Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

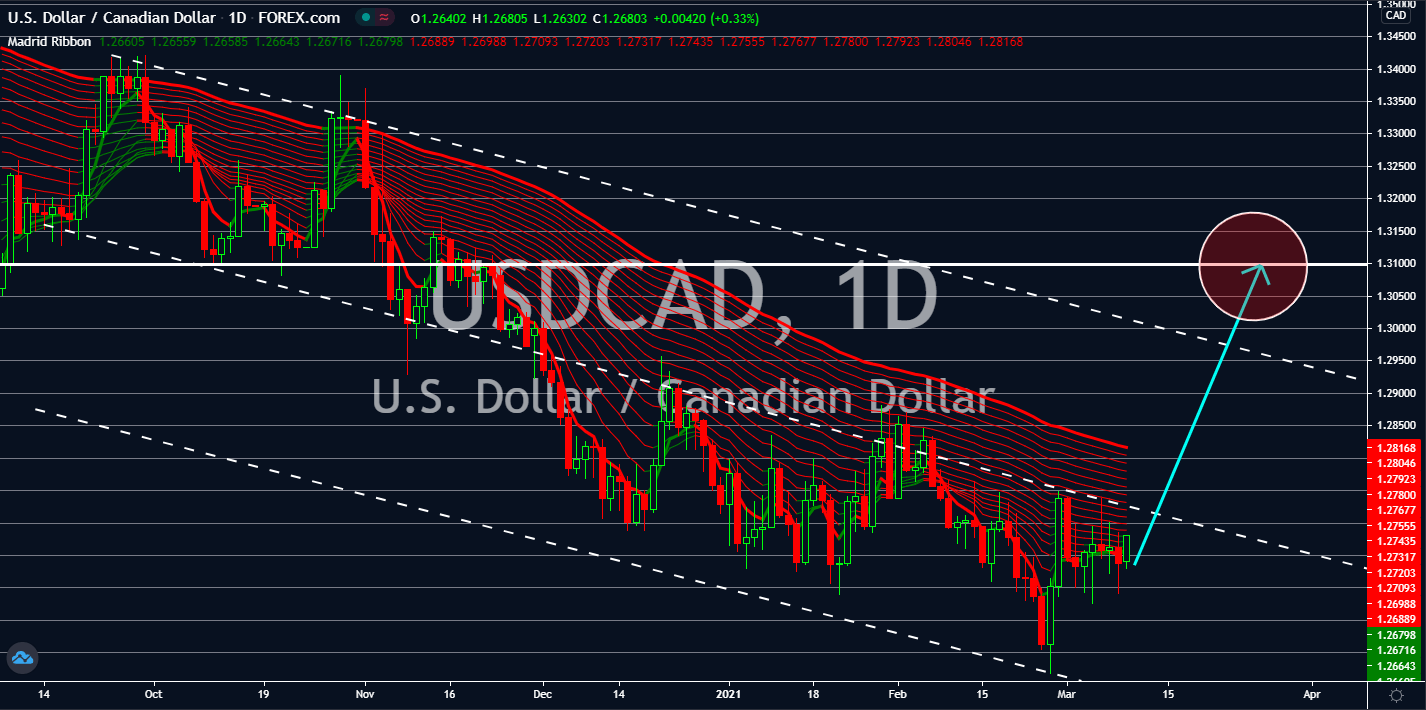

USDCAD

Royal Bank of Canada (RBC) sees Ottowa having the same situation with Washington when it comes to the threats of inflation. CEO David McKay cited the gradual reopening of Canada’s economy as the main reason for the pressure in consumer goods prices. The same tone is shared by Treasury Secretary Janet Yellen who attributed the rising US yield curve to the recovery of the American economy. High inflation usually signals for an interest hike by central banks. However, the Bank of Canada (BOC) is widely anticipated to retain its benchmark interest rate of 0.25% on Wednesday’s meeting, March 10. Analysts and investors were already anticipating the BOC to be the first central bank in the west to increase its rates. However, the central bank said that the unemployment rate remains high and keeping the current rate will further allow businesses to cope up with the pandemic. USDCAD prices are expected to reach a key resistance area at 1.31000.

