Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

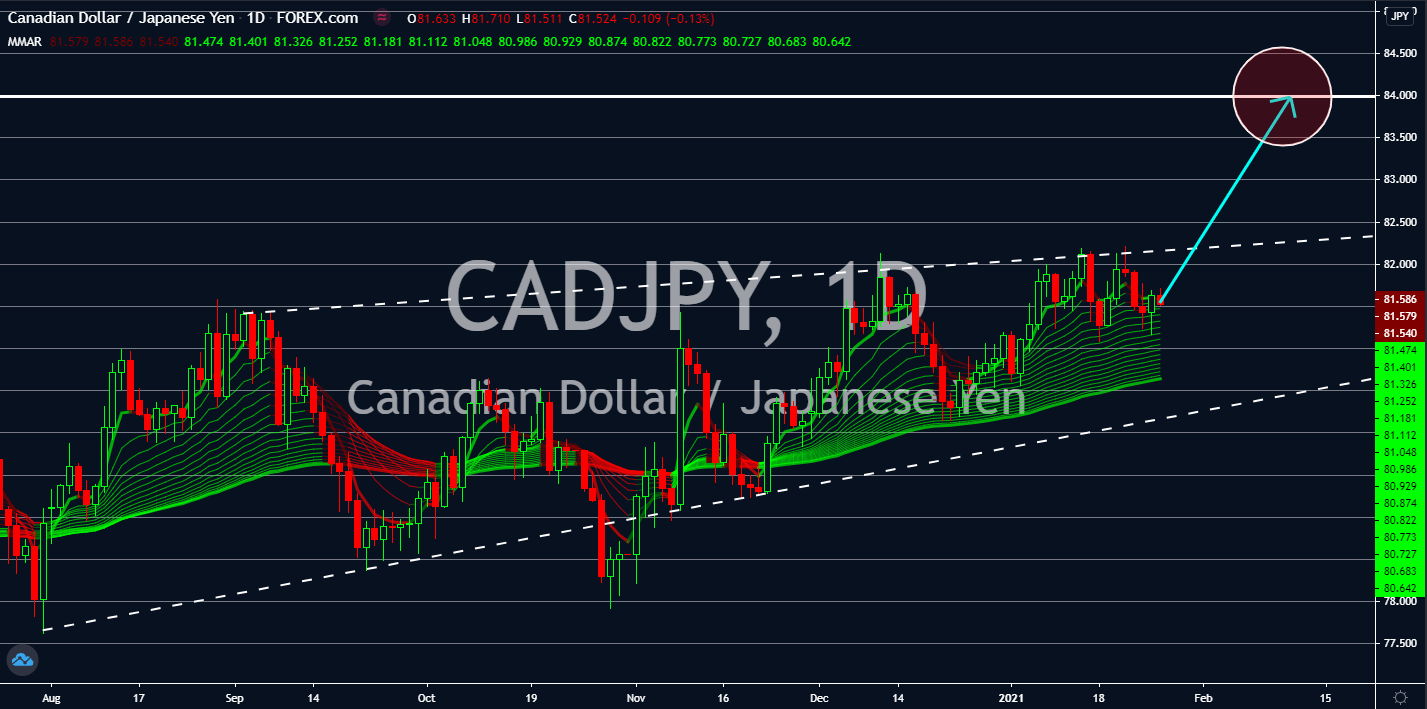

AUDCAD

The International Monetary Fund (IMF) cut Canada’s economic growth forecast for fiscal 2021 by a huge margin. Expectations were now at 3.6% against 5.2% prior projection. Meanwhile, the financial institution upgraded its global economic outlook to 5.5% from 5.2% in October amid vaccine optimism. The IMF didn’t outline any specific reason for the downgrade in Canada’s GDP growth. On Wednesday last week, January 20, Bank of Canada (BOC) Governor Tiff Macklem already warned investors of a possible contraction in the first quarter of 2021 amid the resurgence of coronavirus. But the central bank chief reassured investors that the BOC has enough ammunition to counter any downturn in the Canadian economy. As for the government, Finance Minister Chrystia Freeland announced that Ottawa is now in talks with stakeholders for the 2021 budget. Analysts are expecting a new stimulus, which will add pressure to the Canadian dollar.

