Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

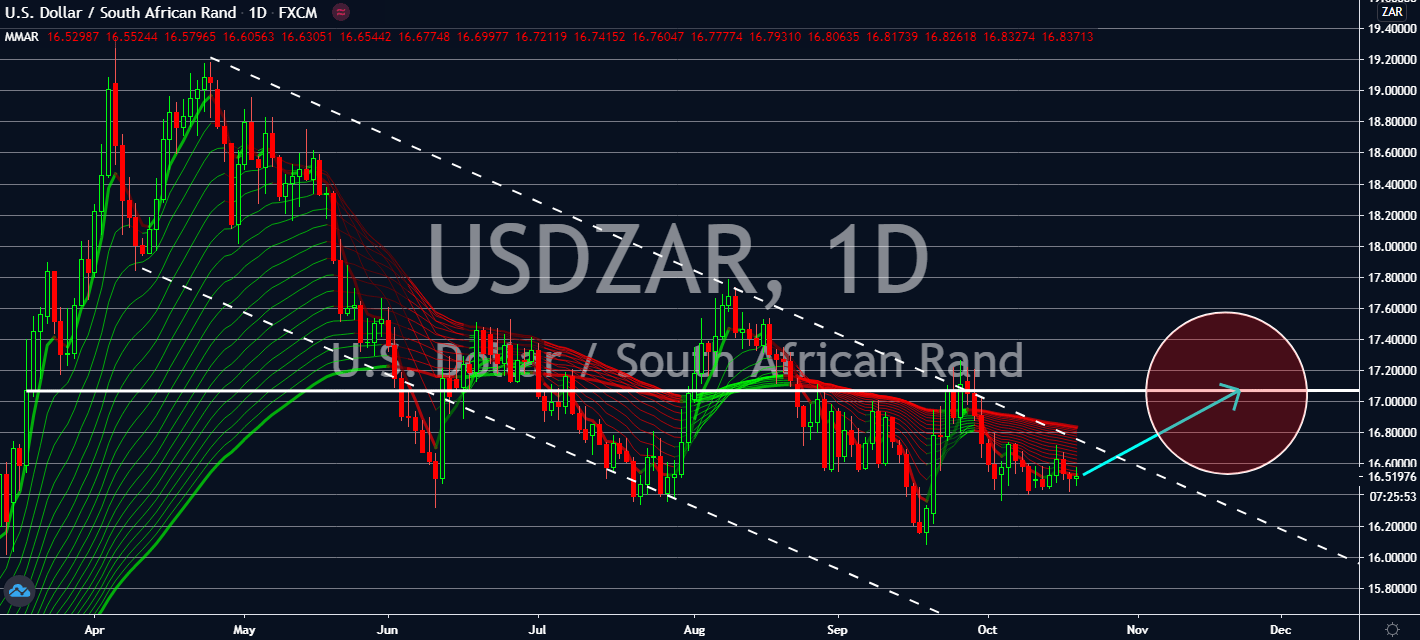

USDZAR

The South African rand is likely to fall against the US dollar in the near-term. Broader risk sentiment is likely to stop as the deadline for a US coronavirus stimulus package approaches. It looks like investors will likely want to benefit from the greenback’s sell-off from the past few weeks as the uncertain environment around the packages ignites the need for safer assets. The United States’ Building Permits also came in better than the market initially expected, a sign that the housing sector has been improving for the past month. From the 476 million recorded previously, the Census Bureau announced that the figure had risen to 1.553 million, which is 23 million more than the market’s consensus of 1.520 million beforehand. The positive result is likely to benefit the outlook for the US economy in the near-term, inevitably helping the greenback lift as risk aversion prevails until the historic election rolls around next month.