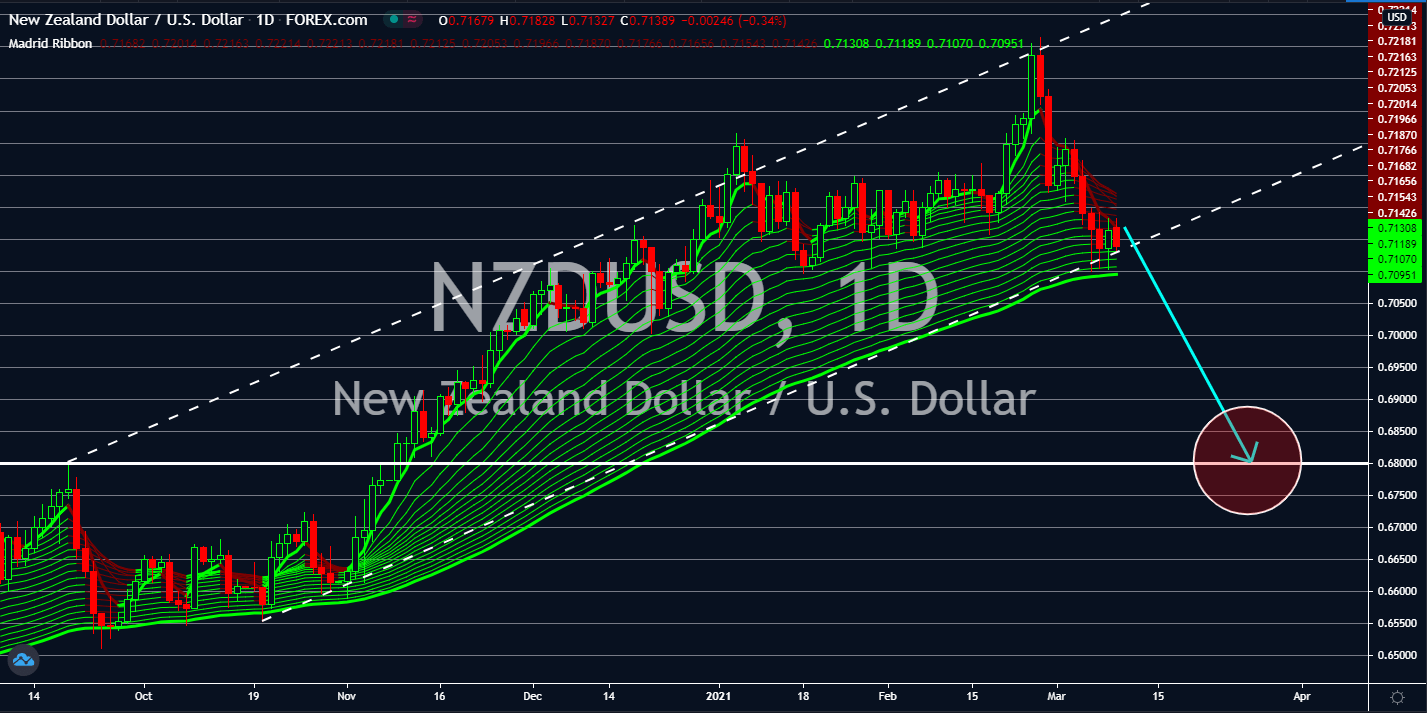

NZDUSD

The New Zealand dollar is back to a 2-month low against the US dollar and is expected to continue to fall this week. This was despite the disappointing economic data from Wellington in the previous days, which could’ve increased the demand for the kiwi currency. On Tuesday, electronic retail card sales dropped by -2.5% for the month of February. On a year-over-year basis, the report shrank by -5.3%, the steepest decline since May 2020. The rising yield curve in the US is driving the recovery of the greenback. The 10-year maturity treasury bonds have seen its annual return hitting the 2021 high on Monday, March 08, before a short pullback. Analysts are expecting a continued increase in the yield in the near-term as the US Congress is expected to pass the proposed 1.9 trillion stimulus on Wednesday. It is then up to President Biden to sign the bill into law before the March 14 deadline. The target price of NZDUSD is around September 18’s high of 0.6800.

