Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

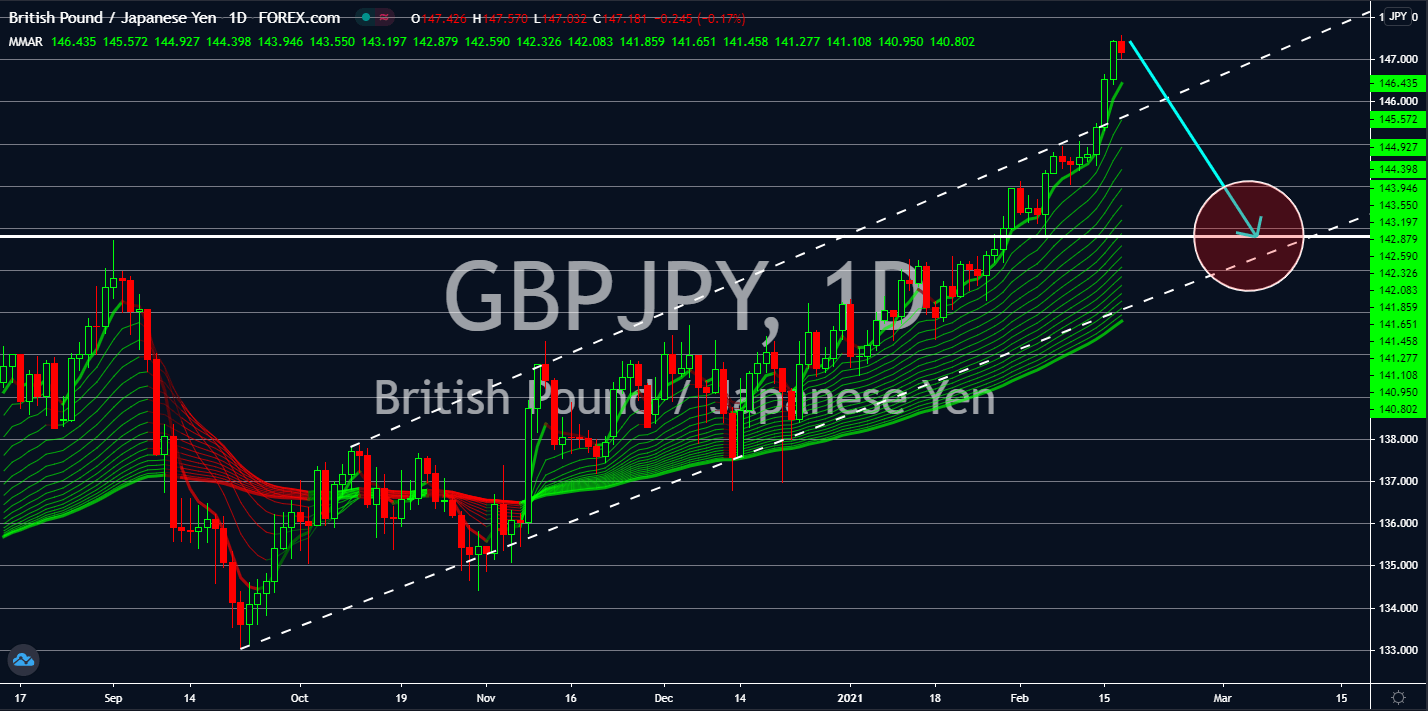

AUDUSD

The worse-than-expected initial jobless claims last week of 793,000 highlights the need for immediate economic support from the US government. As a result, House Speaker Nancy Pelosi promised to get the deal done as early as late February from the initial March target. The $1.9 trillion stimulus proposal has been pushing the US indices to record highs. Analysts are now expecting the number of individuals filing for their unemployment benefit to decline to 765,000 on the upcoming Thursday’s data. Meanwhile, consumption is ticking up. US retail sales in January is expected to post their first positive data of 1.1% for the past four (4) months on Wednesday’s report, February 17. Investors and traders of the AUDUSD pair should also keep an eye on the purchasing managers index reports at the end of the week. Manufacturing PMI forecast is 58.5 points while Services PMI joined the above 50.0 projection with 57.6 points expectations.

