Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

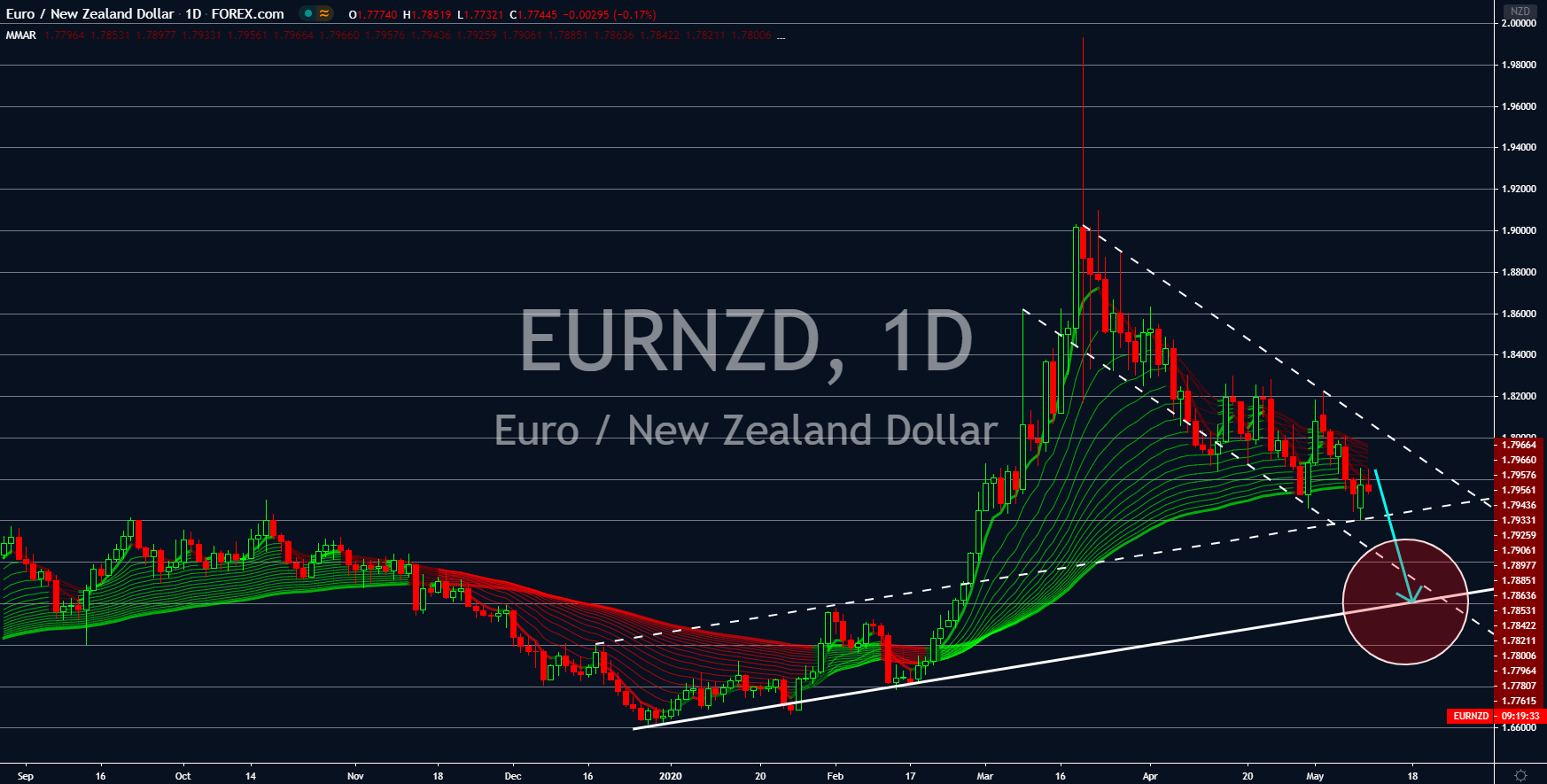

GBPNZD

The British pound will continue its April weakness this month as the United Kingdom faces its worst economic performance in three (3) centuries. The coronavirus pandemic is adding pessimism to the British economy following its weak economic data brought by Brexit. Its withdrawal was supposed to bring economic abundance to the country, but reports show the UK slowing down due to this decision. The weakness was further intensified by the economic threat of COVID-19. Bank of England (BOE) already warned investors that the United Kingdom’s economic output might plunge by 14% this 2020. In addition to this, an independent economist of the British government said 2020 GDP could decline by 35% with 2 million projected unemployment. As countries continue to suffer from the pandemic, New Zealand will be reopening its economy. This attracts investors along with the announcement yesterday by New Zealand PM Jacinda Ardern.

