Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

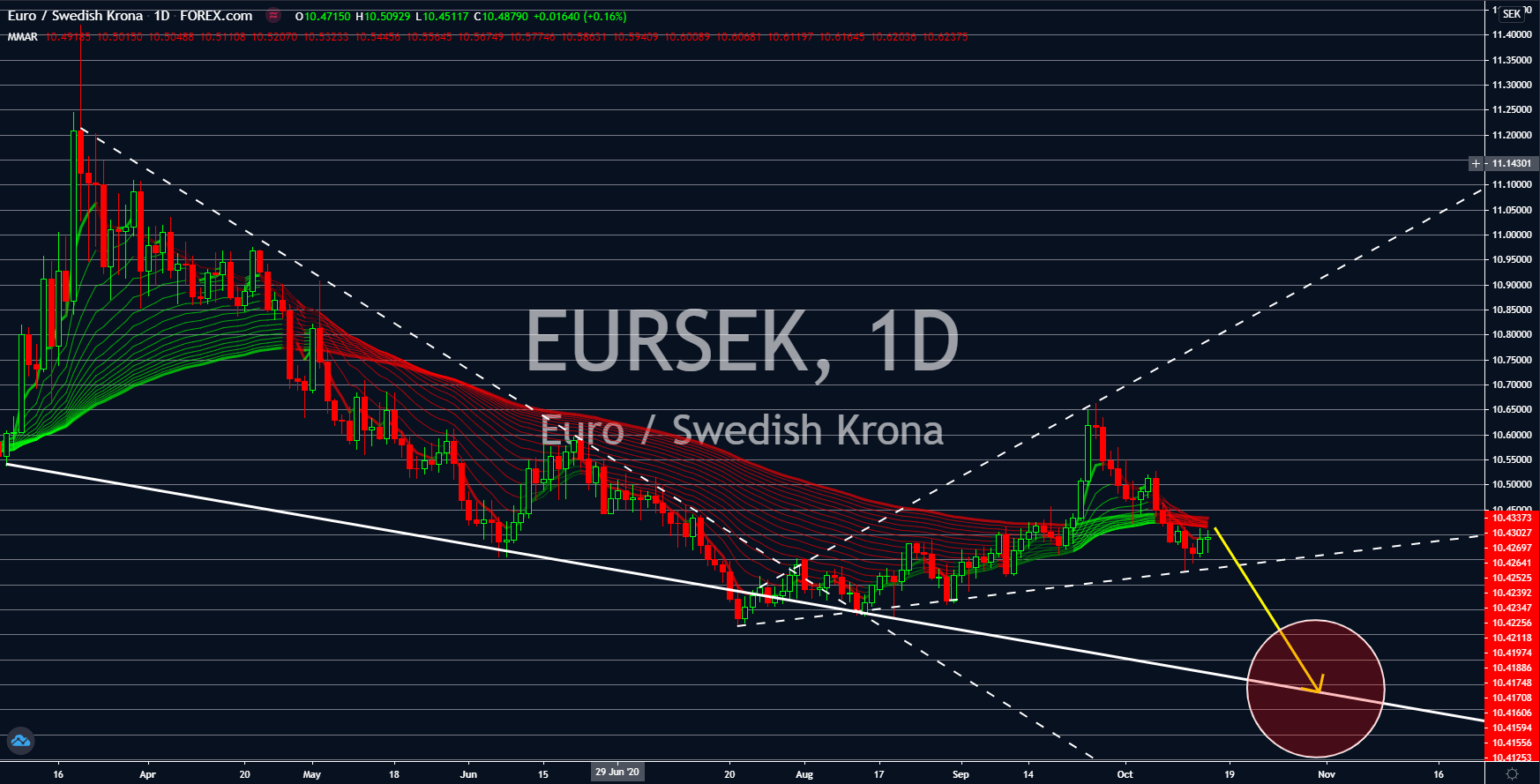

EURSEK

Sweden’s unemployment rate report continues to make progress after posting a 0.5% decline in jobless Swedes. The figure for September came in at 8.3% from 8.8% a month ago. Another reason why investors would continue to increase their holdings of the Swedish koruna was the recent statement from Stefan Nils Magnus Ingves. The governor of Sveriges Riksbank is proposing for the government to change laws to maintain the use of cash in the country. As more economies go digital, the number of physical currencies goes down. This, in turn, makes the currency less stable as the demand for cash cannot be monitored. On the other hand, a pessimistic outlook was given to the Eurozone as the group is set to publish its Consumer Price Index reports on Friday, October 16. Expectations for CPI YoY was -0.3%, the same figure it had in the September preliminary report. The same is true for Core CPI YoY with 0.2% expectations.

