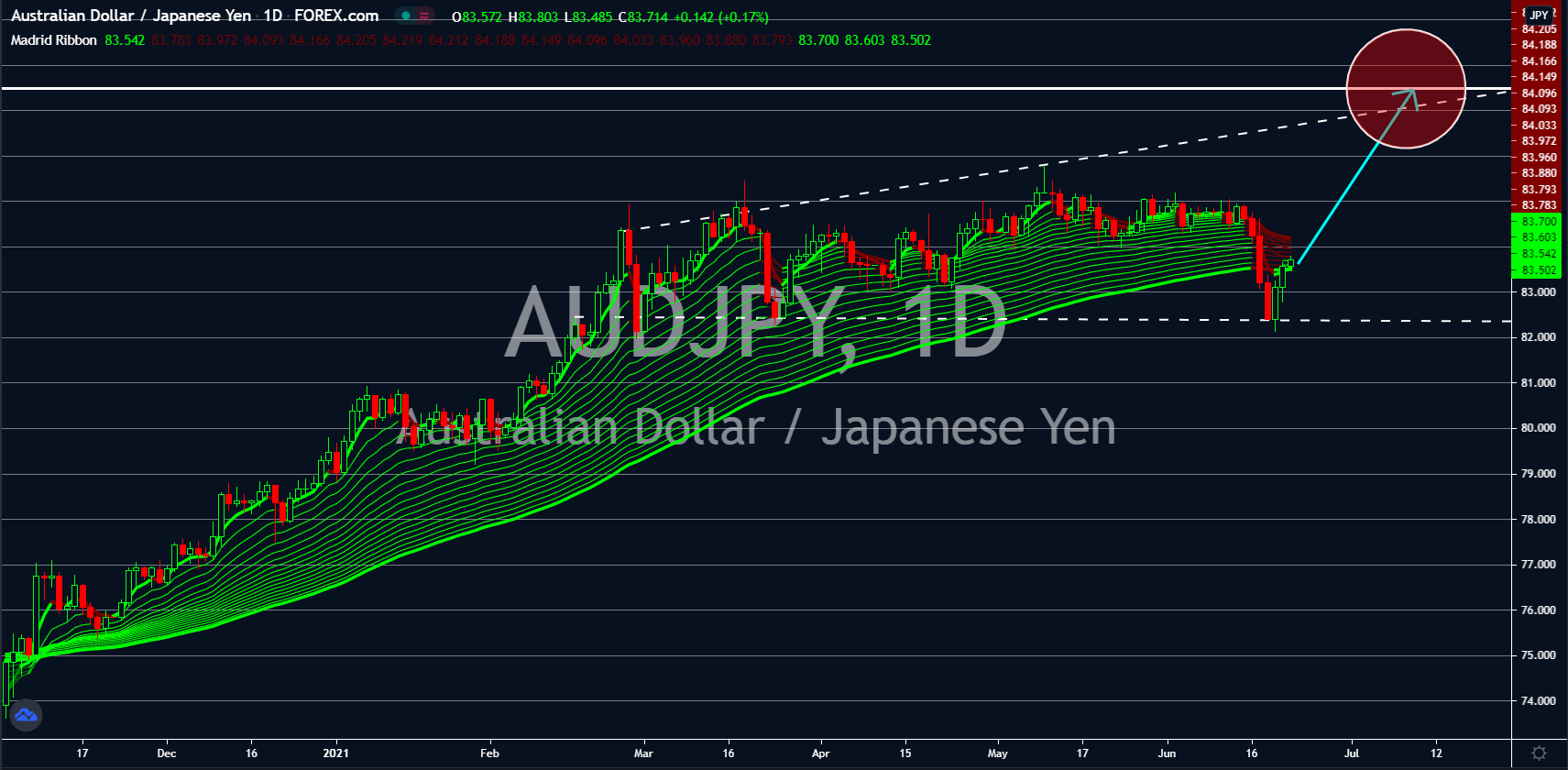

AUDJPY

Investors are starting to reduce their exposure to the yen after reports show a continued slow down in the world’s third-largest economy. Despite the massive stimulus introduced by the Japanese government and the BOJ, inflation still failed to meet the annual target of 2.0%. On Tuesday, June 22, the consumer price index came in at zero percent. Since July 2020, Tokyo’s CPI data has been either flat or in the negative territory. Aside from inflation, the PMI from the manufacturing and services sectors were released on Tuesday. The preliminary figure for June showed a decline to 51.5 points from 53.0 points for the Manufacturing PMI. Meanwhile, the Services PMI made advances to 47.2 points. However, this is still below the 50.0 points benchmark for the report to be considered as positive for the economy. The Coincident Indicator and Leading Index also had mixed results on Wednesday’s report. Figures came in at 2.4% and 103.8 points, respectively.

