Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

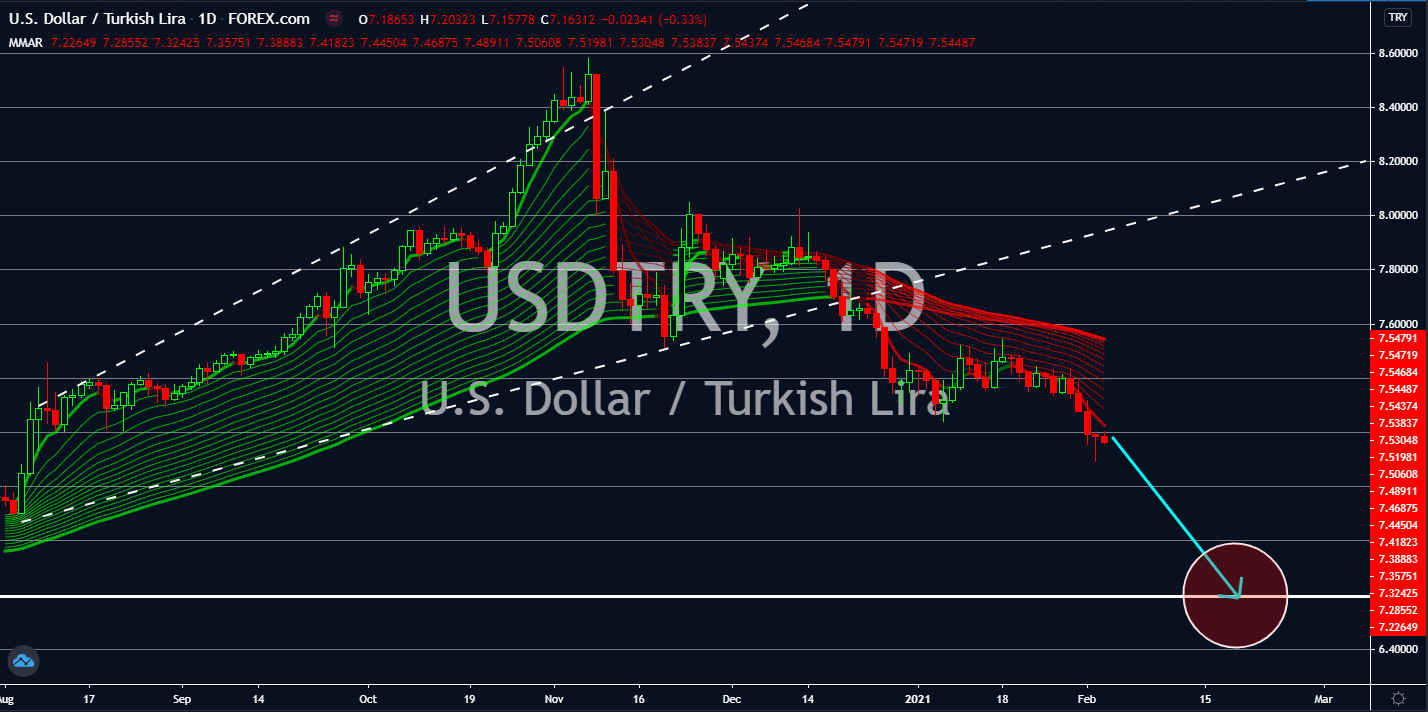

USDHKD

Hong Kong’s retail sales report for the month of December plunged on Tuesday’s report, February 02. The figure came in at -13.2%, which is three (3) times bigger than the prior months -4.0% result. At the same time, the reported number ended nine (9) months of better-than-expected results following March’s decline of -44.0%. The report suggests the growing pessimism of consumers amid the new coronavirus strain. Meanwhile, the special administrative region (SAR) posted 47.8 points for its Manufacturing PMI for January. Despite this, the figure is still below the 50.0 points benchmark, which means that the manufacturing sector continues to contract. In the past weeks, reports showed Hong Kong hitting its 16-year high for the quarterly unemployment rate at 6.6% for the period of October to December. The same data was seen back in 2004. Overall, the SAR’s gross domestic product (GDP) annual growth shrank by -6.1% in 2020, the steepest record.