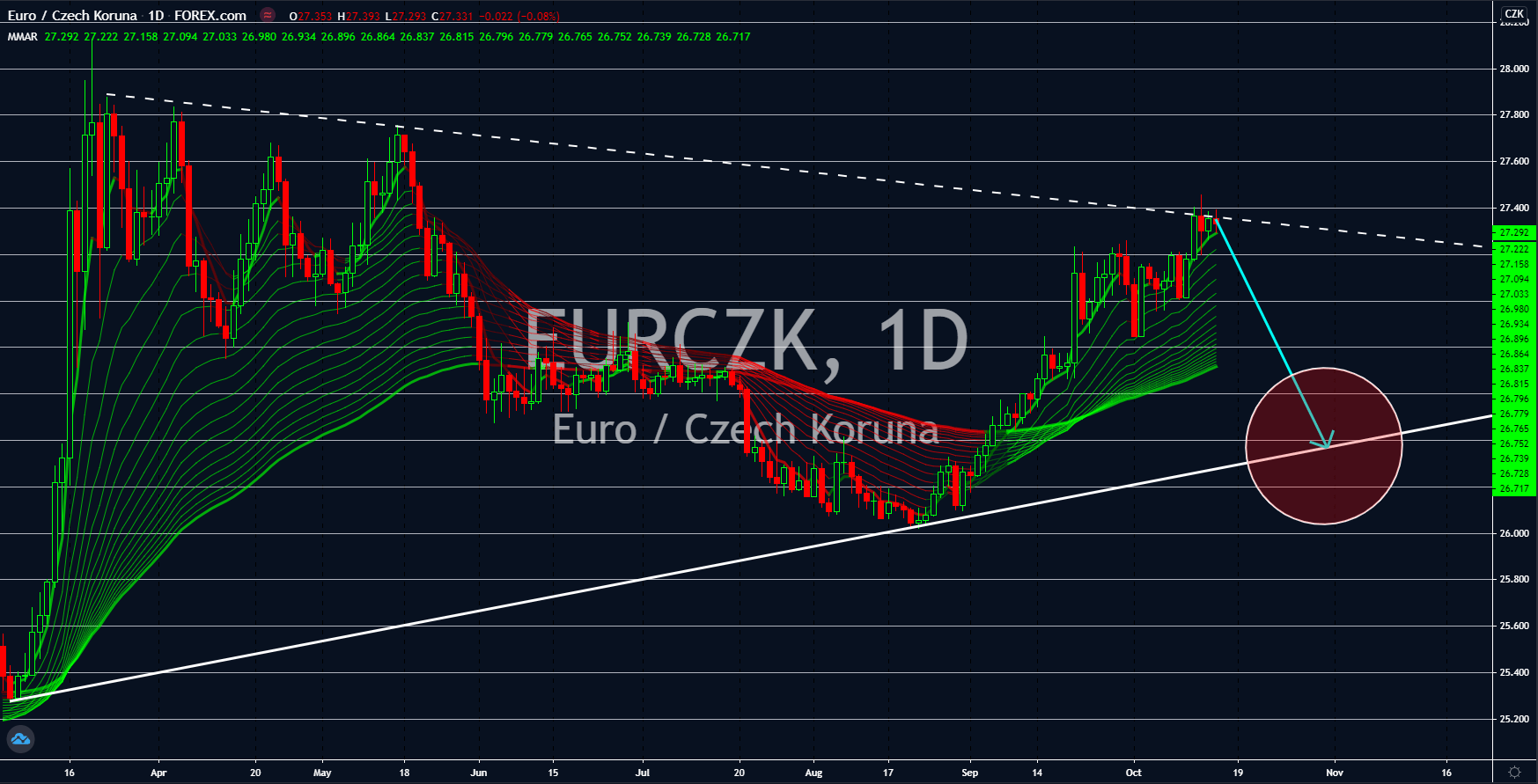

EURCZK

Financial institutions have been downgrading Germany’s economic growth forecast amidst the growing daily cases of COVID-19. The EU’s largest economy is experiencing a spike in the number of new coronavirus cases with a daily figure reaching 5,000 individuals. Expectations from 5 think tanks showed Germany contracting by 5.4% for fiscal 2020. This was higher than the initial forecast of 4.2% back in April. Meanwhile, Germany’s GDP for 2021 is expected to expand by 4.7%, also lower than the initial estimates of 5.8%. Moreover, 2022 forecasted growth will be much slower at 2.2%. This, in turn, is expected to cause a major sell-off in the EURCZK pair. On the other hand, signs of recovery were seen in the Czech Republic following its Producer Price Index (PPI) reports. Figures for MoM in today’s report came in at 0.2% from 0.3% in August. Meanwhile, the year-over-year result was -0.4%, a slight improvement from -0.5% a month ago.

