Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

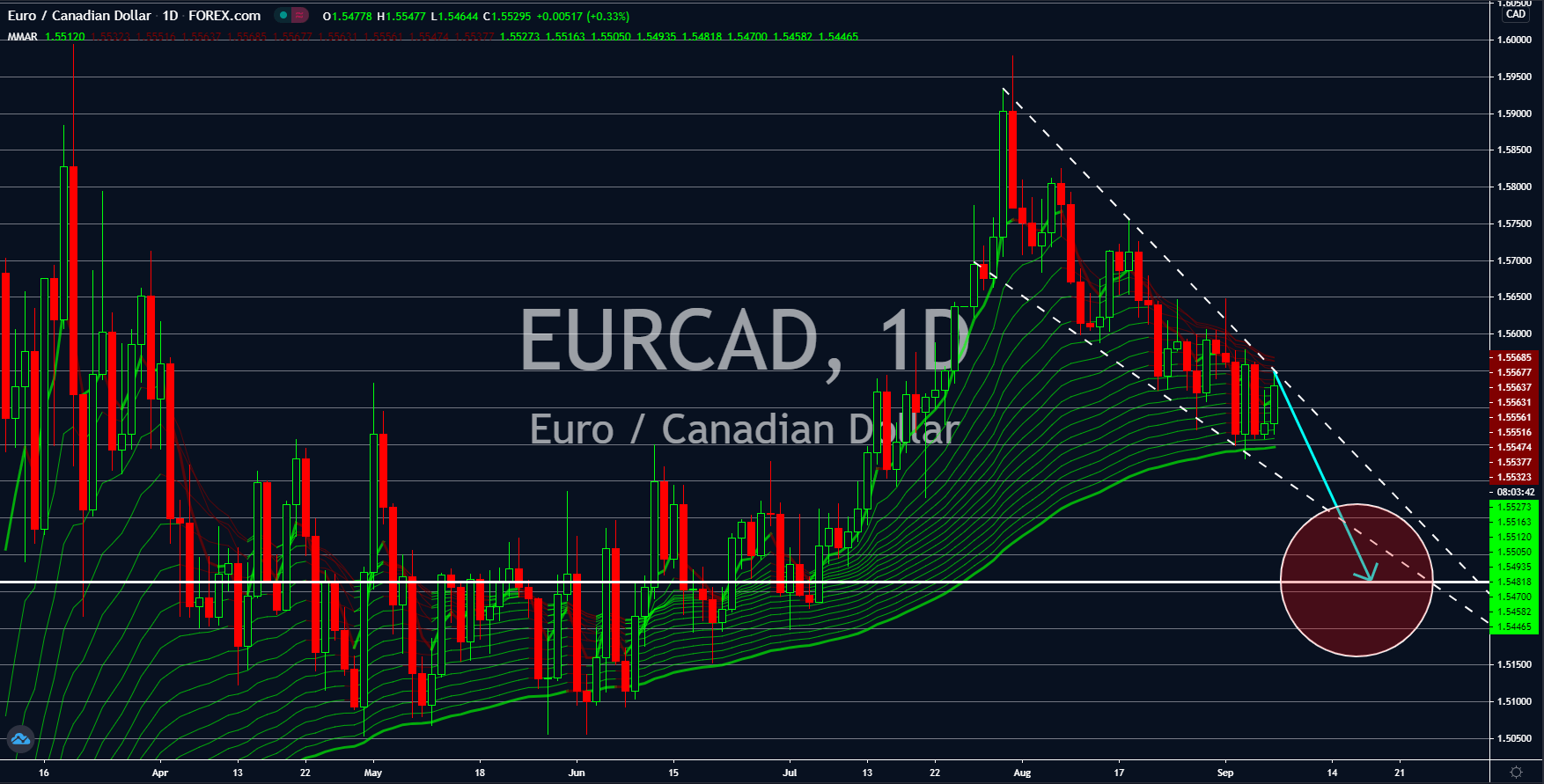

EURCAD

The unexpected turn of events will send the single currency lower against the Canadian dollar. The full-blown effect of the coronavirus pandemic in the European region is starting to show with the Q2 reports from the EU. On its GDP report published today, September 08, the world’s largest trading bloc tumbled down by -11.8% on a quarterly basis and -14.7% on an annual basis. Both of which were almost the same from their previous readings from Q2. Earlier, many analysts believe that the European Union will experience a robust recovery. However, the pessimism from investors with the current global economic outlook is affecting the economy of the European region. Despite the bleak economic outlook for most economies, however, Canada is showing resilience. Canada’s unemployment rate marked the country’s third decline in the report. Figures were now at 10.2% for the month of August compared to July’s 10.9% and from May’s 13.7%.

