Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

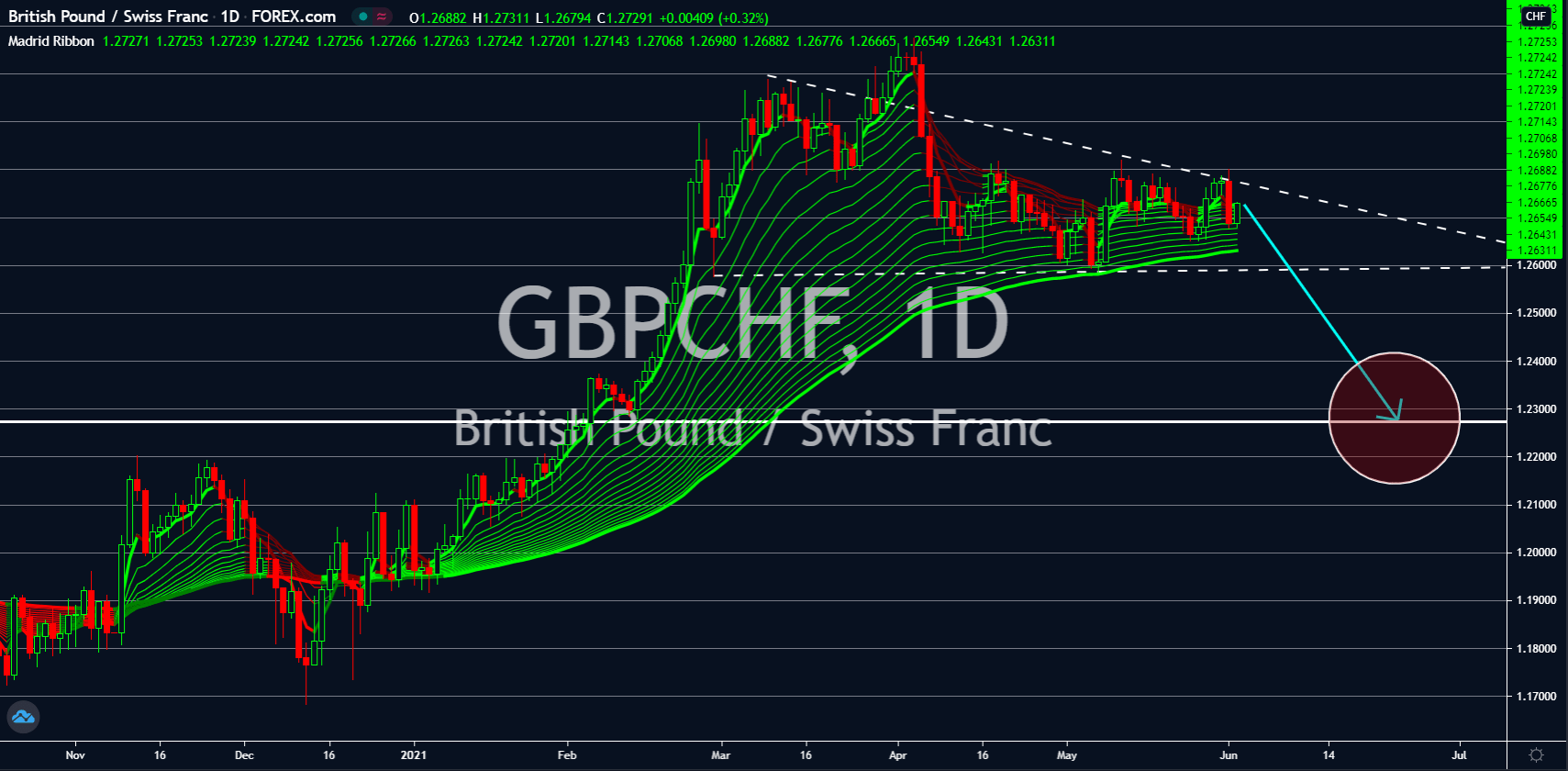

AUDCHF

Demand for the Australian dollar will continue to shrink amid the upbeat economic data from Australia. The country’s gross domestic product (GDP) QoQ expanded by 1.8% in the first three (3) months of fiscal 2021. While the number suggests a slowdown in economic growth, Canberra managed to beat consensus estimates of 1.5%. The annualized figure also advanced by 1.1%, which suggest that Australia managed to recover from the 2020 slump. Meanwhile, consumption during the first quarter as part of the GDP grew by 0.7% and capital expenditure was up by 4.7%. In other news, the Reserve Bank of Australia (RBA) defied pressures from market participants to raise rates from a record low of 0.10%. This was due to the continued increase in house prices, which could lead to a bubble. Furthermore, the central bank said it will continue to support the economy with the prolonged economic stimulus until July 2021.

