Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

GBPUSD

The British pound will lose against the American dollar today, especially since the Bank of England held an emergency rate cut by 50 basis points on March 11. UK’s GDP showed disappointing figures on both year-over-year and month-over-month expectations, which showed more of the country’s declining economy. Britain’s manufacturing production was also lower than expected both in a monthly and year comparison in January. Its trade balances for both EU and non-EU trading were better than expected in January by about 4 billion each, which could dampen the fall when compared to the US figures, which saw a 800 million decrease during the same month. NIESR’s GDP Tracker also saw a GDP increase for next month. The Royal Institution of Chartered Surveyors (RICS) measured 29% house price increases, better than the 20% forecasts. Nevertheless, the recent rate decision will still weigh heavier on GBP.

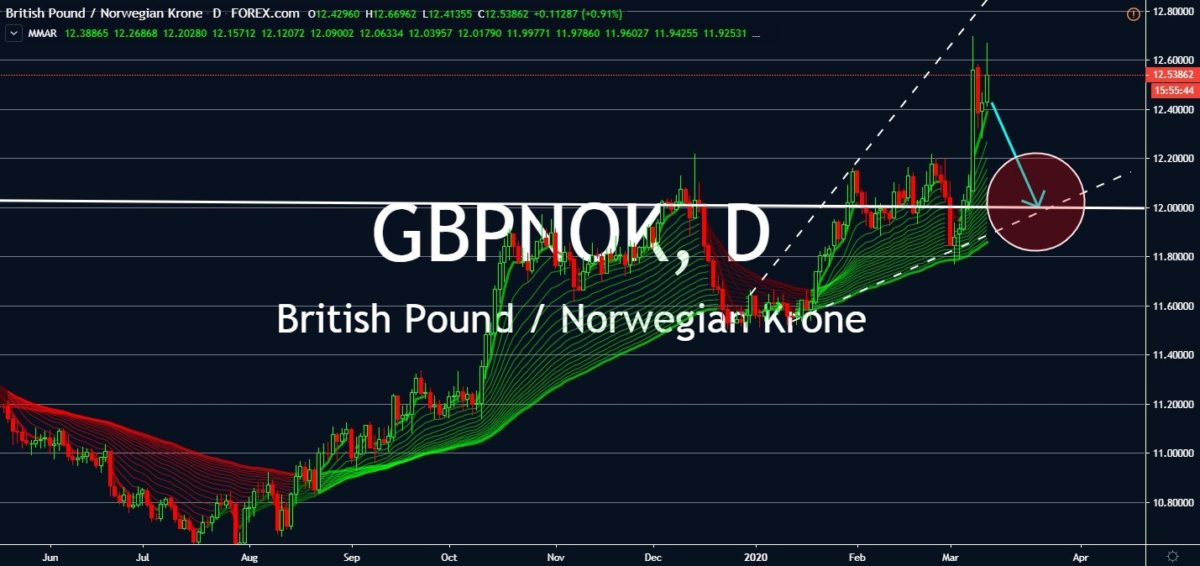

GBPNOK

Despite the GBP’s recent gains against NOK, the British pound might see its first dip against its Norwegian counterpart in a long time, The Krone saw consecutive losses in earlier sessions due to reducing demand for oil across different markets, but the emergency half-point rate cut from the Bank of England will prompt a significant drop. Investors are expected to root for NOK until markets increase demand for GBP even with lesser value. Although the recent rate cut is the pair’s main driver, it might see lesser lows due to less demand for oil, Norway’s main economic driver. Norway also saw disappointing figures on core inflation month-over-month in February, seeing 0.5% instead of the 0.7% figure predicted by futures investors. Sterling might also see gains once it reports positive news of its Autumn budget after the rate decision, which will determine the effectiveness of the cut and persuade other central banks to do the same.

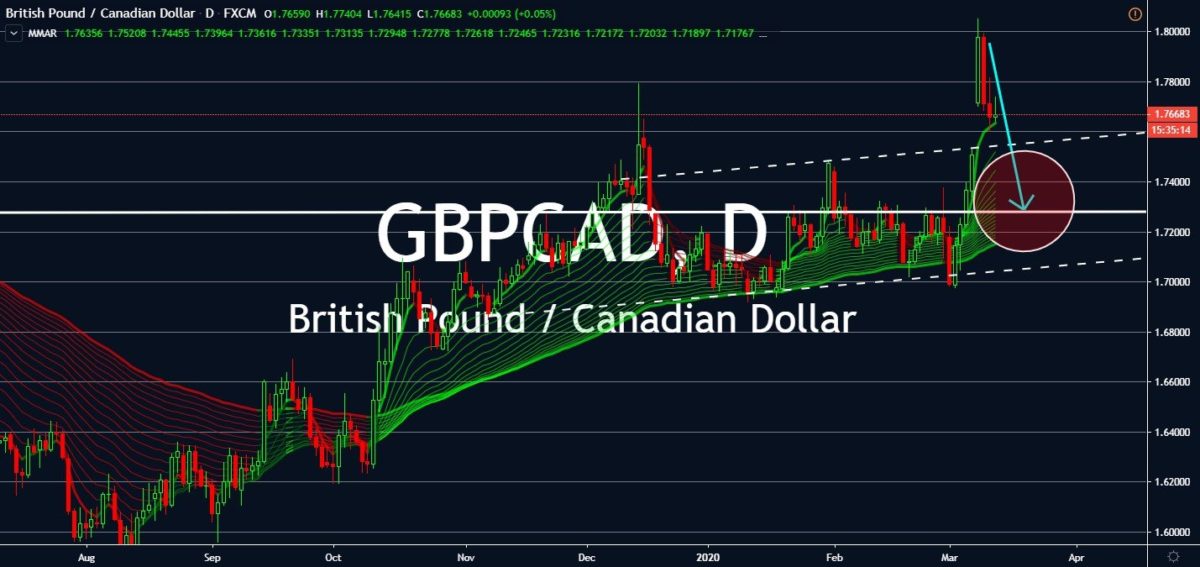

GBPCAD

In past weeks, GBP has been witnessing seemingly endless breakthroughs against the Canadian dollar. Rapidly decreasing demand for Canada’s main economic driver, crude oil, pushed the Loonie down against several other currencies. However, the British pound’s reign is over – the Bank of England held an emergency rate cut by 50 basis point yesterday, which will plummet Sterling back into its previous trading territory with the Loonie. The pair is expected to trade further into its previous pattern following the Bank of Canada’s rate cut of at least 50 basis points held just last week. The movements appear to be a part of coordinated bank actions to hurdle upcoming negative economic effects of the coronavirus. The Canadian dollar is expected to see slight gains for the rest of this week with better-than-expected Housing Starts seen in February, in addition to doubling expectations for Building Permits month-over-month in January.

RUBNOK

Both oil-sensitive currencies are expected to see volatile prices, near-term. For now, oil price slumps will take a toll on the Russian ruble more than the Norwegian krone amid the increasingly aggravating conflict between Russia and Saudi Arabia. Prime Minister Vladimir Putin rejected the Organization of Petroleum Exporting Countries’ proposal to cut oil production, igniting the current conflict between the country’s oil export allies. As inventories continue to increase with much lesser demand brought by fears of the coronavirus, the market is pricing against the main cause of the conflict: Russia. Meanwhile, a survey held by the Norwegian central bank found that most businesses expect less domestic economic growth than a month prior. Rapid slowdown in business activity due to the outbreak, especially with crude oil as its main export, could lead to a potential interest rate cut and into a possible loss against the Russian Ruble.