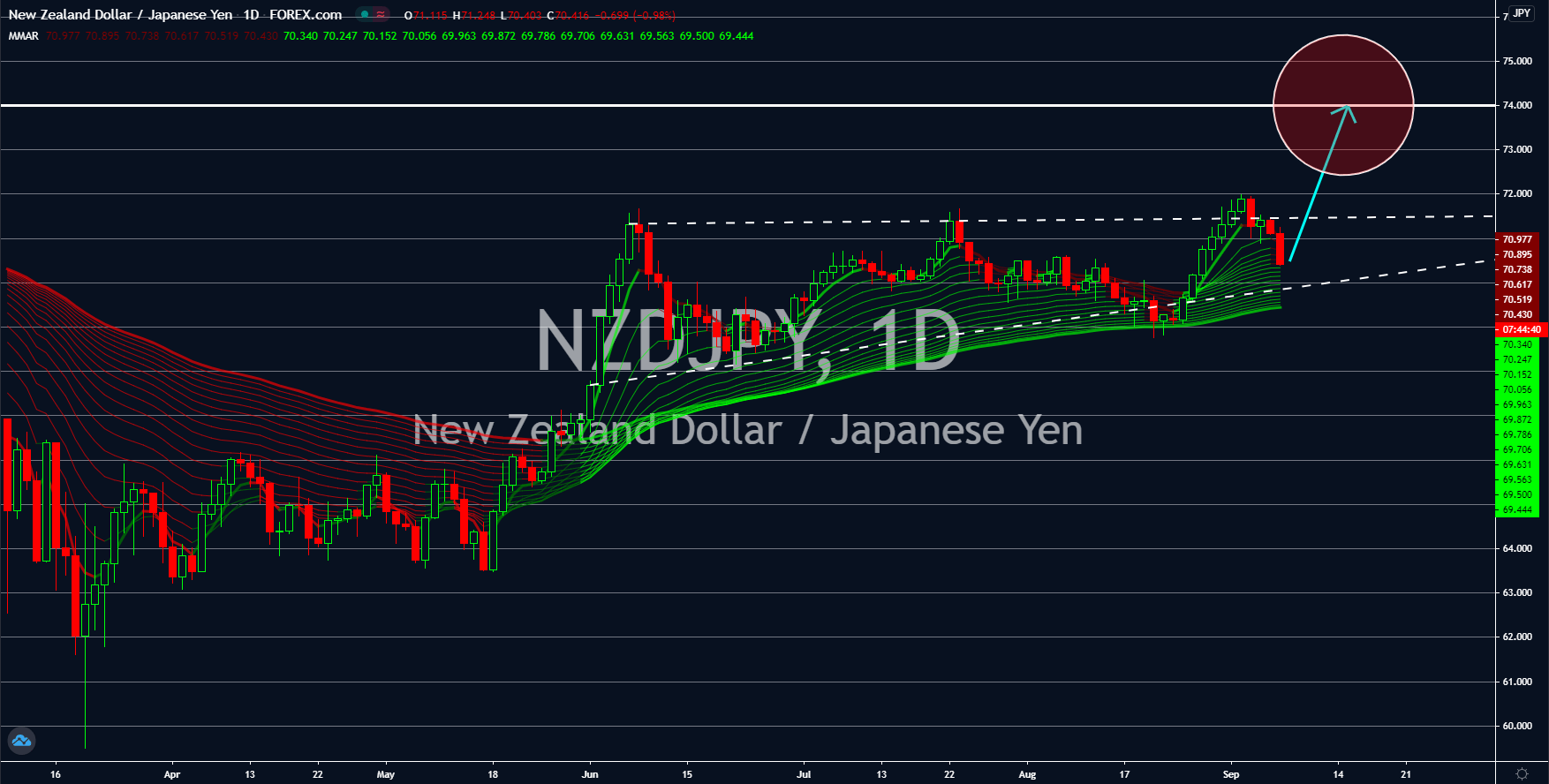

NZDJPY

Japan’s Q2 GDP result QoQ was almost at par with its recent reading. On yesterday’s report, Tokyo announced that its economy shrunk by -7.9%, a bit higher from the 7.8% figure last month. Furthermore, analysts are anticipating the same percentage level decrease on its final Q2 report due next month. Although most investors are looking for economic recovery in Q3, some are convinced that economic contraction will continue until the end 2020. This was following the recent resignation of Prime Minister Shinzo Abe. Abe was the country’s longest serving PM and many investors were in favor of his leadership. Now that one of the country’s highest positions was vacant, analysts were mixed on the long-term stability of the Japanese economy. Meanwhile, despite the 10 points decrease in NZ’s ANZ Business Confidence report, investors were still convinced that the country’s success in COVID-19 will help the economy to outperform its peers.

