Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

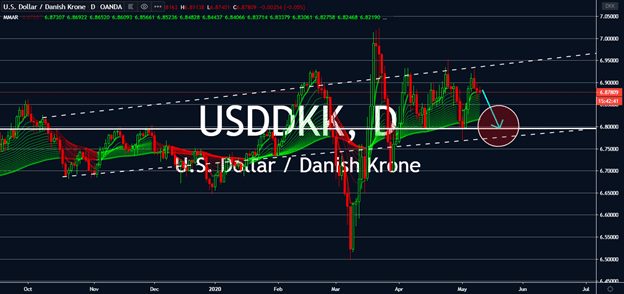

EURDKK

Inner conflict in the eurozone is pushing the single currency down against most of its rivals in the near-term. The weekend after Germany’s ruling that the European Central Bank overstepped its mandate with bond purchases, the European Commission is expected to retaliate. Reports emerge of a possible legal case over its manufacturing capital before the German Constitutional Court’s three-month deadline for the agency to prove its stimulus scheme’s effectivity throughout the eurozone. Meanwhile, Denmark’s benchmark rate is still treading around the negative territory to stimulate its economy. The Danish government is looking to lift most of its remaining lockdown measures by June, which could push its currency above the euro especially if the EU and Germany continue their conflicts. For now, the market is waiting for both economies’ GDP announcement for the first quarter of 2020 this upcoming Friday.

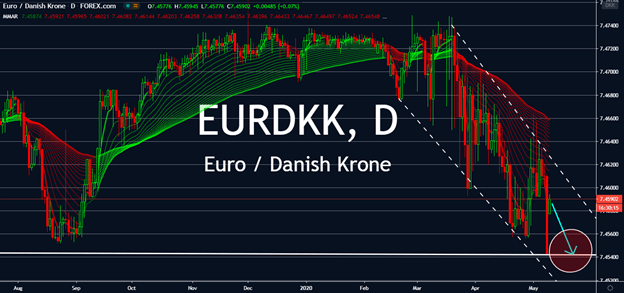

EURTRY

Europe’s journey might have been on track for a rocky three months since last week, the Turkish government seems to do worse. It blocked three banks from transacting with lira after its currency hit a record low against the US dollar last Thursday. Some traders insist that the Federal Reserve’s comment about extending swap facilities to Turkey and others in need will put pressure on the lira in the short term. Local experts claim that it’s now going through a “currency crisis,” in which its central bank was burning through its forex reserves at a faster pace more than most market central banks. Sovereign debt risk rose to a one-month high last week, as well. Now, Turkey faces a relatively high $170 billion in external debt costs this year. Especially now, markets do not trust monetary policy in Turkey courtesy of comment from officials such as its President Tayyip Erdogan, who showed an aversion to interest rates altogether.

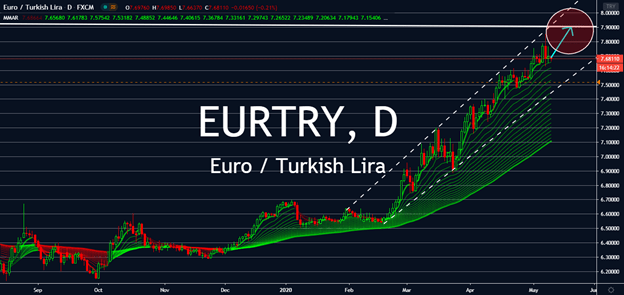

GBPAUD

Investors don’t look too optimistic for the risk-sensitive Australian dollar, near-term. The Reserve Bank of Australia said unemployment would hit 10 percent by the end of this year and claims this would remain high until the end of 2021. It did also forecast a V-shaped recovery, however, where once the country recovered from the health crisis, economic losses would rebound back to its old figures. England is going through the same thing as it announced a positive outlook despite a dire economic situation. The UK is facing its worst economic meltdown in 300 years, but the Bank of England claimed its recovery would be just as quick as its downfall. In the meantime, investors are looking forward to the UK’s Core CPI figures for April in a yearly comparison on Wednesday. Although the region is expected to see a slight fall near-term, the GBPAUD pair is expected to recover into its previous support levels as its new resistance levels following after.

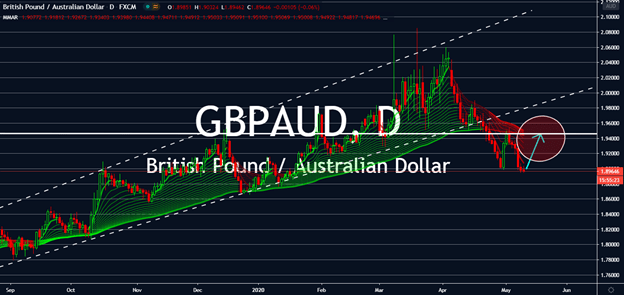

USDDKK

The USDDKK pair continues to trade sideways after a deep V in earlier trading, but the US dollar might see the overly familiar 6.8 territories as Denmark begins to reopen its economy. As long as the stock market continues to see its frequent highs against the greenback, its currency is expected to trade lower than its rivals near-term. Wall Street analysts expect the market to see the Federal Reserve deducting its benchmark interest rates to negative territories by April 2021, which was called “the last resort” for its economic slumps brought by the coronavirus. Moreover, the US dollar seems risk-sensitive not only against other currencies, but also its gold exchanges under renewed downside pressure in the second half of last week due to poor figures in US payrolls. Plus, the market is busy looking at how the US President Donald Trump continues to deal with US-China trade tensions over China’s handling of the coronavirus crisis.