Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

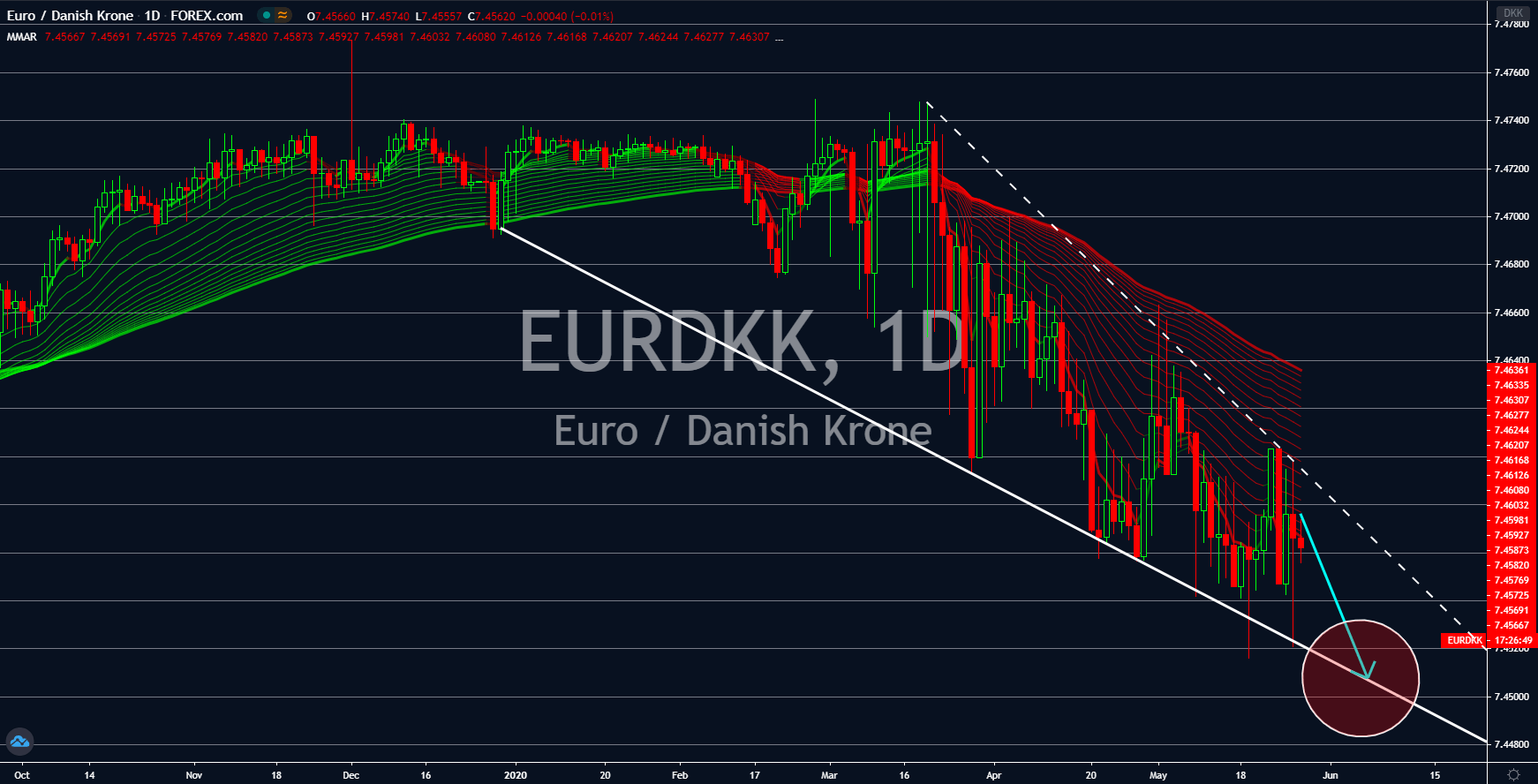

EURDKK

The gloomy outlook in Europe just got darker. On Tuesday, May 26, Denmark announced that it is expecting an economic decline of 5.3% this year compared to the 1.5% contraction expected prior to the coronavirus pandemic. Despite the biggest economic decline in Denmark since WWII, analysts are optimistic that the country will thrive against other countries in Europe. Their comments came after ECB President Christine Lagarde gave a speech yesterday. She said the European Union is heading towards an 8% to 12% contraction this 2020 due to lockdown bought by the virus. During her speech, she also said that the European Commission will unleash $750 billion worth of stimulus. In March, the ECB already injected $750 billion into the EU economy. However, considering the size of the EU, the total of $1.5 trillion will not be enough. The US government and its central bank cumulatively injected $6 trillion in the American economy.

