Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

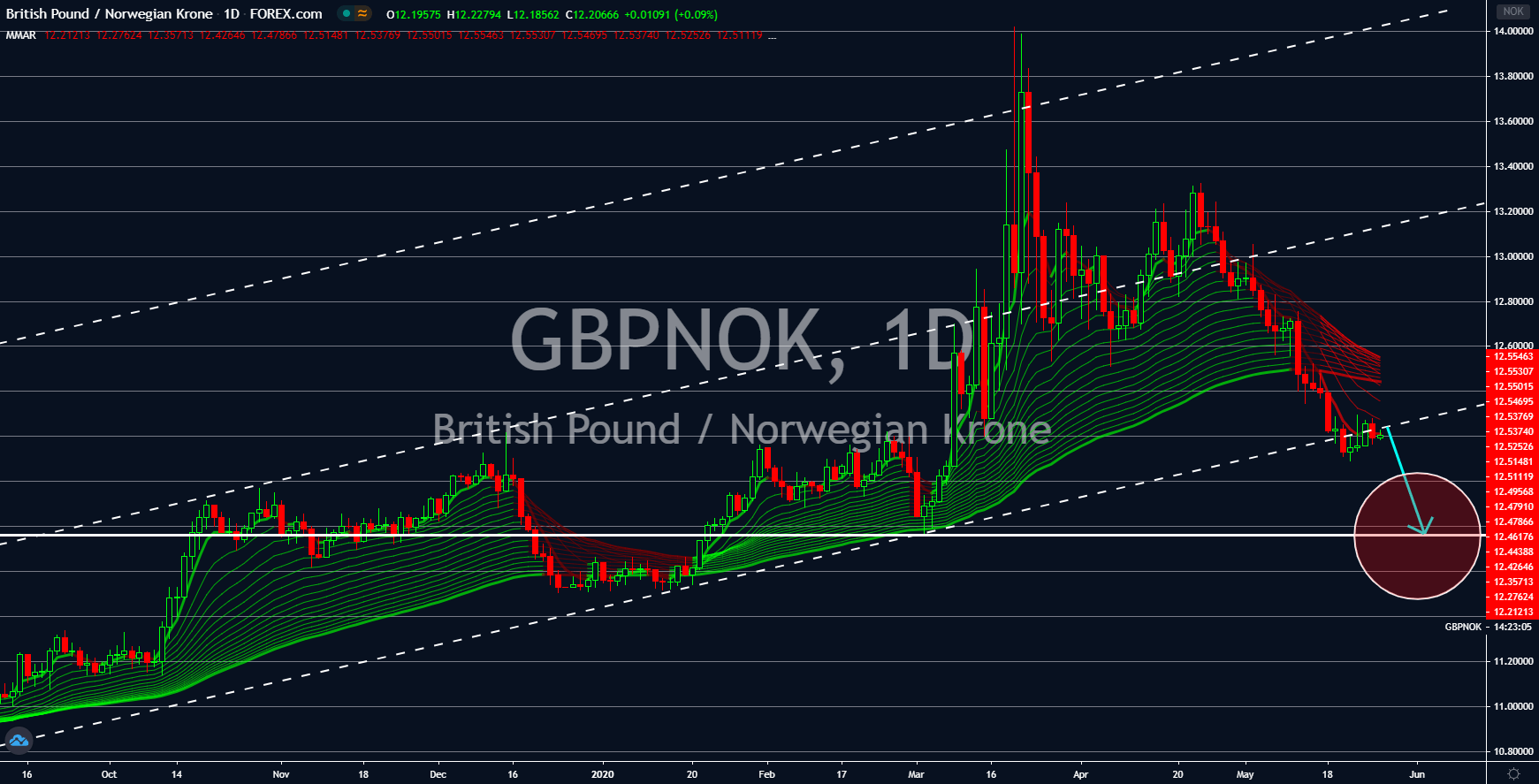

GBPNOK

With no plan of easing the lockdown restrictions soon in hindsight, the British economy will continue to bleed. The United Kingdom has now the highest number of coronavirus cases in Europe at 265,000 and 37,000 thousand deaths. The UK also surpassed Spain, Italy, and France to become the fourth most infected country in the world. Despite the recovery from the coronavirus pandemic in Europe, Britain’s cases continue to rise. This prompted investors to abandon the sixth largest economy in the world since March, which was fully reflected in the decline of the British pound. The Bank of England tried to calm investors after it announced that it is expecting a V-shape recovery in the country. However, this statement was shrugged off by investors of the Norwegian krone. The recovery in Europe and crude oil prices is expected to boost Norway’s economy in the coming months.

