Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

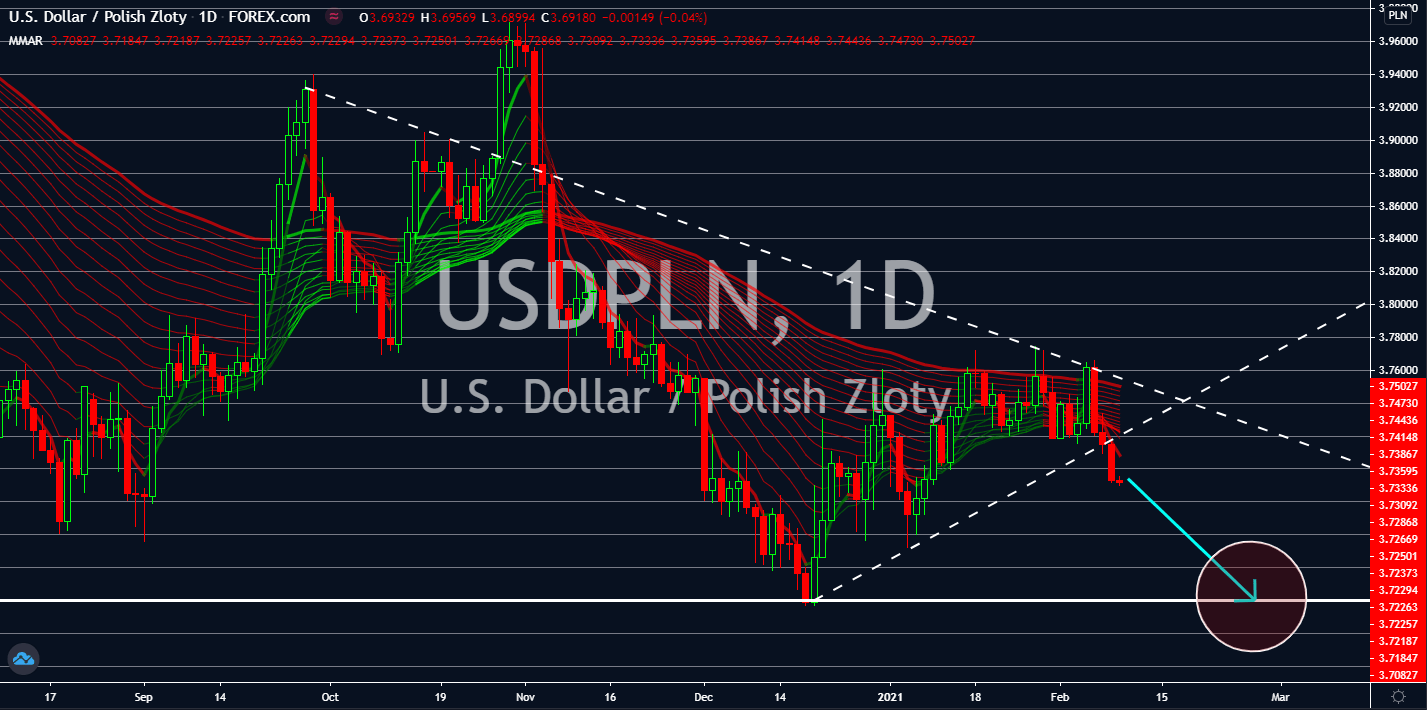

USDHUF

Projections for Hungary’s economic growth for fiscal 2021 varied depending on the government official. On January 20, Marton Nagy, who serves as Prime Minister Viktor Orban’s senior economic aide, forecasts a 5.0% to 6.0% growth for the current year. Meanwhile, Finance Minister Mihály Varga gave a modest projection at 4.0% to 5.0%. However, the majority of the finance executive respondents in a recent poll suggests that Budapest will only advance by 1.5% on its annual GDP growth. The contradictory outlook heightens investors’ worries about the current economic situation of Hungary. As for Monday’s reports, on February 08, Hungary had a budget surplus for the month of January at 198.8 billion, the first in nine (9) months. While government savings soared, the trade deficit in December slowed down to 310.0 million. The reported figure was almost three (3) times lower than the previous month’s 836.0 million results.