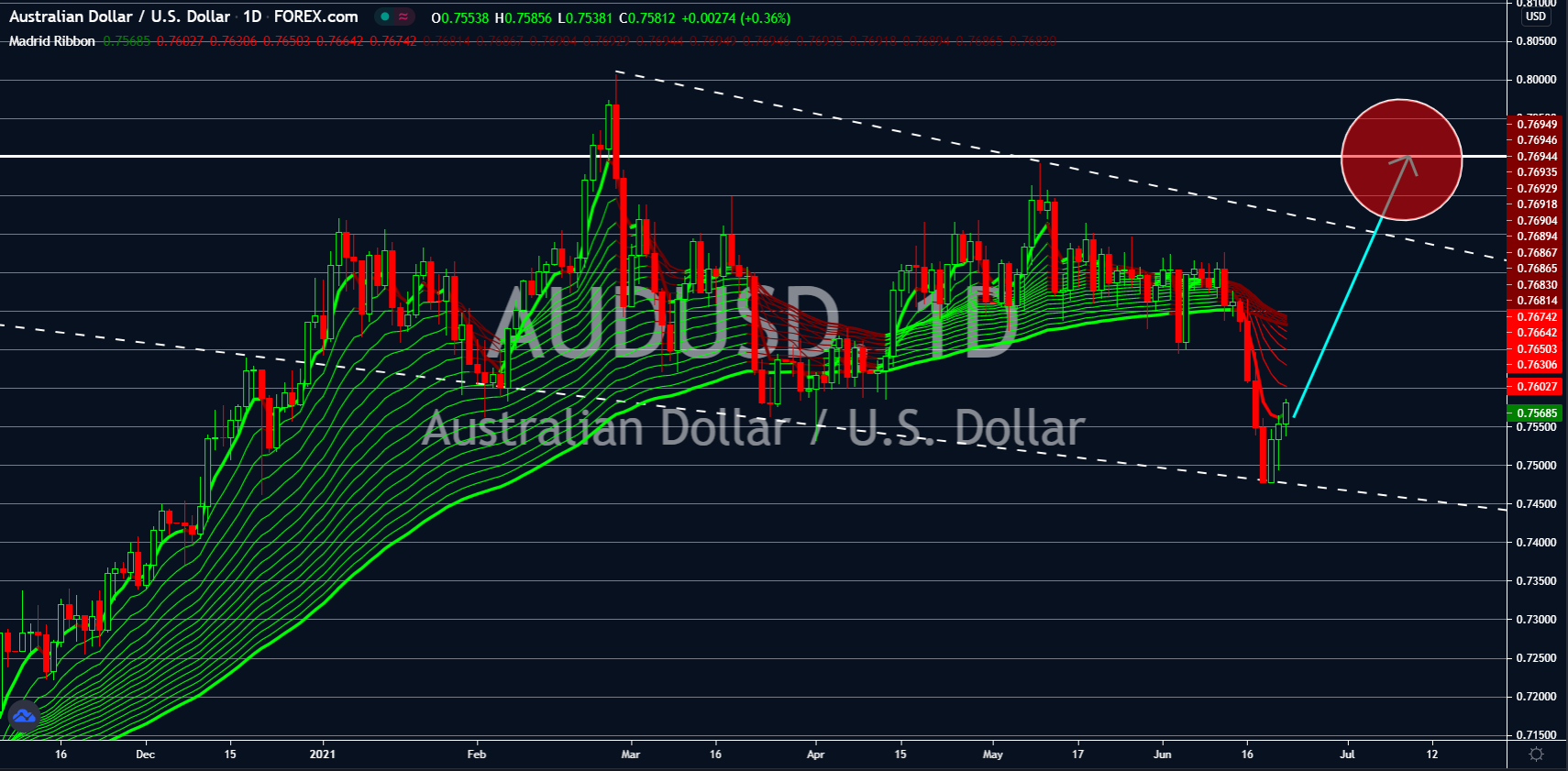

AUDUSD

After reaching their highest records in May, the Manufacturing and Services PMIs are anticipated to post lower figures for the preliminary report for June. The forecasts are 61.5 points and 70.0 points. Adding to the bearish sentiment in the US dollar was the recent comment by Federal Reserve Governor Jerome Powell during his US Congress speech on Tuesday, June 22. The central bank chief said that inflation was not the sole criteria for an interest rate hike. This statement was in contrast to St. Louis Federal Reserve President James Bullard, who says that an increase in the rate could come as early as next year. Powell during the FOMC meeting said that monetary tightening will begin by 2023. Bullard and Powell are both members of the FOMC. The US indices are also set to reach a record-high in the coming days, which makes the greenback less attractive to investors. Meanwhile, the 10-year treasury notes hover below 1.500% in the short to near term.

