Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

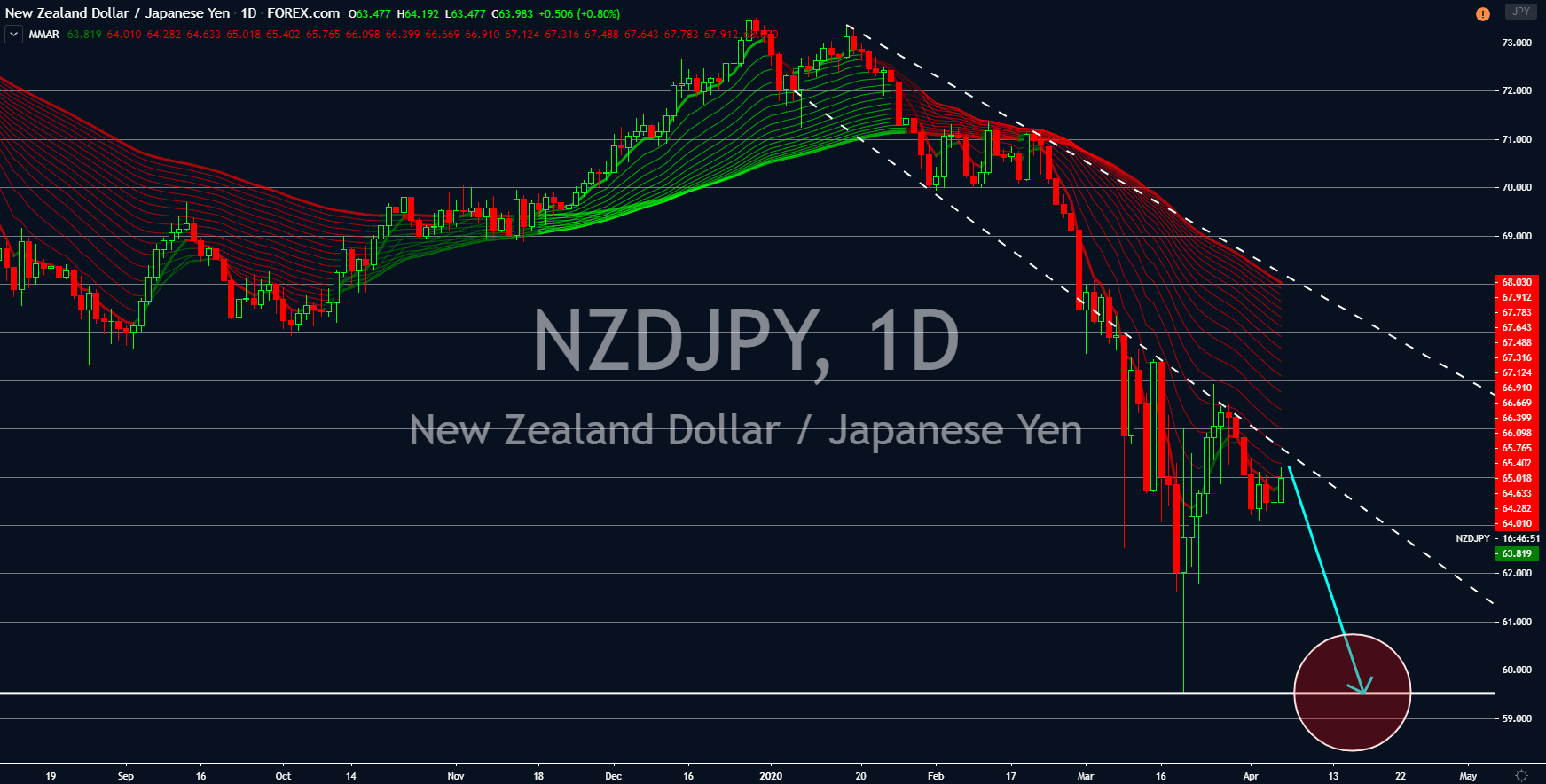

NZDJPY

The New Zealand dollar will continue to trend lower against the Japanese yen is sessions. Just last month, Japanese Prime Minister Shinzo Abe introduced the largest fiscal stimulus in the country’s history. The $555 billion package will be used to aid industries directly affected by the coronavirus. Analysts are expecting Japan to continue supporting its economy until COVID-19 cases around the world subsides. Also, the appeal of the Japanese yen and other safe-haven currencies will shine throughout the market in the coming weeks. Meanwhile, the oil export reliant economy of New Zealand will continue to push the price of NZD lower. The New Zealand Dollar will also be affected by the sluggishness of China, its largest trading partner. The poor performance of the Australian economy will also weigh down on the New Zealand dollar. The OECD suggests that the impact of the coronavirus pandemic will outweigh the 2008 Global Financial Crisis.