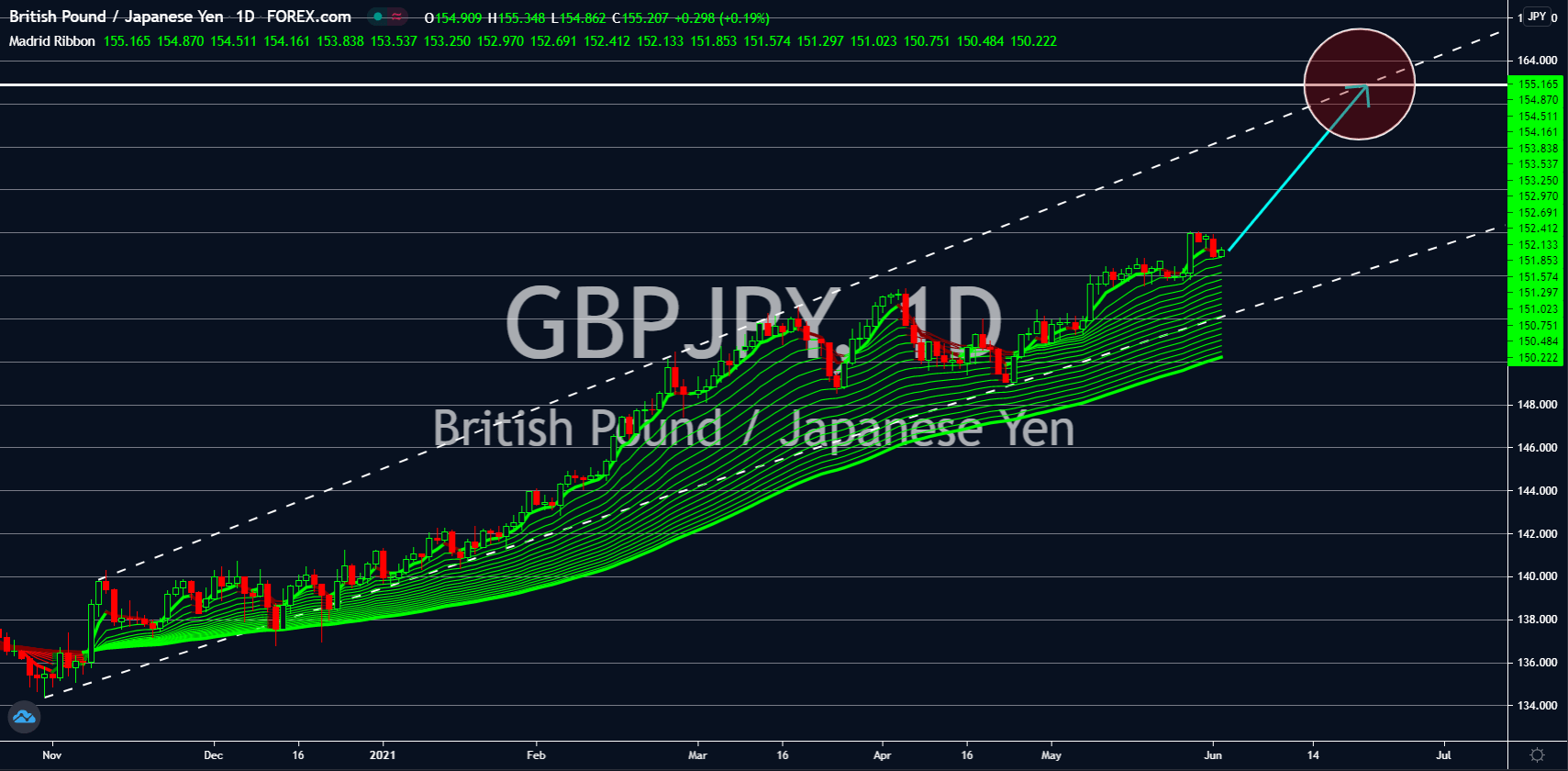

GBPJPY

Japanese businesses refused to spend money in the first quarter of the year to expand their operations. This was due to the uncertainty brought by the coronavirus pandemic. In January 2021, Tokyo declared a state of emergency as the country entered the third wave of COVID-19. The Q1 Capital Spending report came at -7.8%, which ended two (2) consecutive quarterly improvements at the second half of 2020. Analysts expect the Q2 to have steeper a decline as the daily coronavirus cases hit an all-time high record of 7,914 individuals on April 29. In relation to this, construction orders at the peak of the fourth wave have slowed down to 3.3% from March’s 12.5% increase. Investors are also expected to distance themselves from assets related to the Japanese economy as anxiety over the upcoming Tokyo Olympics in July pushes market participants to the other markets. Analysts expect GBPJPY to soar towards 163.000.

