Good day traders! Check now the most recent charts and market updates for today’s session. Learn more about analysis and be updated on the current happenings in the market!

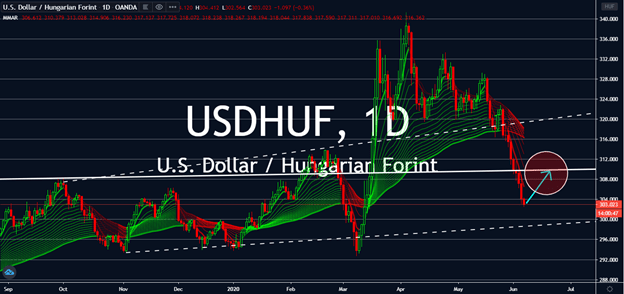

USDHUF

Hungary has mixed feelings with the state of its economy. While the president of the National Bank of Hungary believes its economy will grow by 2 to 3 percent, the government expects its GDP to shrink by 3% by the end of the year, instead. Moreover, the Hungarian government believes that it will grow back by the second half of next year by 3%. Economists, on the other hand, aren’t as optimistic. Reports believe that the Hungarian economy will slump by 4% by the end of this year. Although, it’s still half of the year – the country had just started easing its coronavirus lockdowns, and there’s no telling where the economy can go. But in technicality, investors have exhausted selling the US dollar for Hungarian forints. Near-term, the pair is expected to meet familiar figures between 308.0 to 312.0 and probably return into volatility last seen at the end of 2019 until either country faces worse news than the other.

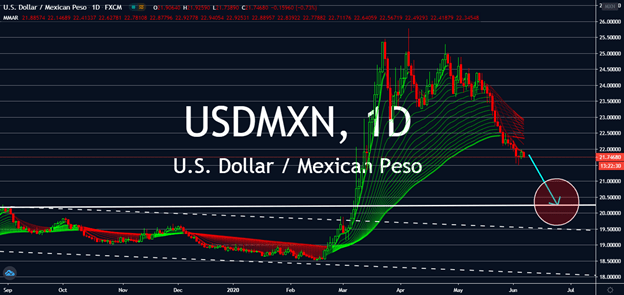

USDMXN

Oil agreements have always been rocky, and even amid a worldwide medical and economic emergency. Currencies sensitive to the commodity have met high volatility through three months since the WHO’s confirmation of the pandemic in March. But last month seemed to be quite decisive for the USDMXN pair as the more powerful currency begins to descend into March figures. Three months from now, as more economies open around the world raising the demand for oil, the pair is expected to see pre-coronavirus resistance levels while the United States lets its protest boil into a revolution. While the USD is expected to see gains in the next few sessions, months-long protests will bring the Mexican Peso upward, at least once the Organization of the Petroleum Exporting Countries reaches a decision on how every member could reduce their own production as per the agreement made last April.

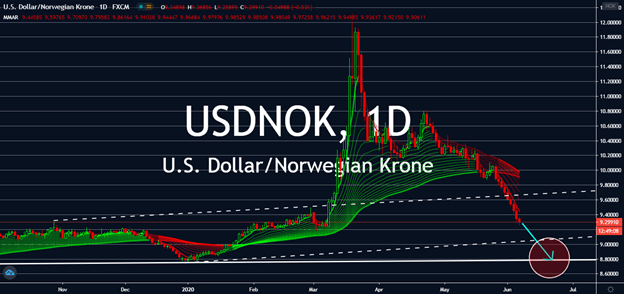

USDNOK

After a record three dollar surge for the US dollar against the Norwegian krone near March, the USDNOK pair reached back into its pre-coronavirus levels as economies begin to reopen around the world. The krone remained resiliant against oil conflicts through the month of May, pushing down the value of the dollar as global markets question the intergrity of the US economy. The Norwegian economy’s figures for the past few months might push its value down in near-term, especially how its economy contracted by 4.7% in April alone. Norway GDP saw a 11.4% economic slump, year-to-date. However, oil and gas production is forecasted to shrink by 3.9% for the year instead of April’s forecast of 5.5% of the same figure. Long-term, this could drive the oil-sensitive currency above the dollar for the next three months while the Norwegian economy waits for how reopening would help itself afloat despite the dangers of COVID-19.

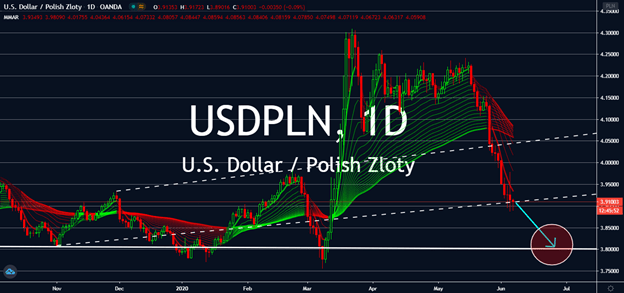

USDPLN

Poland is expected to recover the fastest and the least affected among the European countries by the coronavirus pandemic. This was despite a reversal of everything the country had grown for the past three decades. Forecasts claim that the Polish economy will fall by 4.25% by the end of the year, which will be driven by weaker consumer confidence, falling demand for exports, and rising unemployment rates. But it’s important to note that it’s also set to rise again by 2021, or as per the European Commission’s expectations, by 4 percent in 2021. This alone prompts good news for the country versus the United States, which had economists worried of its own economic status through the end of 2020. In fact, they claim that the American economy might not be able to recover its fiscal losses from the coronavirus for at least three decades. This could pile on further if the government doesn’t act for the protests through three months from now.