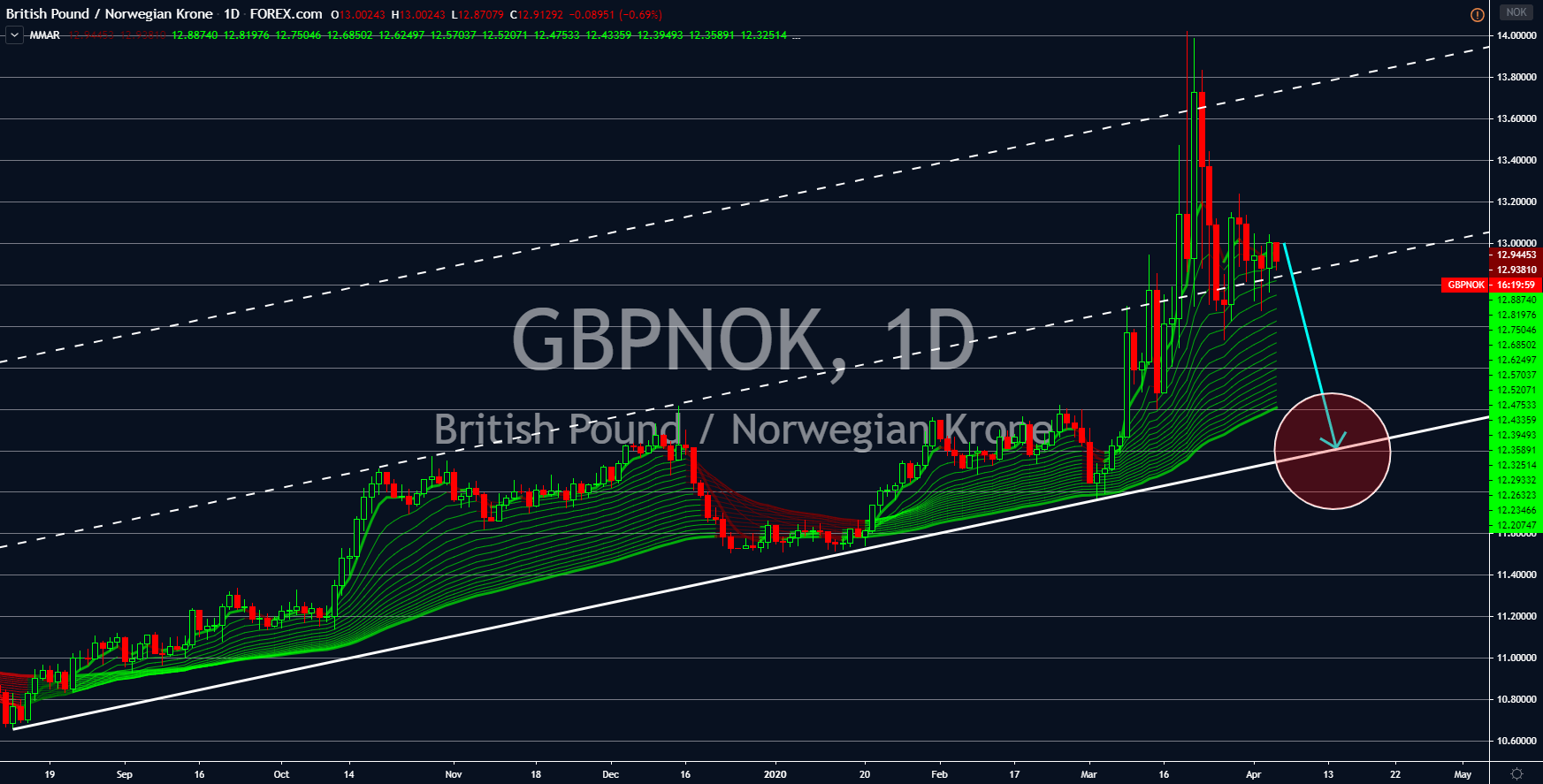

GBPNOK

The Norwegian krone will continue to drag the British pound in sessions. This was after Norway posted a better-than-expected Unemployment Rate report last Friday, April 03. The country’s figure for February was at 2.30% and analysts were expecting this number to climb to 13.50% for March. Norway, however, surprised investors after its unemployment rate was recorded at only 10.70%. Meanwhile, the UK is struggling both economically and politically. Britain was able to finalize the Brexit deal last January after more than three (3) of negotiation. However, the country is heading towards another uncertainty with the coronavirus. Boris Johnson tested positive of COVID-19 a week ago and just recently he was confined after showing symptoms. This puts risks in UK politics as the highest position in the country will be vacant without Johnson. The country’s economy might also see weakness after the UK leaves the European Union.

