Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

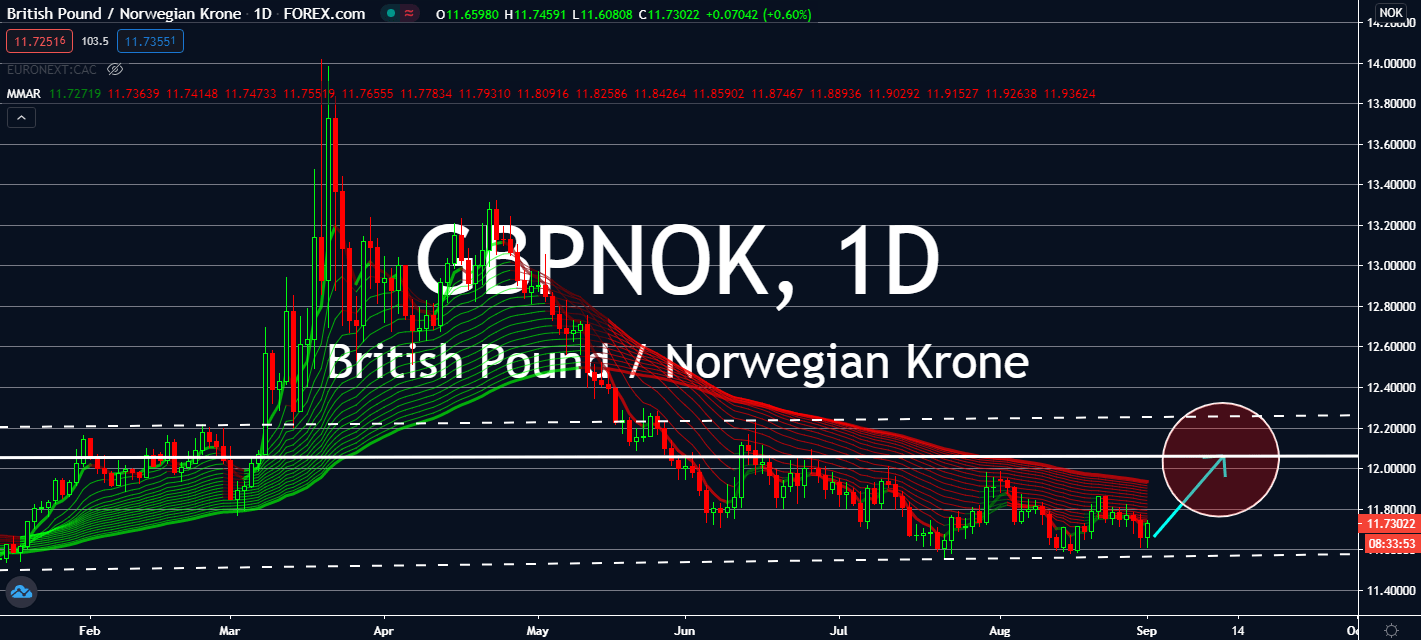

GBPNOK

The United Kingdom’s Manufacturing PMI for August was below the market consensus. This was supposed to be bad for the British pound. However, investors are barely paying attention to the fact that it had decreased. It’s that although it reported a 55.2 figure for August, slightly below 55.3 as estimated prior, it still increased from previous levels. In fact, economists applauded the fact that it had seen the fastest overall growth in the sector since early 2018. It was well above April’s record low of 32.6 and gradually increased without turning back since then. The record is bound to benefit the pound. Now that the figure is above 50, this means that its private sector activity is growing. New orders form export markets also increased for the first time in 10 months around several economies such as Europe, North America, Australia, and Middle East Africa (EMEA). The stagnant Norwegian data will also push the GBPNOK up near-term.

