Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

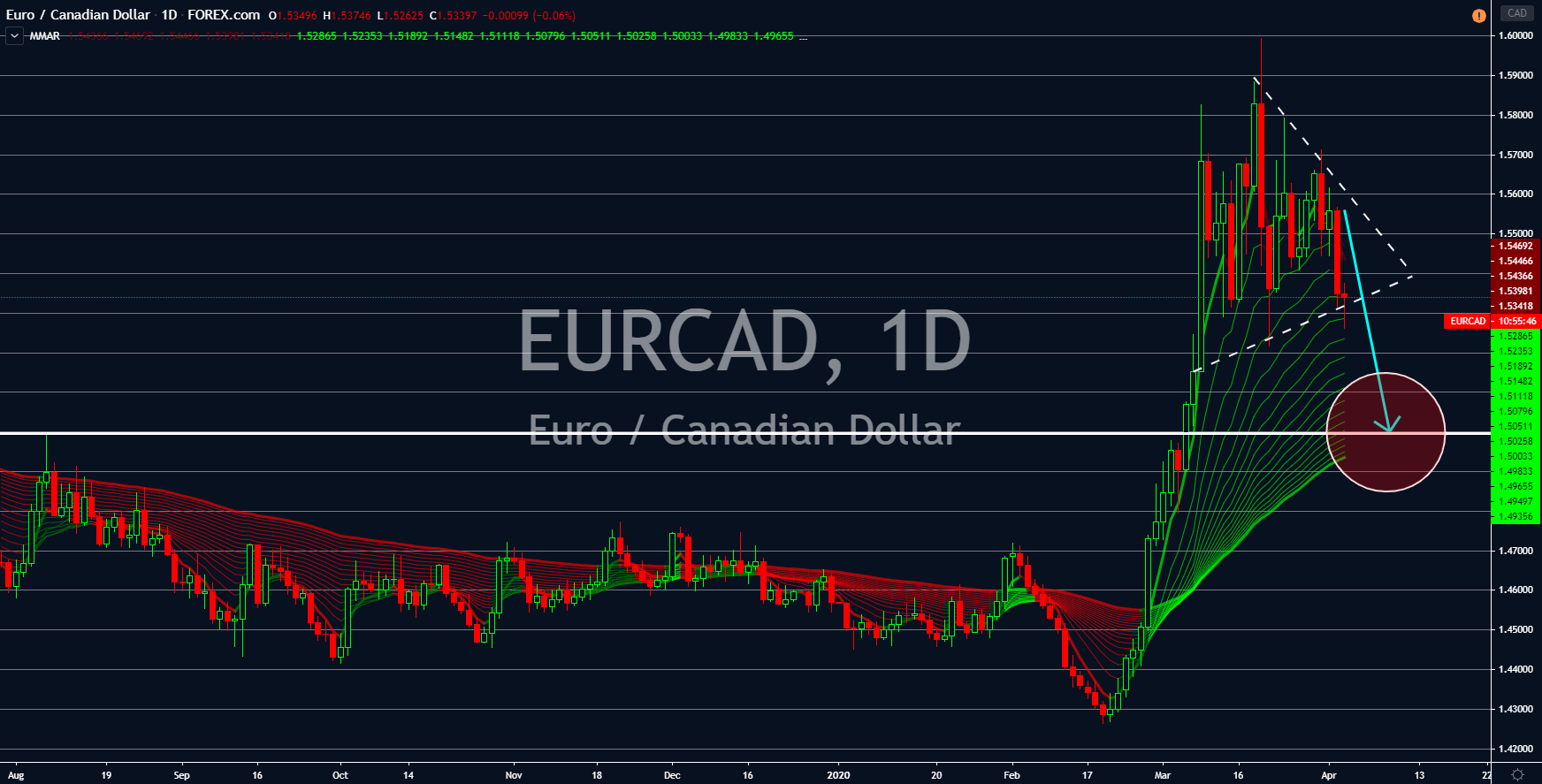

USDJPY

The United States posted a record-breaking jobless claim yesterday, April 02. America had the largest number of people who lost their job during the coronavirus outbreak at $6.6 million. This was higher from the 3.3 million jobless claims reported last week. President Donald Trump and the US Congress already signed a $2 trillion stimulus package to aid companies who suffered during the outbreak. Analysts further expect the US institutions to add additional stimulus in the coming weeks. However, investors and traders should be cautious on today’s trading as the NFP report will trigger volatility in the market. On the other hand, Japanese Prime Minister Shinzo Abe unveiled the largest stimulus package in the country’s history. The $550 billion fund will be used to support the country’s tourism. Between the US dollar and the Japanese yen, investors would bet on the greenback. The cheap dollar will outperform other currencies in the coming sessions.

