Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be up to date on the current happenings in the market!

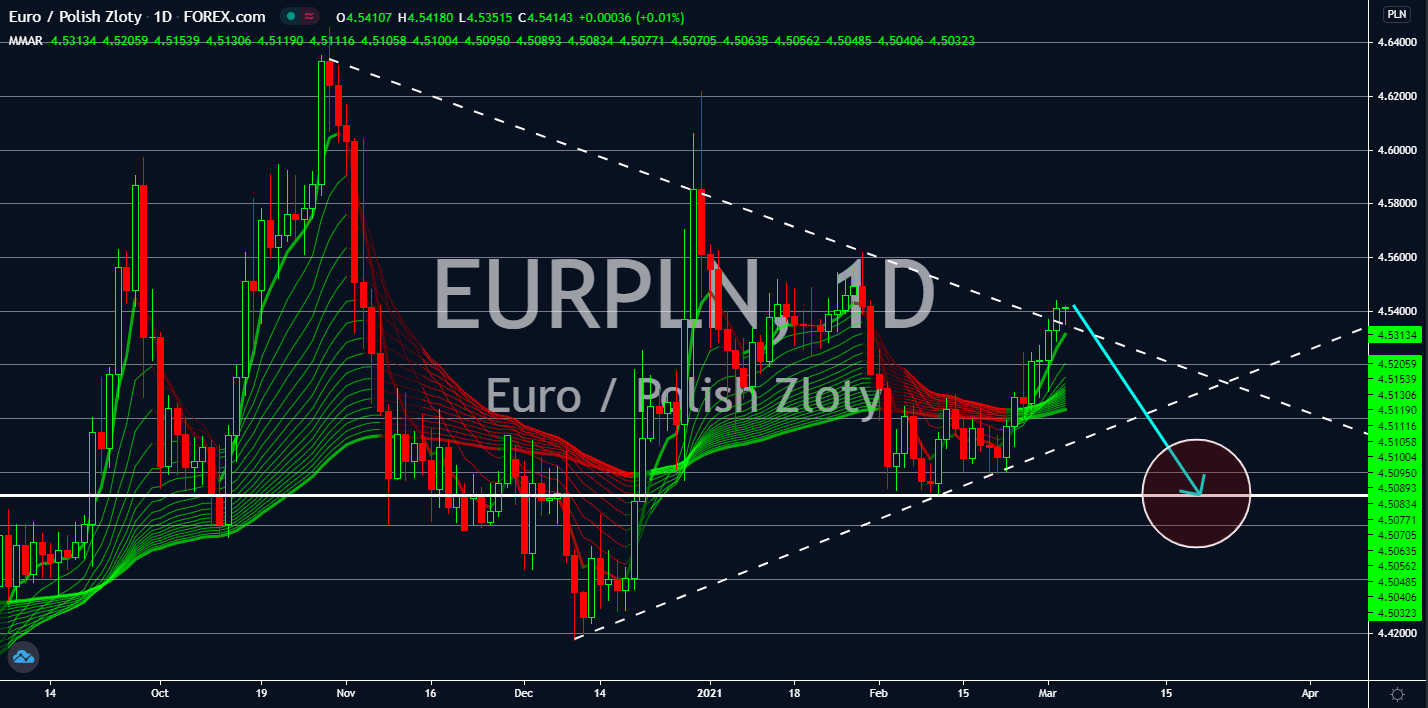

EURPLN

Poland revised its -2.8% contraction in the fourth quarter of fiscal 2020 on Tuesday’s final report for Q4 GDP. Figure came in at -2.7% year-over-year, which ended the pandemic year in a -2.7% decline. The annual GDP data from one of the EU’s fastest growing economies is twice better than Germany’s -5.0% contraction during the same period. Meanwhile, the Manufacturing Purchasing Managers Index (PMI) report for the month of February hit nearly 3-year high. The 53.40 points number is also the highest since pandemic wrecked economic activities around the world. This suggests an optimistic outlook for fiscal 2021 particularly in the first three (3) months of the year. Meanwhile, Poland is also among the fastest countries to inoculate its citizens against COVID-19 in Europe. As of February 25, the total of individuals who received full or partial vaccine shots were 3.16 million. This represents almost 10% of Poland’s 38 million population.