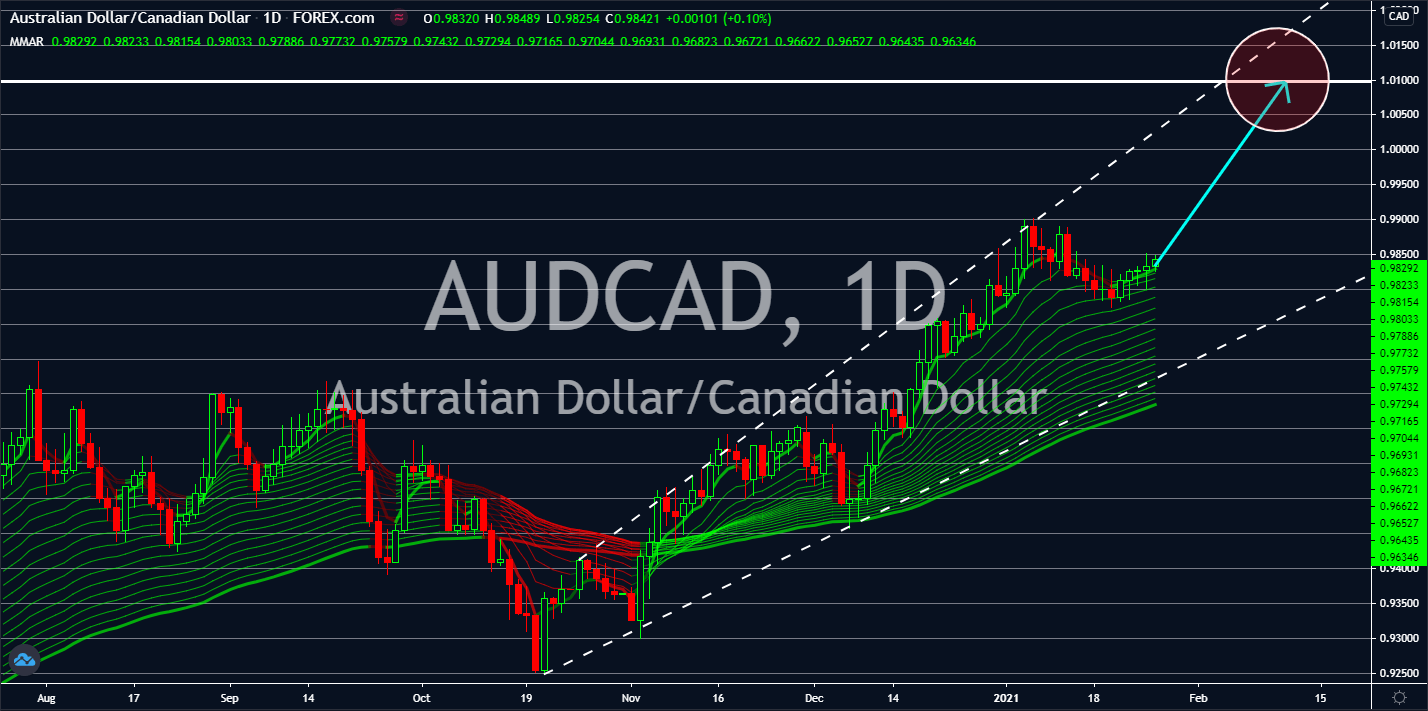

AUDCHF

The Indo-Pacific region is emerging from the COVID-19 pandemic, which prompted the IMF to upgrade economies in the region. The International Monetary Fund’s report on Wednesday, January 27, is now expecting Australia to grow by 3.5% in fiscal 2021. This was a major revision from October’s 0.5% GDP growth forecast. The global financial institution cited Canberra’s strong exports of iron ore and wheat in China amid tensions. Iron exports in December rose to 40 million tons from 34.44 million tons, a 25% change from November’s report. Meanwhile, wheat exports broke records after the $250 million exports to China in the reported month. In 2020, China is the only major economy to grow at 2.3%. On the other hand, Switzerland’s economy is expected to shrink in Q1 2021 amid strict measures in the European region due to the new strain of COVID-19. The Swiss Economic Development is projecting negative growth for the first quarter.