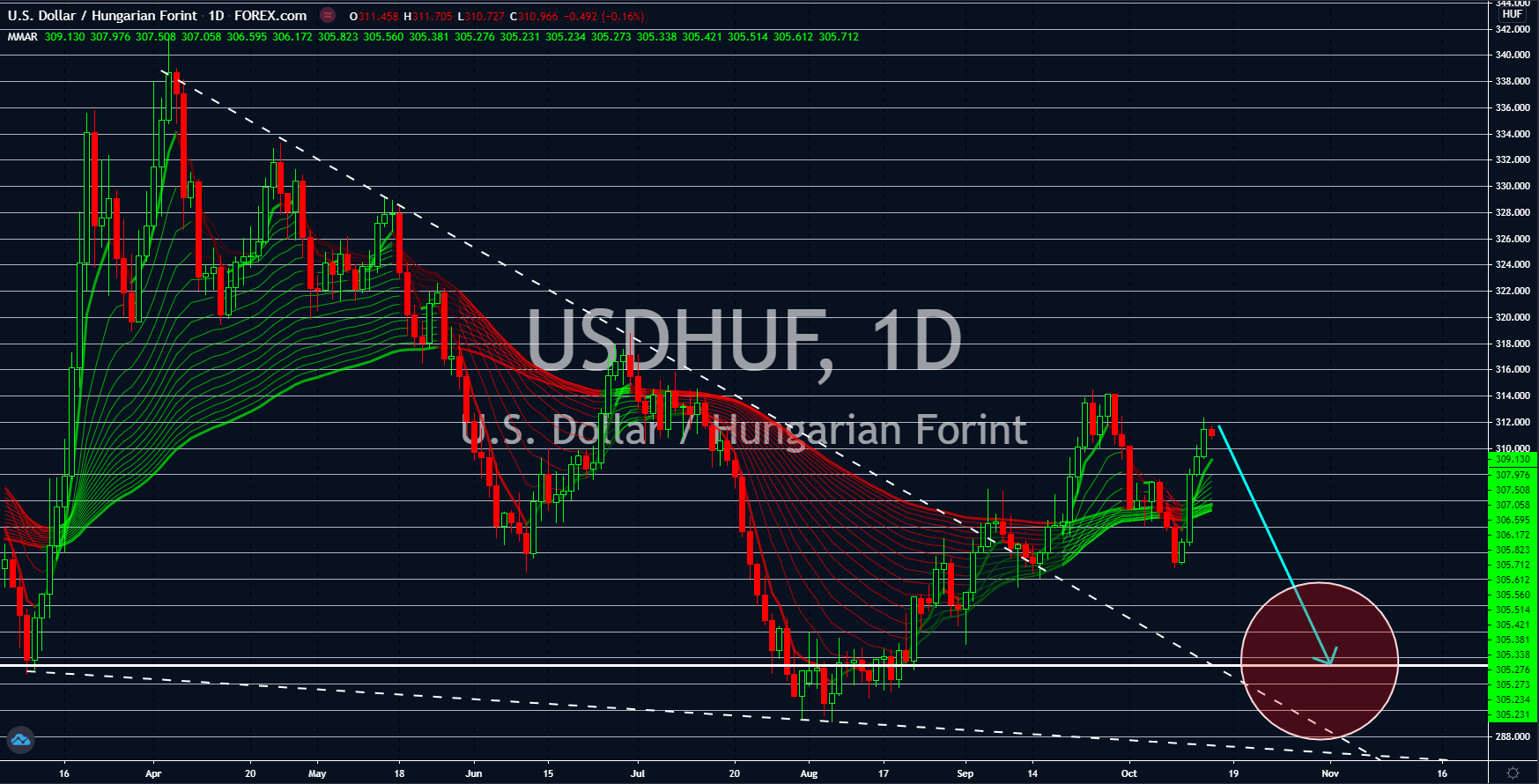

USDHUF

The IMF has revised its outlook for Hungary and downgraded its forecast for the country’s GDP growth for 2020 and 2021. In its previous report back in April, the financial institution projected a 3.1% contraction in the current year followed by a recovery of 4.2% by 2021. However, the past six (6) months has caused some major changes in these projections. The International Monetary Fund now only expects a 3.9% growth next year while it provided a bleaker outlook of 6.1% GDP decline in fiscal 2020. Despite this, investors are expected to increase their holdings of the Hungarian forint. The catalyst for this was Prime Minister Viktor Orban’s reintroduction of a lower VAT for housing projects until 2022 by 5.0%. Moreover, the government is offering almost $10,000 for families who will renovate their houses. The Hungarian government is expecting these measures to boost the country’s economic recovery efforts.