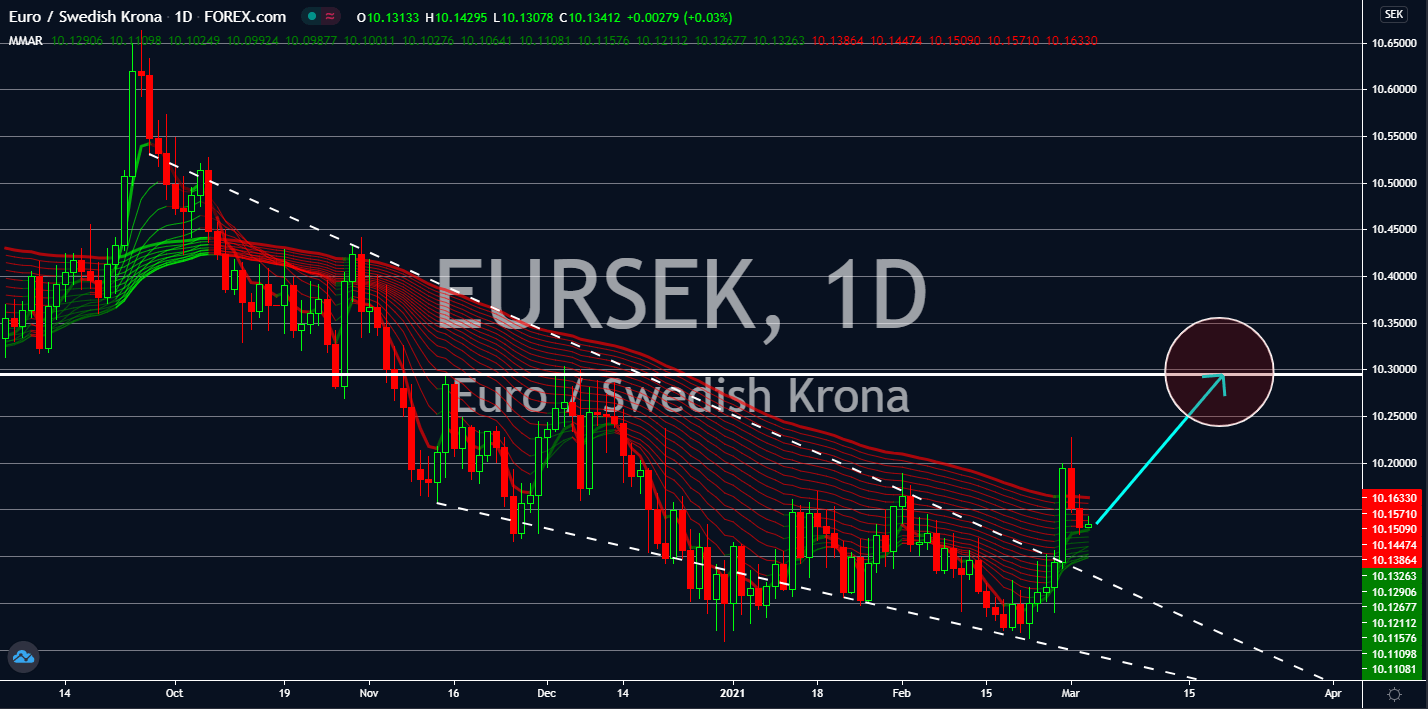

EURSEK

Recovery in Sweden has been slowing based on the recent reports. The final result for Q4 GDP YoY is a -2.2% decline. In the third quarter, the number is -2.5%. Meanwhile, Manufacturing PMI slid for the second consecutive report. Figure came in at 61.6 points against the prior report’s 62.5 points data. While the Swedish krona will see some weakness in the coming sessions, the outlook for the long-term performance is bright. The Swedish government already announced the possibility of creating a COVID-19 passport to help the economy recover from the pandemic induced slowdown. As for the EU’s Purchasing Managers Index reports, the results were mixed. Manufacturing PMI soared to 57.9 points, which easily beats the previous record of 54.8 points. This is the highest recorded figure since March 2018. However, Markit Composite and Services PMIs lag with 48.1 points and 44.7 points expectations for Wednesday’s report, March 03.