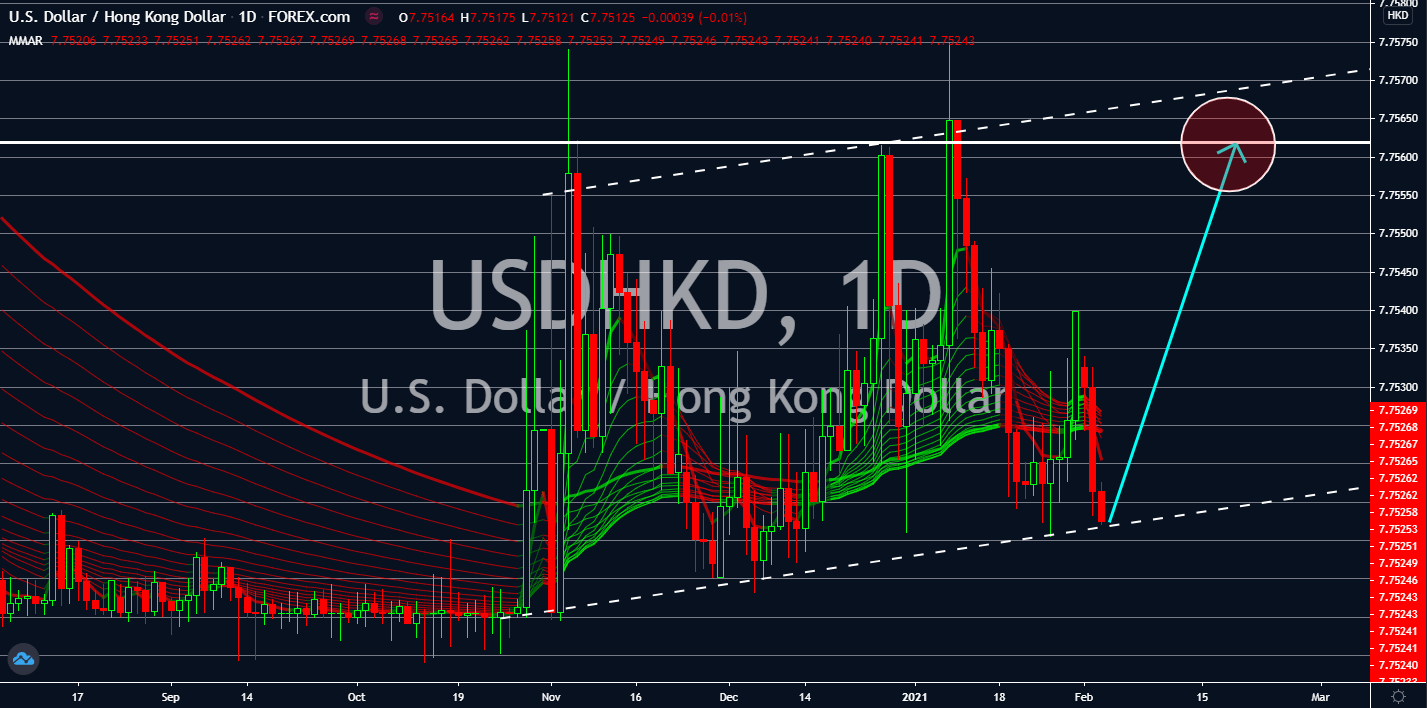

USDSGD

The short sellers will drag the USDSGD pair lower towards the 1.31500 support area. The bearish sentiment on the pair was due to the upbeat performance of Singapore’s Manufacturing PMI on Tuesday’s report, February 02. The city-state posted 50.7 points for January’s result, which was the highest since April 2019. Meanwhile, analysts have weak readings for the upcoming US reports. The Institute of Supply Management (ISM) Non-Manufacturing Business Activity in January is expected to decline to 57.3 points on Wednesday, February 03. For the previous month, the reported figure was 60.5 points. Meanwhile, the ISM Non-Manufacturing PMI has 56.8 points forecast from analysts, which is also lower than its prior month’s record of 57.7 points. Also, for the weekly Crude Oil Inventories report, analysts are looking at 0.446 million barrels built up in reserves last week following the impressive third week of January at -9.910 million barrels.

