Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

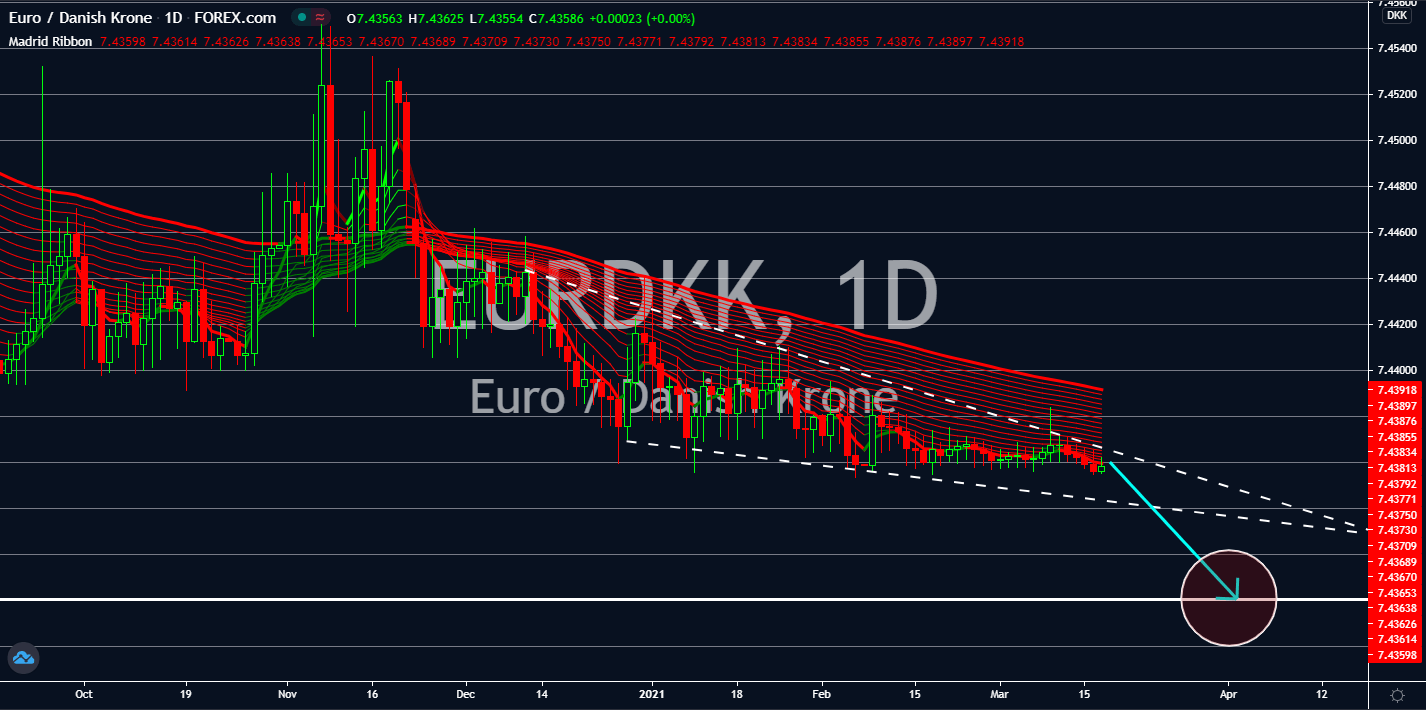

EURDKK

The single currency will continue to fall against its Danish counterpart in coming sessions towards the 7.43000 price area. On Monday, March 15, the Eurogroup area published a report indicating the topics that were discussed by ministers of member states during the meeting. This includes the continued support by the government for the reopening of the global economy. Members are encouraged to implement an 8% budget deficit in fiscal 2021 as the central bank ramps up its bonds purchasing program. The European Central Bank (ECB) has allotted 2.21 trillion to purchase treasury bonds. Following the meeting was a statement by EU Commission Vice President for Economy Valdis Dombrovskis. According to the commissioner, the trading bloc will recover in the second half of the year. In Q4, the Eurozone contracted by -0.6% and analysts are anticipating negative data for the first and second quarter of fiscal 2021 due to the resurgence of the virus.