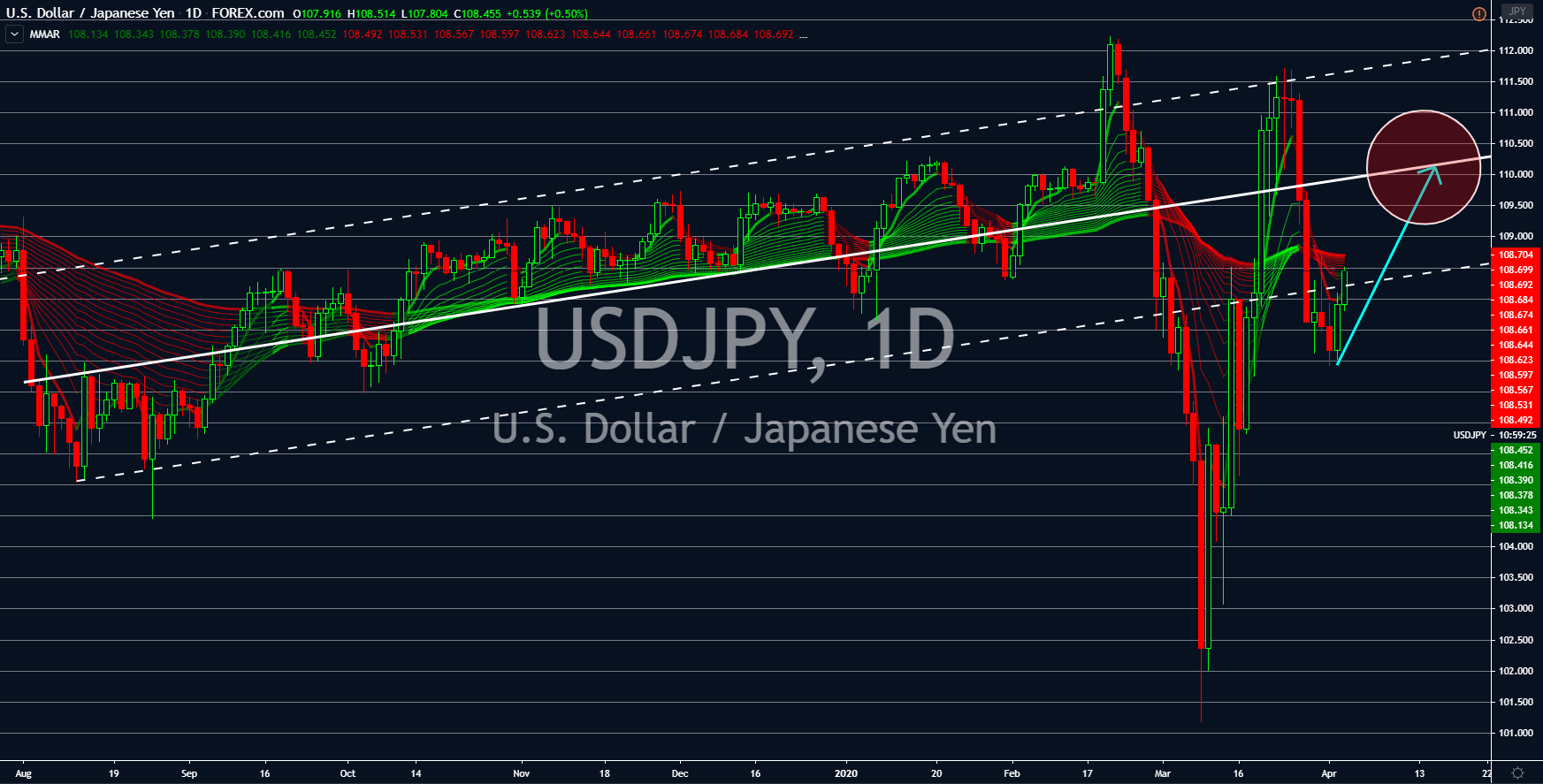

NZDCAD

Canada posted figures for its Import, Export, and Trade Balance report that calmed CAD investors and traders. The country was able to weigh down the economic impact of the coronavirus outbreak despite major economies reporting disappointing results. Among the countries who are affected by COVID-19 is New Zealand. According to analysts, Wellington’s economy could contract by as much as 10%. Meanwhile, jobless claims are expected to plunge to 30-year low during the outbreak. The country already saw a quarterly decline on its economic activity. A report from the OECD (Organisation for Economic Co-operation and Development) says the economic impact of COVID-19 to New Zealand could replicate the 2008 Global Financial Crisis. The New Zealand government already raised efforts to save the economy by introducing a $12.1 billion stimulus package. One of the primary beneficiaries of the fund was NZ’s tourism sector.