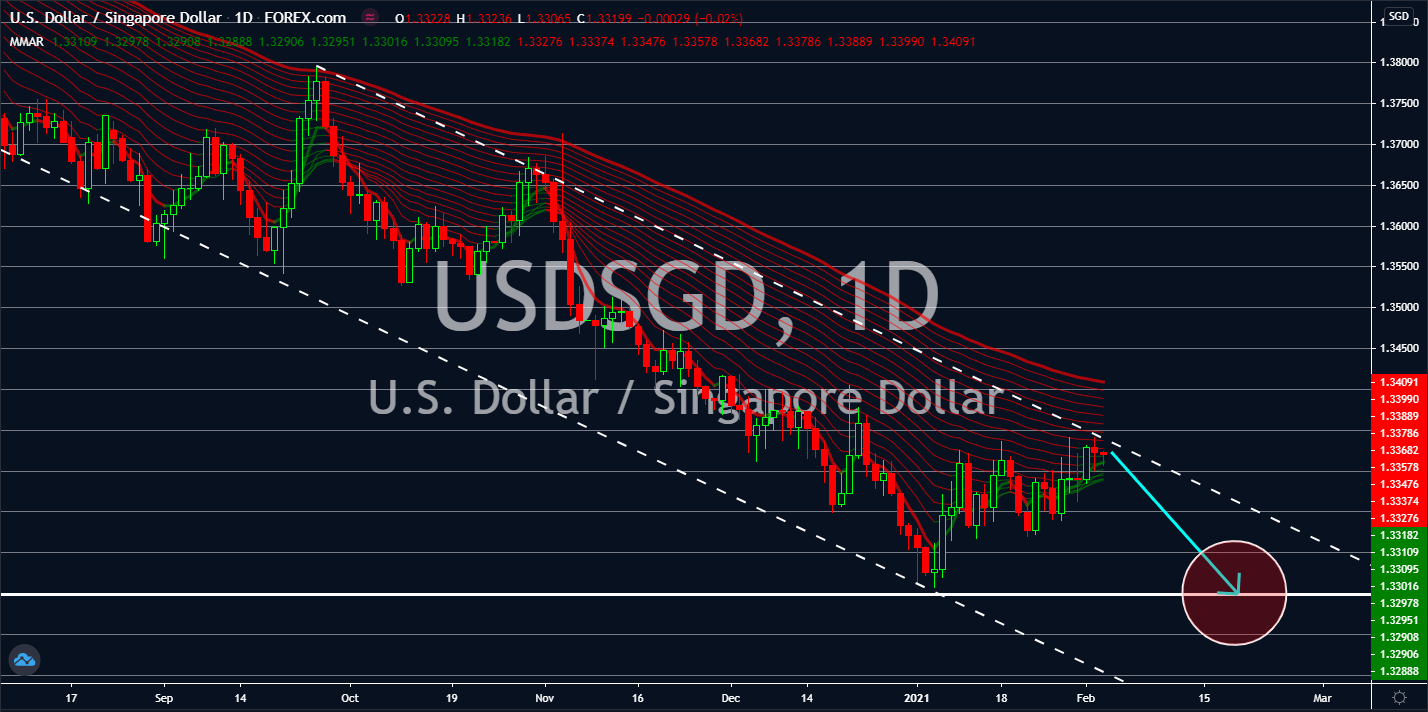

EURDKK

The EU and its member states are set to publish their Composite and Services PMI report on Wednesday, February 03. The majority of the readings were the same as the previously recorded data. The EU’s Markit Composite and Services PMI are expected to post 47.5 points and 45.0 points, respectively. As for the EU’s economic powerhouses, Germany and France, the forecasts were 50.8 points and 47.0 points for the Markit Composite while the expectations for the services sector were 46.8 points and 46.5 points, respectively. Although most figures were below the 50.0 points benchmark, analysts are expecting a positive actual result. On the recently published Manufacturing PMIs on Monday, February 01, market participants were struck with better-than-expected results. Hence, analysts are anticipating the same optimistic data for the remaining PMI results on Wednesday. Prices are then expected to reach its 2021 high in coming sessions.