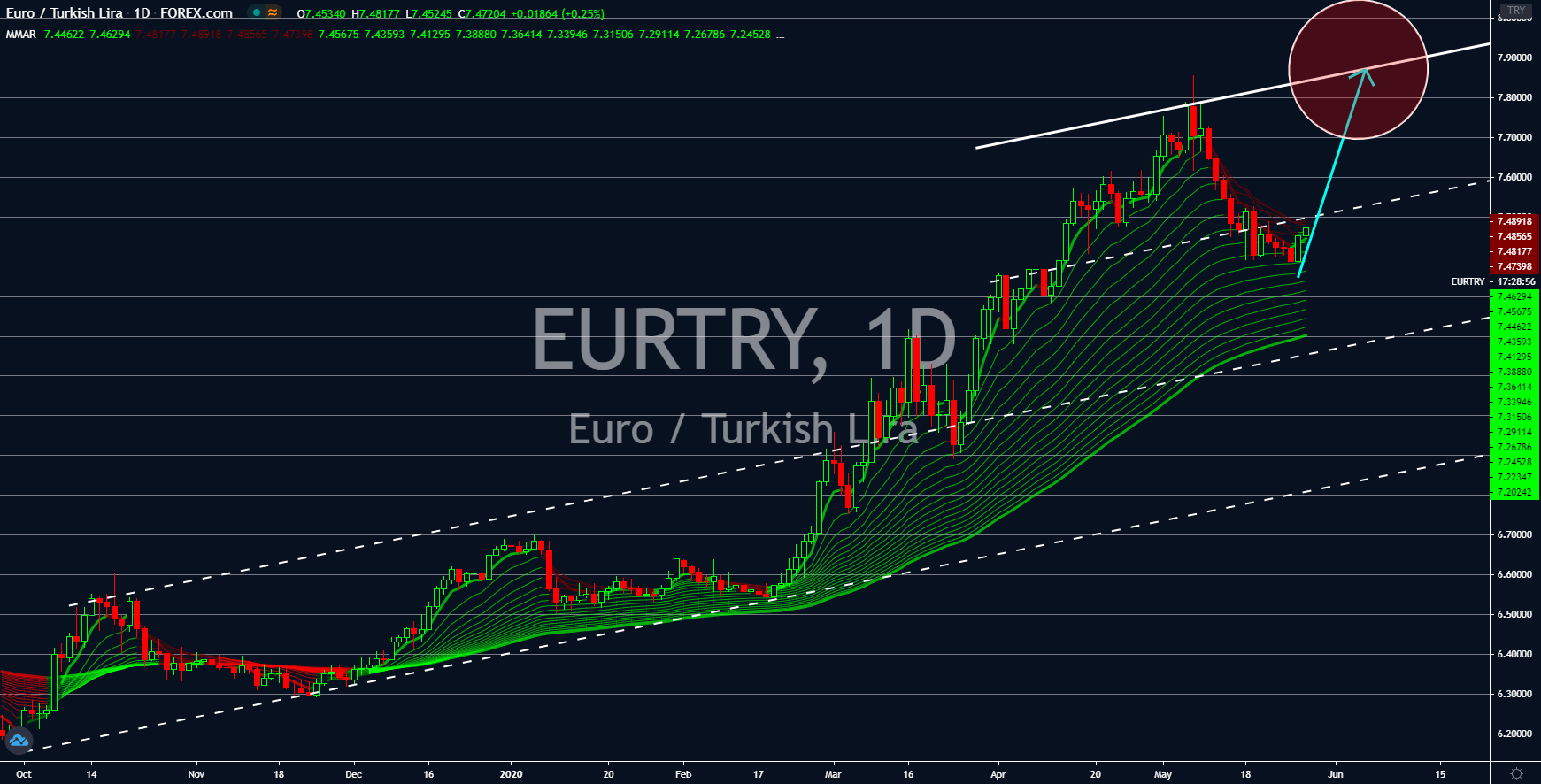

EURTRY

Europe is heading to a recession which will dwarf the 2008 Global Financial Crisis. This was the gist of European Central Bank President Christine Lagarde in her speech yesterday, May 28. However, Turkey might be heading worse than a recession with the latest report on the country’s economic health. Turkey will need to pay $169 billion of foreign debt over the next 12 months. However, the country’s dollar reserve and gold only totals to $84 billion. Analysts were suggesting for the country to ask for a loan from the International Monetary Fund (IMF). However, its populist leader President Recep Tayyip Erdogan vowed never to ask from the international financial institution, which bothered investors. Instead, Turkey turns out to credit swap facility with other counties to keep the Turkish lira afloat. In 2018, the refusal of Erdogan to seek loans from IMF triggered a meltdown in lira, resulting in an increase in inflation and unemployment.