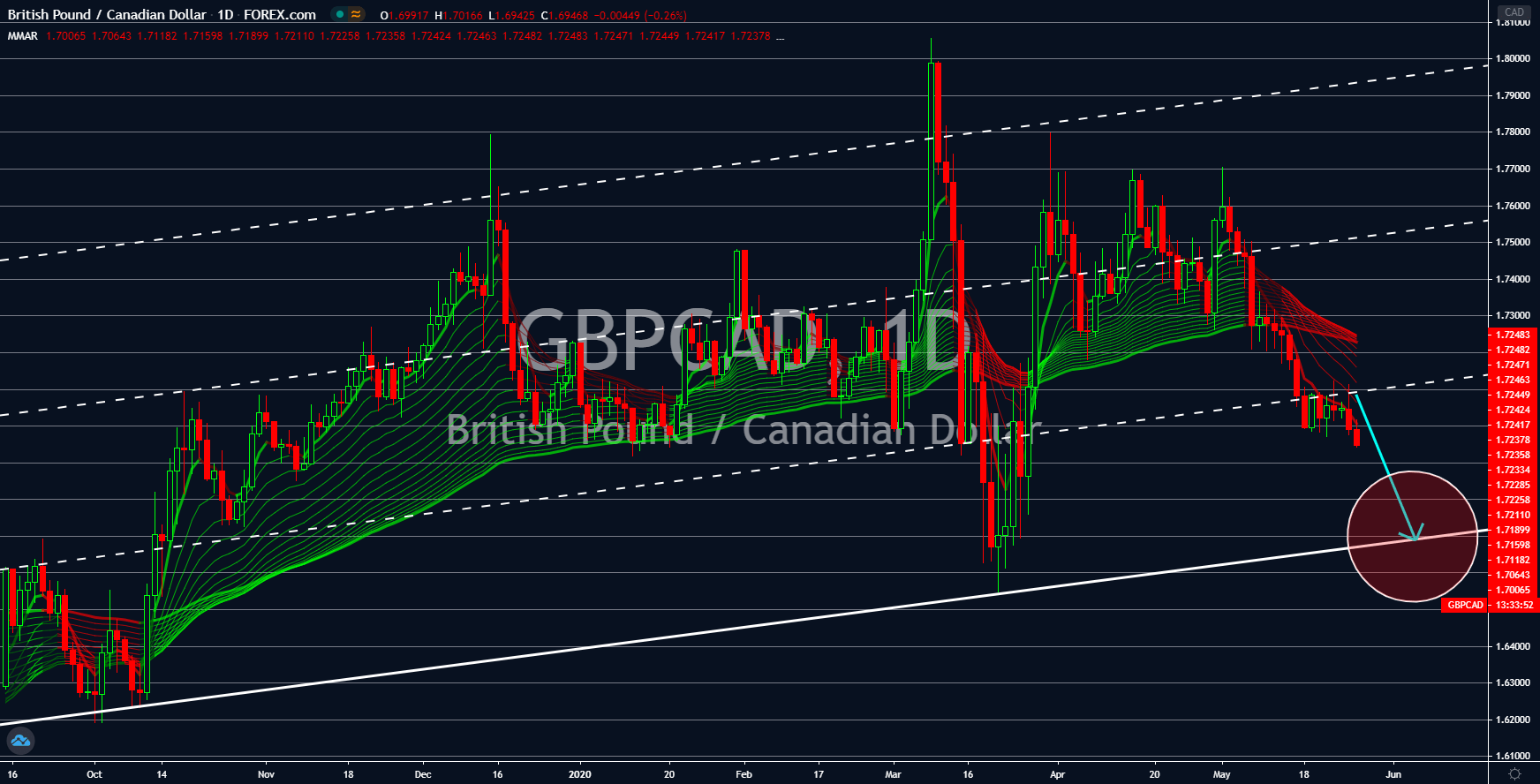

GBPCAD

A strong message from Bank of Canada Governor Stephen Poloz will help the Canadian dollar to thrive in the coming sessions. Governor Poloz said the BOC is ready to increase liquidity in the market if needed to stir economic activity and achieve the central bank’s target for the country’s inflation rate. Meanwhile, investors were not convinced with Bank of England Governor Andrew Bailey that a robust economic recovery in the United Kingdom will happen in the coming months. This was amid the continued increase of coronavirus cases in the country despite most of European economies successfully flattening their COVID-19 cases’ curve. As a neighboring country, Canada is expected to benefit from the record-breaking fiscal stimulus introduced by the US government and the Federal Reserves. Meanwhile, the rift between the United Kingdom and the European Union continues after the UK leaves the bloc on January 31.