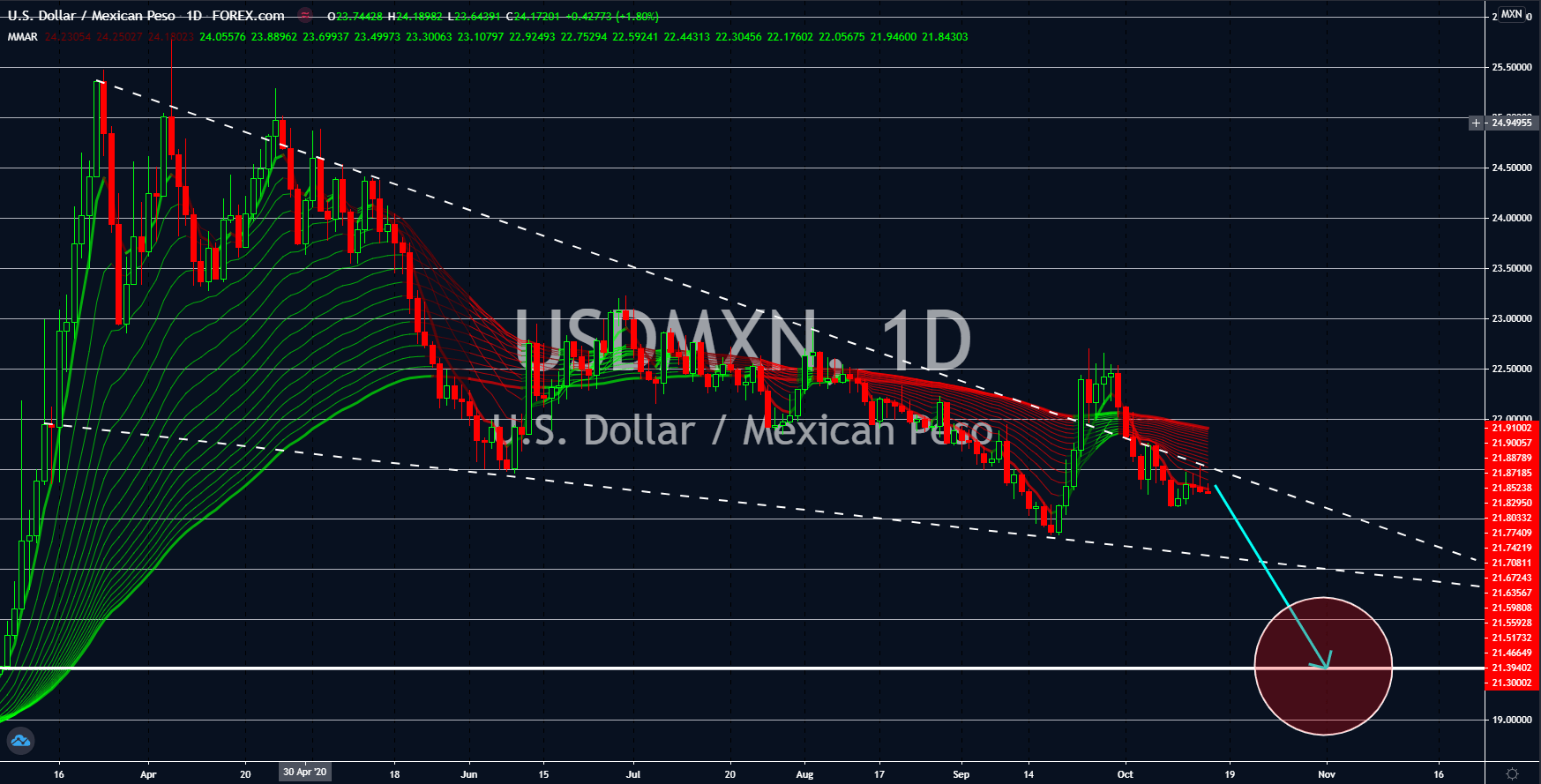

USDMXN

The Mexican economy will outperform its neighbour, the United States. The Central American country is projected to record a 6.5% GDP growth QoQ for the third quarter of the fiscal year. Fitch Ratings further teased investors after saying that the actual growth figure could be higher. The rating agency highlighted the robust recovery in Mexico’s industrial production as the catalyst for the third quarter. Fitch is expecting a 21.7% expansion in the industrial production report quarter-over-quarter. On the other hand, the disappointing US initial jobless claims report on Thursday, October 15, will further drive the USDMXN pair lower. The actual figure of 898K came in higher than the previous week’s 840K result. Meanwhile, analysts were expecting a much lower number at 825K. Higher uncertainty must be expected by USD investors next week due to the postponement of negotiations for the proposed $2.2 trillion additional stimulus.