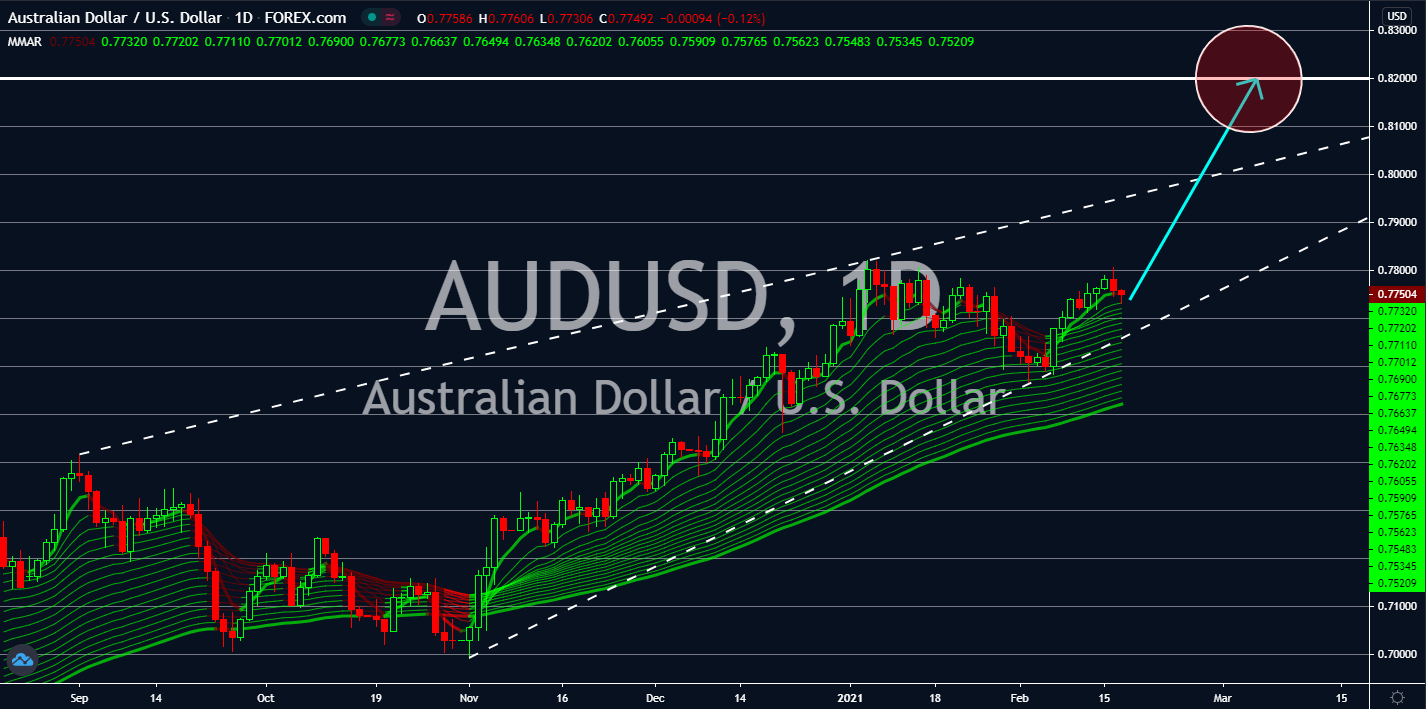

AUDCAD

PM Trudeau’s government is under scrutiny from political opposition and the IMF with its stimulus package. In December 2020, the federal government unveiled its largest economic relief program since World War 2 of $77 billion. However, critics of the aid argued the vague spending plan will become detrimental to the Canadian economy. The CA $100 billion aid represents 3% of the country’s GDP. Failing to provide justification with the stimulus will weaken investor’s confidence in the North American economy. Meanwhile, the International Monetary Fund wants an explanation for the said amount. Despite this, the IMF praised the well-coordinated financial response by Canada. In addition to this, the members of the parliament have approved to create a special committee for US-Canada trade relations, which could boost the two (2) countries’ post-pandemic recovery. The pair will reverse once PM Trudeau is able to clarify these concerns.