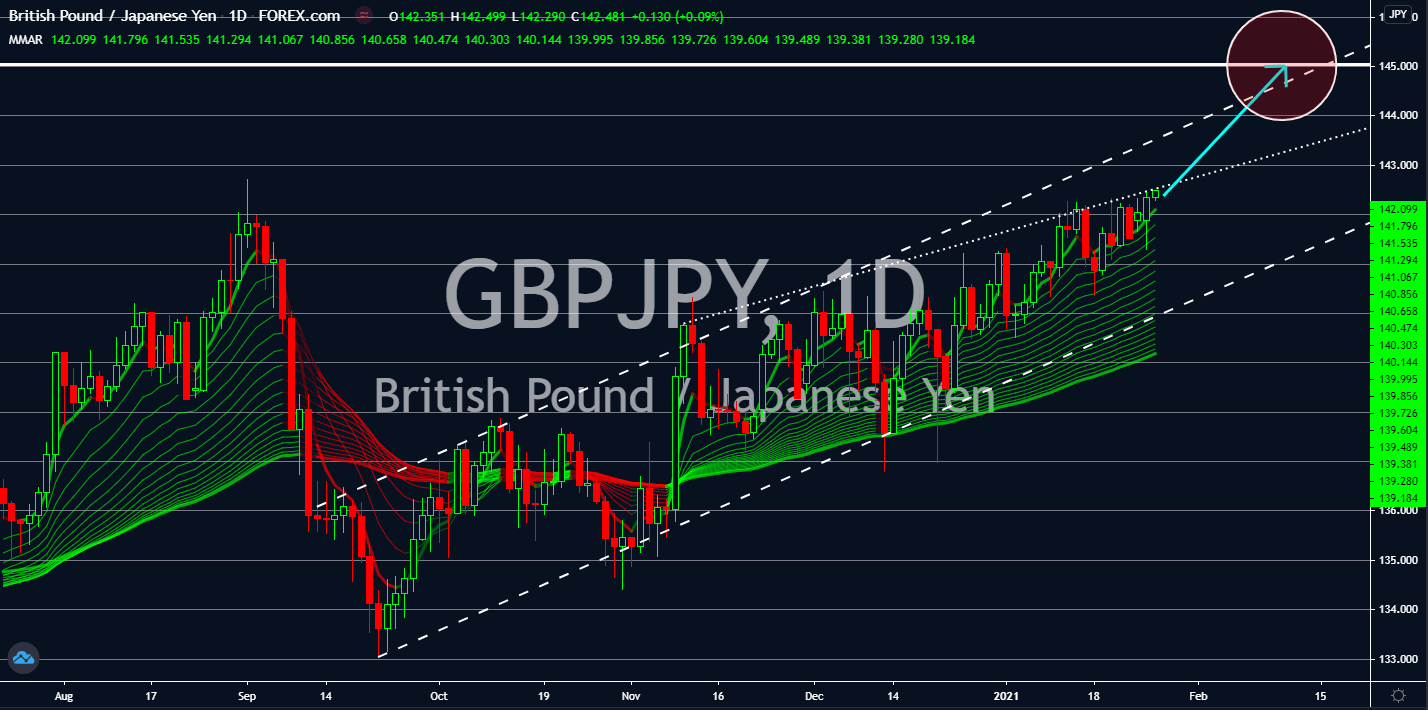

GBPJPY

The Brexit and new COVID-19 strain will hinder the United Kingdom’s recovery. Britain is near to surpass Russia at the fourth spot in the list of countries with the highest coronavirus cases. On Tuesday, January 26, the government added 20,088 new cases, which sent the total cases in the country to 3.69 million. On the other hand, Russia reported lesser daily infections at 17,892. Moscow’s total cases now stood at 3.72 million. The UK is currently in lockdown to contain the virus. This decision has led Bank of England (BOE) Governor Andrew Bailey to silence critics of the central bank. The central bank chief reaffirmed that the interest rate will remain at 0.10% until 2024 despite calls to cut rates to zero percent. The IMF also cuts Britain’s 2021 economic growth from 5.9% to 4.5%. Analysts expect the British economy to recover within two (2) years as economic activity falls to its lowest level since May to 38.8 points for its Services PMI.

