Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

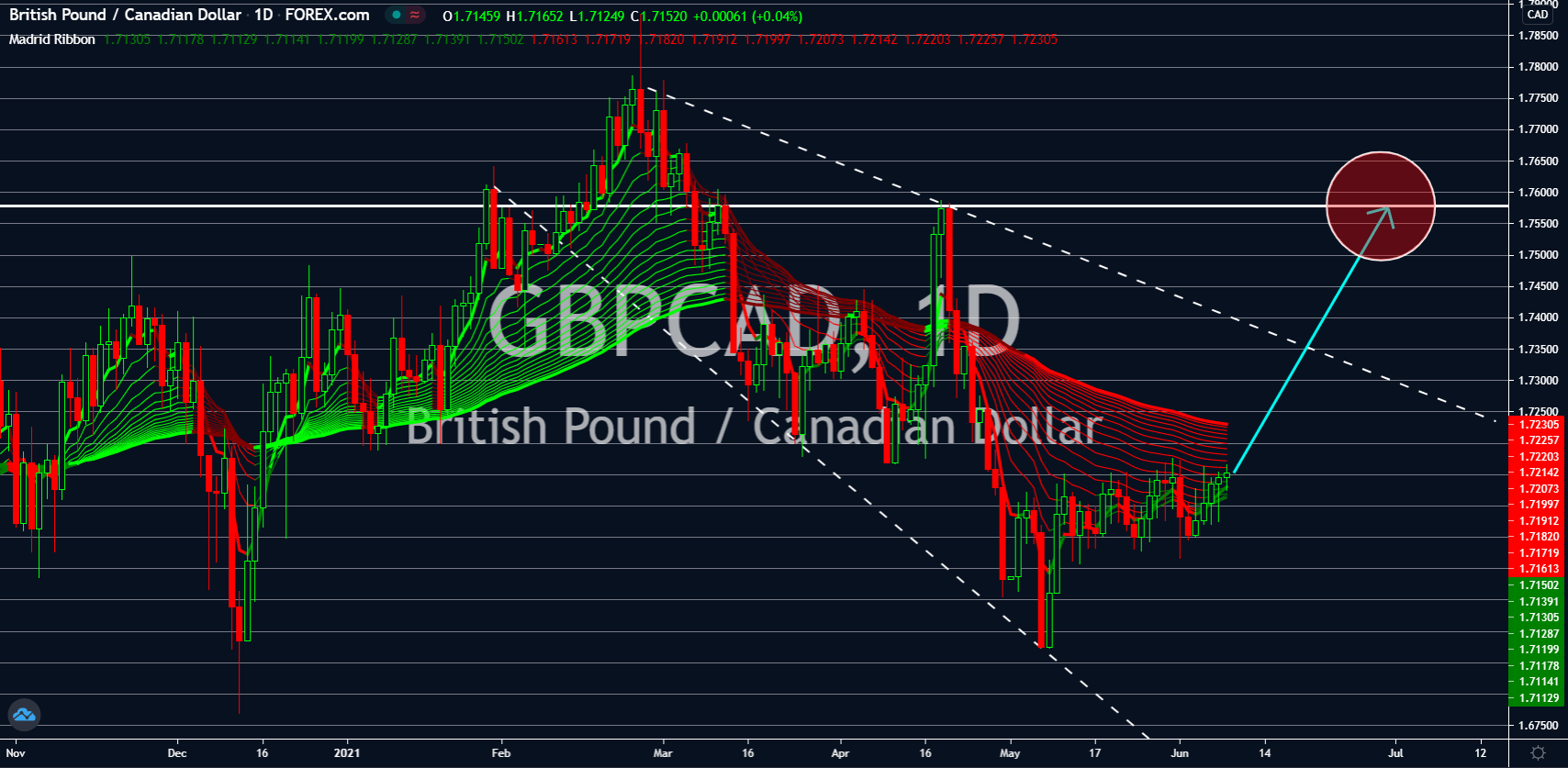

GBPCAD

The market is anticipating the Bank of Canada to keep its benchmark interest rate unchanged on Wednesday, June 09, at 0.25%. The central bank earlier forecasted monetary tightening to start only at the second half of fiscal 2022. The BOC reiterated the need for continued support in the local economy as GDP fell -0.8% in April. This was the first time that the economy contracted this year despite its southern neighbor, the United States, recording 6.4% expansion in Q1 2021. The bearish forecast for the interest rate decision will shrug off the optimism from the trade data. In the month of April, Canada had a trade surplus of 0.59 billion after the deficit in the prior month with a revised figure of -1.35 billion. However, the surplus came with imports declining to 49.61 billion in the reported month from 52.05 billion in March. The drop was steeper than the -0.49 billion net change in the exports data. The next resistance level for GBPCAD is at 1.75750.