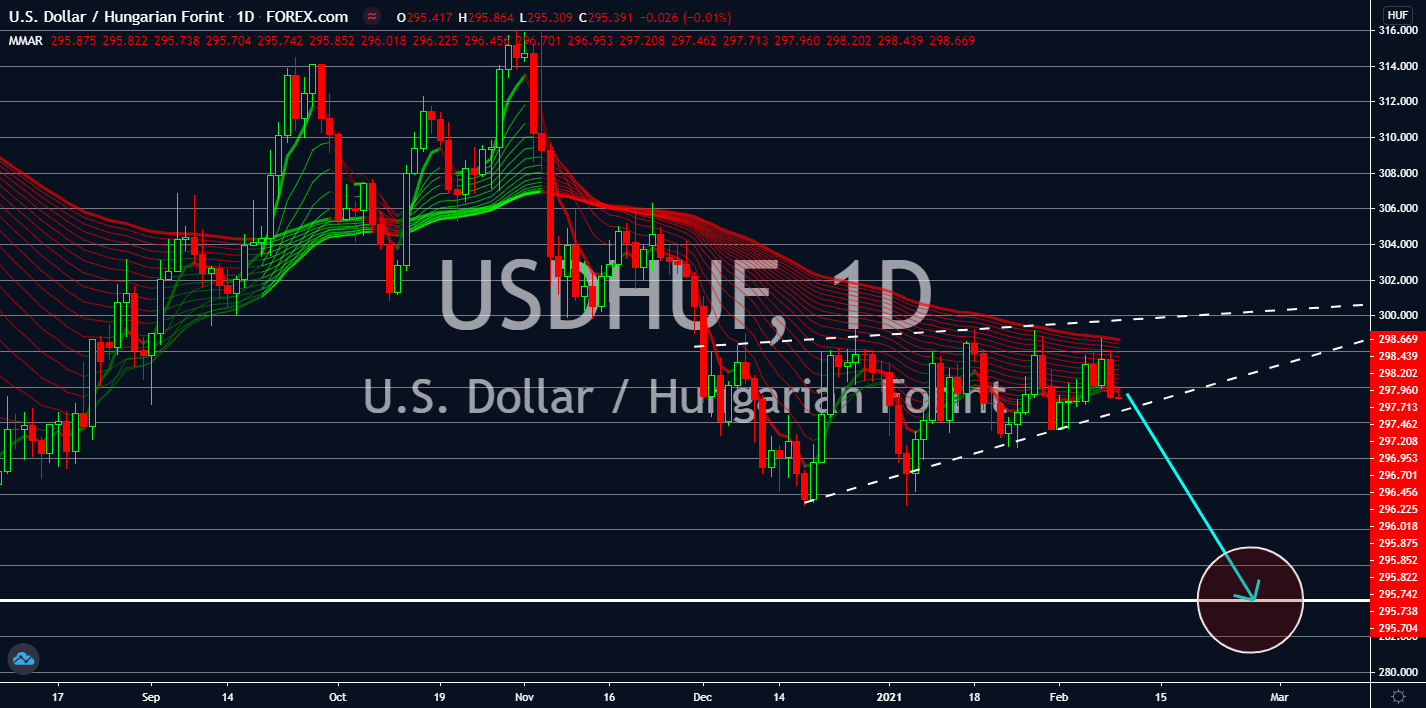

USDMXN

The USDMXN pair will revisit its November’s high of 21.40000 this month. This was amid the possibility that the Mexican central bank will cut its base rate by 25 basis points on the upcoming meeting to 4.00%. Mexico’s economy shrank by 8.8% in 2020, which was the largest economic contraction recorded since the Great Depression of the 1930s.

Meanwhile, President Andrés Manuel López Obrador announced on Wednesday, February 10, that he expects a rebound of 5% in 2021 with a conservative projection of 3.5%. This means that Mexico will take years to rebuild its economy back to the pre-coronavirus level. The continued onslaught of the pandemic could further derail this recovery. Mexico is on the 13th spot in the list of countries with the highest COVID-19 cases. The total number of infections stood at 1.94 million. Mexico’s stock index has been soaring, which makes the peso an unlikely investment option for traders and investors.