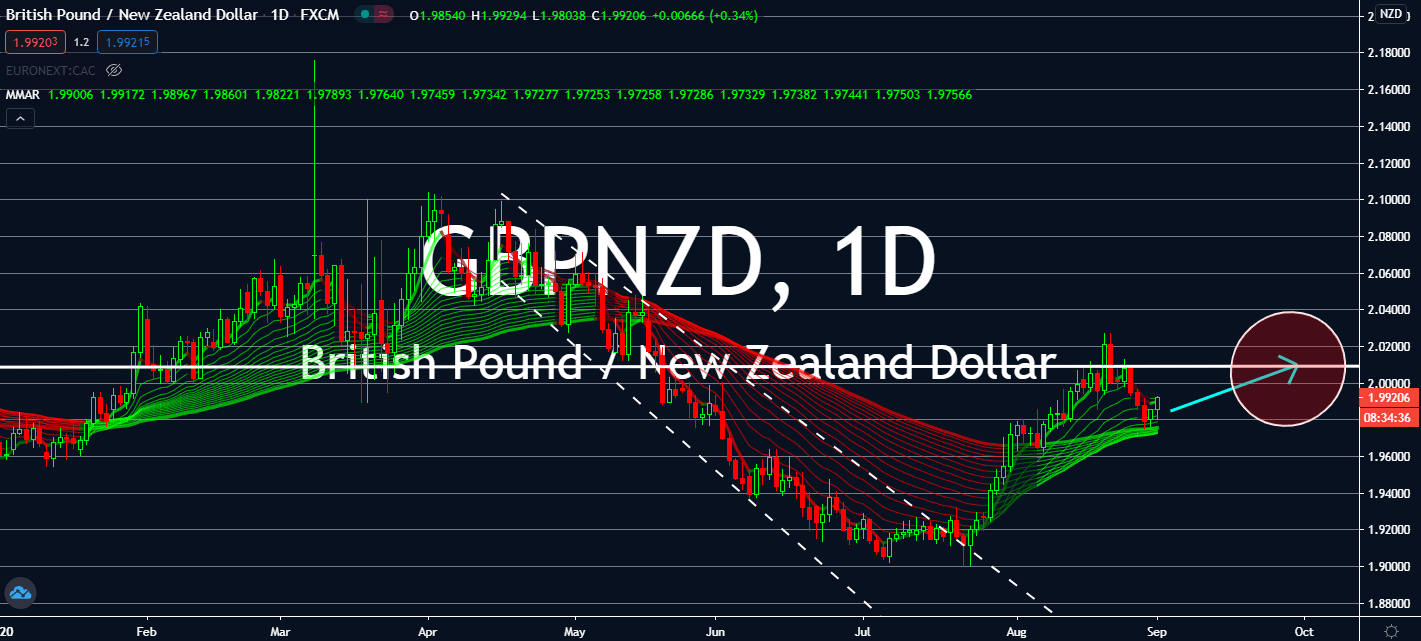

GBPNZD

Exports will be the main determiner for the sterling-kiwi pair in today’s trading. Rob Dobson, a director at HIS Markit, claims that the UK manufacturing sector’s rapid growth for the past months was led by an increase in domestic demand and signs of recovering exports. Manufacturing PMI came in at 55.2 for August, which was an uptick from 53.3 seen the month prior. Moreover, it looks like consumer spending is still benefitting its economy. The Bank of England’s Consumer Credit record saw an increase from -0.382 billion to 1.200 billion, which was way above the forecasted 0.678 billion. Business sentiment also hit a 28-month high in August and remained at the same level as more firms became more confident that they could return to pre-coronavirus growth in output for the next few months. The quiet New Zealand is expected to take a toll on its currency near-term as the country becomes increasingly busy with coronavirus concerns.