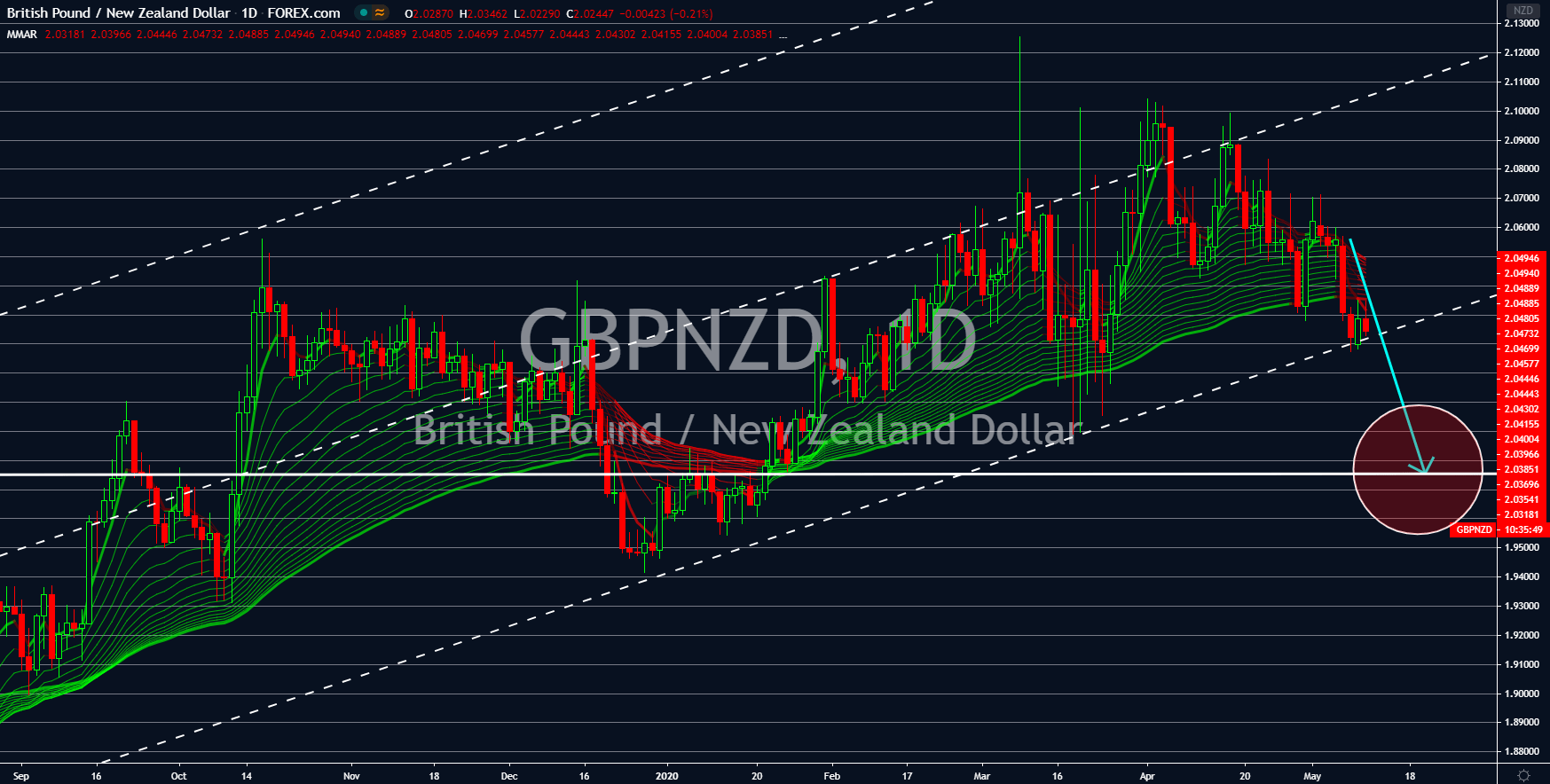

USDCNH

Tension between the two (2) largest economies in the world is once again threatening the stability of the global market. In the previous days, the US government has been attacking China with economic threats. US officials said China downplayed the coronavirus and failed to warn countries with the possible implication of the virus. Furthermore, the US accuses China of hiding the real number of coronavirus cases in the country. Yesterday, May 11, US President Donald Trump said he is not interested in negotiating the next phase of trade deal between the two (2) countries. China retaliated and said that it might invalidate the phase one trade deal. Furthermore, a new report shows Chinese investment in the US dropping to its lowest level since 2009. The US dollar will continue to be firm against a basket of major currencies. The action made by the US government and its central bank shows how far the US is willing to go to defend its economy.