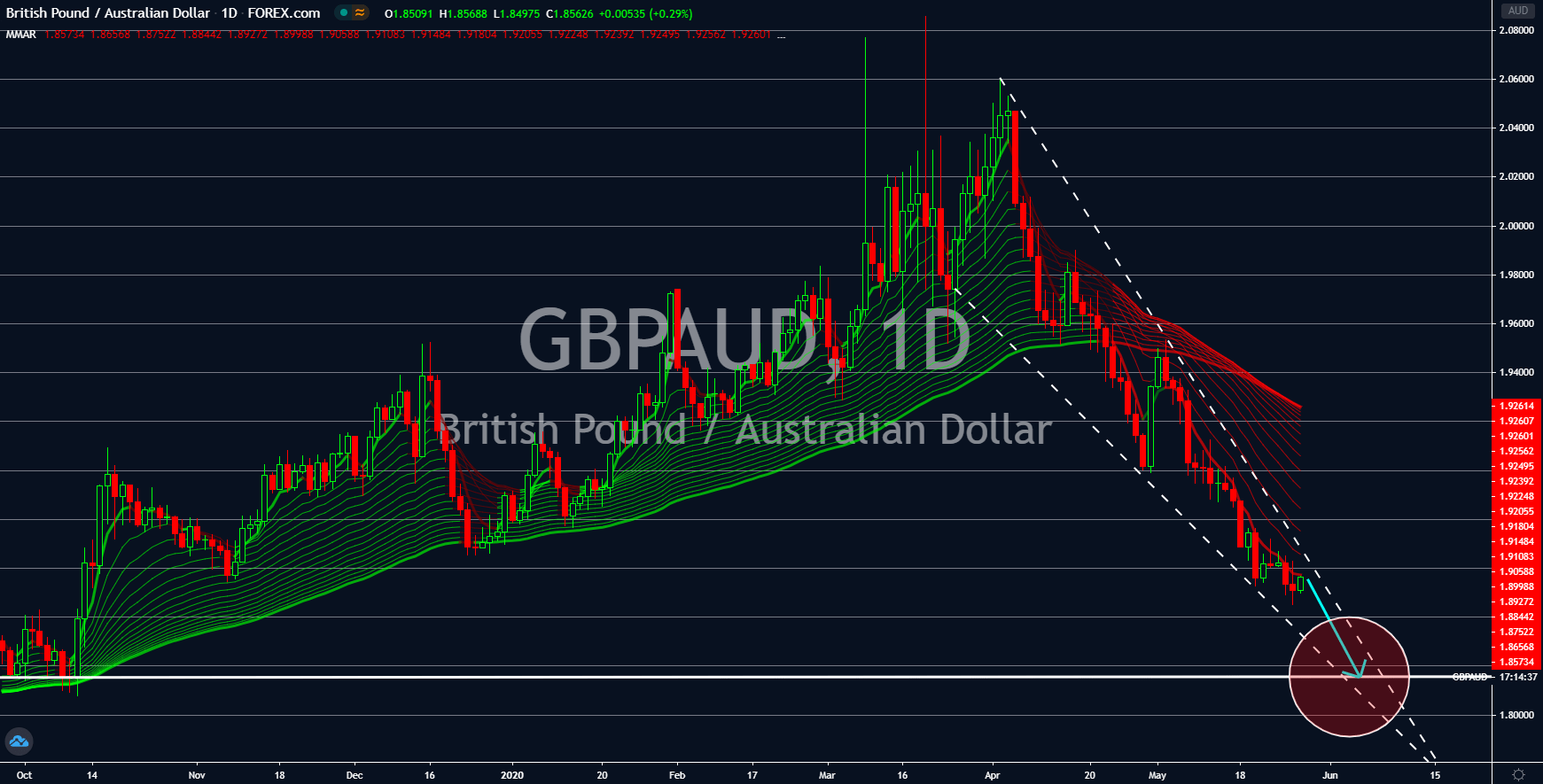

GBPAUD

An optimistic outlook was brought by the Reserve Bank of Australia Governor Philip Lowe in his speech today. The central bank chief said Australia is likely to contract by 6% while unemployment could shoot up to 9% this year due to the coronavirus pandemic. However, he reiterated that the RBA will never turn to negative interest rates and/or additional quantitative easing to stir economic activity. This was after the country reopened its economy and lifted several lockdown restrictions. The central bank is currently sitting at 0.25% benchmark interest rate. Meanwhile, the United Kingdom is struggling to stay afloat due to a double whammy of events. In Q1 2020, the country’s economy shrunk by 2.0% partly due to the coronavirus and mostly from its divorce from the largest trading bloc in the world. However, analysts warned that Q2 GDP result will be in a freefall as the full-blown effect of the pandemic would surface.