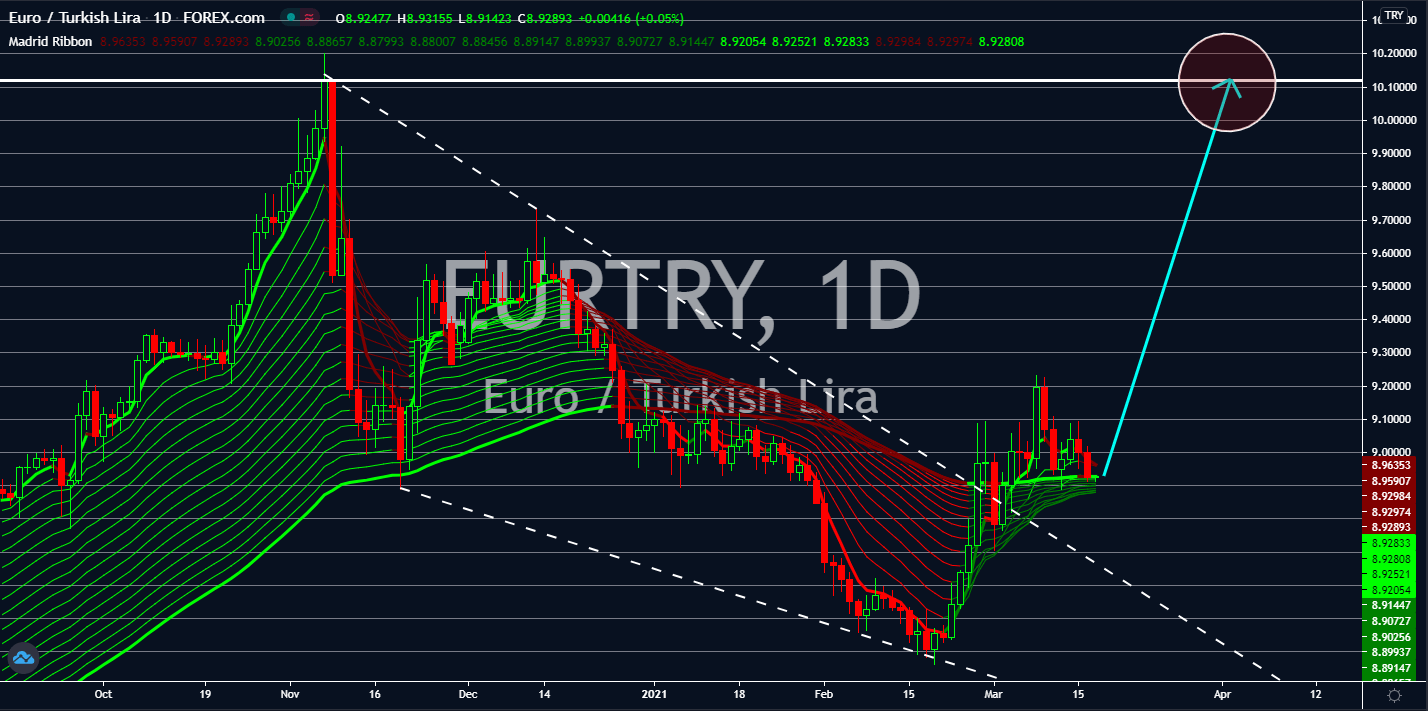

EURTRY

Turkey joined China in posting GDP growth during the pandemic year. Ankara said its economy grew by 1.8% in 2020a after the economy expanded by 5.9% in Q4. Analysts believe that the massive state lending contributed to the upbeat data, which, in turn, was the main reason for the decline in the Turkish lira. As the economy stabilizes, investors should expect the lira to recover as government intervention is expected to end. Finance Minister Lutfi Elvan already announced the tightening of government policy as the country sees 5.0% growth in the current year due to the easing of restrictions this March. Meanwhile, Moody’s revised its previous forecast for 2021 of 3.5% to 4.0% and next year at 5.0% from 4.0% prior. The European Bank for Reconstruction and Development also noted Turkey’s resilience during crises. The country’s economy emerged from the 2009 financial crisis, during the 2016 coup attempt, and now from the COVID-19 pandemic.