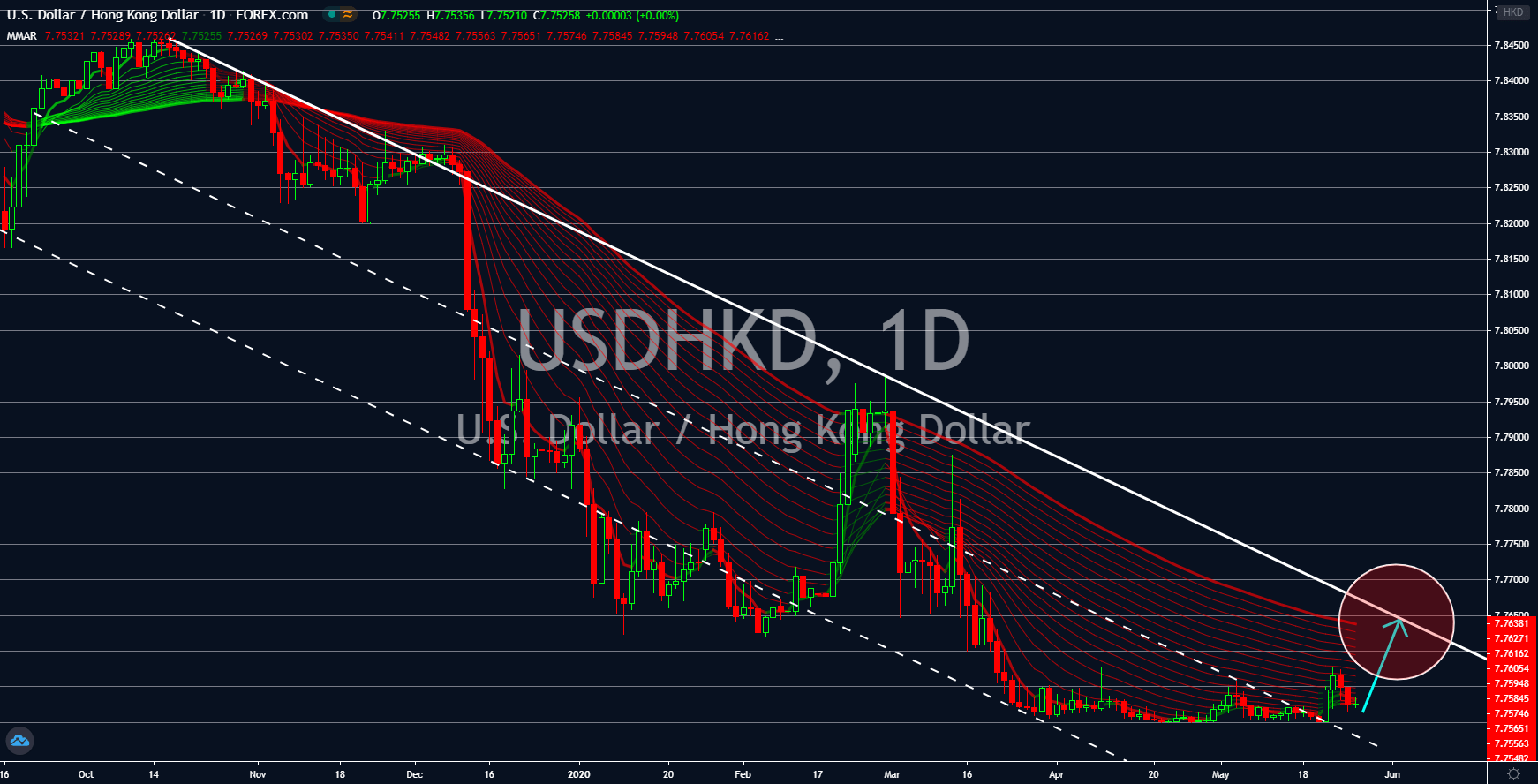

USDHKD

The renewed tension between the United States and China will spell the end of Hong Kong dollar’s dominance. As the US economy continues to struggle due to the coronavirus pandemic, President Trump shifted his focus to China. The US president accused Beijing of intentionally creating the virus in Wuhan to destabilize its enemy. Trump further added that he might reimpose sanctions and increase tariffs to Chinese officials and products. China debunked this claim and warned that it will hit back to the US if it proceeds with its threats. As the world continues to keep their economies afloat, China has been advancing its interest. China recently introduced a law ending the special status of Hong Kong as a special administrative region (SAR). This is expected to cause tension with the US who has a special trading relationship with HK prior to the British turnover of Hong Kong to the Chinese government in 1997.