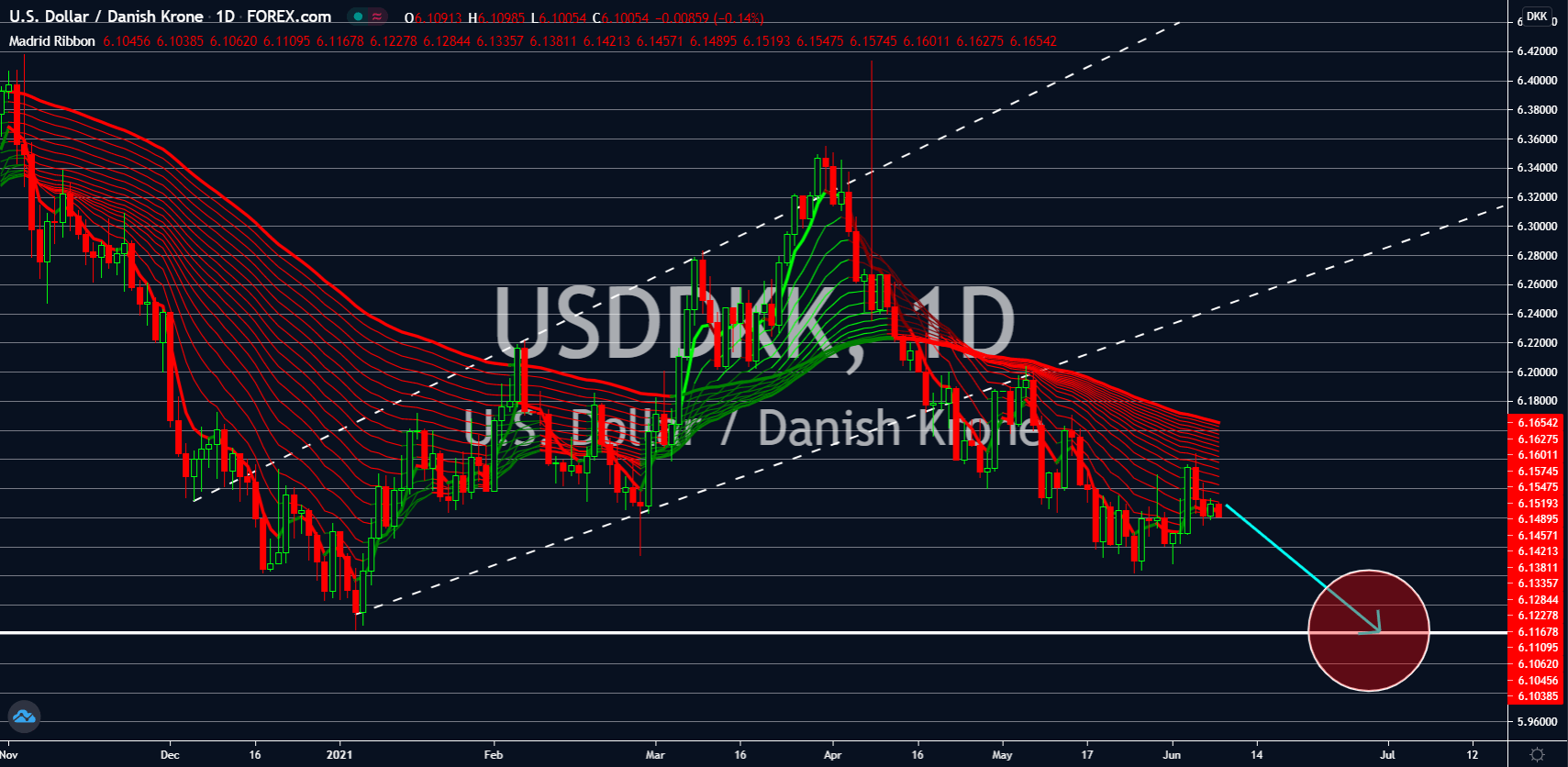

USDDKK

The US bond yield was down 0.104 percentage points since the speech by US Treasury Secretary Janet Yellen. The former central bank governor dismissed concerns by investors and traders over the rising prices of basic goods. Yellen added that inflation is good for the US economy as it transitions in the post-pandemic era. The comment came a week before the inflation report, which many analysts believe will continue to overshoot above the Fed’s 2.0% annual inflation target. The consensus estimate for the consumer price index (CPI) report on Thursday, June 10, is an increase of 4.7% on an annualized basis. This is still higher than the forecast by Treasury Secretary Janet Yellen of 3.0% inflation for the whole year. Also, the optimism in the jobless claims report on the same day of another decline to 370,000 this week will send the greenback lower. A lower number of unemployment benefit claimants make the equities market more attractive than the US dollar.