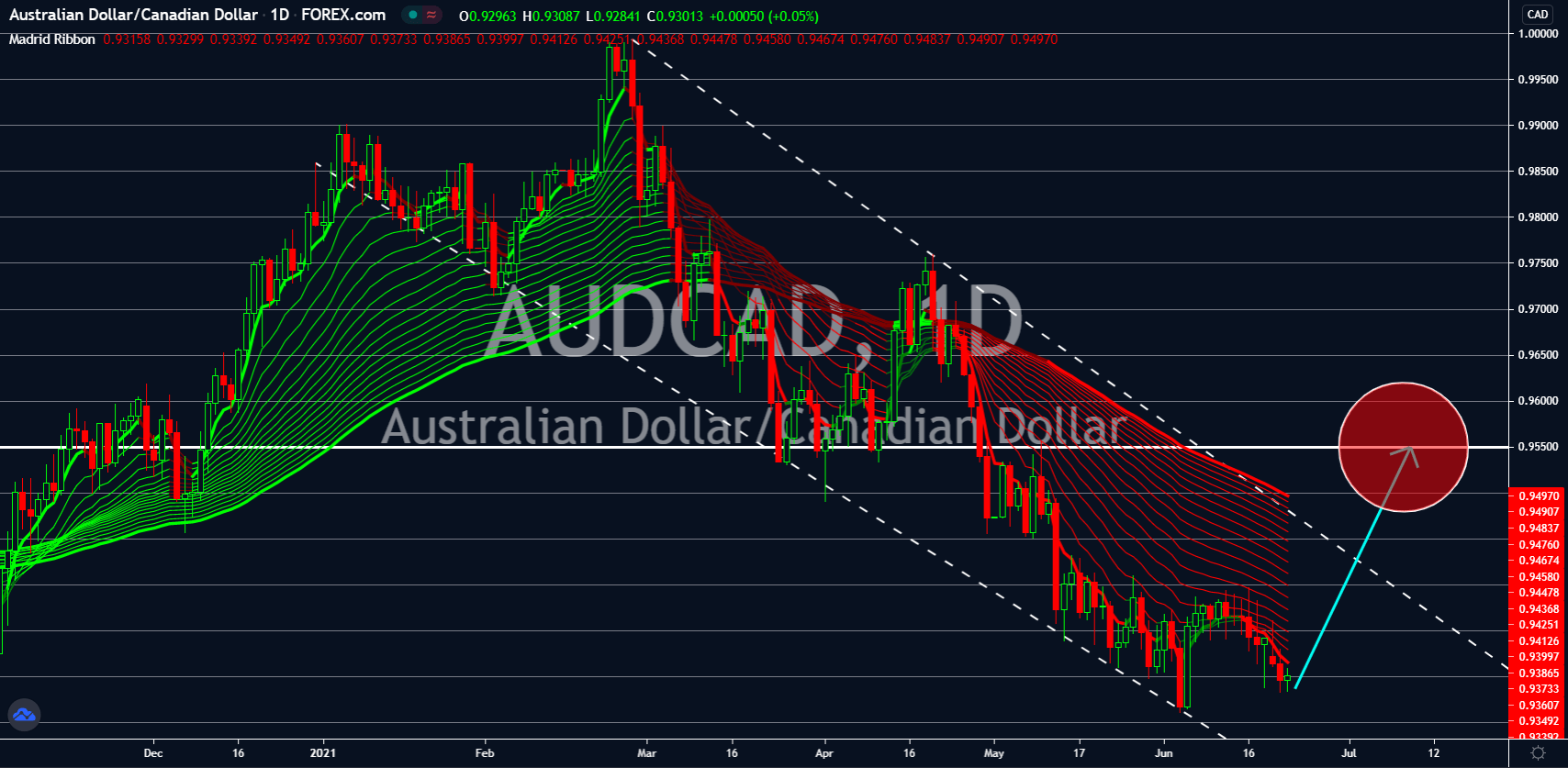

AUDCAD

The delayed reopening of the Canadian borders along with the disappointing economic reports will weigh down on the local currency. Ottawa will be lifting several restrictions for fully vaccinated individuals starting July 05. However, Justin Trudeau’s government defied expectations of reopening the border with its neighbour, the United States. This was despite the high vaccination rate in America. In Canada, the government targets 95% inoculation, 70% fully vaccinated and 25% who have at least one (1) shot, before easing all border measures. This could further send the retail sales data lower in the coming months. As for April, the report measuring consumer purchases is still down by -5.7% compared to the same period last year. The same was seen in the core retail sales report of -7.2%. Both figures were the second and third-lowest recorded figures in the past three (3) decades. The pair will reverse back and move towards the 0.95500 price level.