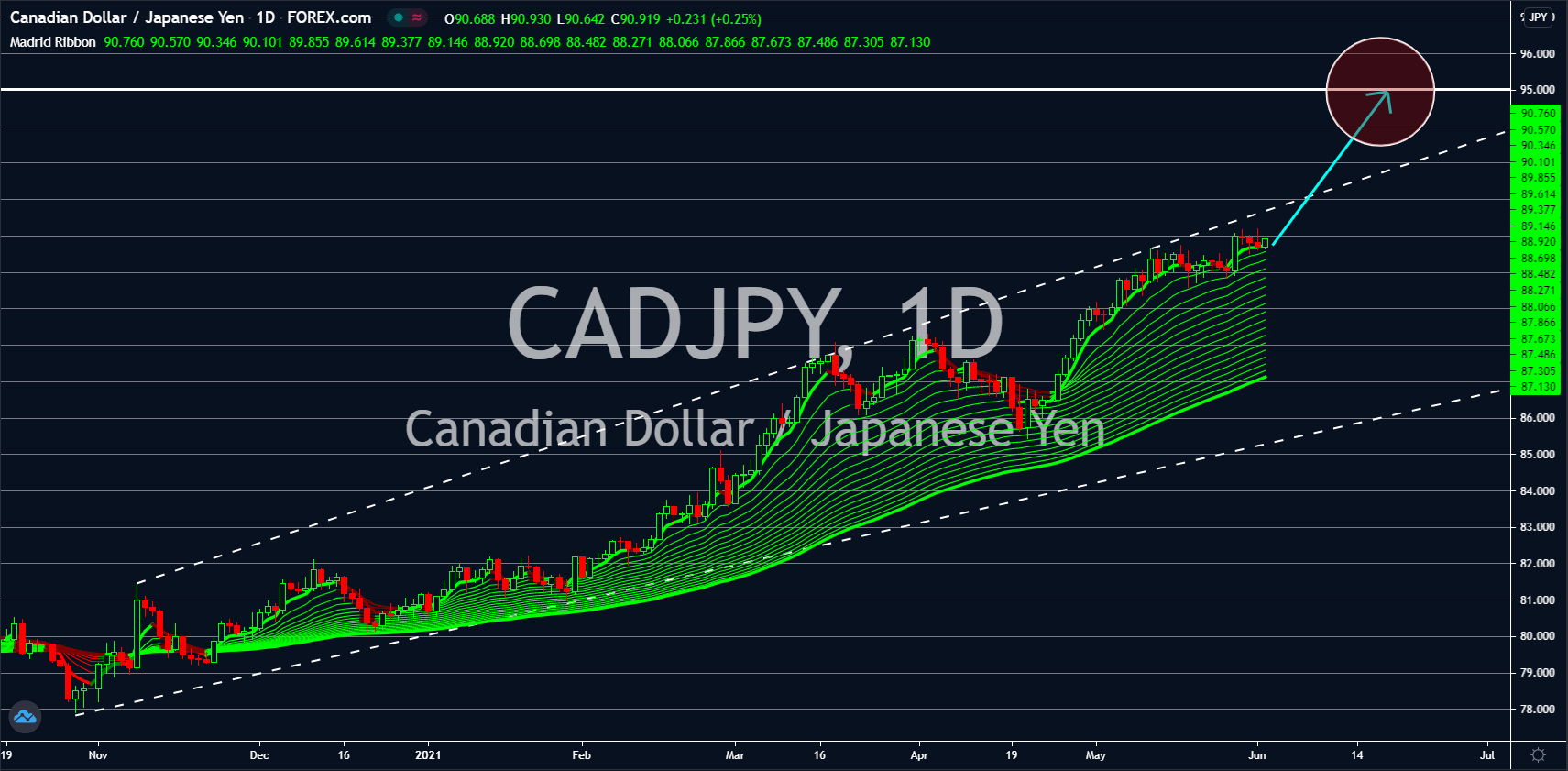

CADJPY

Canada’s economy continues to expand with the March 2021 figure advancing by 1.1% against 1.0% estimate. However, the GDP for Q1 showed a slowing recovery from the coronavirus pandemic with 1.4% growth. In the fourth and final quarter of fiscal 2020, the gross domestic product figure was up 2.2%. Also, the annualized QoQ result differs from the direction of the year-over-year (YoY) data. The former recorded 5.6% expansion, which was lower than 6.7% readings and 9.3% prior result. Meanwhile, the latter jumped by 6.60% after contracting -3.23% in Q4. The mixed signals from the GDP reports will push the Canadian dollar higher against the Japanese yen. As for Canada’s stock market, the TSX index breached the 20,000.00 level for the first time and hit an intraday high of 20,022.13 on Monday, June 01. However, the bears took control of the index at the closing session after TSX dropped by 1.2% in the day.