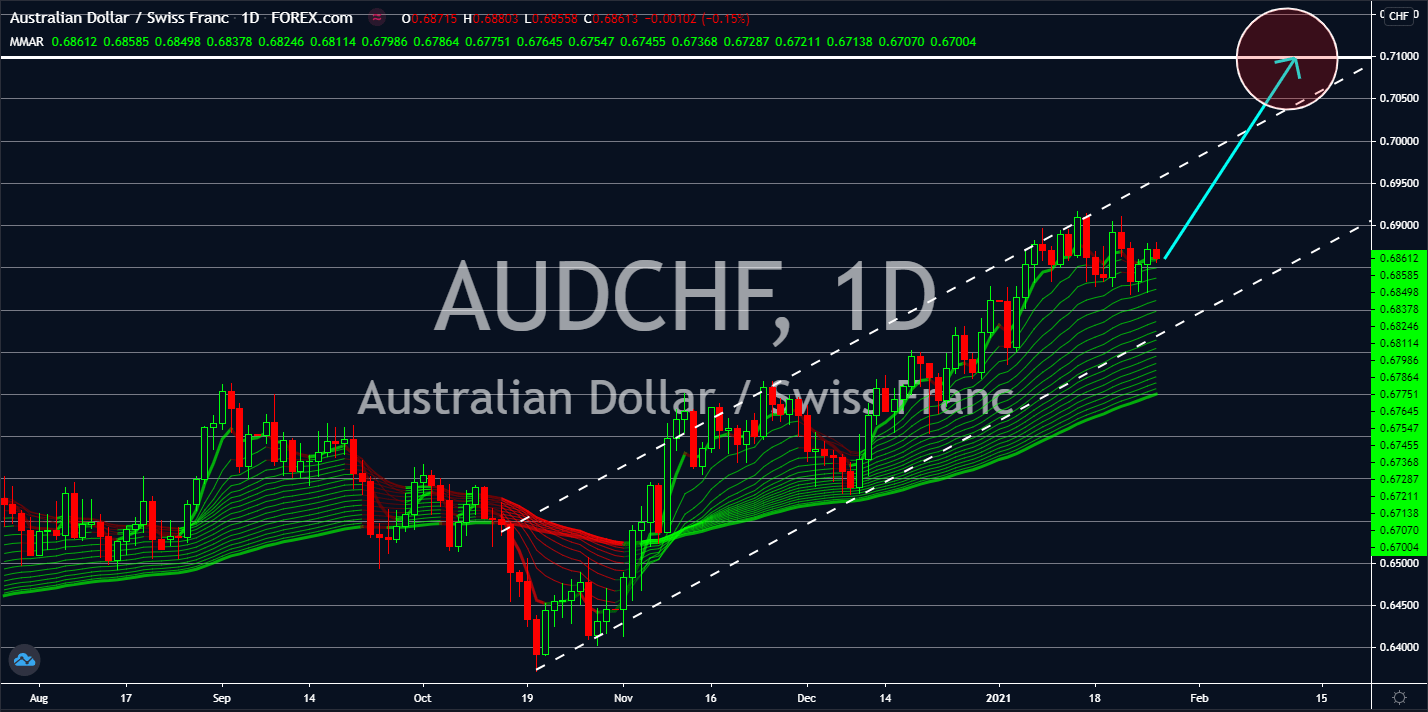

CADJPY

Japan risks having deflation as wage growth has stalled amid the second state of emergency. National CPI fell by -1.0% on Thursday’s report, January 21. This was the fastest decline in prices of consumer goods for the past decade. In addition to this, wage hikes and bonuses fell as companies reduced their operating costs. Japanese trade unions are now in talks with the stakeholders to increase wages by at least 2.0% in 2021. In the previous year, wage growth has slowed down from 2.43% in 2019 to 2.12% in 2020. The Japanese government is also widely criticized after PM Yoshihide Suga increased his focus on local tourism instead of the pandemic. Under his command, the lower house passed a 19.2 trillion yen extra budget. 1 million of the approved budget will go directly to travel discounts before the 2021 Olympics in July. Meanwhile, 60% of the fund will be allocated to the government’s campaign to promote domestic travel.