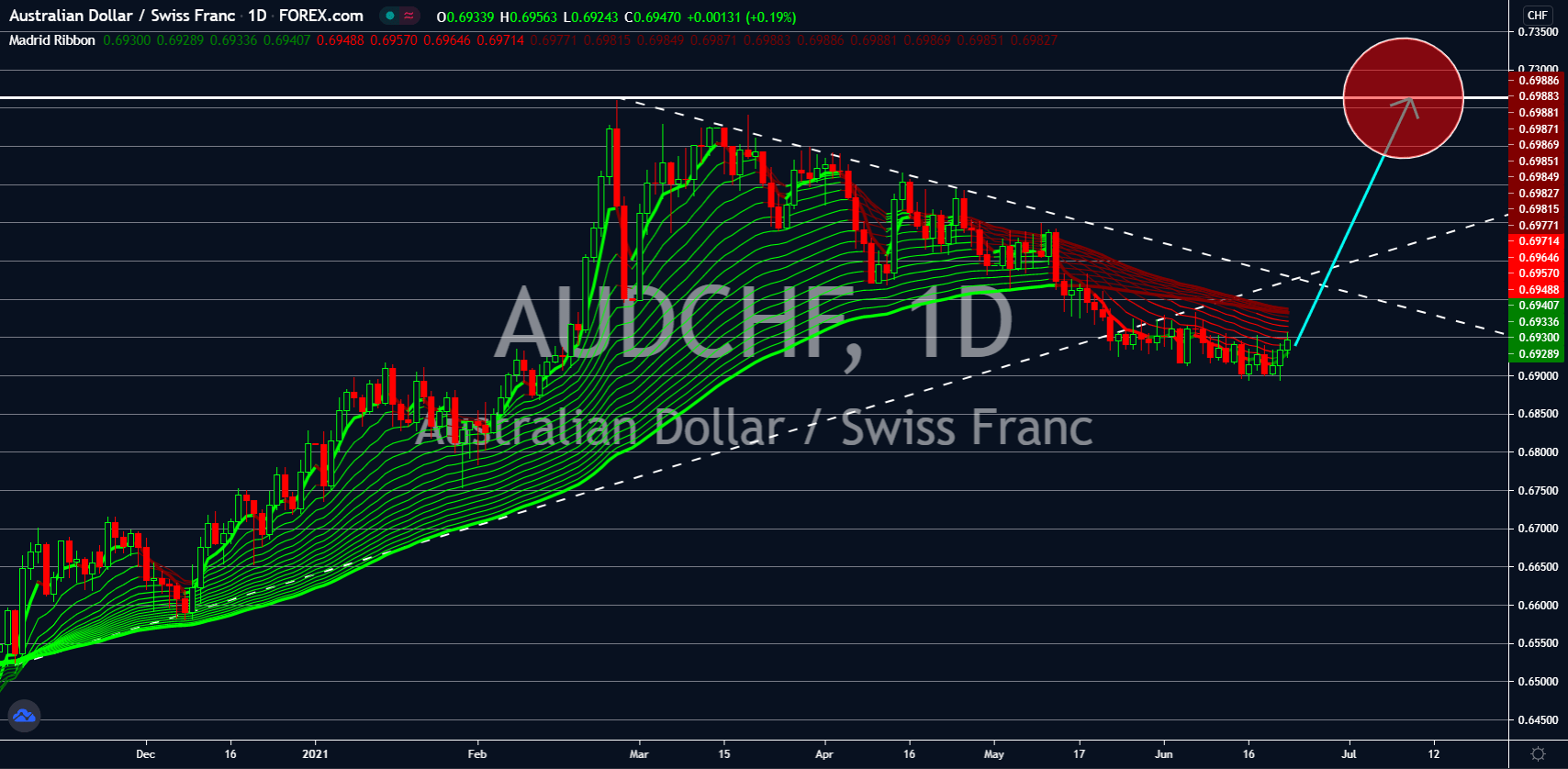

AUDCHF

Australia was among the first to publish and disappoint investors with the PMI data. Both numbers from the manufacturing and services sector for June’s preliminary report were a decline from their previous records. The Manufacturing PMI came in at 58.4 points against the final result for May at 60.4 points. Meanwhile, the Services PMI had 56.0 points on June 22’s report against 58.0 points prior. However, some recent news is expected to boost the demand for the Australian dollar in the short term. Starting in the second half of fiscal 2021, the minimum wage will increase by 2.5% to 20.33 AUD or 15.65 US dollars per hour. The Fair Work Commission raised the lowest hourly wage by 1.75% starting January to June 2021. The added purchasing power will create higher demand for goods and services. Also, the slow progress of vaccination might work in its favour. Australians will be forced to spend their money as borders remain closed for international travel.