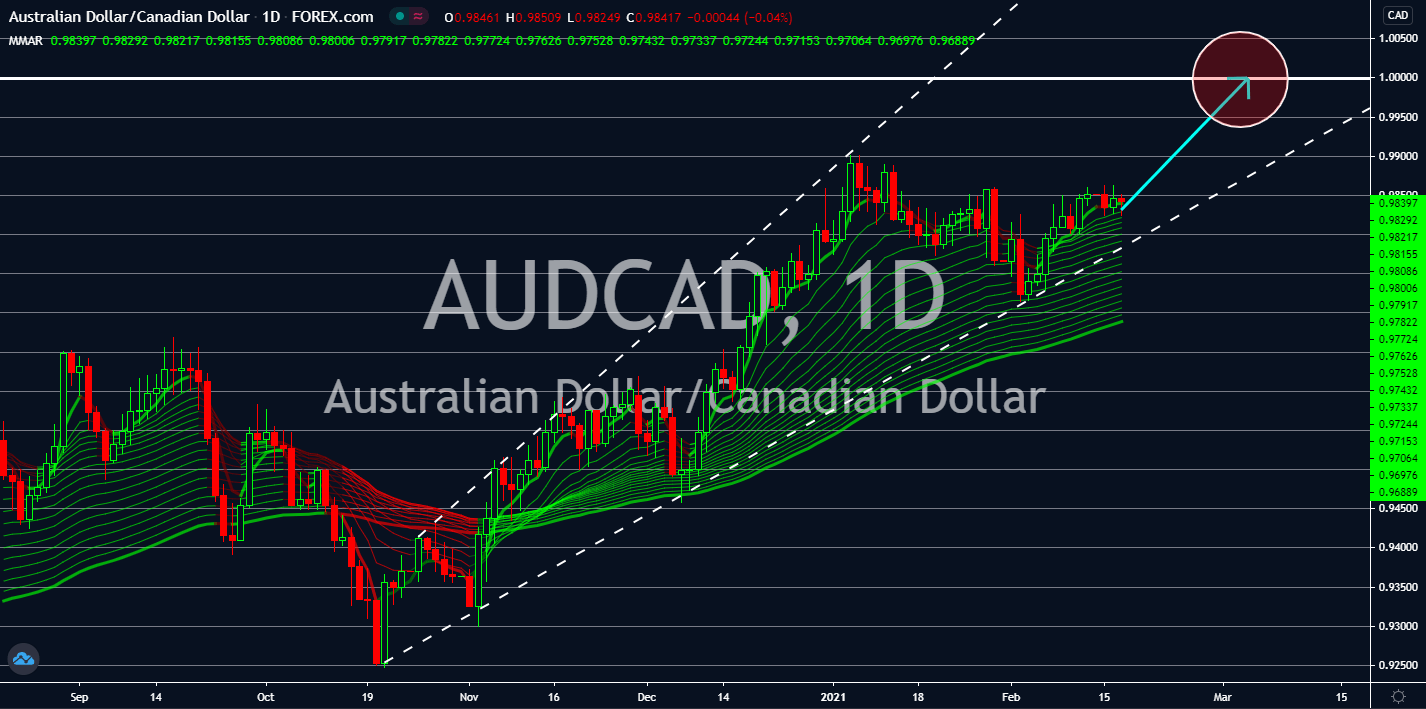

AUDCHF

Analysts are anticipating a double-dip recession in Switzerland. The forecast for the fourth and final quarter of 2020 is a -0.7% contraction. Meanwhile, the expectation for the first three (3) months of fiscal 2021 is a 0.6% decline. This was despite the less severe restrictions in the country. In addition to the bleak forecast for Switzerland’s gross domestic product is the rising unemployment rate. In January, the Swiss economy had a decade high of unemployment at 3.7%, which is the highest reported figure since April 2010. This represents 169,753 unemployed individuals. As for Australia, the expectations for January figure on Wednesday’s report is a drop to 6.5% from 6.6% in the previous month. Meanwhile, the employment change report is expected to add 40,000 jobs for the same month. The participation rate is projected to remain at 66.2%. Analysts expect more positive data from the Australian economy due to its success in containing the virus.