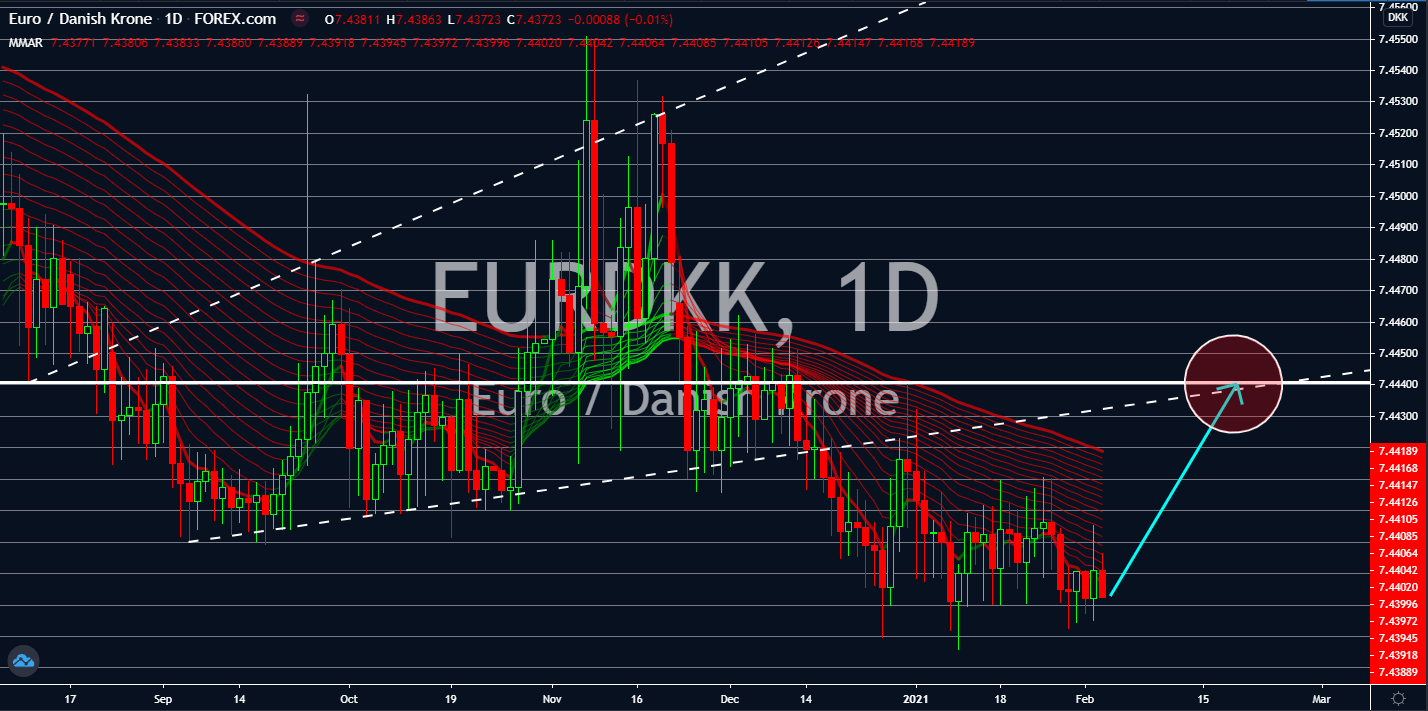

USDTRY

Turkey had impressive results from its recently published reports this week. The Manufacturing PMI rose by 54.40 points against the 50.80 points result in December. The reported number is also the highest for the past six (6) months. Meanwhile, the consumer price index (CPI) was up by 1.68% on Wednesday, February 03. This figure was higher than the 1.25% record prior and 1.40% expectations. On an annual basis, this translates to a 14.97% jump. As for the trade exports, Turkey reached its highest monthly figure in the record at $15 billion in January, a 2.5% when compared to the previous year. On the other hand, imports were down by 5.6% to $18.1 billion. The high export and low import data are positive for the lira as importers of Turkish products pay using the American dollar, which, in turn, will boost the Turkish government’s fiscal position. The export-to-import ratio currently stood at 6.5% for the month of January from December’s increase of 83%.