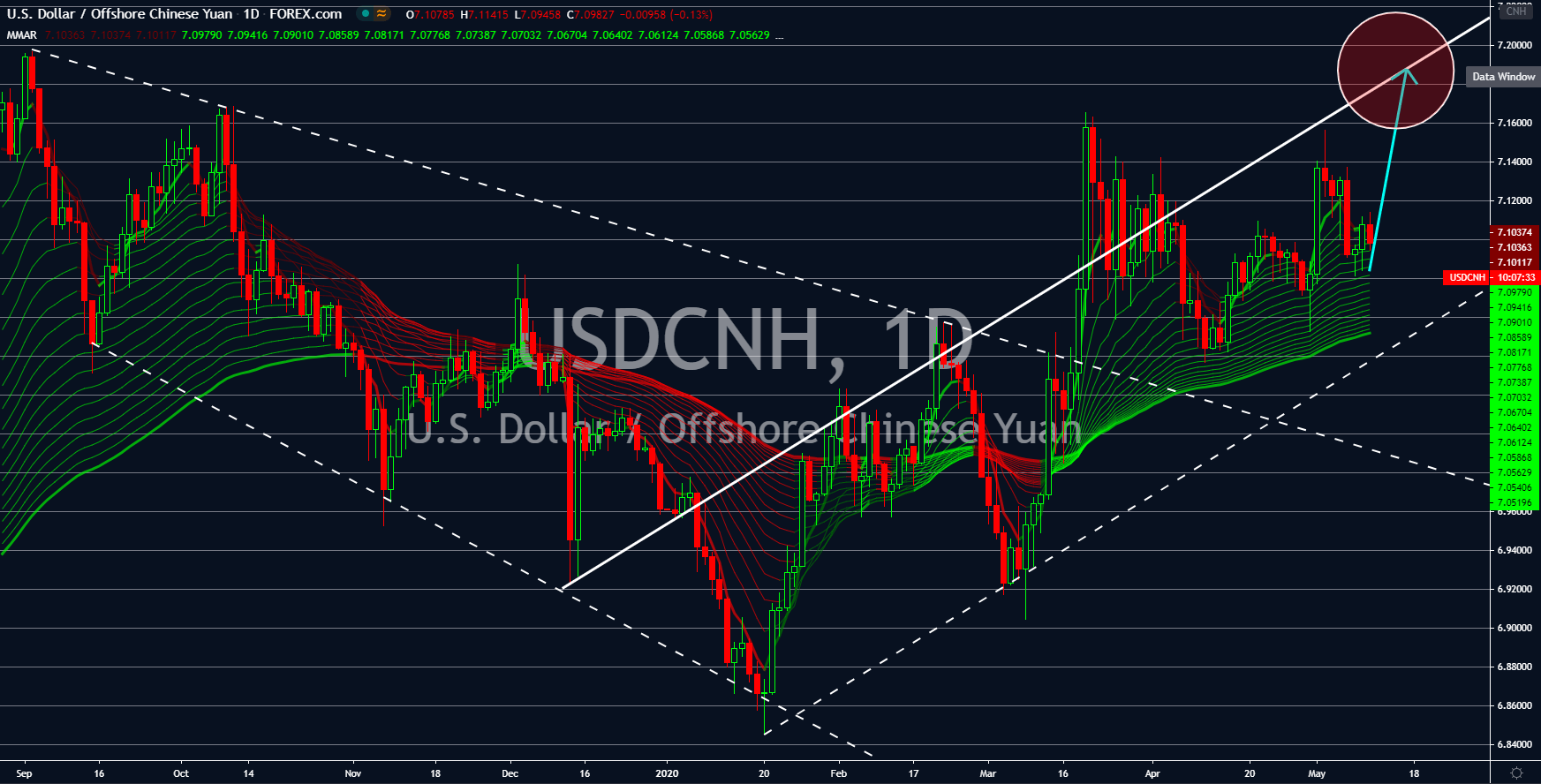

USDTRY

The short-term strength of the Turkish lira is about to end. Lira has been in a winning streak against the US dollar for four (4) consecutive days. This was after Turkey’s president, Recep Tayyip Erdogan, ended his spat with three (3) foreign banks. The ban of these banks was due to the accusations made by Erdogan that they are trying to sabotage the country’s economy. Despite its winning streak against the greenback, the Turkish lira will see its value to continue to diminish in the coming days. The prospect of introducing the phase 4 stimulus package by the US government has made the US dollar attractive among investors looking for a safe-haven asset. The continued intervention of the US government in its economy convinced investors that the Trump administration will not let the US economy go down. In other news, Turkey has been rebuilding the US-Turkey relations following their political and economic disagreements in the past years.