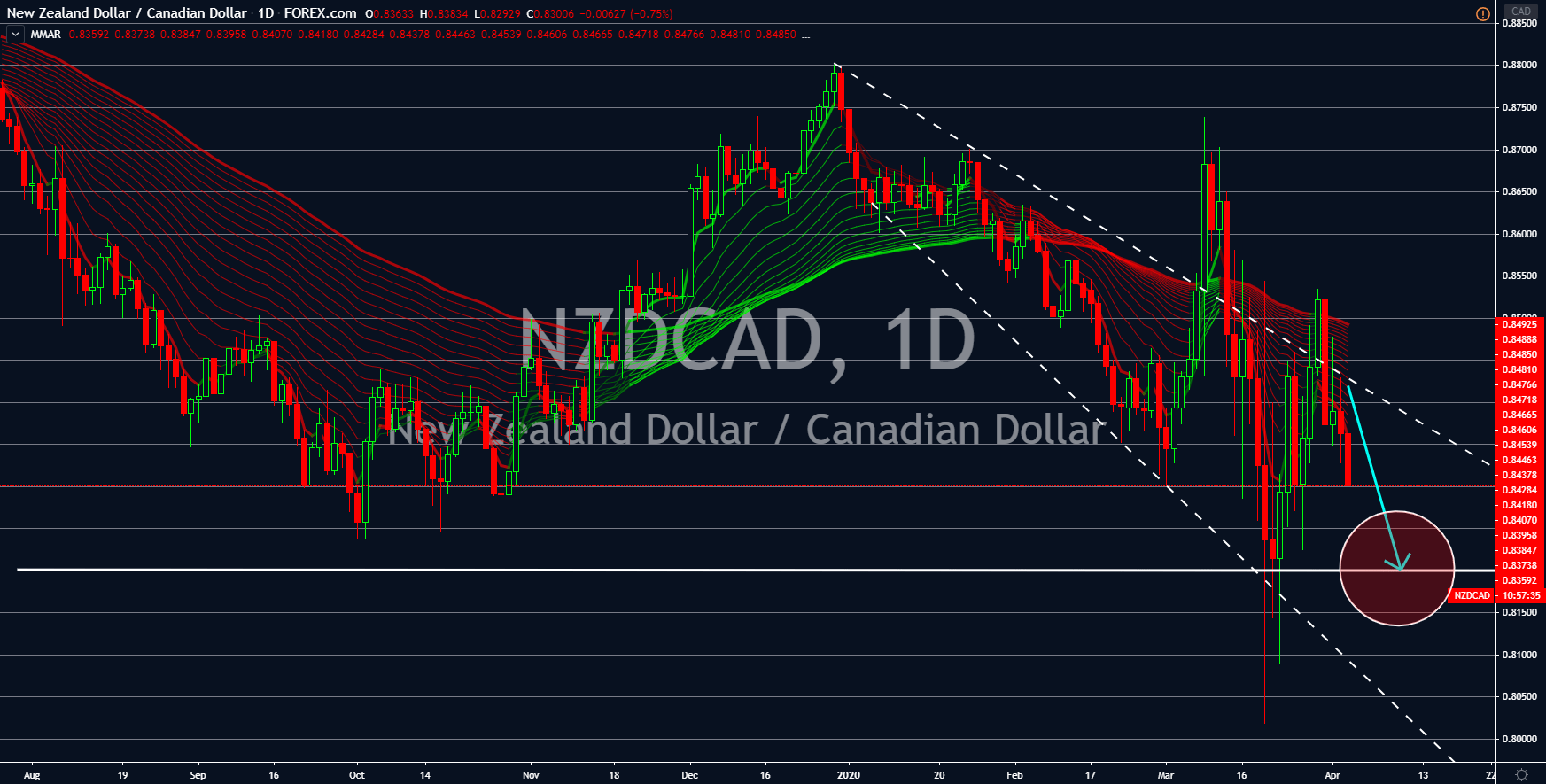

GBPUSD

The United Kingdom posted a worse-than-expected result for its Composite and Services Purchasing Managers Index (PMI) report. Just last month, many analysts believed that the UK can dodge a possible economic downturn. This was following the decision by the UK government to finally leave the bloc last January 31. Brexit caused Britain to shut its borders with other EU member states, effectively eliminating the “free movement of people”. However, UK Prime Minister Boris Johnson released a statement in March saying that more than half of Brits are infected by the virus. Johnson later turned out positive of the COVID-19. These events caused panic among pound investors and traders. On the other hand, the US has now the most reported cases of coronavirus around the world. Unlike the British pound, however, the US dollar would remain stronger against the basket of major currencies.