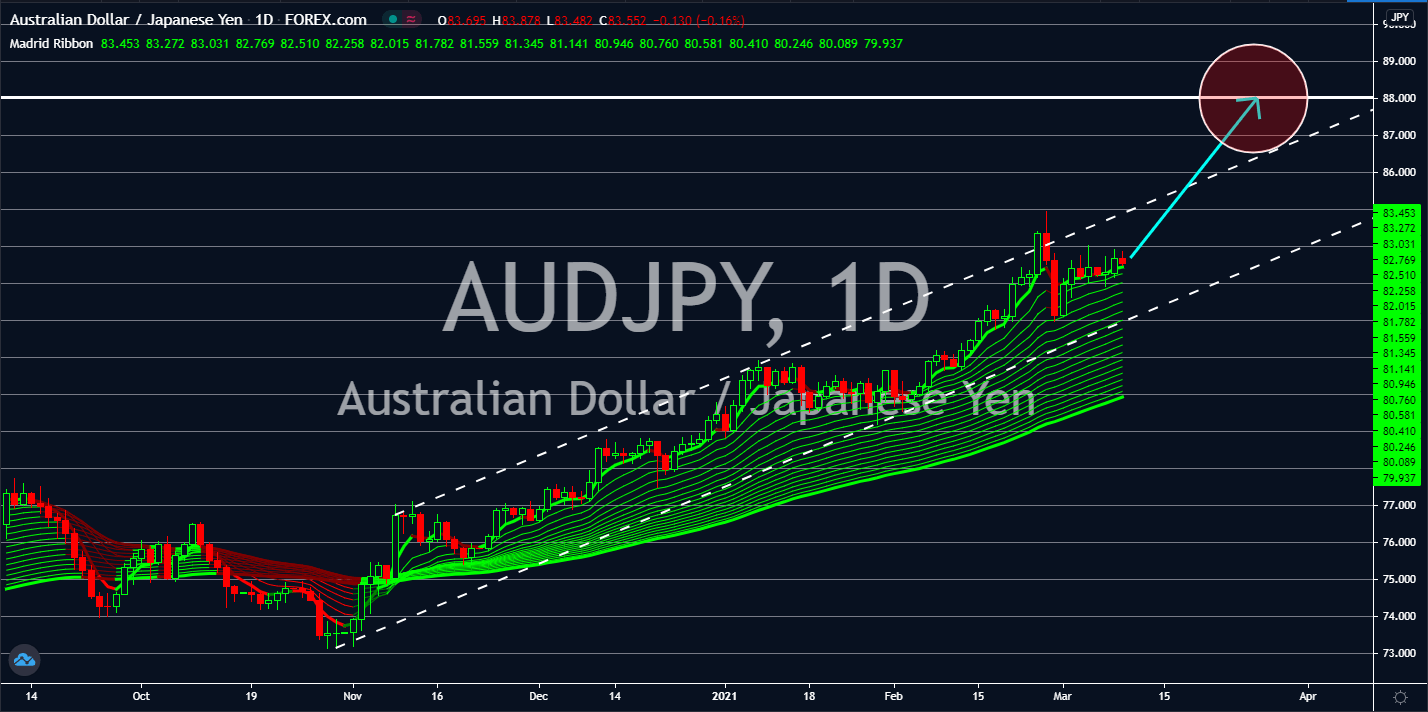

AUDJPY

The positive outlook for the Japanese economy will weigh down on the yen. Initially, investors were bullish for the Japanese currency after January’s Household Spending report on Monday, March 08, dropped a new to the lowest level since December 2019’s report. Meanwhile, the report showed a -6.1% contraction on an annual basis. However, these data were easily shrug off by investors after Coincident Indicator and Leading Index rose by 3.5% and 1.4% for the same month later that day. In addition to this, Economy Watchers Current Index was up to its 2-month high at 41.3 points for the month of February. Another report that will push down the demand for the safe-haven yen is gross domestic product (GDP). For the fourth quarter of fiscal 2020, the world’s third-largest economy expanded by 2.8% despite its counterparts in the EU shrinking in Q4. On a YoY basis, the report was up by 11.7%. Analysts are looking at 88.000 as the next resistance line.