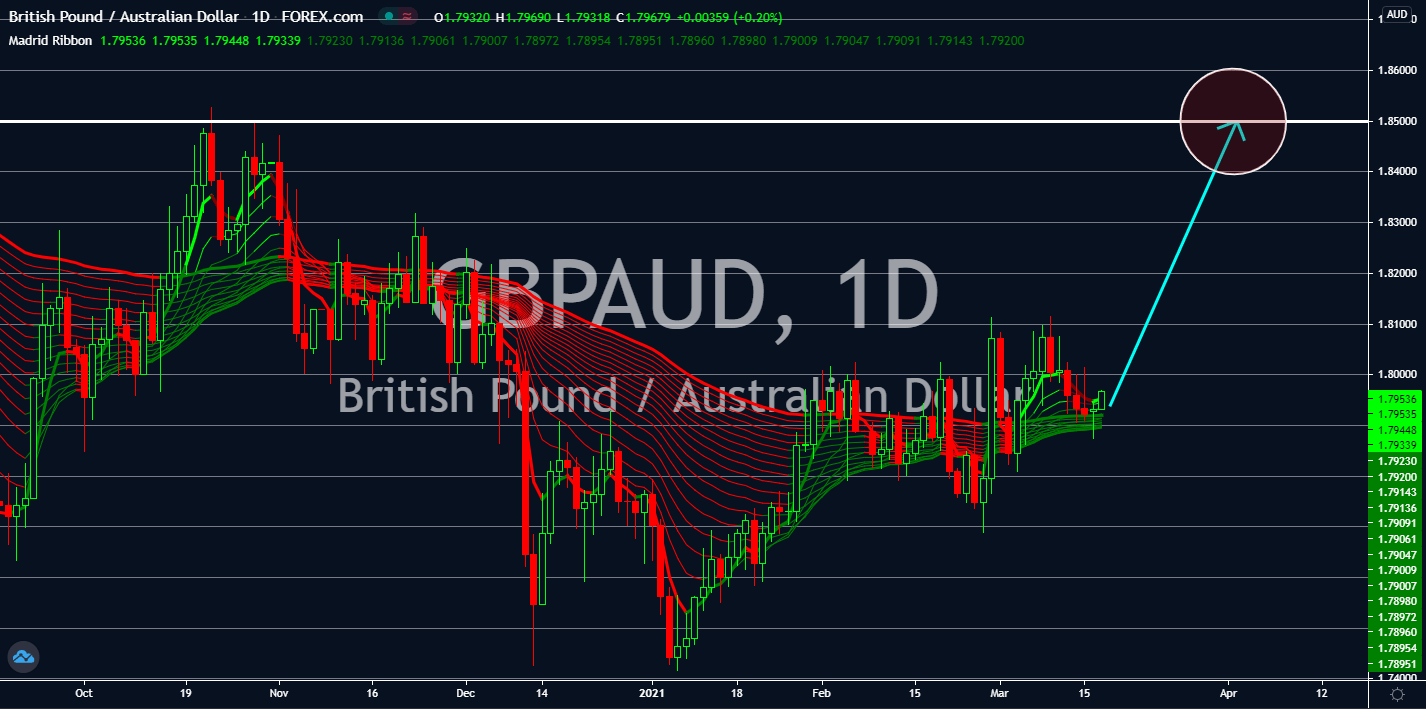

GBPAUD

The Australian Bureau of Statistics published a report showing that the Australian economy was already 85% recovered from the pandemic induced slowdown. The 3.1% jump in Q4 was better than the agency’s 2.5% forecast. On a year-over-year basis, the economy was -1.1% lower. Household spending and private investment also continue to see increased influx of cash due to the 251 billion support by Prime Minister Scott Morrison on companies and workers displaced by the pandemic. Figures came in at 4.3% and 3.9%, respectively. Australia also declined to halt the vaccination rollout of AstraZeneca after European countries held back on the vaccine due to several issues. The low coronavirus cases and rapid inoculation in the country will boost the Australian economy back to its pre-pandemic level in the second quarter of fiscal 2021. Investors should expect a continued recovery in the GBPAUD pair in coming sessions towards 1.85000.