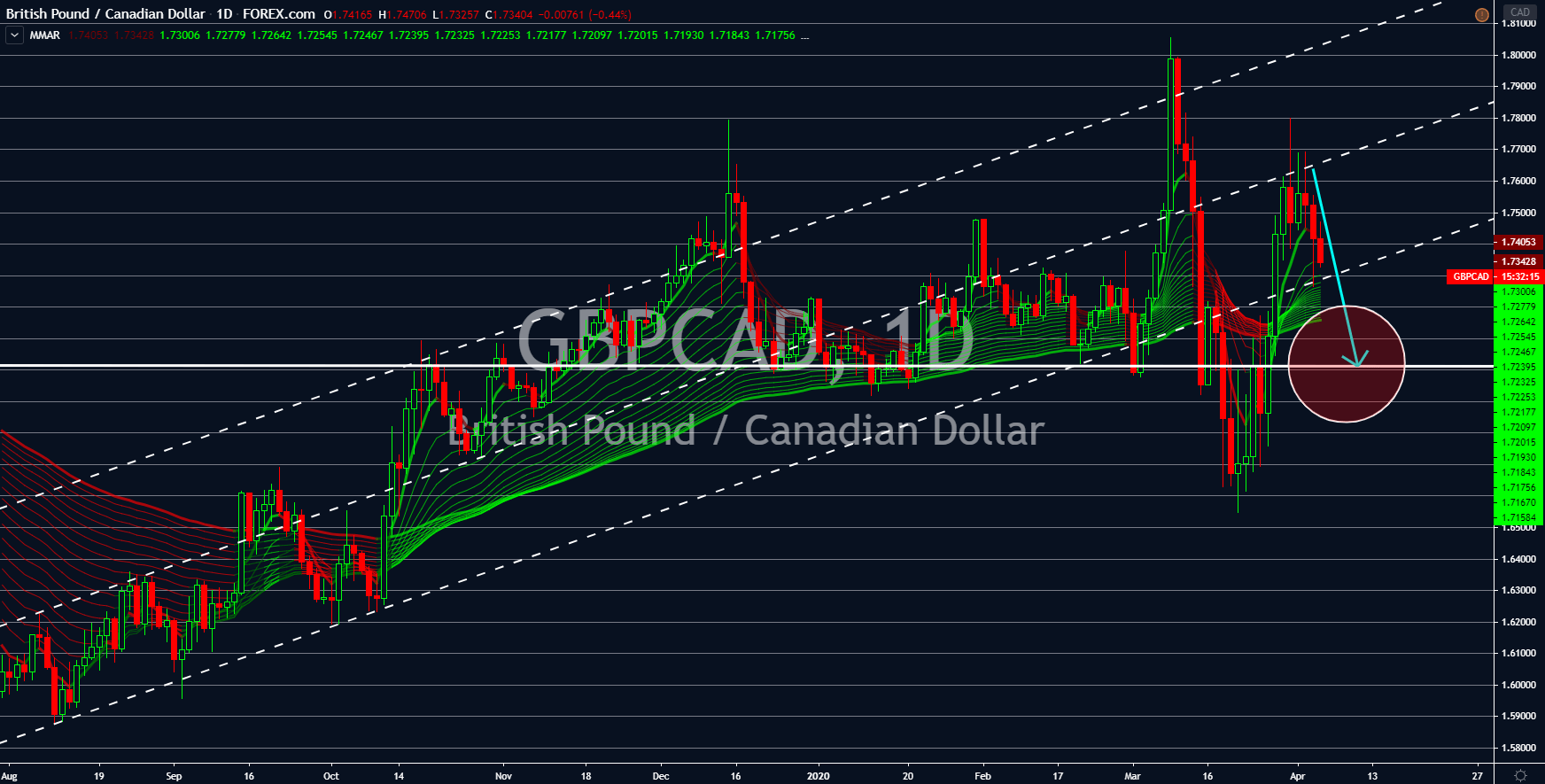

GBPCAD

The United Kingdom posted negative figures last Friday for Composite and Services Purchasing Managers Index (PMI) reports. These numbers along with the news that UK Prime Minister Boris Johnson tested positive and confined due to the coronavirus is weighing down on the British pound. The UK was recently in an uncertain position following the failure by the UK and the EU to agree on the Brexit deal. However, Boris was able to secure the majority of votes during the December 12 election. Despite this, the country might head into recession with the COVID-19 pandemic. Canada, on the other hand, has still some room to counter the coronavirus. The country’s interest rate at the start of 2020 was 1.75%. It was cut four (4) times to date to 0.25 points. Despite this, the country has still some money to increase liquidity in the market once an outbreak threatens its economy. For this reason, the CAD will remain strong against the pounds.