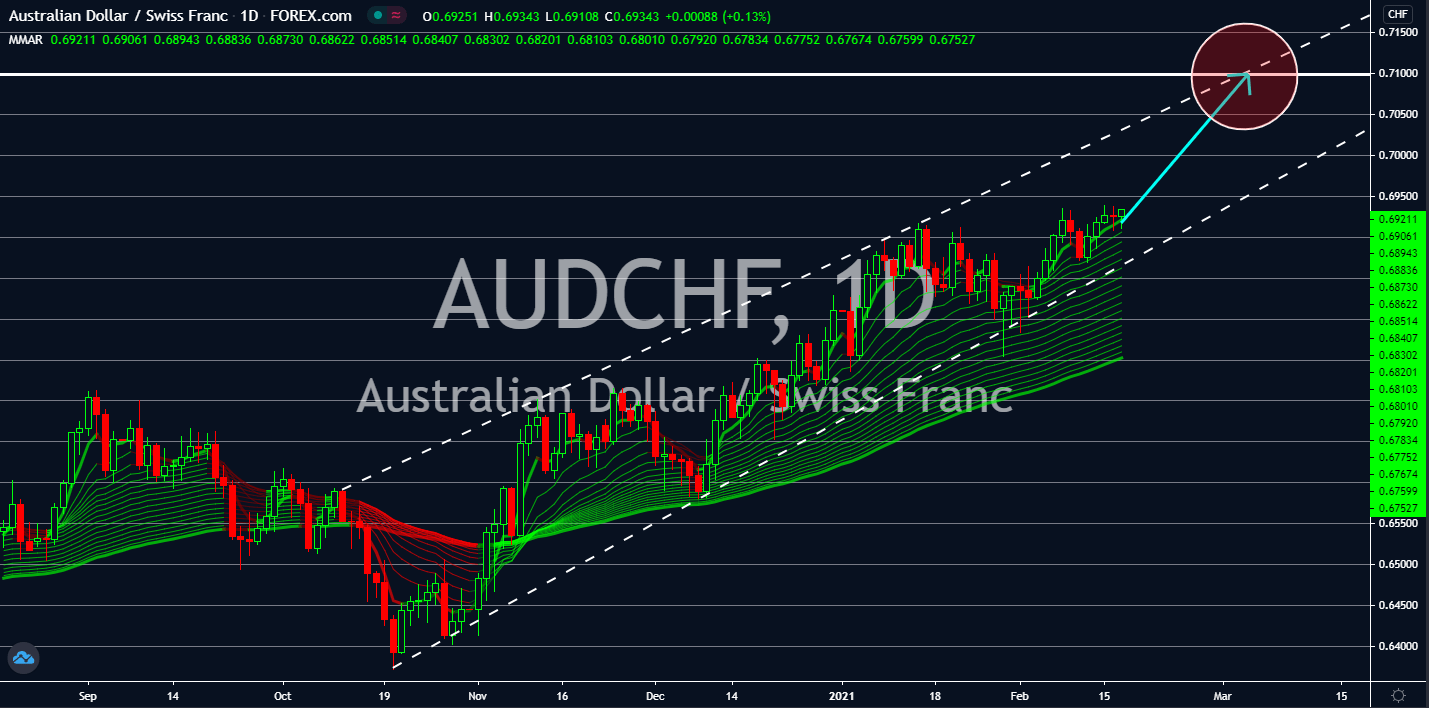

GBPJPY

The UK economy contracted by 9.9% in fiscal 2020, more than Japan’s GDP decline of 4.8% for the same annual year. This data justified the impressive performance of the British pound, which became an investor’s store of value during the heights of the pandemic. However, the news that Britain reached its 1.5 million vaccine jabs until February 15 is leading to investors abandoning the sterling. On Sunday, PM Boris Johnson said that England was able to inoculate the top four (4) vaccine priority groups. This came a day after Wales reached its vaccination target. Currently, almost 30% of British citizens received at least 1 dose of the COVID-19 vaccine. The country’s vaccine minister is looking at the first and second week of March to vaccinate the entire population with almost 1 million daily vaccine targets. This, in turn, will push investors away from the safe-haven of GBP towards riskier and rewarding equities ahead of the economic re-opening.