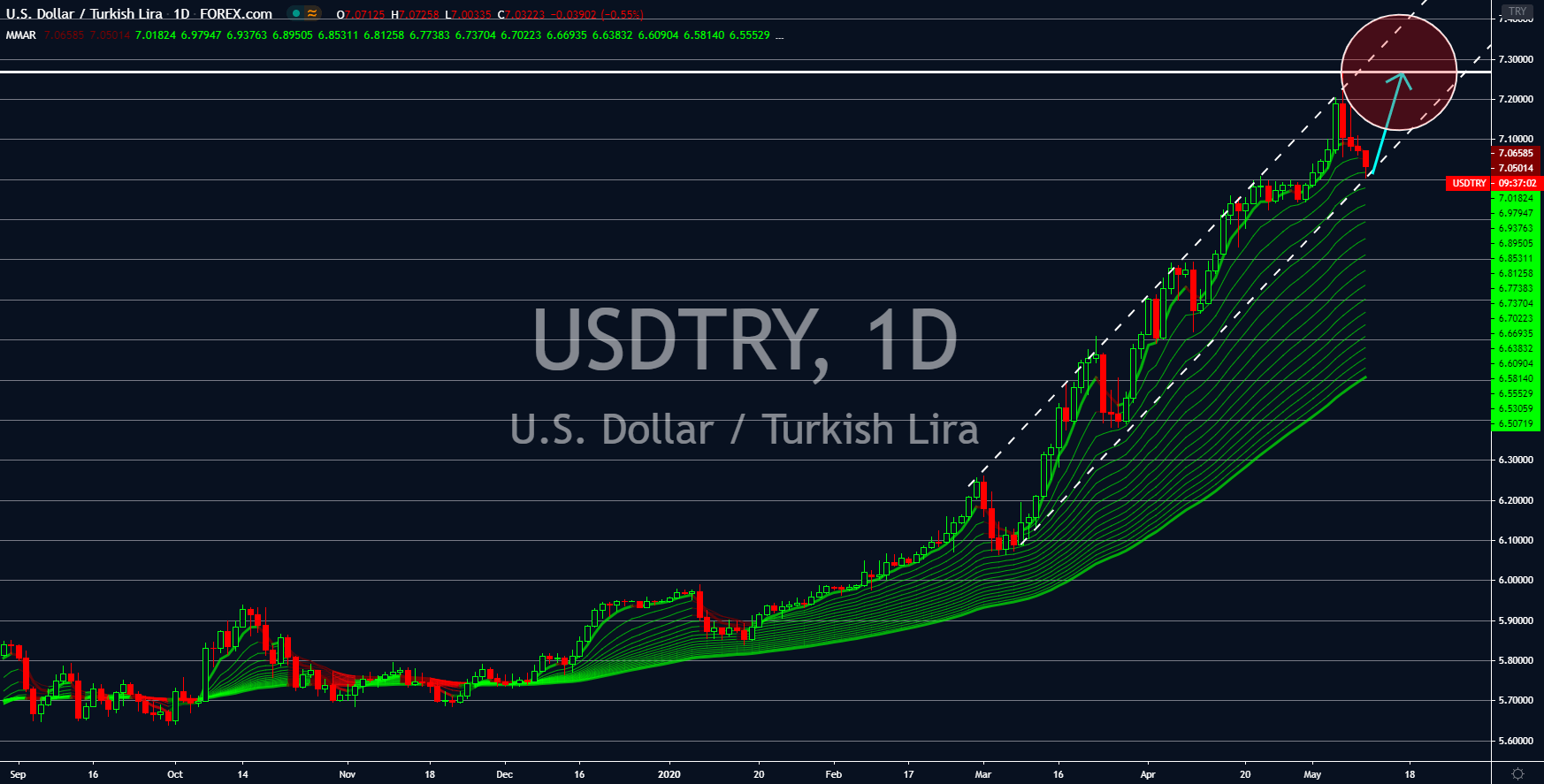

EURNZD

New Zealand Prime Minister Jacinda Ardern is once again showing the world how a crisis should be handled. The country’s total number of COVID-19 cases, as of writing, were only at 1,147 and deaths at 21. Meanwhile, recoveries were higher than the confirmed cases at 1,398. Aside from the health crisis, the Ardern administration has already been tested with political crises. Last year, Christchurch has been bombed, prompting politicians to consider banning Muslim migrants in the region. Ardern’s response, however, was not to put the blame on Muslims. This was well-received by the Arab world, displaying Ardern’s face on the biggest building in the Middle East. Now, the country has defied expectations after Ardern announced yesterday that she is ending the lockdown in 10 days. In Europe, most countries are still in a lockdown, which hurts businesses and investors. The NZD will continue to thrive against the single currency in the coming sessions.