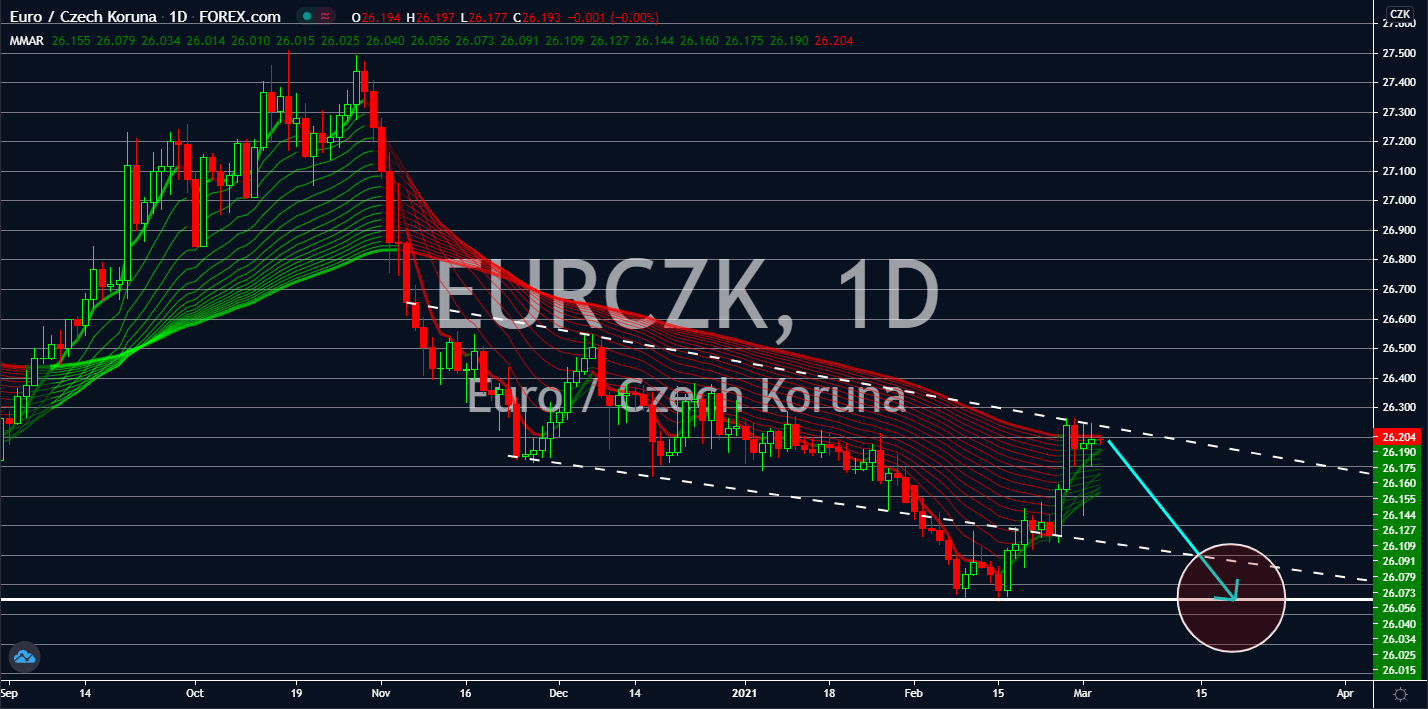

EURCZK

Czech Republic’s economy expanded by 0.6% in the fourth and final quarter of fiscal 2020. This should push the koruna lower as investors’ confidence in the equities were boosted by the better-than-expected GDP data. However, the continued rise of COVID-19 cases in the country threatens to reverse back all the efforts by the government. On February 24, fresh cases reached 15,861. The reported number is the fifth highest daily infection in the country. The 7-day moving average in daily infections showed an increasing trend of cases. As a result, Manufacturing PMI was down to 56.5 points from 57.0 points in the prior month. Also, the government incurred a higher deficit in February of -86.100 billion compared to January’s -31.500 billion deficit. In other news, the Czech government introduced stricter lockdown to prevent cases from further increasing. Analysts are expecting this decision to severely affect the GDP data for the first quarter of fiscal 2021.