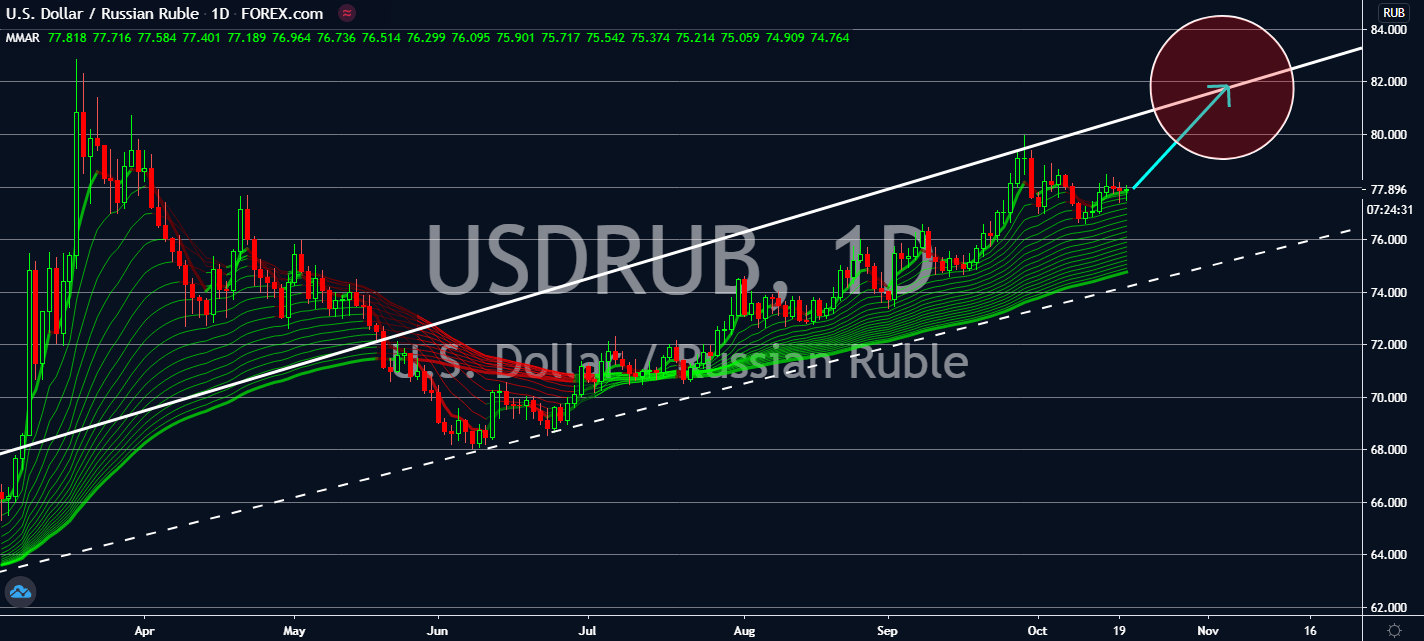

USDRUB

The Organization of the Petroleum Exporting Countries is anticipating a large surplus of oil production at the beginning of 2021, which will be around the estimated time when the coronavirus vaccine will be out. Although most of the participating economies are holding back on producing oil for this period, Russia has been one of the few countries that refused to cut its own production. In fact, it continues to pump out as it did before the coronavirus took over the globe. The market will only be able to take 1.9 million barrels per day from OPEC+ in the near-term or at least until January of next year. The threat of another coronavirus wave around the world is likely to keep the market engaged in the greenback as Russia continues to sink into its own outbreak, contrary to the now-improving US economy as it approaches its presidential elections on November 3. Another stimulus package in the US should also help lift the dollar by then.

