Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

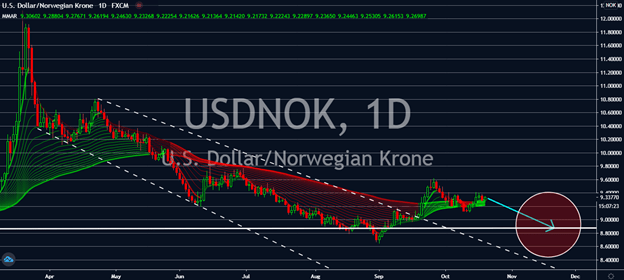

USDNOK

Increasing hopes that the Democratic presidential candidate Joe Biden will win the next election has brought the dollar lower against its peers, and it looks like this will continue the greenback’s current weakness until the end of the elections in November. Expectations of a possible interest rate hike or a surge in oil prices will lift the Norwegian krone as long as the world keeps recovering from the economic effects of the coronavirus. As the world recovers, the oil-dependent economy is projected to follow suit and will continue its surge against bigger currencies, especially the US dollar in the nearer-term. Investors should look out for results regarding the eurozone’s attempt to recover from the pandemic in the region. The uncertainty around the US economy’s recovery has also caused hesitance across the market, which could bleed more as the rest of the world begins to fully reopen and oil prices continue its rise in the long-term.

USDPLN

Corporate wages in Poland increased by 5.6% in September in comparison to the year prior to an average of 5,372 zlotys, or $1,365.93 per month. This was above the market consensus of a 4.5% increase. This optimism will help lift the zloty in the near-term. Although, this looks like a hesitant increase against the greenback. Poland’s economy is starting to decline once again while it’s attempting to rebound from the lockdown lifted in May. Concerns about a second wave of the virus will likely deflate much of the zloty’s increase, which could also result in a fallback in the longer term. In the meantime, the Polish currency is projected to benefit over the possibility of Joe Biden winning the US presidential elections next month, thanks to what could be a better trade relationship between China and the US. Investors should watch out for progress seen for the elections as well as Poland’s progress towards its economic recovery to the end of the year.

USDILS

Pre-election anticipation is projected to pull the greenback lower as its economy continues to suffer from coronavirus unease. The market is keeping an eye on the next move from the Federal Reserve regarding economic stimulus and its efforts to improve employment figures until November 3rd, and it looks like the greenback won’t be ready to increase until then. The Asian market’s reemergence to pre-coronavirus activity has also been taking a toll on the dollar’s near-term safety. Meanwhile, Israel’s progress towards opening its gates towards Arab countries will help its currency increase near-term. The country had just signed a visa treaty with the United Arab Emirates to become Israel’s first agreement with Arab economies. The visa exemption agreement is projected to pump more travel activity for both countries, which will inevitably help the recovery of both countries as Israel hesitantly eases its lockdown measures across the nation.

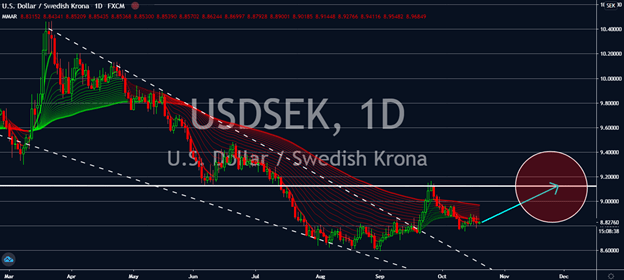

USDSEK

Sweden is reconsidering its so-called herd immunity approach. Regional health authorities in Sweden highly recommended its citizens to avoid high-risk public areas and encouraged residents to avoid getting too close to the elderly and immuno-compromised individuals. Only a day after analysts confirmed of its outrageous average daily coronavirus cases rising by 173%, one of the highest in the world, the Swedish krone is expected to fall with increasing pessimism over its attempt to outlive the coronavirus. The greenback is more likely to lift near-term as the eurozone scrambles to balance its economy and the coronavirus outbreak in the bloc, while the US economy has been more optimistic about any new stimulus packages following the November elections. The greenback has been weak as of late but fortunately, the US economy is rebounding stronger than what economists anticipate for the Swedish counterpart.