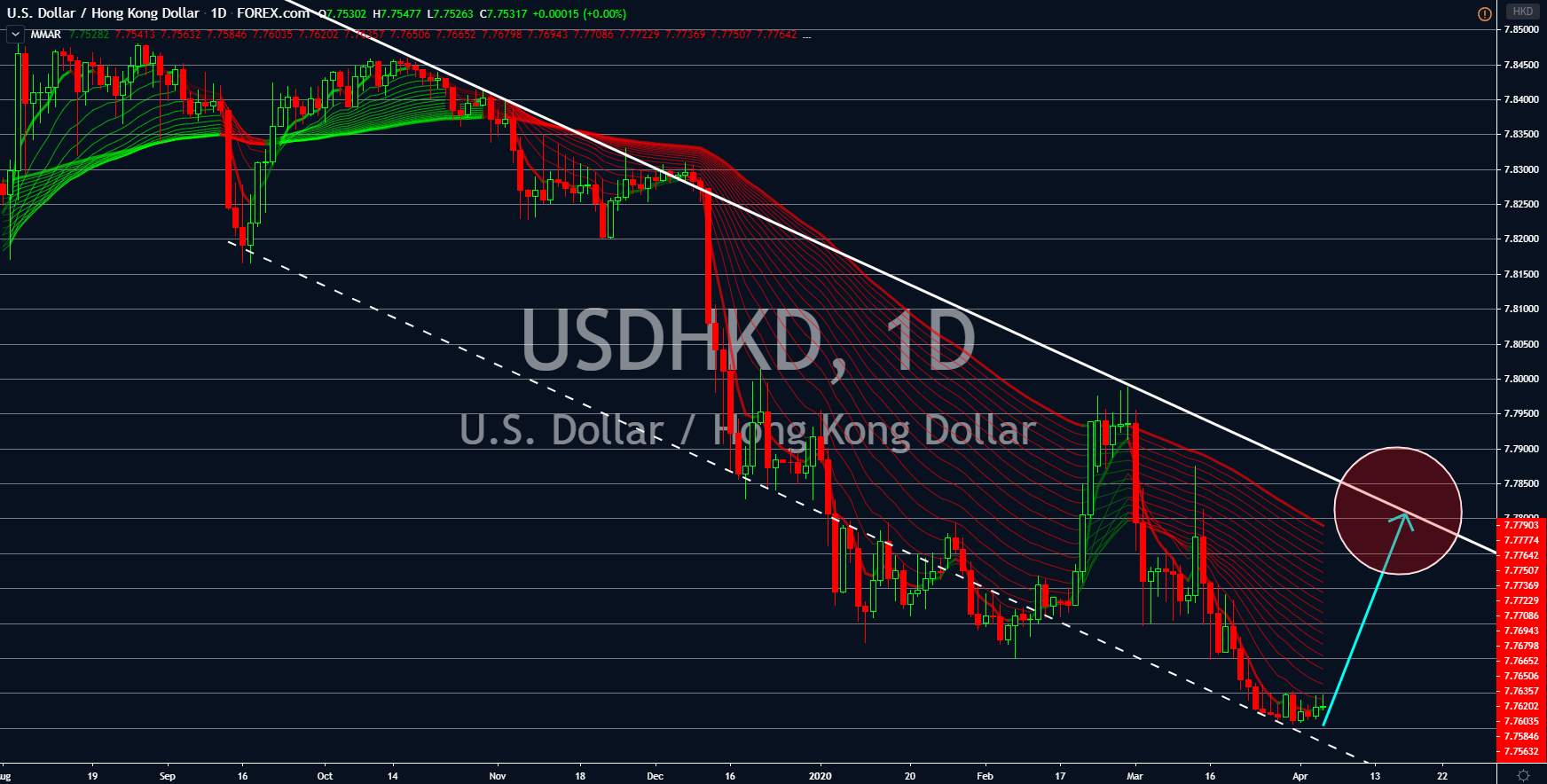

USDHKD

The demand for the US dollar will continue to soar in coming sessions. President Donald Trump and House Speaker Nancy Pelosi signed a $2 trillion stimulus package to help the American economy. However, analysts anticipate more fiscal and monetary policy from the government to ease the market. This was after the US reported 3.3 million jobless claims in the third week of March. The figures doubled to 6.6 million in the fourth week. Analysts anticipate the first week of April to dwarf these record-breaking figures with 7 million jobless claims. Since the US dollar is widely used for international transactions, analysts are expecting investors and traders to get a piece of the cheap dollar. Meanwhile, the British pound is suffering from the disappointing results from the Composite and Services Purchasing Managers Index (PMI) report. This was in addition to the news that PM Johnson tested positive and now confined in a hospital due to coronavirus.