Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

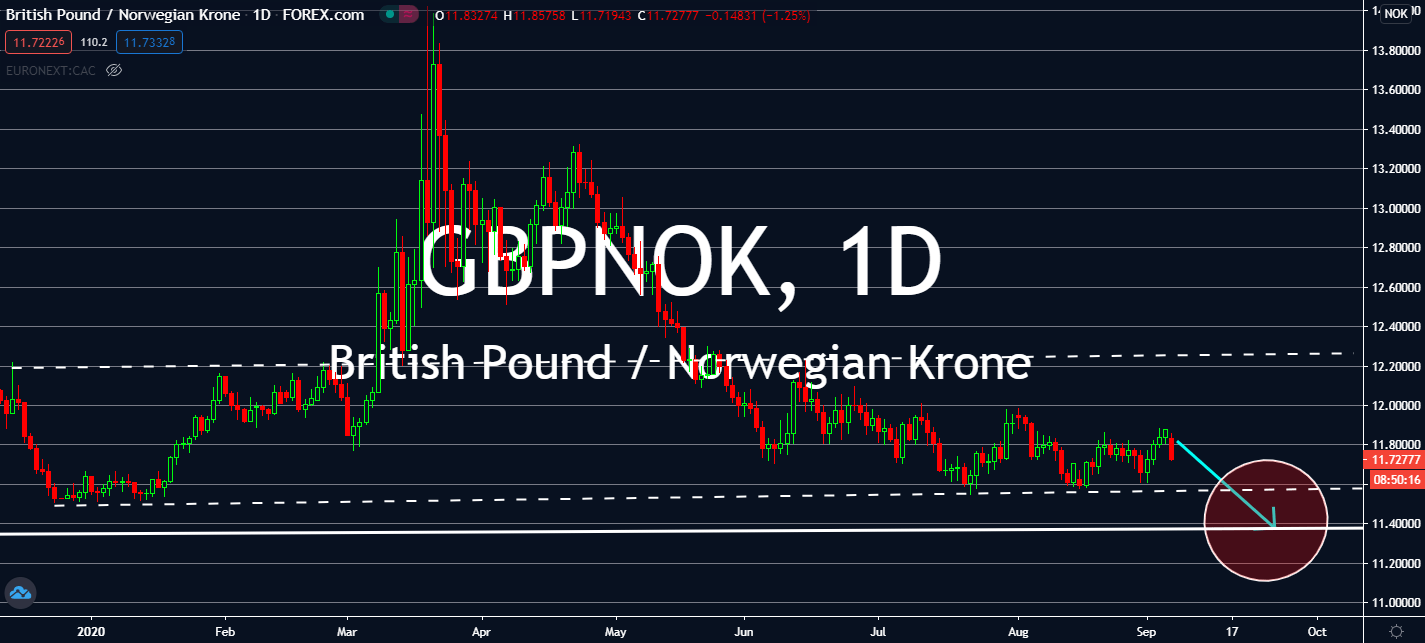

GBPNOK

The announcement for how the United Kingdom fared in the second quarter is coming later this week. Markets expect its government to report a 21.7% annualized decline in GDP compared to -1.7% from the year 2019. It will arrive only days after it announced another nationwide lockdown after a record 2,988 surge of infections on Sunday. Moreover, Secretary of State Dominic Raab confirmed that the economy might experience another decrease this month for businesses that will be forced to operate in work-from-home conditions. The shift harmed High Street businesses that rely on commuters and office workers. Pret A Manger plans to cut a third of its workforce while SSP Group warned that it would cut up to 5,000 jobs soon. Meanwhile, Norway’s manufacturing sector beat consensus to rise from 0.2% in June to 1.8% in July. The surprise upped optimism in the forex market, contrary to the falling Pound amid its conflicts with the European Union.

