Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

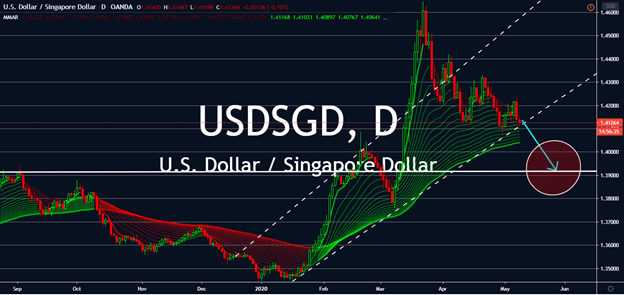

GBPNOK

The Bank of England kept its interest rate at 0.10% at its monetary meeting yesterday, which usually signals sufficient economic recovery from the economy. However, experts believe this isn’t the case near-term for the sterling. The slight rise in last month’s record low for the currency was dubbed as nothing more than a “blip” in what’s to come this year. In fact, Duncan Brock, Group Director at CIPS, claims that April’s figures are even more worrying because they haven’t reached the pandemic’s peak yet. The Norwegian krone rose yesterday despite seeing no expansion in the Norwegian labor market, which economists believe were mostly from volatile commodity swings. The country’s heavy reliance on oil and gas production remains as the pair’s main driver, with easing lockdown levels worldwide used as a boost to the krone until England sees the aftermath of its deteriorating economy amid the pandemic.

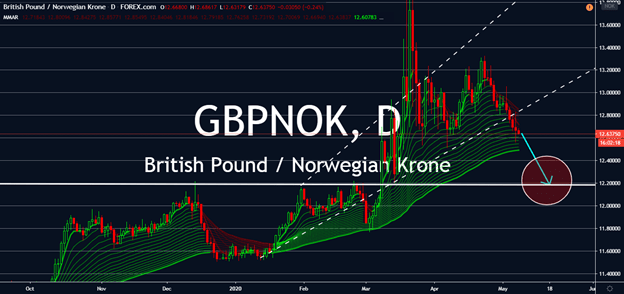

GBPCAD

The sterling-loonie has been one of the few flat exchanges in the foreign exchange market amid the coronavirus economy. A few days ago, the Bank of England initiated a short-term boost for its currency against the Canadian dollar for hopes that the BoE could extend quantitative easing, but the central bank is likely to extend asset purchases, instead. The United Kingdom has been slower than most countries to announce reopening its economy, weighing on its economy especially against oil-dependent Canada. Namely, its own economy was left somewhat flat compared to the eventful BoE since it announced unemployment figures in April. Reopening economies and rising demand for oil will influence oil-dependent economies like Canada to rise up against weakening economies like the UK, or at least until it reopens businesses in the country to stimulate fiscal movements against the coronavirus.

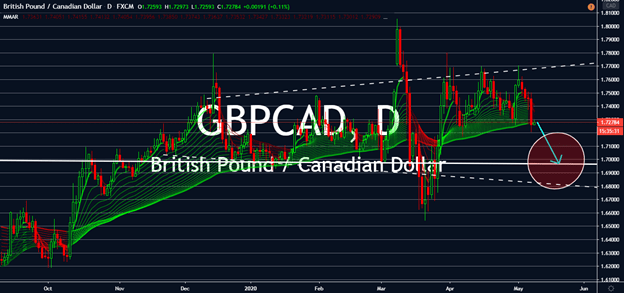

USDHKD

After reaching 2016 lows, the USDHKD pair has been trading sideways since March. But recent figures in Hong Kong looks like it’s going to lead its own dollar down in the long term. The city’s central bank refuses to lower its interest rates, which usually makes selling the greenback for HKD a profitable trade. However, it might have failed to address the fact that its economy shrank by 8.9% for three months ending March compared to the same quarter in 2019. The Hong Kong Monetary Authority is adding funds to defend it, but it looks like it wouldn’t be enough, mostly because investor confidence wouldn’t return for its currency. Since the city experienced massive disruptions led by anti-government protests during the second half of 2019, the figure is expected to lower even further, at least until the pandemic is over. Obviously, this wouldn’t happen near-term, putting the greenback higher against HKD in the near future.

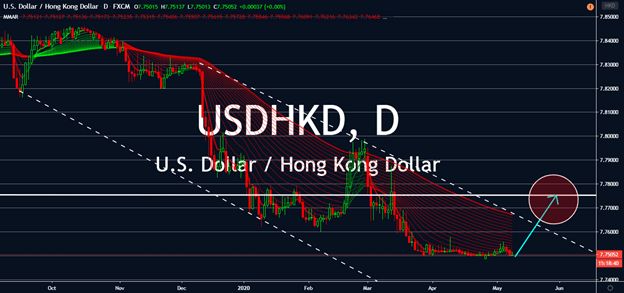

USDSGD

The ringgit opened higher than the US dollar earlier today on better demand for the currency. The greenback is on broader weakness near-term due to US President Donald Trump’s tariff threats against China, but experts believe this was also led by weaker yields, as the 10-year US treasury yield is down by 10%. The ringgit also higher trades against other major currencies after falling slightly on Wednesday. Although Singapore’s official PMI fell to 44.7 in April compared to the expected 40.0, its currency is still expected to trade higher than the US dollar near-term due to easing lockdowns in the country. If the country reports better figures as the reopening takes effect, this path will continue. However, if the recent stimulus packages from the Federal Reserve proves effective or if the United States somehow reopens some major businesses, the US dollar might see gains, but its status as the coronavirus epicenter looks like it won’t wrap up soon.