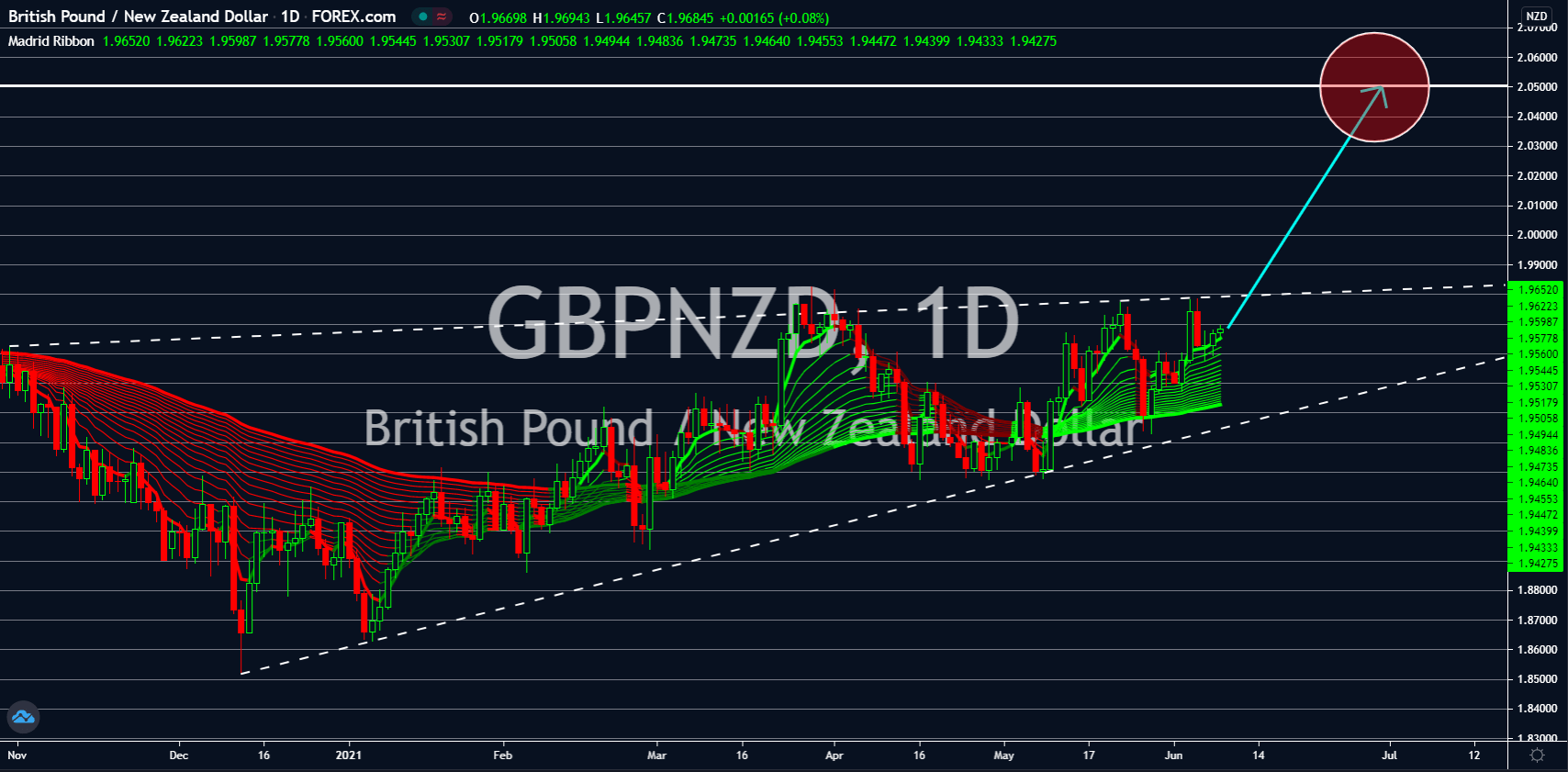

GBPNZD

The Bank of England (BOE) signalled a possible end of stimulus for Britons and UK firms as the economy edged towards the pre-pandemic level. The BOE’s chief economist, Andy Haldane, sees positive data from Britain’s economic reports as a sign that the central bank could stop supporting the UK market. As evidence, a leading recruitment firm in the country recorded a year-over-year (YoY) increase in job postings for the month of May by 237% to 275,000. The number represents a 26% jump from the prior month’s result. The number is expected to rise as more restrictions were eased in the coming weeks. However, due to Brexit, analysts are expecting fewer individuals to fill the roles as free movement pulls out millions of workers from other EU member states. Also, ending the UK government’s stimulus to firms to keep their employees during the pandemic could put 1.3 million Brits out of work. This would bring the unemployment rate higher to 5.5%.