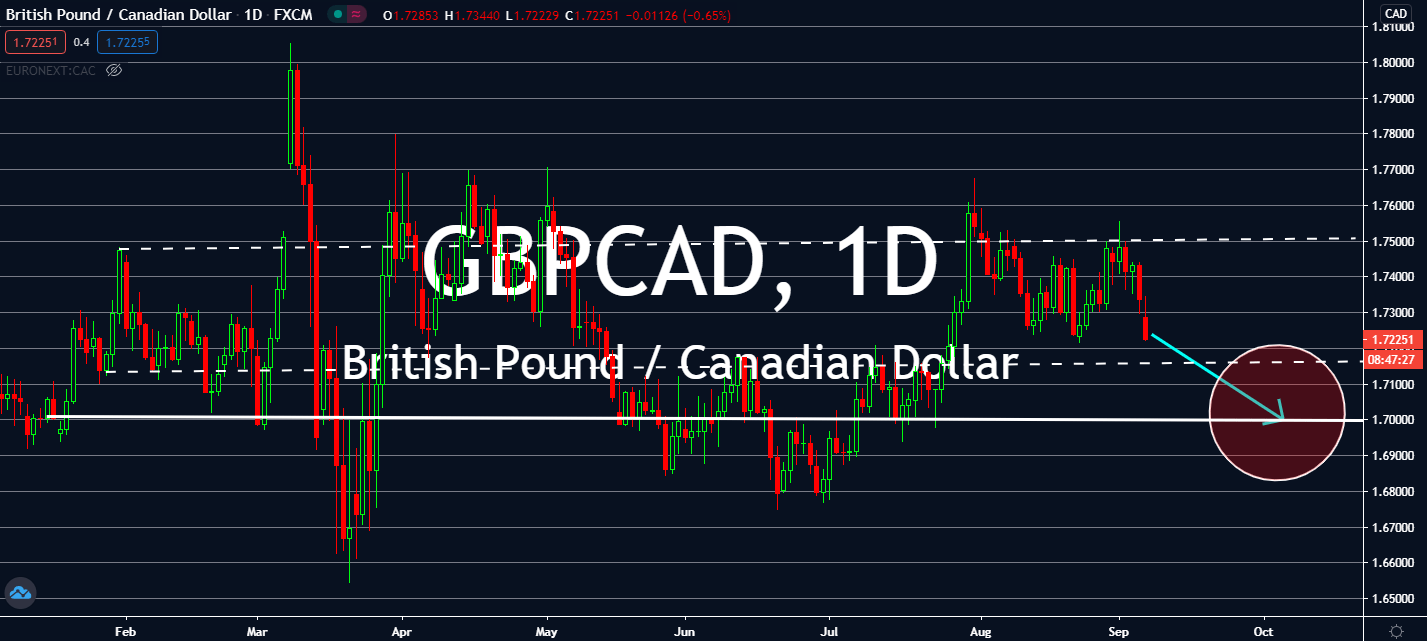

GBPCAD

Canada’s unemployment rate fell to 10.2% in August, while the United Kingdom restarts its nationwide lockdown procedures. The figure accounts for 246,000 Canadians added in the labor market as more businesses reopened. This showed that the economy recovered almost two-thirds of what it lost during the first surge of the pandemic. CIBC analyst Andrew Grantham said that the reopening is expected to continue until a vaccine is available in the market. The increase was much better than when its unemployment rate doubled from low levels of 5.6% seen in February to 13.7% mid-May. Meanwhile, the United Kingdom is under pressure for its negotiations with the European Union even as it deals with the second wave of nationwide lockdowns that were implemented on Sunday. Businesses are expected to suffer throughout the week or until the UK could report a better-than-expected figure for its Q2 GDP for 2020.