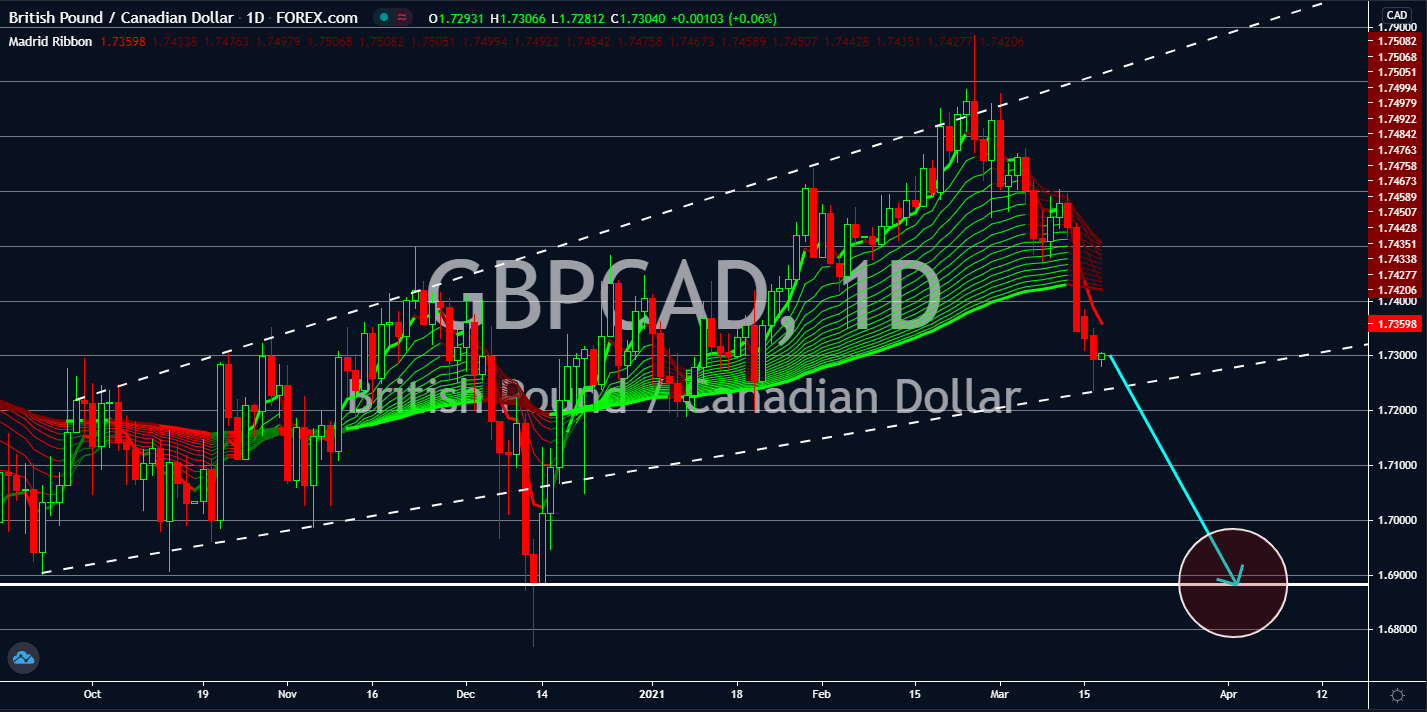

GBPCAD

A massive sell-off in the British pound is expected following the comments by the Bank of England. The central bank said that the UK economy will recover at a faster pace and will end 2021 above the pre-pandemic level. This was in contrast from the March 03 budget speech by Finance Minister Rishi Sunak where he unveiled his proposed corporate tax increase to 25% from 19% starting 2023. The tax hike will be used to cover the expenses by the government during the pandemic. In 2020, the British economy sank by -9.9%, the worse performance in the past three (3) centuries. Chief Andrew Bailey credited the government’s vaccination drive as the reason behind the optimistic outlook. Meanwhile, Deutsche Bank sees 98% recovery of the UK economy from the pandemic in late 2021 with 5.7% annual GDP growth, up from the initial 4.5% forecast. Meanwhile, the investment firm downgraded the Eurozone’s economy from 5.6% to 4.6%.