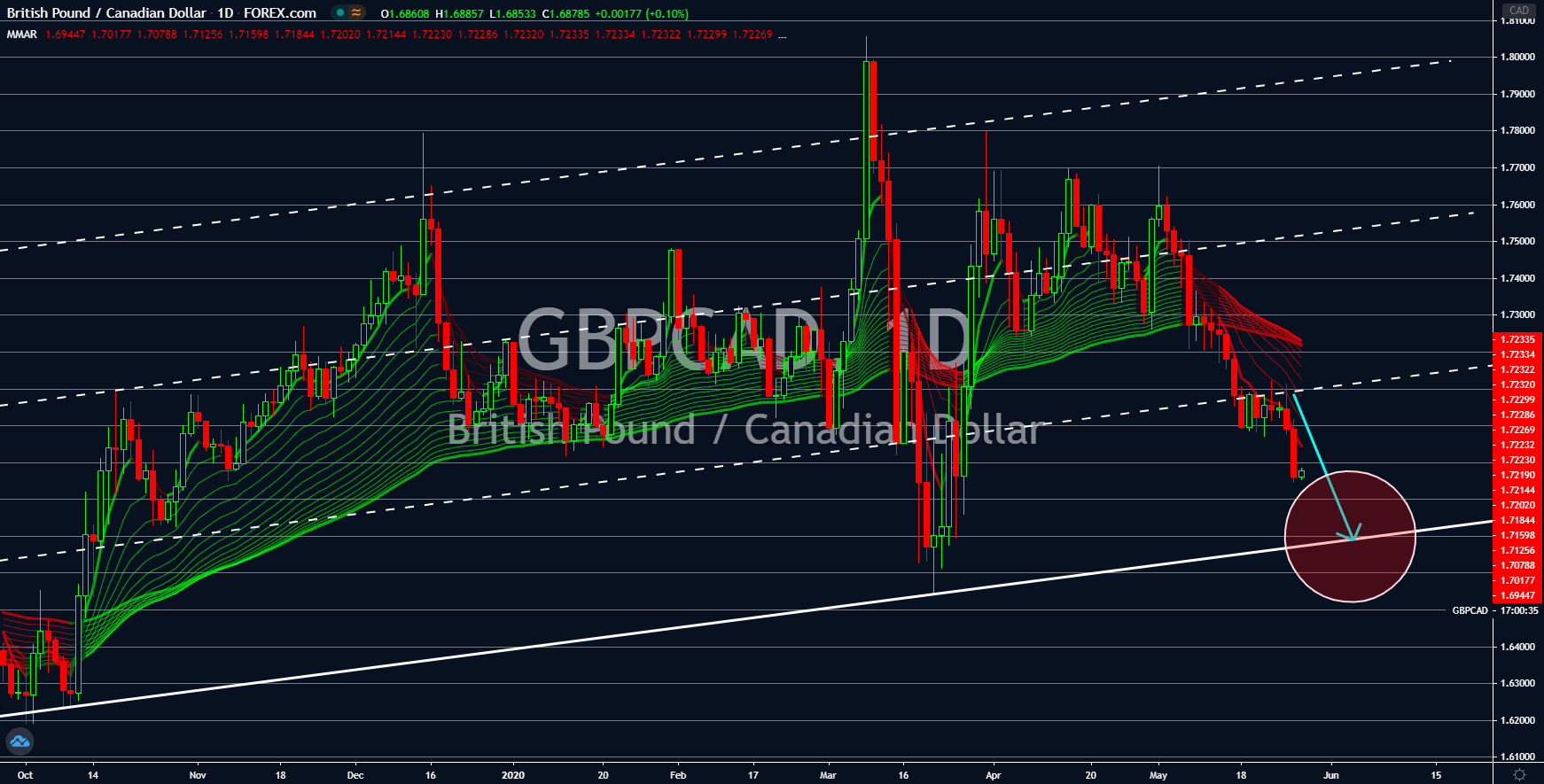

GBPCAD

The Conference Board of Canada gave a pessimistic outlook for the country’s second quarter and annual GDP growth. At the same time, it gave investors a much-needed confidence for the succeeding quarters. The CBC expects an economic contraction of 4% this year with the Q2 report having the steepest decline of 25%. However, the organization reassured its citizens and investors that Canada is up for a rebound in the third quarter of fiscal 2020. The clarity in Canada’s economic outlook is expected to result in continued momentum for the Canadian dollar against the British pound. In the United Kingdom, officials are still scrambling on how to contain the coronavirus pandemic in the country. The UK has now the fifth largest cases of coronavirus, which is higher than Spain, Italy, and Germany. Aside from this, Britain is still in a lockdown, increasing the prospect that the UK economy will experience a double recession in the coming quarters.