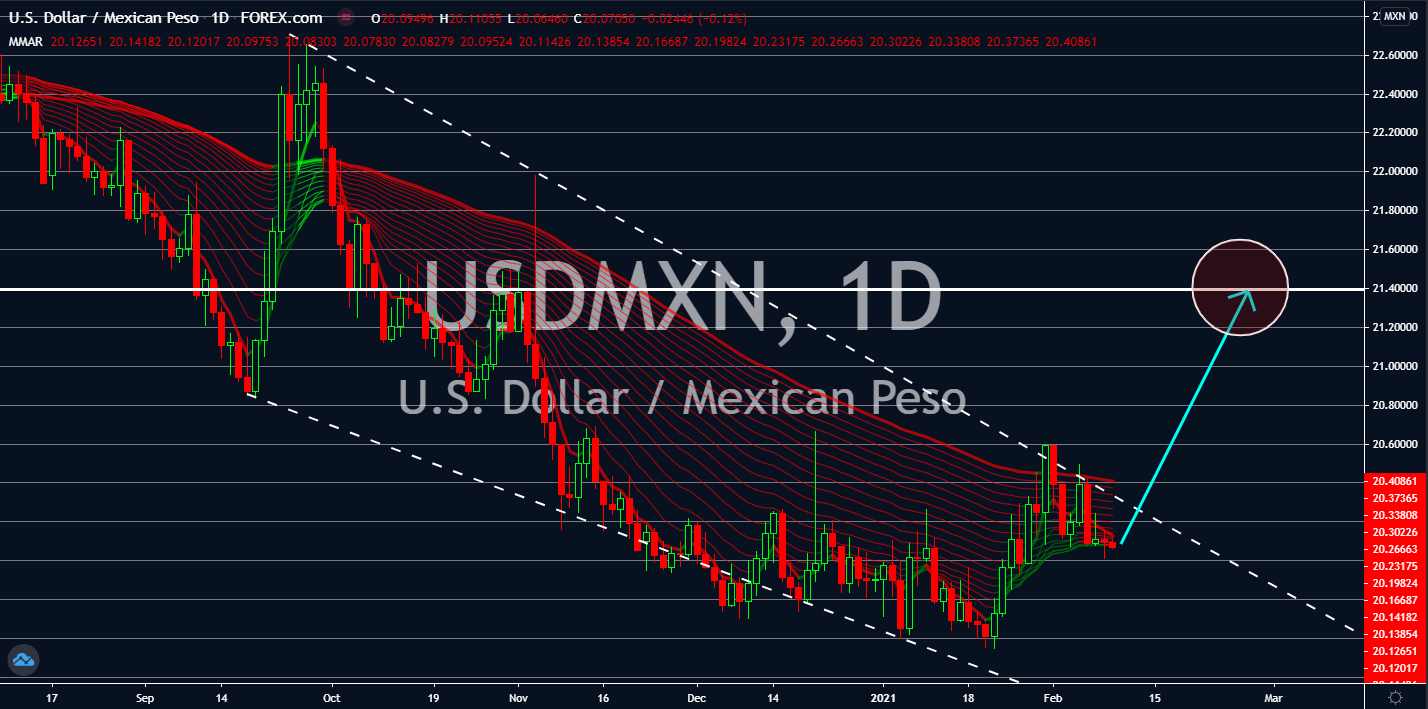

USDNOK

The US dollar will continue to fall against its Norwegian counterpart in coming sessions. The American Petroleum Institute published a -3.500 million result for the Weekly Crude Oil Stock report on Tuesday, February 09. This figure was higher compared to API’s -4.261 million result last week. Meanwhile, projections for the Energy Information Administration’s report on Wednesday is an inventory build-up of 0.985 million. The mixed forecast for the consumer price index (CPI) reports will not also help to reverse the current trend of the greenback. January’s CPI is anticipated to jump by 0.3%, which is slower than the 0.4% growth in the month prior. On an annual basis, the expectation is 1.5%.

Investors might also continue to digest the recent approval of the US Senate in the proposed $1.96 trillion stimulus this week. This means that prices will continue to fall unless negative data from Norway or upbeat reports from the US were published.