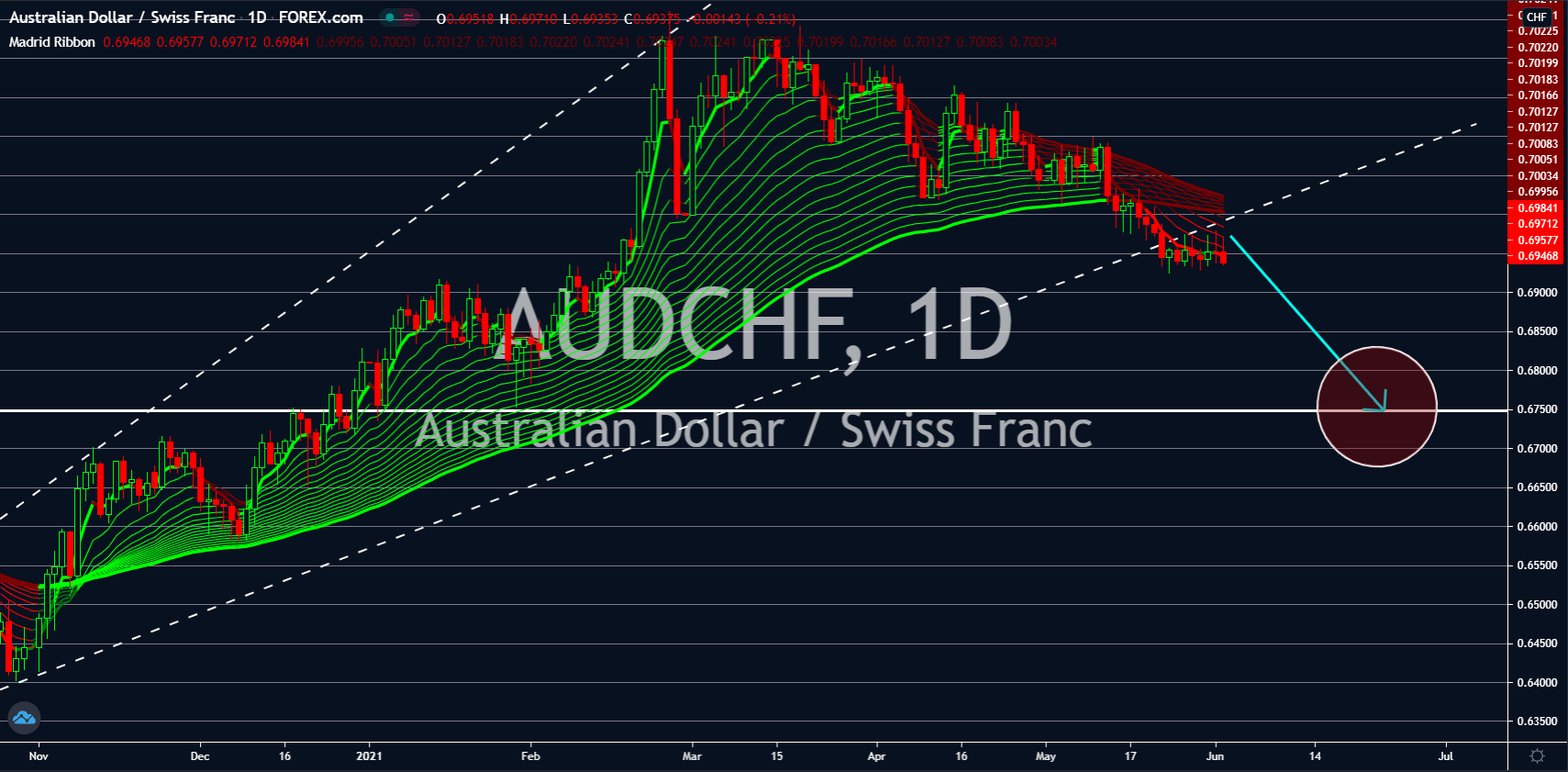

GBPCHF

Demand for the Australian dollar will continue to shrink amid the upbeat economic data from Australia. The country’s gross domestic product (GDP) QoQ expanded by 1.8% in the first three (3) months of fiscal 2021. While the number suggests a slowdown in economic growth, Canberra managed to beat consensus estimates of 1.5%. The annualized figure also advanced by 1.1%, which suggests that Australia managed to recover from the 2020 slump. Meanwhile, consumption during the first quarter as part of the GDP grew by 0.7% and capital expenditure was up by 4.7%. In other news, the Reserve Bank of Australia (RBA) defied pressures from market participants to raise rates from a record low of 0.10%. This was due to the continued increase in house prices, which could lead to a bubble. Furthermore, the central bank said it will continue to support the economy with the prolonged economic stimulus until July 2021.