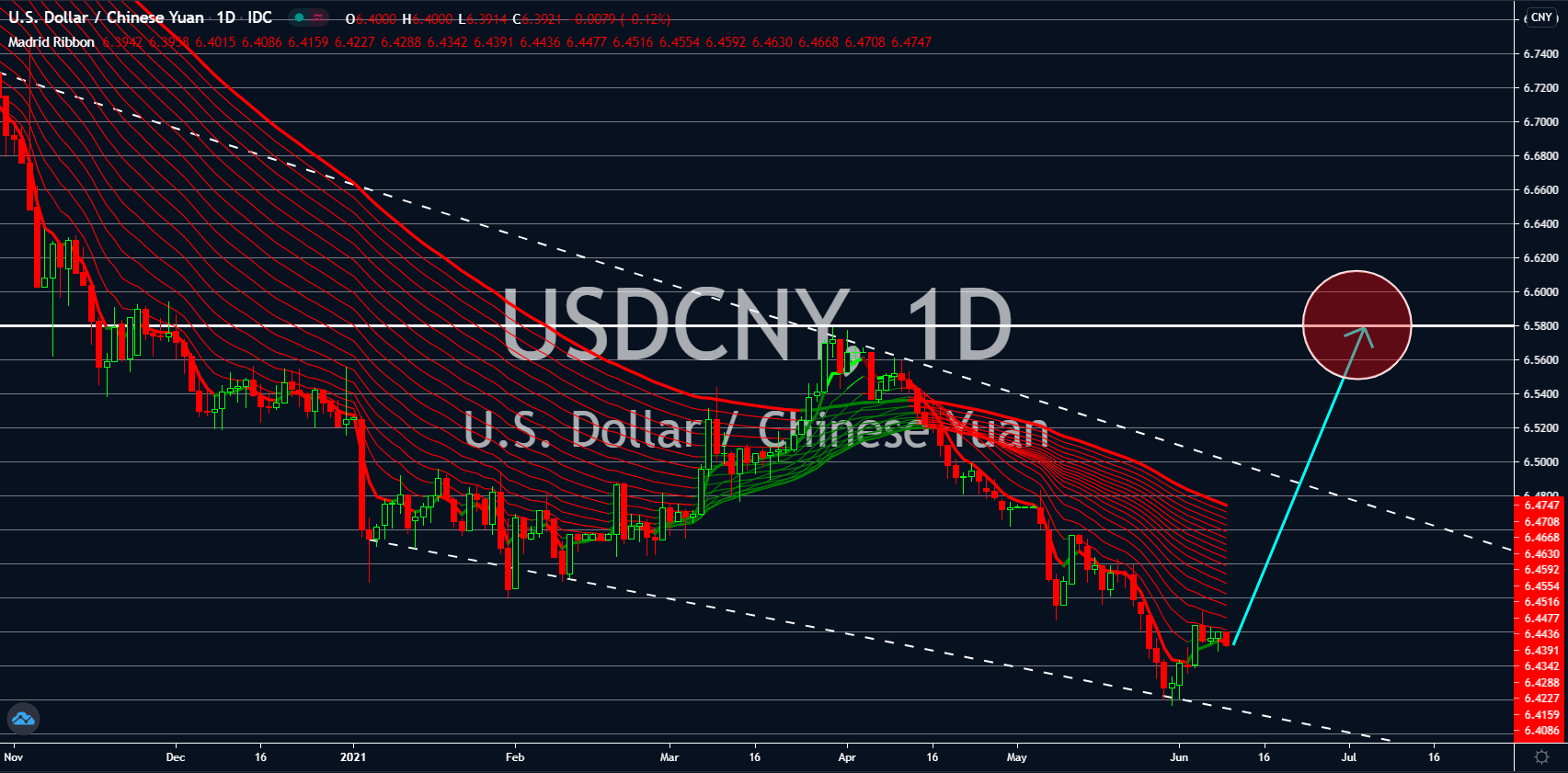

USDCNY

The National People’s Congress (NPC) along with the People’s Bank of China (PBOC) announced in May a tighter price regulation in China. The soaring commodity prices are putting pressure on the country’s central bank to raise rates, which will make the yuan less competitive against other currencies. As a result, trade data from May fell short of analysts estimates. Trade surplus posted 45.53 billion, up from April’s 42.86 billion but below the 50.50 billion forecasts. Imports also advanced by 51.1% compared to May 2020. However, exports data slowed down at a 27.9% pace. On the other hand, the US trade deficit showed a smaller figure at -68.90 billion from -75.00 billion prior. This was due to a slowdown in imports from its largest trading partner, China. Meanwhile, the consumer price index in Beijing shrinks following the price control by Chinese authorities. On a year-over-year basis, the CPI was up 1.3%, which is lower than the anticipated 1.6% result.