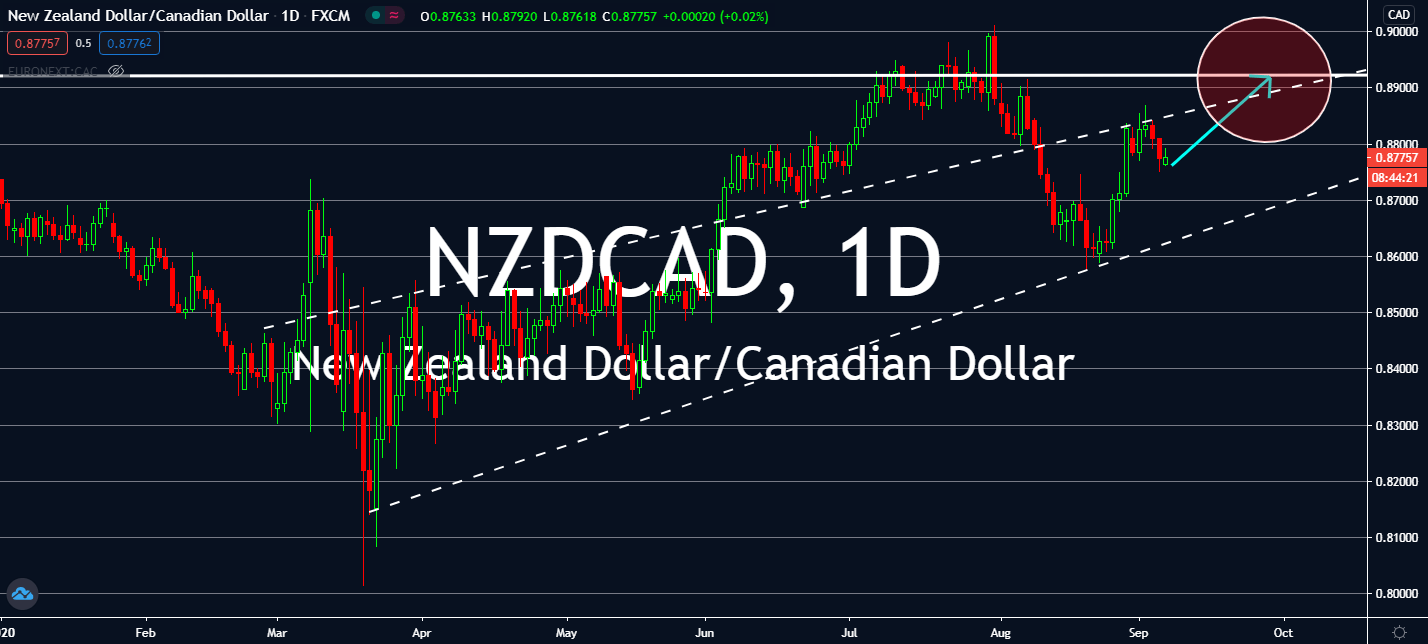

NZDCAD

New Zealand is still focusing on the medical side of recovery from the coronavirus, but markets claim that its fiscal recovery will still be relatively resilient. The kiwi government is expected to report its GDP figures for the second quarter next week, but investors have been optimistic thanks to domestic travel figures seen over the quarter, which Statistics NZ noted that around 100,000 visitors stayed in the country in August compared to 250,000 in July. This helped the travel sector see gains around that period. Considering its impact on services exports in the June quarter, markets concluded that the further impact in the coronavirus economy will be spread out through different quarters. Canada, on the other hand, saw an unemployment decrease from 10.9% to 10.2% in the previous month, a record higher than the 10.1% expected prior and indicating an employment change of not more than 245.8K, down from the forecasted 275.

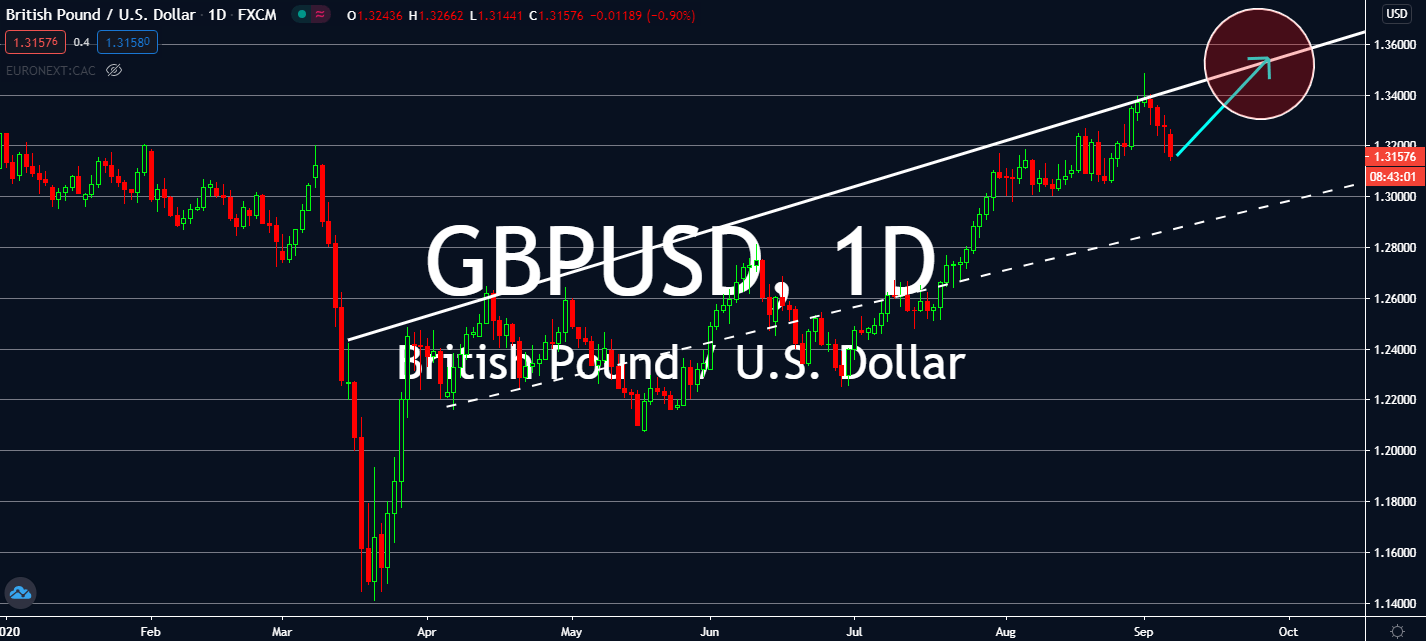

GBPUSD

It’s Labor Day in the United States, but its economic data won’t take a break with it. The US government this year will run the largest budget deficit, according to the Congressional Budget Office. Basically, it means that its debt will surge higher than its full gross domestic product costs for the first time since 1946. The gap between what the government spends and what it collects will be $3.3 trillion by the end of September, the widest in 75 years. The federal debt could reach 100% of its GDP by next year, and could even climb to 107% by 2023. The pandemic sent the US economy tumbling into a 31.7% collapse in the second quarter and recorded the worst quarter for added jobs since 1947 when it amounted to 22 million jobs slashed. The Pound is now expected to lift even after it implemented another wave of nationwide lockdowns brought by an unprecedented surge in new daily cases found on Sunday.