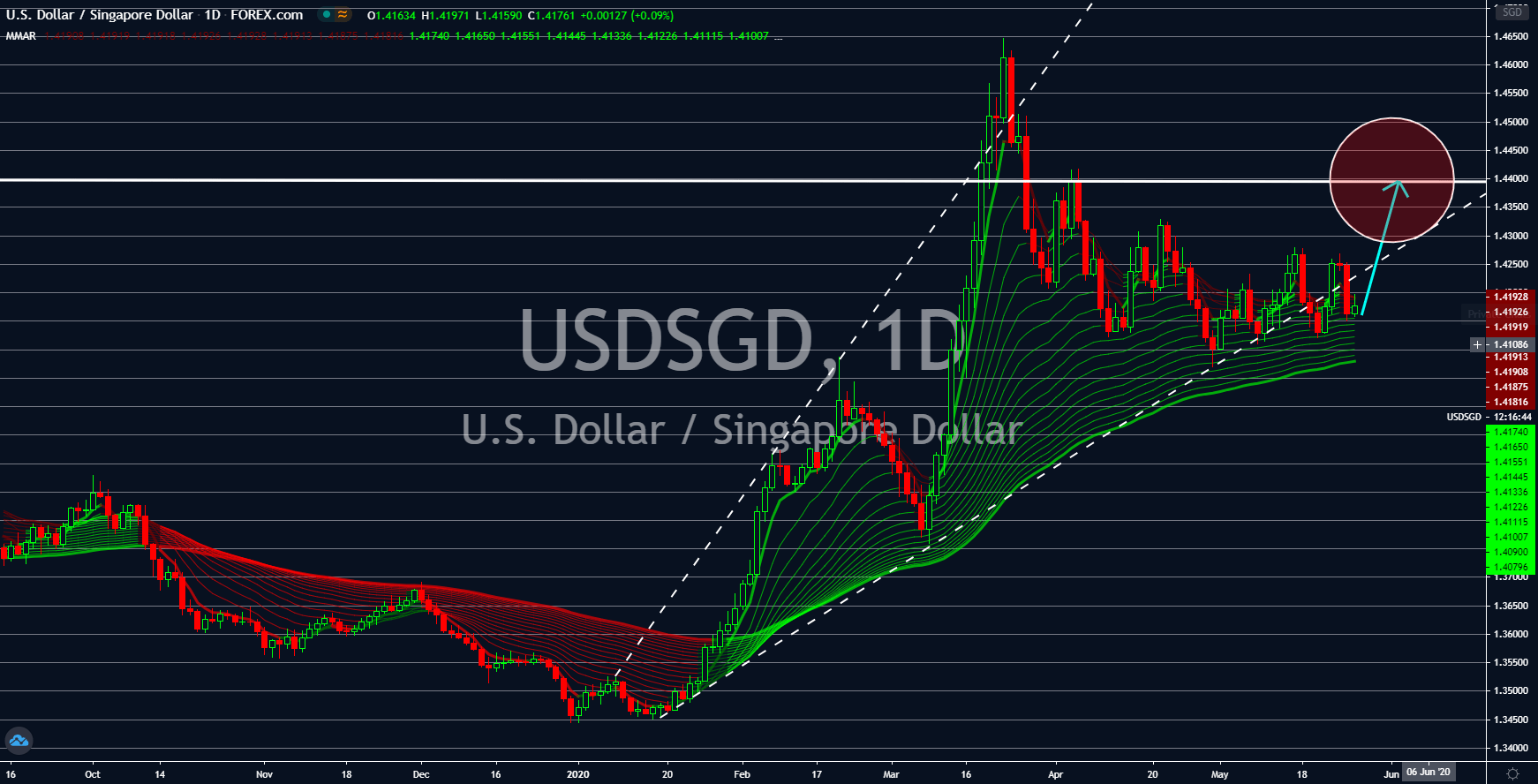

USDSGD

Singapore revised its economic forecast for the third time as the effect of the coronavirus bites into one of Southeast Asia’s largest economies. Singapore is now expecting an economic growth decline between 4.0% to 7.0%. The last projection was a decline of 1.0% to 4.0%. This will send Singapore on its deepest decline since the Dot-com bubble in 2001. To combat the coronavirus pandemic’s effect to its economy, the Singapore government unveiled its fourth package of fiscal stimulus. The $23 billion will be distributed to businesses as most countries begin lifting their lockdown and reopen their economy. In total, Singapore had injected $70 billion to its economy. However, analysts are divided if this figure is enough to stop its economy from further bleeding. In the US, the government and the Federal Reserve cumulatively injected $6 trillion to its economy. This shows that US institutions will fight to maintain its economic dominance.