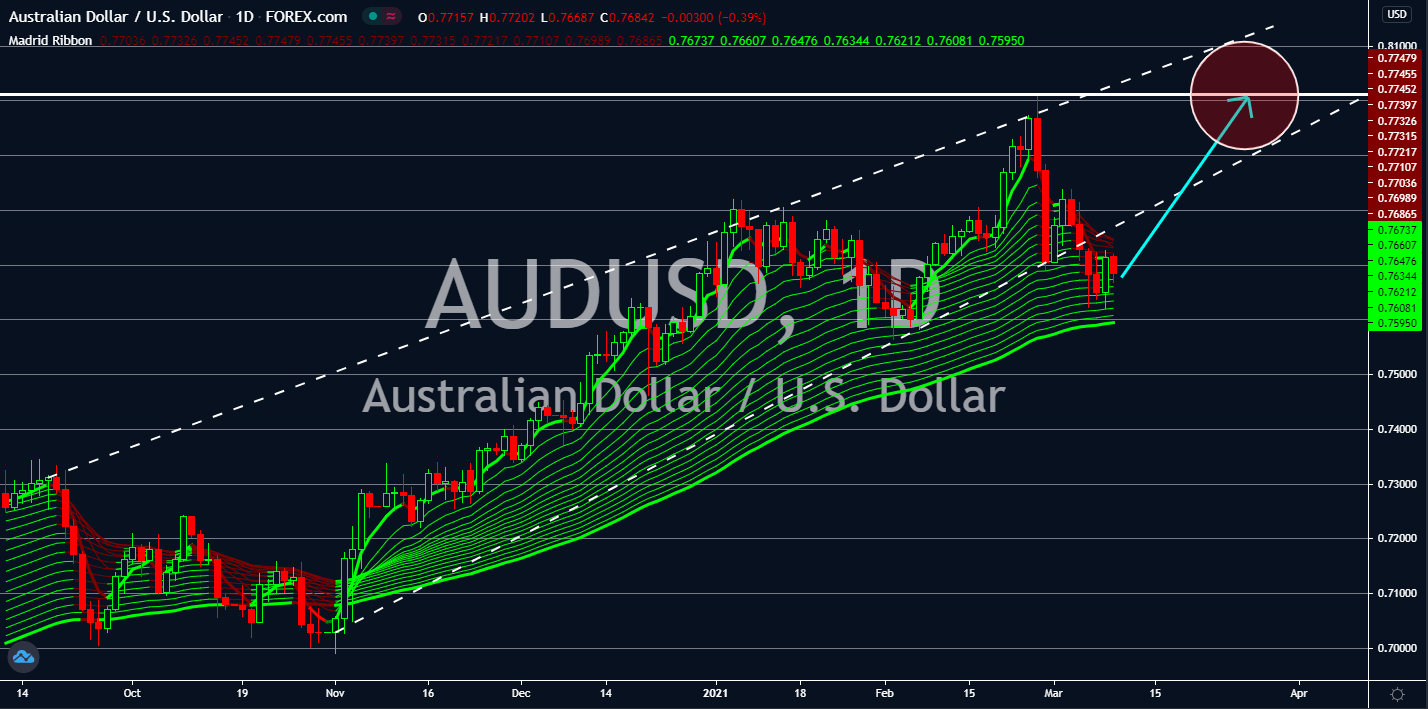

AUDUSD

Despite the strong influence of the rising US inflation over the AUDUSD pair, the Australian dollar will still regain its strength against the greenback. This was following the recent decision by the Australian government to cut support to the labor market. The 70 billion AUD wage subsidy will end this March as Australia’s economy started to a V-shaped recovery. Instead of providing financial support to those seeking for jobs, the scheme will be reduced to a 1.2 billion AUD support extension for apprenticeship. In July, the unemployment rate peaked at 7.5%, However, the recent figure for the report posted 6.4% data against the prior month’s 6.6% result. This is also lower than the forecast 6.5% unemployment rate by analysts. The subsidy for apprenticeship will be available starting April 2021 until April 2022. Business confidence in Australia surged to 16 points for February from 10 points prior. Meanwhile, consumer sentiment logged 2.6% growth this March.