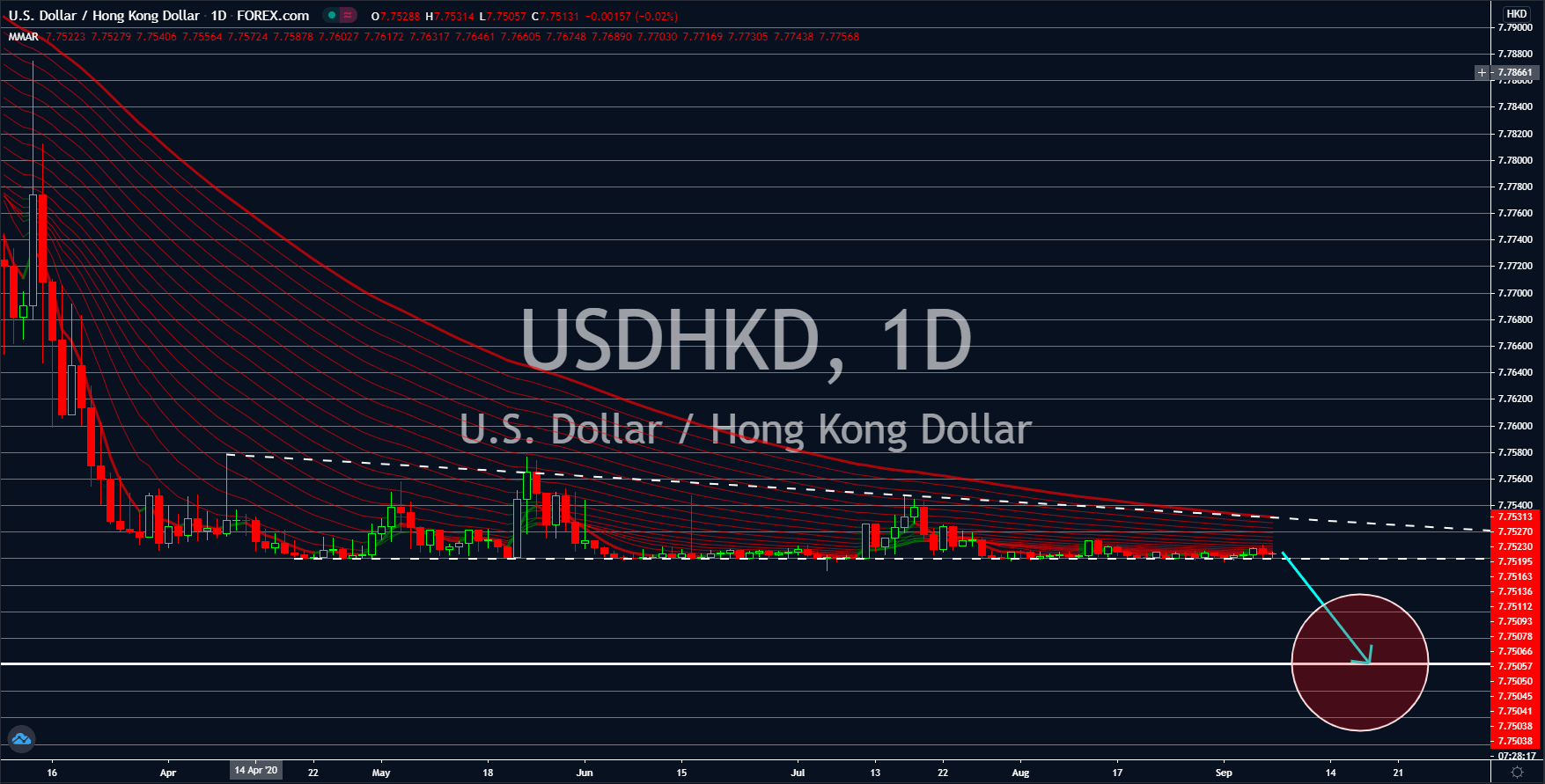

USDHKD

The USDHKD pair will see new lows soon as investors remain pessimistic with their US outlook. On Thursday, September 03, US indices and the greenback suffered a major blow due to the disappointing NFP figure. Non-farm payrolls added 1,371K jobs for the month of August, which was lower from the prior month’s 1,734K reading. Investors are worried that without the US government and Federal Reserve’s intervention, the US economy could soon collapse. Cumulatively, the Fed and the government injected more than $6 trillion in stimulus to support individuals and businesses affected by the pandemic. Although it saved the largest economy from a steeper recession in the short run, the effect of COVID-19 could hunt the US economy in the long-term. On the other hand, the integration of Hong Kong to mainland China is helping the special administrative region to cope up with the effects of the coronavirus pandemic.