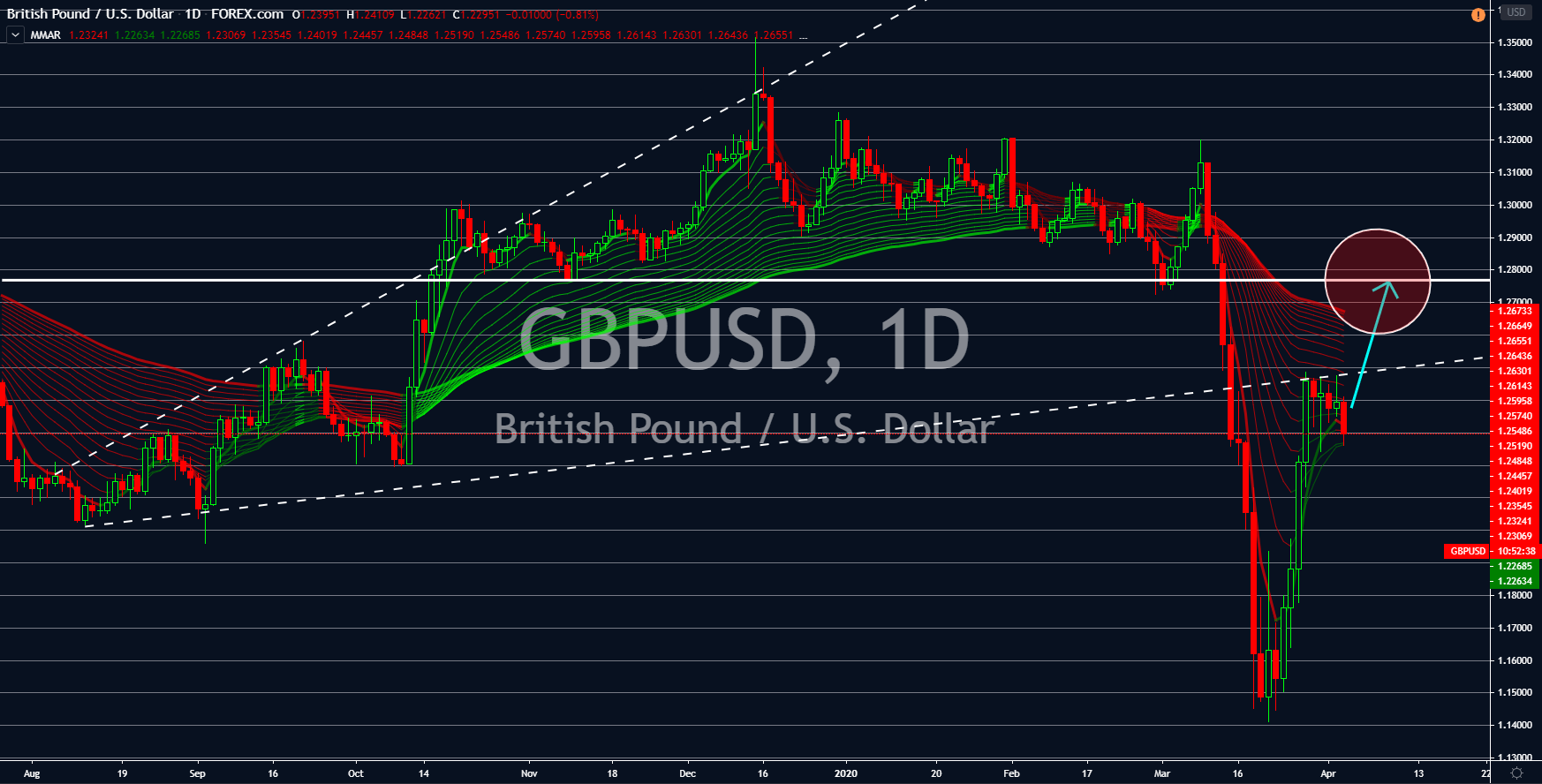

EURCAD

The EU member states posted Purchasing Managers Index (PMI) reports for Services and Composite yesterday, April 02. The figures were mixed but analysts were disappointed with the performance of the two (2) largest economies in the European Union – Germany and France. The two (2) economies’ figures for Services PMI were halved from what they posted a month ago. Germany posted 34.5 points while France reported 29.0 points. Overall, the EU recorded a slump in the Services PMI from 52.6 points to 28.4 points. Meanwhile, Composite PMI for Germany and France were recorded at 37.2 points and 30.2 points, respectively. These reports are expected to weaken the single currency in sessions. Meanwhile, Canada’s previous reports were a surprise to investors. Imports, Exports, and Trade Balance were all positive, which indicates that Canada is weighing down the economic impact of coronavirus.