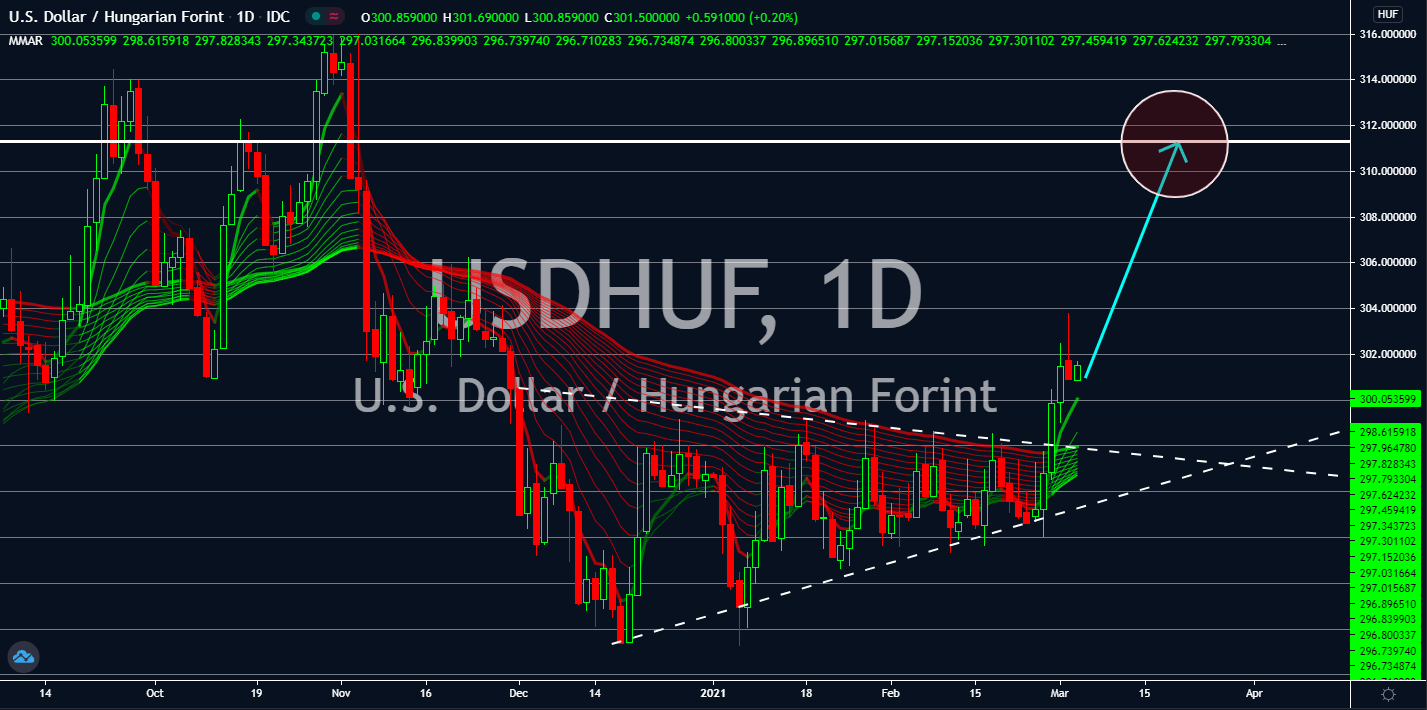

USDHUF

The increasing US yield curve and rising inflation brought by the $1.9 trillion economic aid proposal is driving the US dollar higher. In addition to this, the PMI reports showed stable data. The manufacturing sector was down to 58.6 points, but better than the 58.5 points forecast. Meanwhile, Markit Composite is expected to soar to 58.8 points, which, in turn, represents the highest reported figure since September 2014. The same is true for the services sector, which will hit its 5-year high if figures came close to estimates of 58.9 points. The labor market is pulling the US economy to quickly recover from the pandemic. But the recent data last week points to a gradual recovery. Also, the ADP Nonfarm Employment Change on Wednesday is projected to post 177,000 jobs creation. As for Hungary, the Manufacturing PMI contracted in February. Figure came in at 49.4 points against the 20-month high of 54.5 points in January 2021.