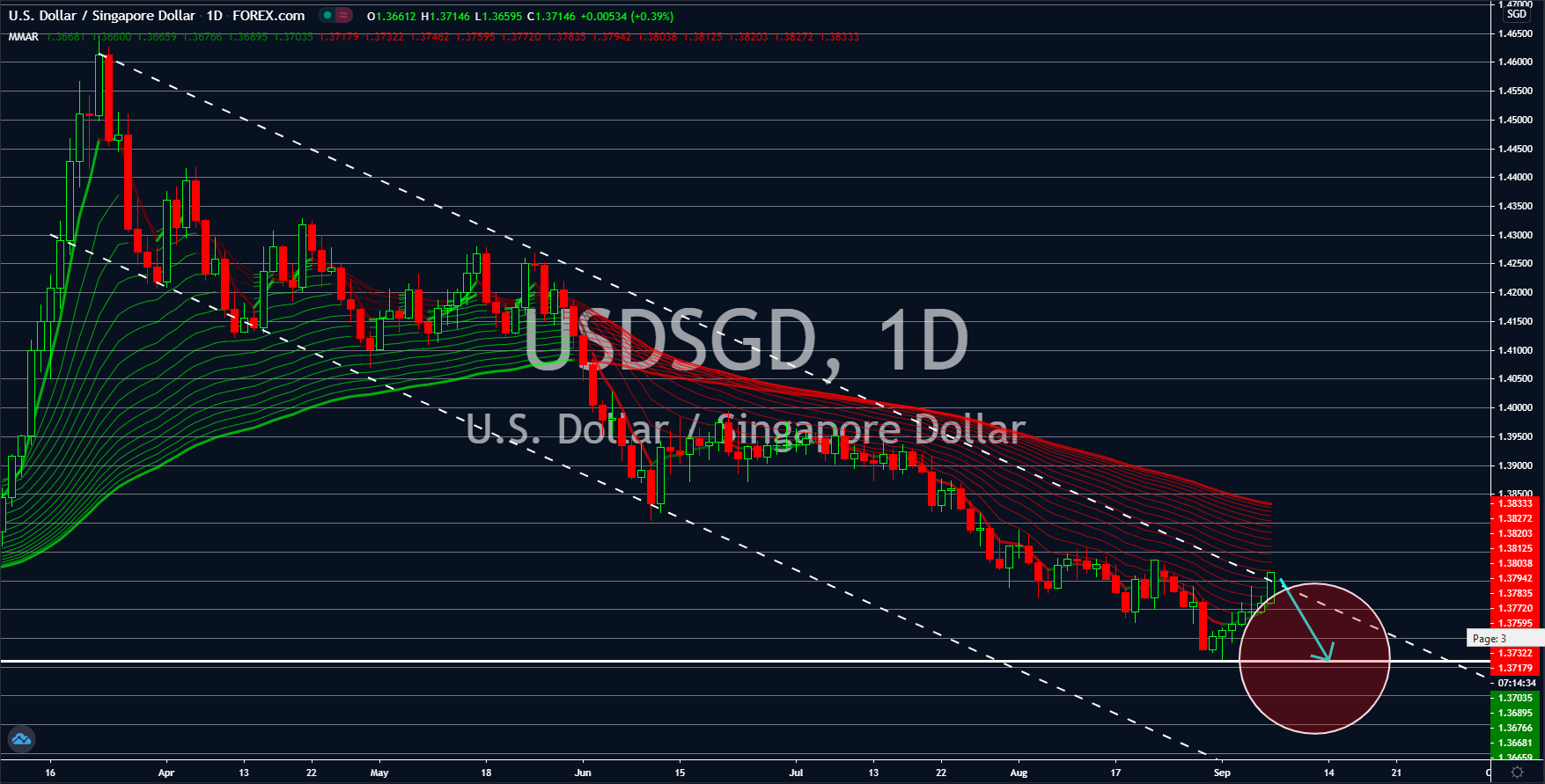

USDSGD

Singapore took the opportunity to build its US dollar reserves during the pandemic with the cheap greenback. Yesterday, September 07, the city state added $6.1 billion on its USD reserves, from $321.4 billion in July to $327.5 billion in August. This, in turn, will support the value of the Singaporean dollar as the country’s liquidity continues to soar. On the other hand, the aggressive stimulus plan by the US government and the Federal Reserve has proven to be beneficial to the US economy. However, this was done at the expense of the US dollar. The increased supply of greenback in the global economy has caused the value of the US dollar to decline. US indices experienced a massive growth while the US dollar’s value saw its lowest value in years. Aside from this, analysts are worried that without the US government and the Fed’s intervention, the largest economy could collapse. Analysts are expecting the pair to go back to their previous low.