Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

EURCZK

Inflation data from the EU member states soared on Tuesday’s report. Among the EU’s largest economies, only Germany was able to post above the ECB’s annual target of 2.0%. The actual figure came in at 2.5% in May against 2.0% in the prior month. Meanwhile, France and Italy’s numbers were up by 1.4% and 1.3%, respectively. While the European Central Bank has retained its benchmark interest rate unchanged at zero percent, the uptick in the consumer price index (CPI) might result in a more hawkish tone from the central bank. In addition to this, investors are hoping to end the Pandemic Emergency Purchase Programme worth 2.21 trillion due in March 2022. This was amid expectations of a faster recovery in the second half of the year. In Q1 2021, the German economy shrinks -1.8% YoY while France recorded a -0.1% decline in the first three (3) months of fiscal 2021. The average first-quarter GDP of the Eurozone is at -1.3% compared to Q1 2020.

USDHUF

Just like the United States, Hungary’s headline inflation is also raising concerns among investors. The consumer price index (CPI) report showed an increase of another 5.1% for May after posting the same figure in last month’s report. However, the growth in inflation is uneven with April’s industrial production massively missing the consensus estimate of 68.0% with an actual result of 58.8%. The Hungarian government’s budget deficit in May jumped to -269.0 billion from a 100.0 billion surplus in the previous month. Meanwhile, mid-April’s trade transactions are still net positive. However, the 321.0 million surplus was the lowest so far in 2021. Despite this, analysts believe that the eastern European countries of Hungary and the Czech Republic will soon pull their support to the local economy. This will result in these economies’ central banks increasing their benchmark interest rate. On Friday, June 11, Russia had its third interest rate hike in 2021 to 5.50%.

USDMXN

While inflation picks up in most countries, Mexico recorded a decline in the consumer price index (CPI) for May. The actual figure came in at 5.89% compared with April’s 6.0% record. Although the figure is still below Banco de México’s inflation target of 3.0% with a +\- 1.0% range, the easing in prices of basic goods provides bearish sentiment among investors with regards to the interest rate. Analysts are no longer expecting a rate hike anytime soon until the headline inflation remains in check. In other news, the market awaits further development in US-Mexico relations. On June 01, President Joe Biden ended the “remain in Mexico” policy by his predecessor. This could ignite further cooperation between the two (2) neighbors along with the full implementation of the USMCA (United States-Mexico-Canada) deal. Meanwhile, the US president formally picks the US ambassador to Mexico. Former Interior Secretary Ken Salazar will be taking the post.

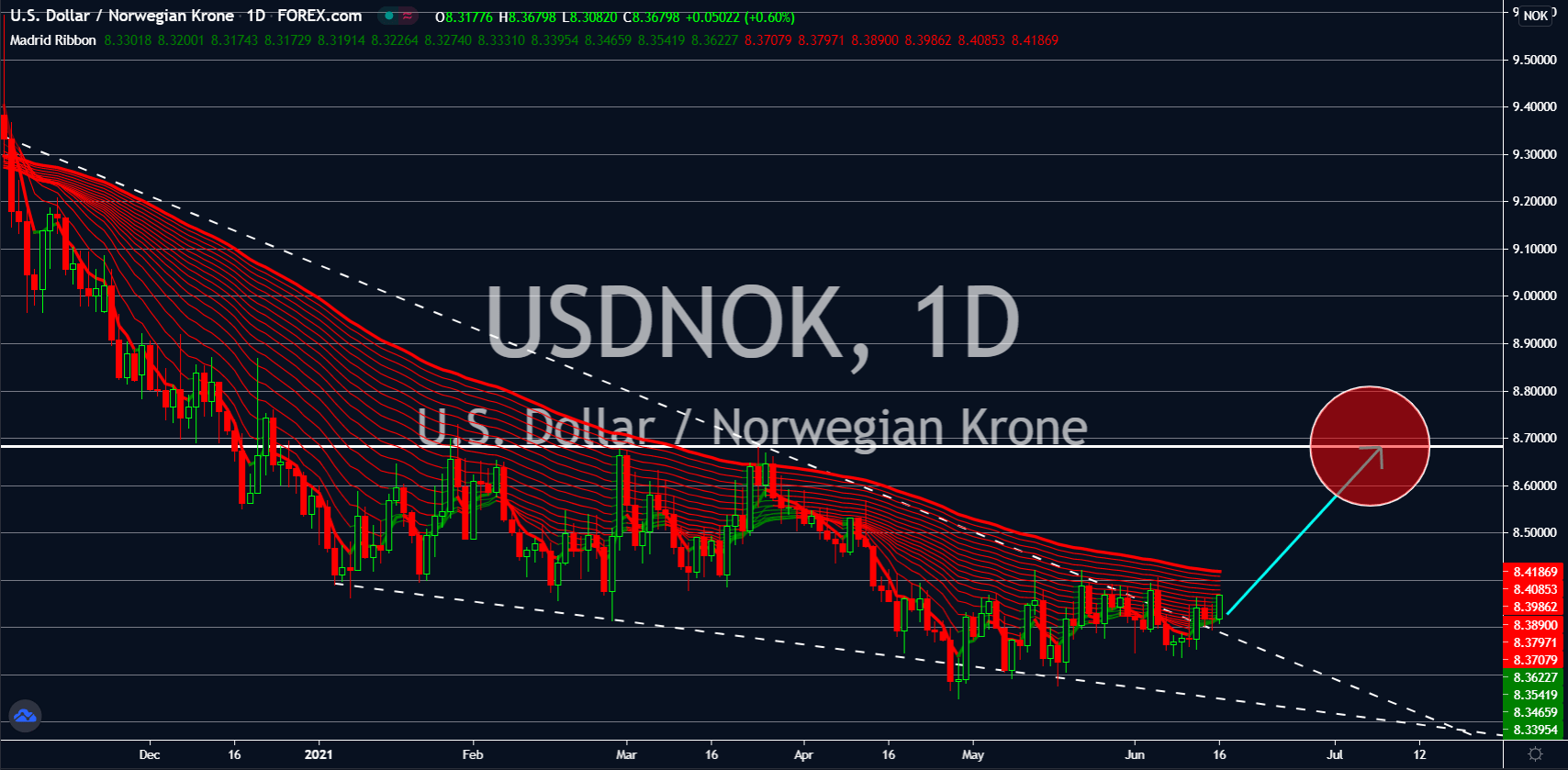

USDNOK

Demand for the US dollar will increase ahead of the FOMC’s meeting on Wednesday, June 16. The group headed by Federal Reserve Governor Jerome Powell will decide the US central bank’s short-term monetary policies through the interest rate. The Fed has a mandate of maximum employment and stable prices. Last week’s initial jobless claims show the number of individuals filing for unemployment benefits dropping to 376,000. This was the lowest recorded number since April 2020. Meanwhile, the US inflation soared to its 13-month high at 5.0%. As employment is starting to recover, the only report that needs fixing is inflation. The emerging markets have already started hiking their benchmark interest rate. On June 11, Russia increased the country’s short-term interest by 50-basis points to 5.50% while expectations for Brazil on June 16 of a 75-basis points hike to 4.25%. The US expected to remain at a record low of 0.25% on Wednesday.