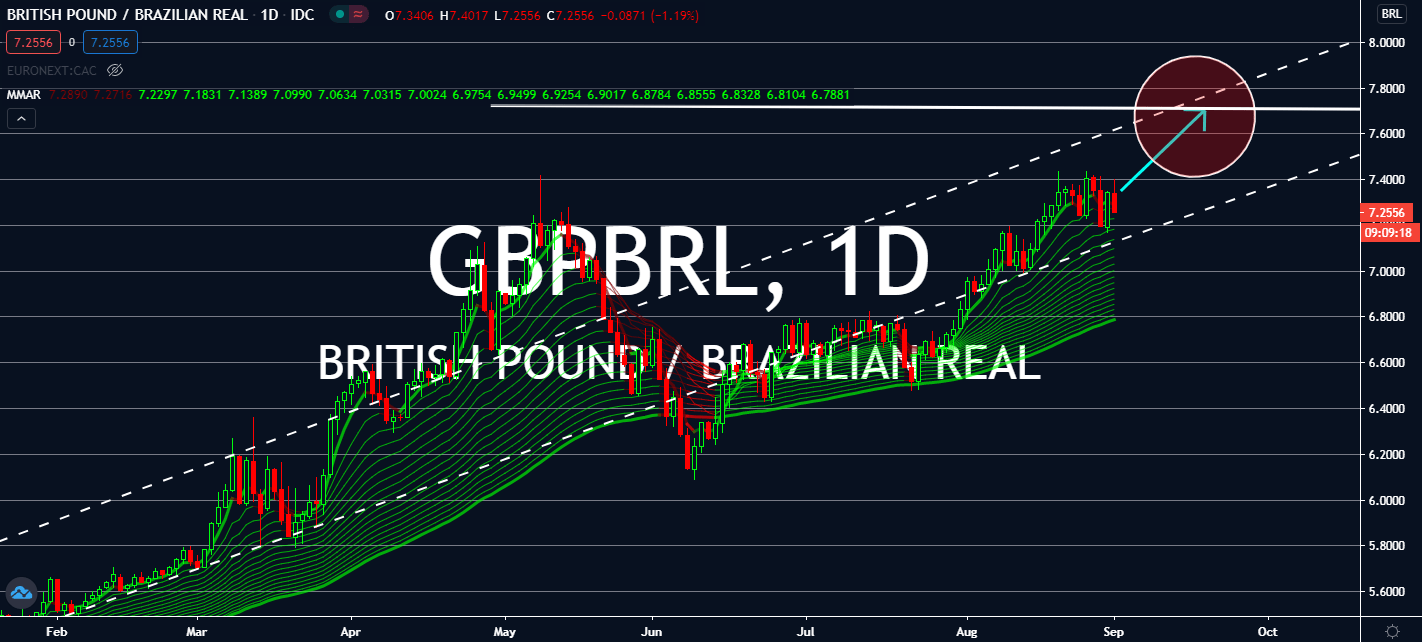

GBPBRL

Today, Brazil confirmed that its economy was doing was far worse than what it had been reporting. Its yearly gross domestic fall for the second quarter had fallen by 11.4% from the already declining economy in Q2 2019 that stood at -0.3%. The figure was even lower than Wall Street had predicted beforehand. Investors had expected at least a lower figure than the 9.7% decline it had seen in the same quarter in comparison to the first ending April, which came in at -1.5%. Meanwhile, the UK is seeing a series of good news today thanks to increasing consumer spending and manufacturing figures that have stabilized above the 50-point standard that signified growth in the sector. Manufacturing PMI came in almost as predicted at 55.2. which is still way above the April low of 32 and more than last month’s record of 53.3. Consumer Credit spending also increased in the UK from negative levels to positive at 1.200 billion from -0.382 billion seen in June.

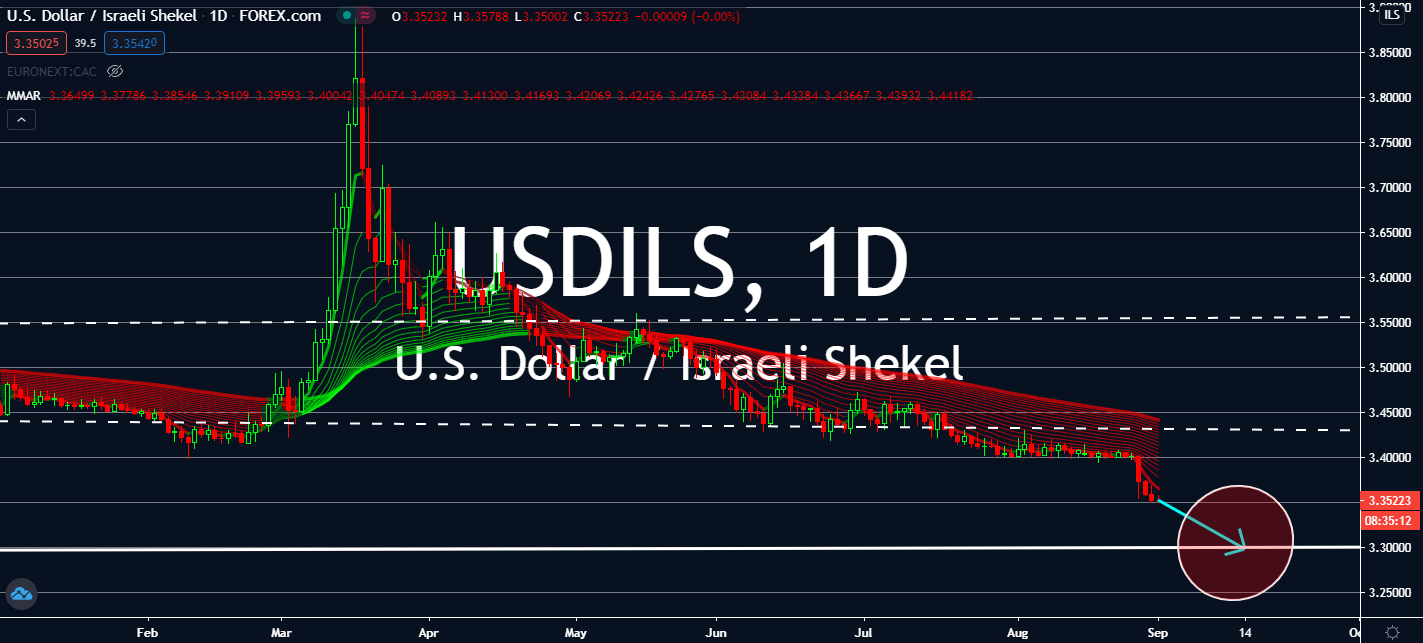

USDILS

The US ISM Manufacturing PMI is projected to report an increase from 54.2 to 54.5 later today. If so, it will indicate that the figure is experiencing growth, since it’s above the 50-point threshold. Moreover, it would be the third consecutive month of growth since it approached the level in May. Its Manufacturing PMI might also report an uptick from 50.9 to 53.9. Technically speaking, spending for the manufacturing sector will determine today’s path against the Israeli shekel. But it’s important to note that the pair had recently seen an abrupt fall to lows similar to what was seen in 2011 when the effects of the Great Recession had lingered. Now that the Federal Reserve is under pressure to implement another stimulus package to help its suffering economy, the Bank of Israel’s claim that its economy doesn’t need central bank interventions in the near future will help its currency more than investors would for the greenback in upcoming sessions.