Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

EURAUD

The Euro saw consecutive gains this month following the Reserve Bank of Australia’s interest rate cut, which brought the cash rate at a record low 0.5% in the region. Westpac Consumer Sentiment in Australia disappointed investors with a -3.8% decrease compared to a tame forecast of -0.4%. Fortunately for Australia, it also saw higher-than-expected employment change that came in 13,500 compared to a forecast of 10,000. However, the result won’t help the currency anytime soon. The Eurozone’s employment change also saw supportive results for both year-over-year and quarter-over-quarter, meeting and exceeding expectations, respectively. Euro-favored investors are now waiting for the European Central Bank’s policy meeting tomorrow with expectations of little to no interest rate cuts, due to higher-than-expected GDP in a yearly comparison. The currency is expected to show gains at least until the ECB announces its rate decision.

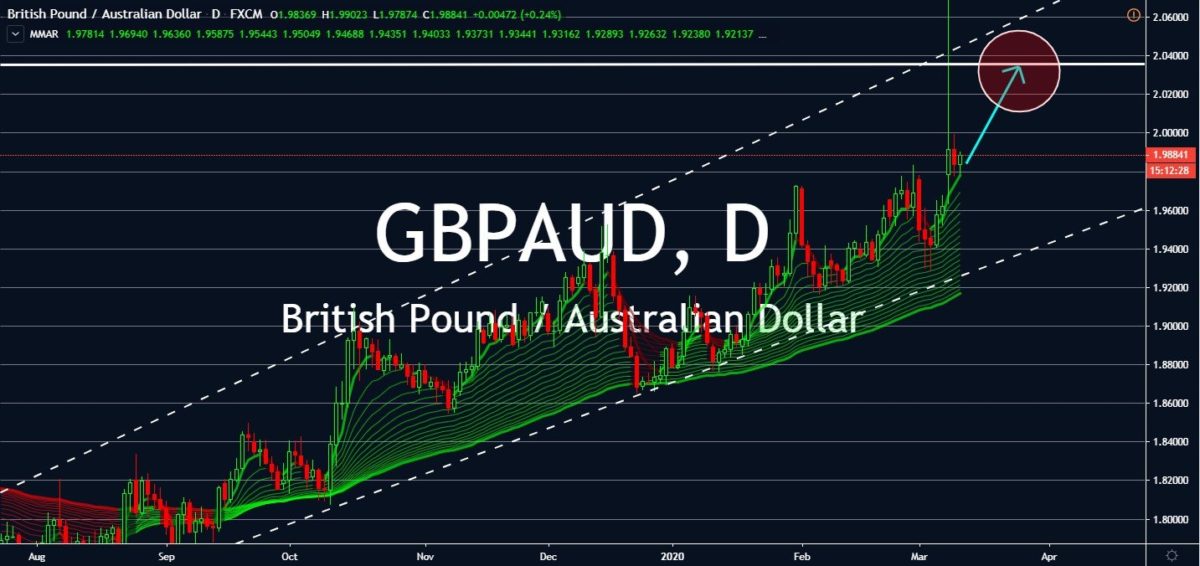

GBPAUD

The Australian dollar will continue to see wide-scale sell offs. Westpac Economist Bill Evans claims the region will keep experiencing pullbacks on its economy even after the Reserve Bank of Australia’s half-point rate cut earlier this month. Exports and inventories will take a toll on the region’s economic strength given their close trading relationship with the center of the coronavirus, China, which halted several exports and imports due to the crisis. Because of this, the British pound will rise against the Aussie in spite of a weaker-than-expected British Retail Consortium retail sales report for February with a decline to 0.4% against 0% recorded on the same month last year. Moreover, Sterling’s Spring Budget is anticipated to stimulate the British economy following the health crisis’ negative impact on global and domestic trade. The European Central Bank’s monetary policy decision due tomorrow will determine the exchange’s course in the long term.

AUDUSD

Even after the rebound attempt for the Australian dollar against the greenback, the Aussie is expected to experience record lows due to China’s effect on Australia’s economy, in addition to economic assistance led by the US President Donald Trump. Trump proposed to cut payroll taxes while working with declining industries in order to combat the economic impact of the coronavirus crisis in the country. His proposal encouraged investors to push the Dow Jones Industrial Average to skyrocket over 1,167 points on Tuesday following the country’s stock market’s biggest one-day drop since the economic recession in 2008. The greenback is anticipated to see consecutive gains as the market looks forward to the effects of his movements on the American economy, which also boosted stock futures as soon as he finished his remarks earlier this week. The only way the Aussie can earn back its losses is a further interest cut rate from the Federal Reserve later this quarter.

EURUSD

After a half-month decline on February, the Euro saw increasing gains over circulating cases of the coronavirus in the US. Fortunately for the single currency, yesterday’s mood lifted with reports of a better-than-expected 1.0% year-over-year in GDP, which suggests that the local economy might be on firmer ground than anticipated. Employment change was also higher than expected year-over-year, measuring higher employment in the Eurozone economy. These figures brought positive signs with less probability of the first interest cut of the year due on the European Central Bank meeting tomorrow. Until then, the Euro is expected to rise against the American dollar. However, it’s important to note that the dollar is currently seeing better ground following US President Trump’s announcement of hindering the coronavirus’ economic impact with a proposal to cut taxes on payrolls and other programs that could help the American economy.