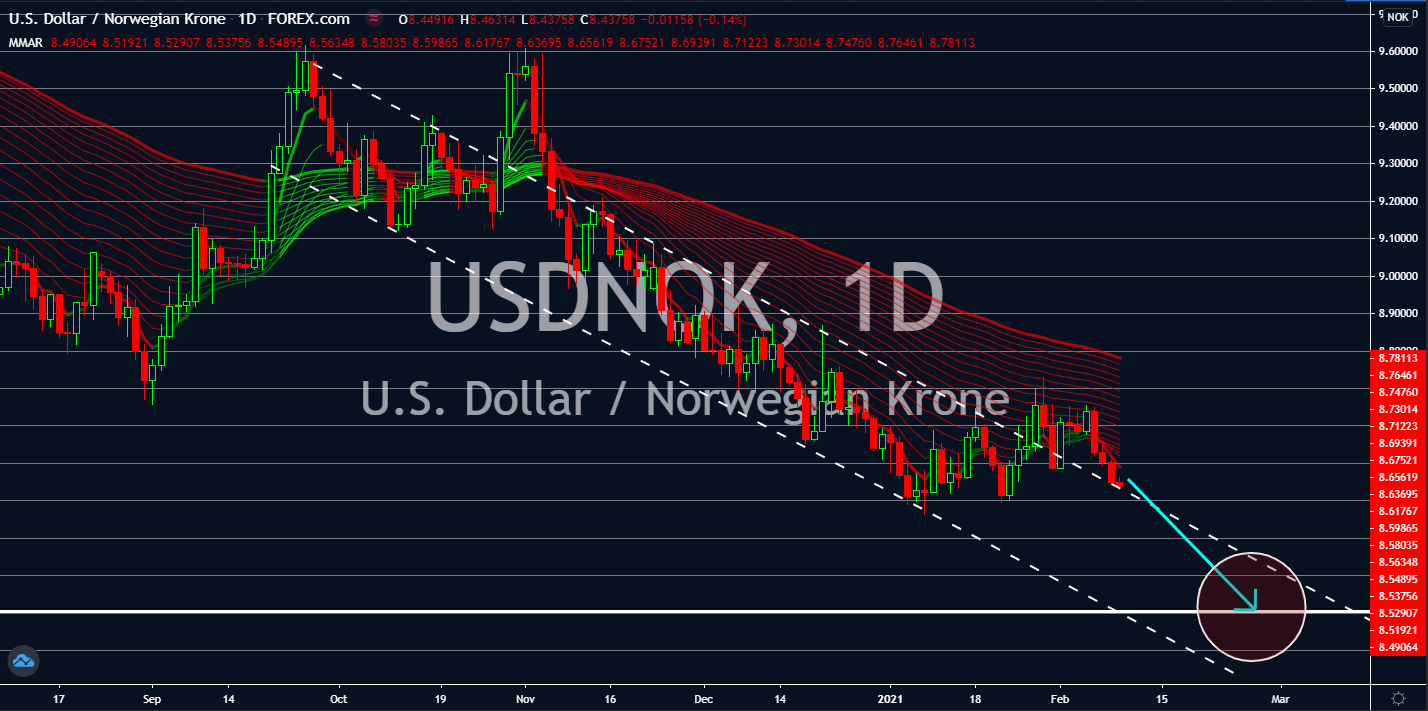

USDPLN

The International Monetary Fund provided a new report for the 2021 GDP forecast. The financial institution said that Poland would experience a robust recovery for the current year. Projections for the GDP growth was 2.7%, which is better given that contraction in 2020 only showed a 3.4% result. The IMF added that Warsaw would fully recover from the pandemic-induced economic slowdown in 2022, where it is likely to grow by 5.1%. Meanwhile, economic growth is expected to advance by 3.25% on average for 2023-25.

In other news, the Polish labor market remains strong with 5.0% wage growth YoY. The stalled cooperation between China and the CEEC (Central and Eastern European Country) is also favorable to Poland. The Germano-Franco alliance has called out the V4 nations numerous times with their increased ties with Russia and China. The EU Commission threatens to reduce funding of countries that are violating the EU’s rule of law.