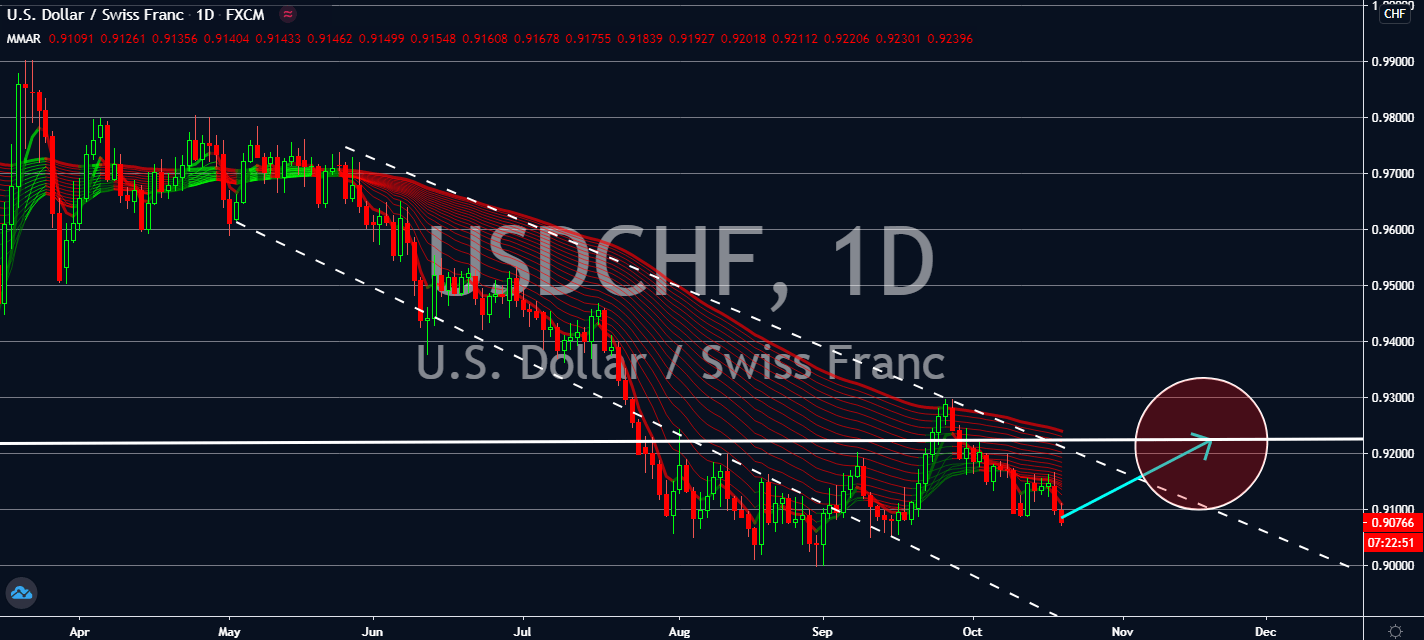

USDCHF

Swiss President Simonetta Sommaruga announces new COVID-19 measures on Monday, October 15, as Switzerland records the highest daily coronavirus cases in the region. In the past week, local transmission of the deadly virus rose by 146 percent alarming public officials of a second wave of the coronavirus pandemic. This news is untimely for Switzerland as it published a disappointing trade balance report today. The trade surplus for the month of September went down from $3.543 billion to $3.279 billion. Analysts are now expecting the trade surplus to narrow as the new restrictions will limit trading activities. On the other hand, despite the overall uncertainty in the US economy, the greenback is expected to advance in the coming sessions. The catalyst for this was the recent reports on the housing market. Building permits for the previous month went up by 5.2% representing 1.553 million additional permits.

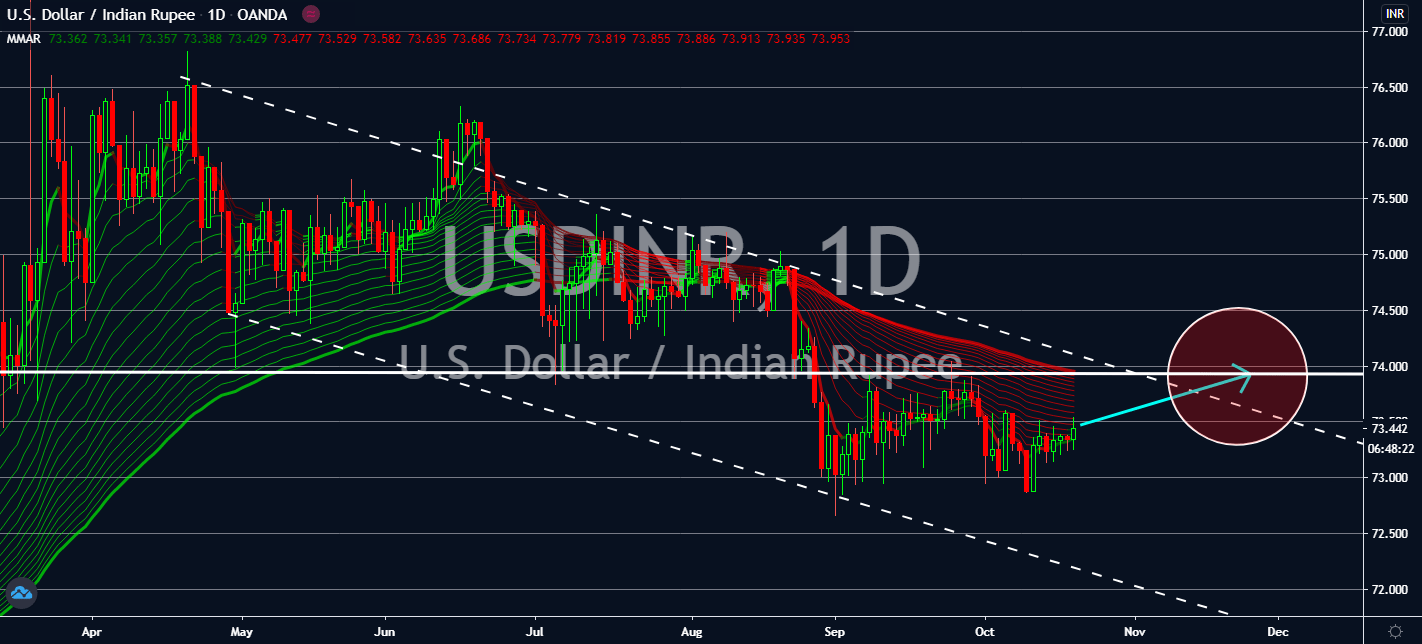

USDINR

Improving figures in the US economy is projected to push the greenback up against its riskier markets. The US had reported notable improvements for its housing sector earlier today, and it looks like this will ignite optimism for the greenback in the near-term. Building Permits grew by 5.2 percent as per the recent announcement, which showed an increase to 1.553 million more permits within the month. Consensus had called for a growth of 1.8% in September after the figure had fallen by 0.5% in August. Housing Starts, on the other hand, increased by 1.9% in the same month. Although this was lower than analysts’ expectations of a 2.8% growth, this was still good news when compared to the 6.7% decline seen the month prior. These will likely be the main driver of the pair’s increase as House Speaker Pelosi and the US Treasury continue their talks for another stimulus package less than a month before the presidential elections.